When planning your taxes, one area that often goes unnoticed is Section 10(32) of the Income Tax Act. This section offers a small but useful exemption on income from minor children, helping families legally reduce their tax liability. It’s a crucial clause for taxpayers with minor dependents, & in this article, we’ll break it down in simple terms.

Whether you're a salaried individual or running your own business, knowing how to claim deductions & exemptions can significantly impact your tax savings. Let's deep dive into this powerful provision of the Indian tax law.

What Is Section 10(32) of the Income Tax Act?

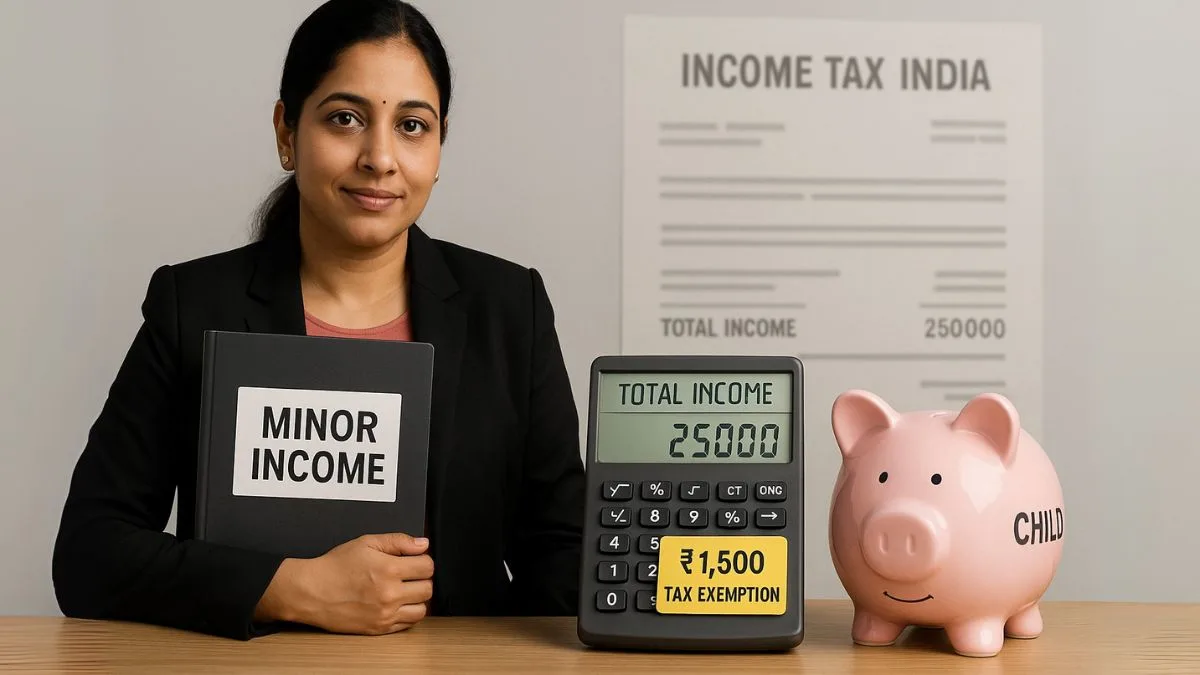

Section 10 of the Income Tax Act provides a list of incomes exempt from taxation. Among these, Section 10(32) specifically deals with the income of minor children that is clubbed with the income of the parent.

Under Section 64(1A), if a minor earns income (except through their manual work or from talent/special skill), such income is added to the income of the parent who earns more. To ease the tax burden slightly, Section 10(32) provides an exemption of ₹1,500 per child per year from the total clubbed income."

How Does the Exemption Work?

Here’s how it works in practical terms:

- Suppose your minor child earns ₹20,000 in interest from a fixed deposit.

- This income will be clubbed with your income.

- But under Section 10(32), you can claim a deduction of ₹1,500 for that child.

- So, only ₹18,500 will be added to your taxable income.

And yes, if you have two minor children with income, you can claim ₹1,500 exemption per child, i.e., ₹3,000 in total. While it may seem like a small amount, when applied correctly every year, it can lead to decent cumulative tax savings.

Can Income Be Accumulated Over Time?

A common question that arises is whether such income from minors can be kept aside & saved over the years. As per income tax law, income shall not be accumulated for more than 5 years if it is to be held in a trust for the benefit of a minor.

So, if you’re planning to create a financial buffer for your child using investments that generate income, you should plan the withdrawals or reinvestments accordingly. Section 10(32) only offers the ₹1,500 exemption annually, & it does not allow for indefinite accumulation for tax-free benefits.

Real-Life Example:

Let’s say:

- You have two children: a 12-year-old daughter & a 9-year-old son."

- You’ve invested in fixed deposits in their names, which earn ₹25,000 each per year.

- The entire ₹50,000 is added to your income.

- But under Section 10(32), you get a deduction of ₹3,000 (₹1,500 × 2).

- That brings your total taxable clubbed income from them down to ₹47,000.

It’s small, but every deduction counts—especially if you're in the 30% tax bracket.

Legal Interpretation and Application

This section is straightforward in its wording, yet powerful in its application. It acts as a cushion for parents managing finances for minor children. Income shall not be accumulated for more than 5 years, making it important to plan.

Many taxpayers are unaware that any income includible in their total income under that sub-section becomes eligible for exemption. It’s not automatic—you need to claim it while filing your return.

Is It Applicable to All Types of Income?

No. This exemption only applies to income earned, not from the child’s skill or talent. For instance:

- If your child earns money by acting or modelling (using their skill), that income is not clubbed.

- If your child earns interest from FDs or rental income (passive), it will be clubbed with the parent’s income, & here’s where Section 10(32) helps.

Final Thoughts

While ₹1,500 per child may seem nominal, it reflects a principle of fair taxation & offers relief to those supporting minors. Combine it with other exemptions, & it becomes part of a smart tax-saving toolkit.

Exemption on income from minor children under Section 10(32) of the Income Tax Act is simple, yet it requires attention & a timely claim during ITR filing.

If you're unsure how to claim exemptions like these or need personalised tax-saving advice, our experts at Callmyca.com can help simplify your tax journey, so you don’t miss out on even the smallest exemptions that can make a big difference.