When it comes to income tax in India, most people are aware of the basics—salary, business income, deductions under Section 80C, & so on. But what if you sold shares back to a company & received a profit? Does the taxman knock? That’s where Section 10(34A) of the Income Tax Act steps in & saves the day for shareholders.

Let’s dive into what this section is, why it matters, & how you can make the most of it.

What Is Section 10(34A) of the Income Tax Act?

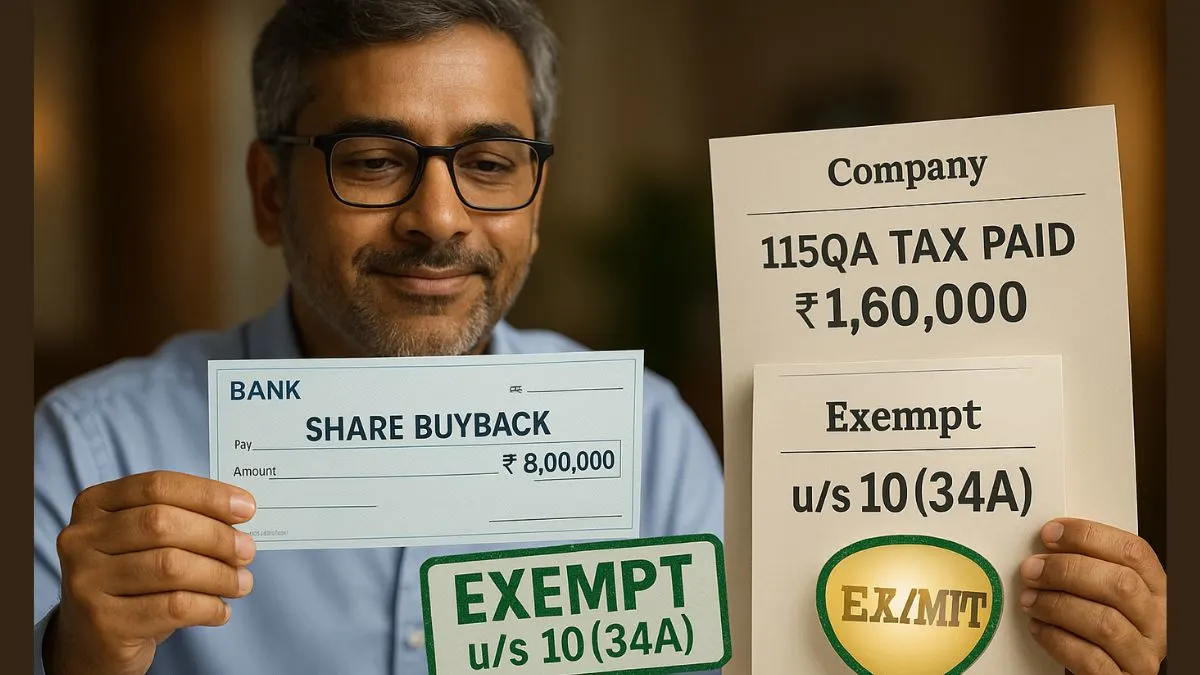

Section 10(34A) of the Income Tax Act exempts any income arising to the shareholder on account of the buyback of shares by a company that is listed on a recognized stock exchange.

Simply put:

If a company buys back its shares from you, & you make a gain, that gain won’t be taxed in your hands (as long as certain conditions are met).

This section was inserted to provide tax relief to individuals & HUFs from double taxation. Earlier, both the company & the shareholder were being taxed—first through distribution tax & then through capital gains. This was unfair. So, this exemption balances the scale. “

Income or Gains from Buybacks Are Tax-Exempt in the Hands of Shareholders

Section 10(34A) ensures that income or gains from buybacks are tax-exempt in the hands of shareholders. This means if you sold your shares back to the company under a buyback offer, you won’t need to worry about paying capital gains tax on the profits.

But here's the catch:

The company will have to pay the buyback tax under Section 115QA.

So, the government still gets its tax, but from the company, not you.

Buybacks Before October 1, 2024: No Tax for Shareholders

Here’s something important you need to know if you're planning a strategic exit from your investments.

Any buyback of shares before October 1, 2024, by a listed company continues to exempt the shareholder from paying any tax. The entire amount received is tax-free in your hands.

After this date, changes may be implemented, so it's important to stay updated with the latest Finance Act amendments.

Eligibility – Who Benefits from Section 10(34A)?

This section applies to:

- Resident individuals

- HUFs (Hindu Undivided Families)

- Non-residents (subject to certain treaty protections)

The exemption is available only when:

- The company is listed on a recognized stock exchange

- The buyback is done under Section 68 of the Companies Act

- The tax has already been paid by the company under Section 115QA

So yes, the government ensures tax is collected, but you, as a shareholder, walk away with your entire gain tax-free. “

Why Is This Section Important?

Because taxation on buybacks can get messy. A shareholder selling on the open market pays capital gains tax. But a shareholder who participates in a buyback offer covered under Section 10(34A) doesn’t have to worry about that.

This becomes especially helpful during:

- Corporate restructurings

- Strategic exits by large investors

- High-net-worth individuals using buybacks as a tax-friendly exit route

Real-Life Example

Let’s say you bought shares of XYZ Ltd at ₹500 & the company offers a buyback at ₹800 per share. You tender your shares & earn a profit of ₹300 per share.

Without Section 10(34A), this ₹300 would have been taxed as capital gains.

But thanks to Section 10(34A), you pay zero tax on this profit. The company pays the buyback tax, & you walk away with your full earnings.

Buyback vs Open Market Sale

|

Basis |

Buyback is Covered under Section 10(34A) |

Open Market Sale |

|

Tax in the hands of the shareholder |

Exempt |

Taxable |

|

Tax applicable |

Paid by company (115QA) |

Capital gains tax as per the holding period |

|

Ease of transaction |

Requires offer acceptance |

Just sell on the exchange |

Final Thoughts

If you’re an investor or HUF holding listed shares, Section 10(34A) of the Income Tax Act can help you avoid unnecessary taxation on buybacks. The provision allows for a legitimate, legal way to save tax while optimising your investment exit strategy.

However, always make sure the company has paid the applicable buyback tax under Section 115QA to keep yourself in the clear.

💡 Planning a strategic share exit or need clarity on how to use Section 10(34A) efficiently? Our experts at Callmyca.com are just a click away. Book a consultation now & save your capital gains the smart way.