Section 11 of Companies Act 2013: What It Was, Why It Was Omitted, and What It Means Today

If you started learning company law after 2016, chances are you’ve heard of Section 11 but never actually used it.

And if you incorporated a company before 2015, you probably remember it very well—because Section 11 of the Companies Act 2013 once decided whether your company could even start doing business or not.

This section has an interesting journey. It existed, created confusion and delay, and was then completely removed.

So let’s understand this properly, in a calm and human way:

- What Section 11 of Companies Act 2013 originally said

- Why it was considered a problem

- How and when it was removed

- What rules apply now

- And how it connects (or doesn’t connect) with directors and board requirements

What Was Section 11 of the Companies Act 2013?

Originally, section 11 of the Companies Act 2013 dealt with the commencement of business.

The law said:

A company having a share capital shall not commence any business or exercise borrowing powers unless certain conditions are fulfilled.

In short:

👉 Incorporation alone was not enough

👉 A company needed permission to start business

The Concept of “Certificate of Commencement of Business”

Under Section 11, after incorporation, a company had to obtain a certificate of commencement of business.

Without this certificate:

- The company could not start operations

- The company could not borrow money

- Even basic business activity was restricted

This was meant to ensure that:

- Share capital was actually brought in

- Subscribers were serious

- Shell companies were discouraged

On paper, the intention was good.

In practice, it caused delays and compliance burdens.

Conditions Under Old Section 11

Under the original Section 11 of the Companies Act 2013, two main conditions had to be fulfilled:

- Minimum subscription received

Shareholders had to pay the agreed share capital. - Declaration filed with ROC

Directors had to confirm that money was received.

Only after this would the registrar issue the certificate.

Until then:

A Company having a share capital shall not commence any business

Why Section 11 Became a Problem

In real life, this section created more problems than protection.

Here’s what actually happened:

- Companies were legally formed but practically stuck

- Bank accounts were delayed

- Investors waited unnecessarily

- Startups lost momentum

India was trying to improve its ease of doing business, and Section 11 became a roadblock.

That’s why lawmakers rethought this requirement.

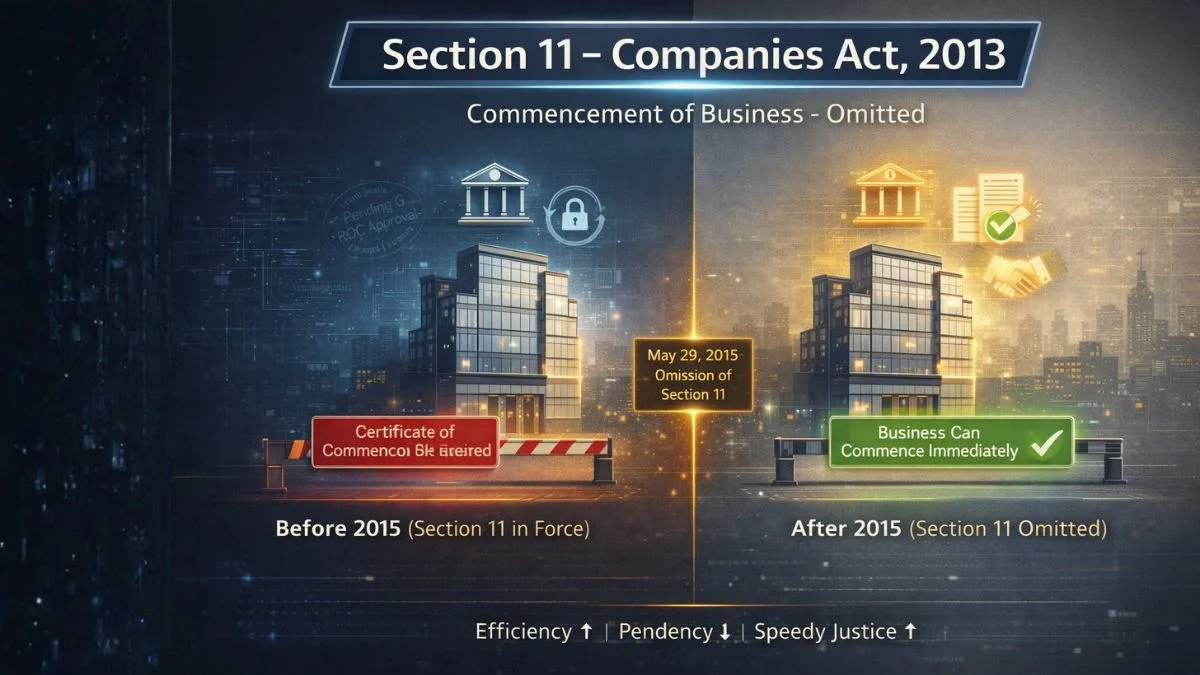

Omission of Section 11: A Big Change

Here’s the most important update:

👉 Section 11 of the Companies Act 2013 was omitted by the Companies (Amendment) Act, 2015.

👉 with effect from May 29, 2015.

This means:

- Section 11 no longer exists in the Act

- There is no requirement of certificate of commencement under this section

This single change streamlined the incorporation process significantly.

What Does “Omission” Mean in Law?

Let’s clarify this word, because it’s important.

Omission means:

- The section is completely removed

- It has no legal force

- It cannot be applied or enforced

So when we say Section 11 – Omission, it means:

The law has consciously deleted it.

It’s not suspended.

It’s not inactive.

It’s gone.

What Changed After Omission of Section 11?

After May 29, 2015:

- Companies could start business immediately after incorporation

- No separate certificate was required

- No additional declaration under Section 11

- Borrowing powers became available right away

This was a huge relief for startups and small companies.

Important Clarification: Is Commencement Completely Unregulated Now?

This is where many people misunderstand.

Even though Section 11 was omitted, later amendments introduced similar checks under other sections (especially Section 10A, introduced later).

So while the old Section 11 is gone:

- The concept of accountability still exists

- But in a more practical, time-bound manner

The government didn’t remove control—it removed unnecessary delay.

Common Confusion: Section 11 vs Directors & Board

Now let’s address the bullet points you mentioned—because this confusion is very common.

“Appointment and Qualifications of Directors”

This does not belong to Section 11.

Director-related provisions are mainly covered under:

- Section 149 – Company to have Board of Directors

- Section 152 – Appointment of Directors

- Sections 164 & 165 – Qualifications and limits

Section 11 had nothing to do with who can be a director.

“Company to have Board of Directors”

Again, this is Section 149, not Section 11.

Every company must have:

- A Board of Directors

- Minimum number of directors as prescribed

But this requirement exists independently of Section 11.

“An individual can hold directorship in not more than 20 companies.”

This rule comes from Section 165, not Section 11.

It states:

- An individual can hold directorship in not more than 20 companies

- Out of these, a maximum of 10 can be public companies

This has no connection with the commencement of business.

Why People Still Search Section 11 of Companies Act 2013

Even today, Section 11 of the Companies Act 2013 is frequently searched because:

- Old study material still mentions it

- CA/CS students read about it historically

- Professionals handling older cases encounter it

- People see “omission” and want clarity

Knowing why it was removed is as important as knowing what it said.

Practical Example: Company Before vs After 2015

Before 2015:

- The company was incorporated on 1st April

- Could not start business immediately

- Had to wait for certificate of commencement

- Delays of weeks or months were common

After 2015:

- The company was incorporated today

- Can open bank account

- Can start business activities

- Can enter contracts immediately

This is what ease of doing business looks like in practice.

Does Section 11 Apply to Existing Companies Today?

No.

Since Section 11 was omitted, it:

- Does not apply to new companies

- Does not apply to existing companies

- Cannot be enforced by ROC

Any reference to it today is only historical or academic.

Key Takeaways (In Plain Language)

Let’s summarize everything simply:

- Section 11 of Companies Act 2013 dealt with commencement of business

- It required a certificate of commencement

- It stated that a company having a share capital shall not commence any business without compliance

- This section was omitted by Companies (Amendment) Act, 2015

- Omission took effect from May 29, 2015

- Now, companies can start business immediately after incorporation

- Director rules like

- Appointment and qualifications of directors

- The company is to have Board of Directors

- An individual can hold directorship in not more than 20 companies

belong to other sections, not Section 11

- Appointment and qualifications of directors

Final Thoughts

Section 11 is a great example of how law evolves.

It started with good intention:

“Let’s make sure companies are genuine.”

But when it became a hurdle rather than a safeguard, it was removed.

That’s healthy lawmaking.

If you’re incorporating a company today, you don’t need to worry about Section 11—but understanding its history helps you understand why current rules exist and how compliance thinking has changed.

If you need help with company incorporation, director compliance, or ROC filings—and want advice that’s practical, not textbook—professional guidance matters.

For reliable support and end-to-end company law assistance, visit callmyca.com.