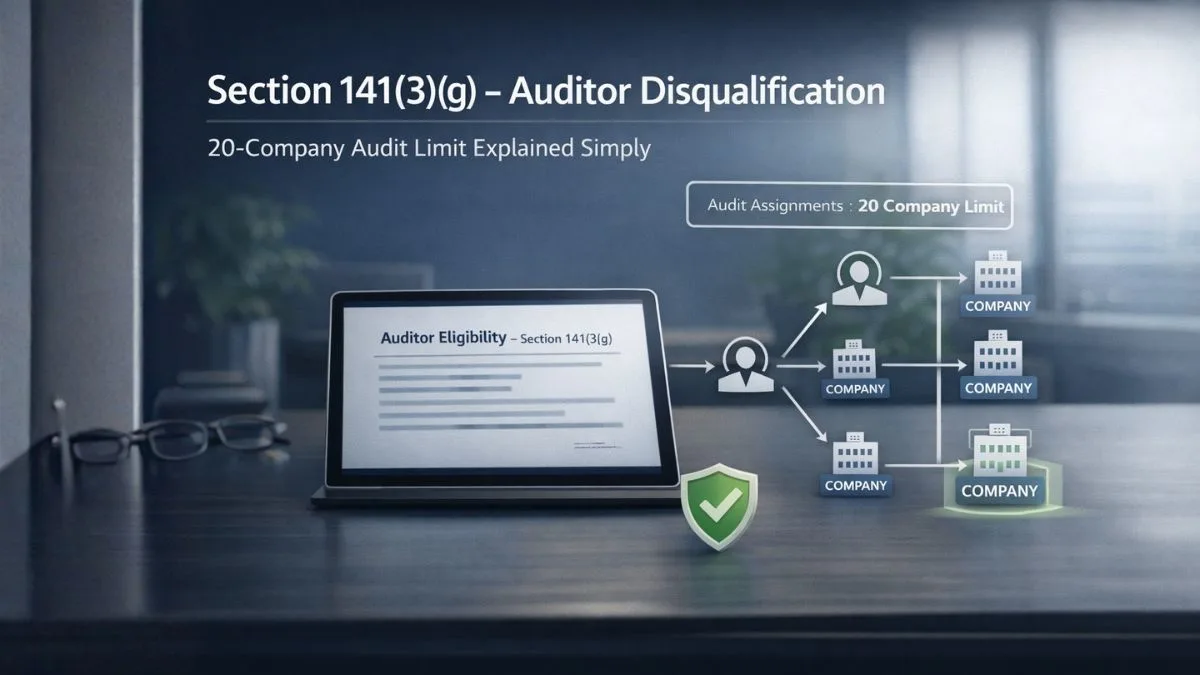

Section 141(3)(g) of Companies Act 2013: Auditor Disqualification Explained Simply

Auditor appointment looks simple on paper. A company passes a resolution and files forms, and the auditor starts work.

But behind this process lies one of the strictest compliance filters in company law—Section 141 of the Companies Act, 2013.

Among all its clauses, Section 141(3)(g) of the Companies Act 2013 is one of the most searched and most misunderstood.

I’ve seen companies unknowingly appoint ineligible auditors, and auditors accept assignments that later forced them to immediately vacate the office of auditor. The result? Invalid audits, regulatory risk, and avoidable panic.

This blog will explain Section 141(3)(g) of the Companies Act 2013 in plain, human language—with real-world logic, examples, and practical takeaways.

Why Section 141 Matters in the First Place

Before zooming into clause (3)(g), let’s understand the context.

Section 141 of the Companies Act, 2013, lays down:

- Who can be appointed as an auditor

- Who cannot be appointed as an auditor

- Which persons or entities are disqualified from becoming an auditor?

The intention is simple:

👉 Ensure auditor independence, quality, and accountability.

An auditor who is overburdened or conflicted cannot protect shareholders’ interests.

What Is Section 141(3)(g) of the Companies Act 2013?

At its core, Section 141(3)(g) of the Companies Act 2013 places a numerical cap on audit assignments.

It disqualifies an individual or a firm from being appointed as an auditor if they are already holding an appointment as an auditor for more than 20 companies, other than one-person companies.

This limit applies to:

- Individual auditors

- Partners of audit firms

And yes—it’s stricter than many people assume.

The 20-Company Limit Explained Clearly

Under Section 141(3)(g) of the Companies Act 2013:

- An individual auditor cannot audit more than 20 companies

- A partner of a firm also cannot exceed 20 company audits

- One Person Companies (OPCs) are excluded from this count

This rule exists to prevent auditors from spreading themselves too thin.

Why OPCs Are Excluded

Many people ask this question.

OPCs are excluded because:

- They have simpler compliance requirements

- Limited shareholder complexity

- Lower audit intensity

That’s why the law explicitly states:

“other than one-person companies.”

Who Is Covered Under Section 141(3)(g)?

This is where confusion often arises.

1. Individual Auditors

If an individual auditor is already auditing 20 companies (excluding OPCs), they cannot accept another audit.

2. Partners of Audit Firms

Even if a firm has multiple partners:

- Each partner’s individual limit matters

- A person or a partner of a firm shall not be eligible for appointment as an auditor if the limit is crossed

This prevents firms from bypassing the rule using internal allocation tricks.

Full-Time Employment: Another Hidden Disqualification

Apart from numerical limits, Section 141 also covers employment conflicts.

A person who is in full-time employment elsewhere is not eligible to be appointed as an auditor.

Why?

Because auditing demands independence and professional attention. A full-time job elsewhere compromises both.

Real-Life Example: How This Becomes a Problem

Let’s take a realistic scenario.

Mr. A is:

- A partner in a CA firm

- Already auditing 18 companies

- Working as a full-time finance head in a private company

Now:

- He accepts 3 more audit appointments

This violates:

- Section 141(3)(g) of Companies Act 2013 (crossing 20 audits)

- The rule barring a person who is in full-time employment elsewhere

Such an appointment is invalid from day one.

What Happens If Disqualification Arises Later?

This is extremely important.

If after appointment:

- The auditor crosses the 20-company limit

- Or accepts full-time employment

- Or becomes otherwise ineligible

They must immediately vacate the office of auditor.

There is no grace period.

The law is very strict here.

Meaning of “Immediately Vacate the Office of Auditor”

It means:

- The auditor’s position becomes vacant automatically

- No board resolution is required

- No notice period applies

The company must:

- Treat the office as vacant

- Appoint a new auditor as per law

- File necessary forms with ROC

Ignoring this can invalidate audit reports.

Why Section 141(3)(g) Is So Strict

From a governance perspective, this section protects:

- Audit quality

- Stakeholder trust

- Financial transparency

An auditor juggling too many companies cannot:

- Apply professional skepticism

- Give adequate time to risk areas

- Maintain independence

Hence, Section 141(3)(g) of the Companies Act 2013 exists as a preventive control.

Common Misconceptions Around Section 141(3)(g)

Let’s bust a few myths.

❌ “The limit applies to firms, not partners.”

Wrong.

It applies to each partner individually.

❌ “Private companies don’t count.”

Wrong.

All companies count, except OPCs.

❌ “Temporary excess is allowed.”

Wrong.

The moment the limit is crossed, disqualification kicks in.

Companies’ Responsibility Under Section 141

It’s not just the auditor’s headache.

Companies must ensure:

- Auditor eligibility before appointment

- Written consent and eligibility certificate

- Confirmation that Section 141 limits are not breached

Appointing an ineligible auditor can lead to:

- Compliance violations

- Regulatory queries

- Re-audit requirements

Penalties and Practical Consequences

While Section 141(3)(g) itself is a disqualification clause, violations can lead to:

- Invalid audit reports

- Non-compliance under Companies Act

- Professional misconduct proceedings against auditors

This is why both sides must be careful.

Why This Section Is Frequently Googled

Search data shows Section 141(3)(g) of the Companies Act 2013 is heavily searched because:

- Auditor limits are often crossed unknowingly

- Companies rely blindly on auditors’ declarations

- Many professionals confuse this with Income Tax Section 141

Context matters.

Quick Compliance Checklist (Very Practical)

Before appointing an auditor:

- ✔ Confirm total number of audits handled

- ✔ Exclude OPCs correctly

- ✔ Confirm no full-time employment elsewhere

- ✔ Obtain written eligibility confirmation

For auditors:

- ✔ Track assignments regularly

- ✔ Monitor firm-wide partner limits

- ✔ Decline appointments if close to threshold

Final Thoughts

To summarize in plain terms:

- Section 141(3)(g) of Companies Act 2013 restricts audit overload

- It disqualifies an individual or a firm from being appointed as an auditor if they are already holding an appointment as an auditor for more than 20 companies, other than one-person companies

- A person who is in full-time employment elsewhere is also disqualified

- If disqualification arises, the auditor must Immediately vacate the office of auditor

- The law clearly defines persons or entities that are disqualified from becoming an auditor.

- A person or a partner of a firm shall not be eligible for appointment as an auditor if conditions are violated

This section isn’t about punishment—it’s about quality, independence, and governance.

If you’re a company appointing auditors or a professional managing audit assignments, clarity on this provision is non-negotiable.

For expert guidance on auditor appointment, ROC compliance, and company law advisory, visit callmyca.com.