When it comes to salary income, most taxpayers only focus on their basic pay, allowances, & bonuses. But did you know that there are several other benefits, called perquisites, that are also taxable? One such crucial provision is Section 17(2)(vii) of the Income Tax Act, which deals with the taxation of specified perquisites provided by an employer to an employee.

In this article, we break down what this section means, who it applies to, & how it affects your tax liability in simple words.

What is Section 17(2)(vii) of the Income Tax Act?

Section 17(2) of the Income Tax Act defines the term “perquisite” about salary income. These are additional benefits that employees receive from their employers, either in cash or in kind, beyond their regular salary.

Sub-clause (vii) of Section 17(2) specifically refers to any other benefit or amenity, service, or advantage provided free of cost or at concessional rates to the employee, which has monetary value.

These perquisites form part of the employee's income under the head ‘Salaries’ & are, therefore, taxable.

Why is Section 17(2)(vii) Important?

The provision ensures that employees do not receive untaxed benefits in non-monetary forms. Perquisites under Section 17(2)(vii) could include:

✅ Free or subsidised accommodation.

✅ Interest-free or concessional loans.

✅ Free club memberships.

✅ Use of employer-owned assets (like cars).

✅ Gifts or vouchers exceeding prescribed limits.

Such benefits are often used to compensate high-level executives or senior professionals in addition to their fixed salary.

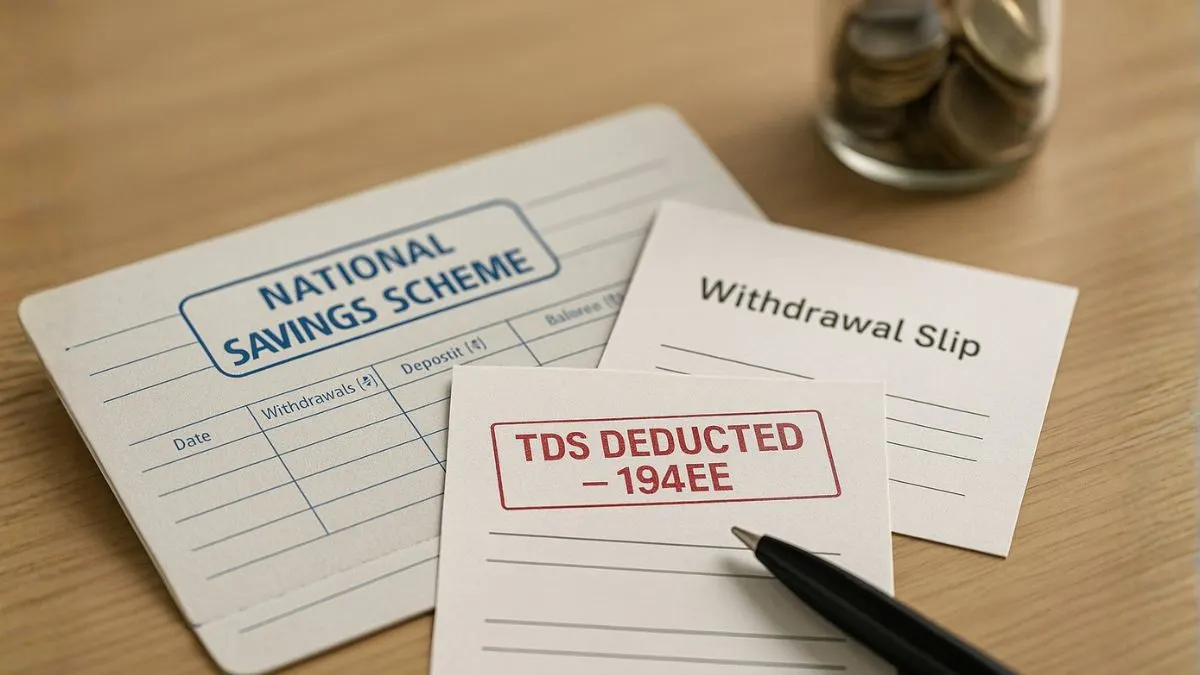

Key Points You Should Know About Section 17(2)(vii)

✔ It applies to all employees receiving non-cash or concessional benefits from their employers.

✔ The fair market value of the benefit is calculated & added to the taxable salary.

✔ These benefits are taxed under the Income Tax Act based on prescribed valuation rules under Rule 3 of the Income Tax Rules, 1962.

Examples of Perquisites Taxable under Section 17(2)(vii)

To make it simple, let’s look at some examples:

1️⃣ An employee is given free accommodation—its value is taxable.

2️⃣ An employee receives a car from the employer for personal use—taxable.

3️⃣ A company gives a luxury holiday package to an employee, taxable as a perquisite.

These are not just fringe benefits; they have real monetary value & hence, fall under the purview of Section 17(2)(vii)."

Tax Calculation on Perquisites:

The value of perquisites is determined as per specific valuation methods provided in the Income Tax Rules. Once the value is computed:

- It is added to the employee’s gross salary.

- Tax is calculated based on the applicable slab.

👉 This ensures transparency & avoids tax leakage through non-monetary benefits.

Are There Any Exemptions?

Yes. Certain perquisites are fully or partially tax-exempt under various provisions, such as:

✅ Medical reimbursement up to specified limits.

✅ Employer’s contribution to the provident fund (subject to threshold).

✅ Free tea, coffee, & snacks provided at the workplace.

However, most high-value benefits offered as part of executive compensation packages fall squarely under Section 17(2)(vii)."

Why Employers & Employees Should Care About Section 17(2)(vii)

For Employers:

- Accurate reporting of perquisites in Form 16 is mandatory.

- Non-compliance can lead to penalties.

For Employees:

- Awareness helps in correct tax planning.

- Failure to account for perquisite tax can lead to income tax notices.

Practical Scenario:

Mr. A, a senior manager, is provided with free accommodation valued at ₹1.2 lakhs annually. This value is added to his taxable income under Section 17(2)(vii), increasing his overall tax liability.

Frequently Asked Questions (FAQs):

Q1. What is Section 17(2)(vii) of the Income Tax Act?

It refers to the taxation of perquisites provided by the employer, such as free services or amenities, which are added to the employee’s salary for tax purposes.

Q2. Are gifts from employers taxable?

Yes, gifts exceeding ₹5,000 in value are taxable as perquisites under Section 17(2)(vii).

Q3. How is the value of perquisites calculated?

It is calculated using Rule 3 of the Income Tax Rules, depending on the nature of the perquisite.

Q4. Are company-provided vehicles taxable?

Yes, if used for personal purposes, the value of the benefit is taxable.

Q5. Are there exemptions available?

Some benefits, such as tea, coffee, & free medical check-ups, may be exempt within specified limits.

Conclusion:

In an era where employee compensation often includes more than just a paycheck, understanding Section 17(2)(vii) of the Income Tax Act is vital for both employers & employees. It ensures that all forms of income, including perks & privileges, are treated fairly under the tax laws.

Knowing how perquisites are taxed can help you plan better, avoid surprises during tax filing, & stay compliant with the law.

Confused about how your perks & benefits impact your taxes? Don’t worry—let our experts at Callmyca.com help you decode Section 17(2)(vii) & optimise your salary structure for maximum savings. Get your taxes sorted today!