India’s digital economy is booming. From groceries to electronics, everything is being sold online. But with that rise, it also became easier for sellers to underreport income. To tackle this, the government introduced Section 194O in the Income Tax Act through the Finance Act, 2020.

This section brings e-commerce transactions under the TDS (Tax Deducted at Source) net.

In short, an E-Commerce operator is required to deduct TDS when making payments to sellers on their platform. It helps the tax department track online income and ensures sellers remain compliant.

🧾 What is Section 194O?

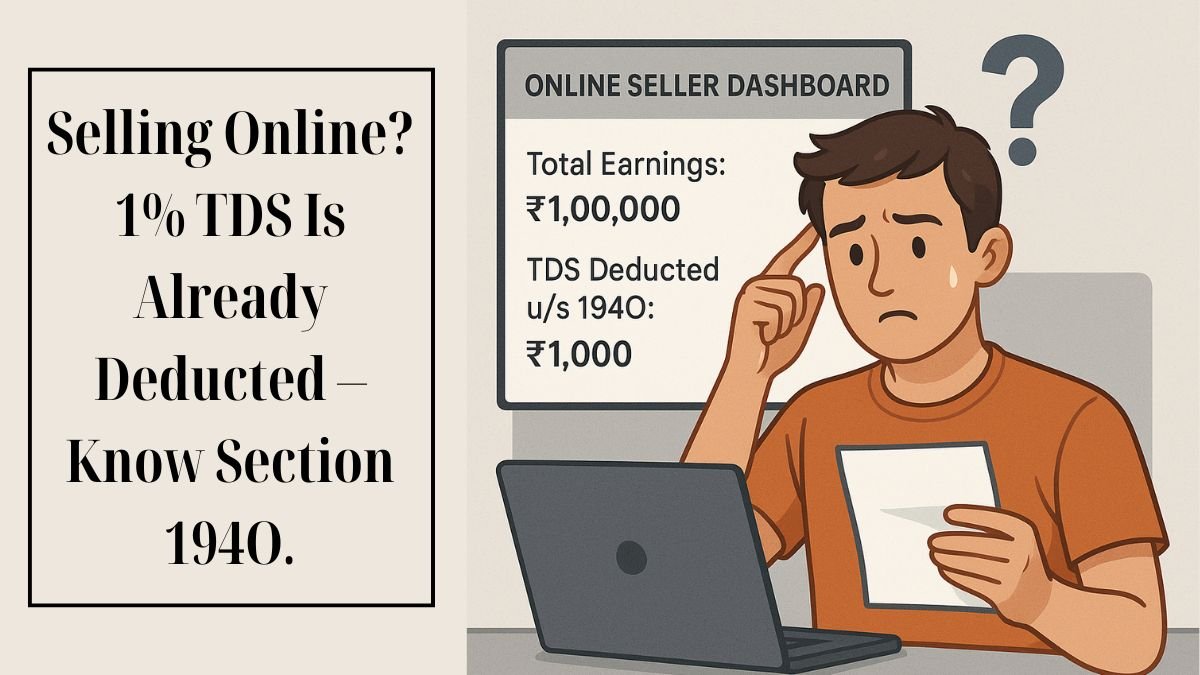

Section 194O of the Income Tax Act mandates that the e-commerce operator—the platform, not the individual seller—deduct TDS at 1% before making payments to the seller for goods or services sold through its platform.

So, if you’re selling on Amazon, Flipkart, or Meesho, & they pay you ₹1,00,000, they will deduct ₹1,000 (1% TDS) & pay you ₹99,000.

The deducted TDS is deposited with the Income Tax Department & reflected in your Form 26AS. "

🛒 Who is an E-Commerce Operator?

As per the law, an E-Commerce Operator is defined as:

“A person who owns, operates or manages a digital or electronic facility or platform for electronic commerce.”

This includes:

- Marketplaces like Flipkart, Amazon, and Myntra

- Food delivery apps like Swiggy, Zomato

- Cab aggregators like Uber, Ola

If the platform facilitates the sale of goods or services, then under Section 194O, an E-Commerce operator is required to deduct TDS.

👨💻 Who is an E-Commerce Participant?

A seller or service provider selling via an e-commerce operator is termed an E-Commerce Participant.

This can be:

- Individuals

- Firms

- Companies

- Startups

- Freelancers

As long as they’re earning income through online platforms, this section applies.

📊 TDS Rate Under Section 194O

- Standard Rate: 1% on the gross amount of sales or services (including GST)

- If PAN is not provided, 5% TDS under Section 206AA

So, sellers must link their PAN with the platform to avoid higher deductions.

🧑⚖️ Exemption for Small Sellers

There’s a relaxation.

If the e-commerce participant:

- Is an Individual or HUF

- Gross annual sales on the platform are less than ₹5 lakhs, and

- They have provided PAN or Aadhaar

Then the E-Commerce operator is not required to deduct TDS under Section 194O.

This exemption protects small home-based sellers & hobby businesses from excessive compliance.

🧮 Example for Better Clarity

Ravi is a T-shirt seller on an e-commerce platform. His monthly sale is ₹60,000. Annual total = ₹7,20,000.

Flipkart will deduct 1% of ₹7,20,000 = ₹7,200 as TDS under Section 194O and deposit it on Ravi’s behalf.

Ravi can view this amount in his Form 26AS & claim credit while filing ITR.

🔎 Why Section 194O Was Introduced

Before this section, many small online sellers escaped the tax radar, especially if they weren’t registered or didn’t declare full income.

This provision:

- Brings accountability to online earnings

- Reduces underreporting of income

- Ensures a wider tax base without burdening sellers

- Makes income visible in Form 26AS, avoiding mismatch issues

📜 Legal Wording of Section 194O

According to the law:

“An E-Commerce operator is required to deduct TDS at the time of credit of the amount of sale or services to the account of an e-commerce participant or at the time of payment thereof, whichever is earlier.”

This means even if the amount is not paid in cash but credited to the seller’s dashboard/wallet, it still attracts TDS.

💬 Frequently Asked Questions

- Is TDS deducted even if the e-commerce operator doesn’t pay in cash?

Yes. Even virtual credit or wallet transfer triggers TDS. - Can sellers claim a refund of TDS?

Absolutely. If your total tax liability is lower than the TDS deducted, you’ll get a refund upon filing your ITR. - Are GST or delivery charges included in the TDS calculation?

Yes, currently, TDS is calculated on the gross amount, including taxes and charges. "

🧾 Compliance Checklist for E-Commerce Platforms

- Collect PAN from all sellers

- Deduct 1% TDS at the time of payment or credit

- File TDS returns (Form 26Q)

- Issue Form 16A to sellers

- Ensure seller details match the PAN database

Failure to comply may lead to penalties under Section 271H.

📘 Section 194O in Hindi (Quick Glimpse)

"धारा 194O के अनुसार, एक ई-कॉमर्स ऑपरेटर को अपने प्लेटफॉर्म पर व्यापार करने वाले विक्रेताओं से भुगतान करते समय टीडीएस काटना अनिवार्य है।"

📄 Summary Table

|

Particular |

Details |

|

Section |

194O of Income Tax Act |

|

Applies To |

E-commerce operators and participants |

|

TDS Rate |

1% (5% if PAN not furnished) |

|

Exemption |

Sellers earning < ₹5 lakh annually and having PAN |

|

Deduction Timing |

At credit or payment, whichever is earlier |

✅ Conclusion

With the digital economy growing rapidly, the government is focused on bringing all e-commerce earnings under the tax net. Section 194O of the Income Tax Act ensures that an E-Commerce operator is required to deduct TDS so that all digital income is reported transparently.

If you’re selling online—even casually—it’s important to understand how this affects your earnings, returns, and refunds.

💬 Need help calculating your TDS deductions or filing ITR as an online seller?

We’ve got your back. Connect with CallMyCA.com & simplify your e-commerce tax compliance.