Every salaried employee, businessperson, or professional in India is affected by income tax slabs. The Income Tax Act, 1961, follows a progressive taxation system, where higher income means higher tax liability. Over the years, the government has made several changes to simplify taxation & offer relief to middle-class taxpayers.

Section 202, in common references, is often associated with income tax slabs and the categorization of taxpayers under different regimes. While tax slabs may look straightforward, understanding deductions, exemptions, and the difference between the old & new regimes is crucial. In this article, we will cover all aspects of Section 202 income tax slabs in detail.

What are Income Tax Slabs?

India follows a progressive tax structure, meaning individuals with lower income pay lower tax, while those with higher income pay more. Income tax slabs define the rate of taxation applicable to different ranges of income.

- For instance, if your income is ₹6 lakh, only the portion above the exemption limit is taxed, not the entire income.

- The slabs are revised periodically in Union Budgets to keep up with inflation & provide relief to taxpayers.

From slab calculations to exemptions and special deductions, we decode the rulebook for you — so you only pay what’s truly required. 👉 click here

Old vs New Tax Regime – Section 202 Income Tax Slabs

The government introduced the new tax regime in Budget 2020 as an optional system. Taxpayers can choose between the old regime (with exemptions & deductions) or the new regime (lower tax rates but fewer deductions).

Old Regime Highlights

- Allows multiple deductions under Sections 80C, 80D, HRA, LTA, etc.

- Rs 50,000 standard deduction remains for those in the old regime.

- Suitable for individuals who invest heavily in tax-saving instruments.

New Regime Highlights

- Simplified structure with reduced tax rates.

- Most exemptions & deductions are not allowed.

- Beneficial for individuals who do not claim many exemptions.

Also Read: Old Tax Regime: Everything You Need to Know Before Filing Your Taxes

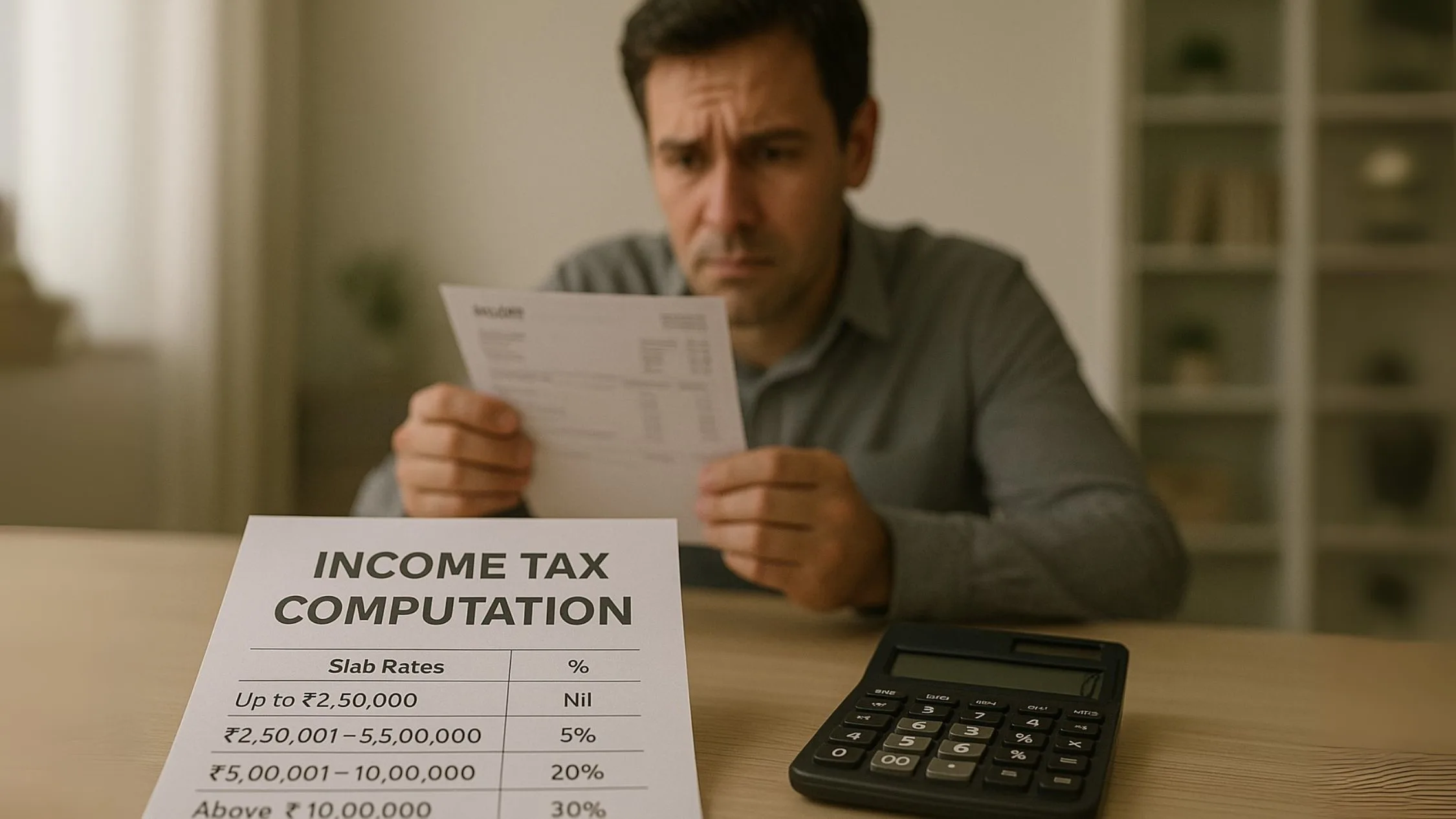

Section 202 Income Tax Slabs – FY 2024-25 (AY 2025-26)

Old Regime (with deductions & exemptions)

- Up to ₹2.5 lakh – No tax

- ₹2.5 lakh to ₹5 lakh – 5%

- ₹5 lakh to ₹10 lakh – 20%

- Above ₹10 lakh – 30%

- Plus applicable surcharge & cess

(Note: Rebate under Section 87A makes income up to ₹5 lakh tax-free)

New Regime (revised slabs from April 2023 onwards)"

- Up to ₹3 lakh – No tax

- ₹3 lakh to ₹6 lakh – 5%

- ₹6 lakh to ₹9 lakh – 10%

- ₹9 lakh to ₹12 lakh – 15%

- ₹12 lakh to ₹15 lakh – 20%

- Above ₹15 lakh – 30%

(Note: Rebate under Section 87A makes income up to ₹7 lakh tax-free under the new regime)

Standard Deduction under Section 202 Income Tax Slabs

One of the most notable benefits is the standard deduction of Rs 50,000 for salaried individuals & pensioners under the old regime. This deduction directly reduces taxable income without requiring proof of expenses or investments.

- Example: If your salary is ₹6 lakh, taxable income becomes ₹5.5 lakh after applying the standard deduction.

- In the new regime, this deduction was initially unavailable but has now been extended to certain salaried taxpayers from FY 2023-24 onwards.

It’s not just your income that decides your tax — deductions, exemptions, and tax slabs rewrite the final number. Curious what really applies to you?👉 click here

Key Exemptions and Deductions under Old Regime

While the new regime has lower tax rates, many individuals still prefer the old regime because of deductions like:

- Section 80C – Investments in PPF, ELSS, LIC, etc. (up to ₹1.5 lakh).

- Section 80D – Health insurance premium deduction.

- House Rent Allowance (HRA) – For salaried individuals staying in rented houses.

- Leave Travel Allowance (LTA) – For travel expenses.

These deductions, along with the Rs 50,000 standard deduction, make the old regime attractive for taxpayers who invest systematically.

Also Read: New Tax Regime: A Simpler Way to Pay Taxes in India

Choosing Between Old and New Regime

Taxpayers must carefully compare both regimes before filing returns:

- If you have high investments in tax-saving instruments, the old regime is beneficial.

- If you have low or no exemptions, the new regime with lower tax slabs may save you more money."

- The government allows taxpayers to switch regimes every financial year (except businesses).

Impact of Section 202 Income Tax Slabs on Different Categories

- Benefit from the Rs 50,000 standard deduction.

- Can optimize savings under HRA, LTA, & 80C deductions in the old regime.

Senior Citizens (60-80 years)

- Exemption limit increased to ₹3 lakh under old regime.

- New regime still follows general slabs but may benefit due to higher rebate.

Super Senior Citizens (80 years)

- Exemption limit of ₹5 lakh under old regime.

- No additional benefits in new regime.

Example Calculation (Old vs New Regime)

Suppose Mr. X has an annual income of ₹10 lakh.

Under Old Regime

- Gross Income = ₹10 lakh

- Less: 80C investment = ₹1.5 lakh

- Less: 80D Health Insurance = ₹25,000

- Less: Standard Deduction = ₹50,000

- Taxable Income = ₹7.75 lakh

- Tax = ₹72,500 (approx)

Under New Regime

- Gross Income = ₹10 lakh

- No major deductions allowed (except standard deduction in some cases)."

- Taxable Income = ₹10 lakh

- Tax = ₹60,000

Here, the new regime is beneficial if Mr. X does not invest much in tax-saving options.

Also Read: The ₹1.5 Lakh Tax-Saving Secret Most Taxpayers Miss!

Advantages of Section 202 Income Tax Slabs

- Progressive taxation ensures fairness.

- Flexibility to choose between old & new regimes.

- Rs 50,000 standard deduction provides relief for salaried taxpayers.

- Encourages investments in financial products under old regime.

Challenges Faced by Taxpayers

- Confusion between regimes & applicability.

- Limited exemptions in the new regime reduce flexibility."

- Frequent changes in slabs require constant awareness.

Conclusion

Section 202 income tax slabs provide the framework for how individuals are taxed in India. With the option to choose between the old regime (with exemptions like 80C, HRA, and the Rs 50,000 standard deduction) and the new regime (simplified slabs but fewer exemptions), taxpayers can optimize their savings based on their financial situation.

Understanding these slabs is essential for tax planning & avoiding unnecessary liabilities. Whether you are a salaried employee, business owner, or professional, a careful comparison of regimes can help you save significantly.

👉 Want personalized advice on which tax regime suits you best? Visit Callmyca.com – your trusted partner for expert tax planning and filing.