Section 234A of the Income Tax Act: What Really Happens When You File ITR Late

Most people don’t panic when they miss the income tax return due date.

They think,

“We’ll file it a little late.”

“If there’s a penalty, we’ll deal with it.”

What many don’t realize is that the Income Tax Act quietly starts charging interest, month after month, without sending any warning.

That’s where Section 234A of the Income Tax Act comes into play.

This section deals purely with the late filing of your income tax return. No investigation. No notices. Just cold, automatic interest.

What Is Section 234A of the Income Tax Act?

In simple language, section 234a of the Income Tax Act applies when you file your income tax return after the due date and some tax is still payable.

That’s it.

No complicated conditions.

If tax is due and the return is late, interest starts ticking.

Interest for Defaults in Furnishing Return of Income

The legal heading of this provision is very clear:

👉 Interest for defaults in furnishing return of income

So the law is not punishing income.

It is punishing delay.

If you were required to file your return by the due date and you didn’t, Section 234A steps in.

How Much Interest Is Charged Under Section 234A?

This is where people get surprised.

Under section 234a of the Income Tax Act, the law imposes a simple interest penalty of 1% per month (or part of a month).

Yes, even one day late is counted as a full month.

And this interest is calculated on the outstanding tax amount, not on total income.

You Will Be Charged an Interest Amount of 1% Per Month

Let’s say this clearly because it’s important:

👉 You will be charged an interest amount of 1% per month

👉 calculated on unpaid tax

👉 from the due date till the actual filing date

No discretion.

No negotiation.

No “first time excuse.”

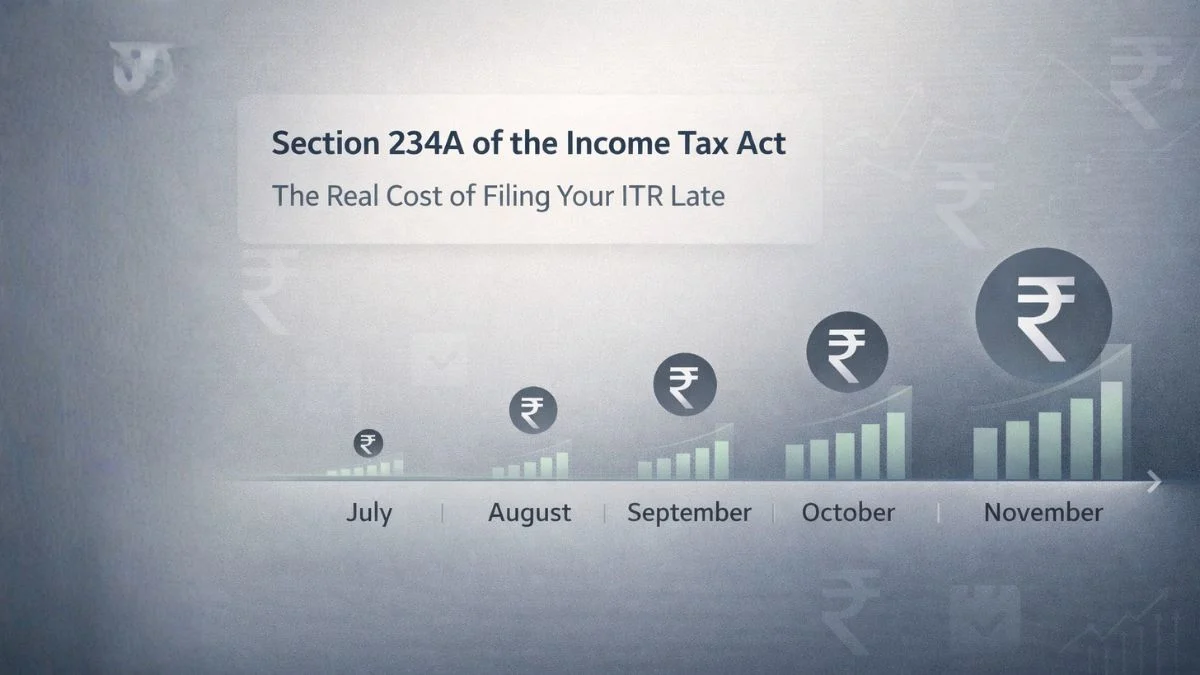

Simple Example (Real-Life Scenario)

Suppose:

- Tax payable after TDS = ₹40,000

- Due date to file ITR = 31 July

- You file return on 20 November

Delay = August, September, October, November

That’s 4 months (even though November was only 20 days)

Interest under Section 234A:

₹40,000 × 1% × 4 = ₹1,600

This is over and above late filing fees or any other charges.

When Does Section 234A Not Apply?

Here’s a relief many people don’t know.

If:

- your total tax payable is zero, or

- entire tax is already paid through TDS / advance tax

Then section 234a of the Income Tax Act does not apply, even if you file the return late.

The late filing fee under Section 234F may still apply, but 234A interest won’t.

Late Filing of Your Income Tax Return: The Hidden Cost

People often focus only on the late filing fee.

But interest is more dangerous because:

- it keeps adding silently

- it increases with time

- it reduces refunds

- it shows up suddenly in tax computation

That’s why late filing of your income tax return is costlier than it looks.

Relationship With Advance Tax (Common Confusion)

You might have noticed references like

“On or before December 15 of the previous year, at least 75% of advance tax…”

That rule relates mainly to Section 234C, not 234A.

But here’s the connection.

If you didn’t pay advance tax properly and also filed late:

- Section 234B / 234C apply for advance tax default

- Section 234A applies for late filing

Yes, multiple interest sections can apply together.

Section 234A Is Automatic

This is important.

Interest under section 234a of the Income Tax Act is:

- system calculated

- auto-applied

- not dependent on assessment

The portal computes it automatically when you file your return late.

You won’t get a choice.

Can Section 234A Interest Be Waived?

In very rare cases, yes.

The CBDT has limited power to waive or reduce interest, but only when:

- delay is due to genuine hardship

- natural calamity

- court orders

- systemic issues

For most taxpayers, interest under Section 234A is non-negotiable.

Common Situations Where Section 234A Applies

From real cases, this section usually hits:

- people waiting for Form 16

- freelancers who procrastinate

- taxpayers expecting refunds but miscalculating tax

- people confused between original return and revised return

- individuals filing after December thinking, “Now it’s an updated return anyway.”

Interest applies regardless of intent.

Why the Law Is So Strict

Think of it like this.

Tax is government revenue.

Delay means loss of time value of money.

So the law doesn’t argue.

It just charges interest.

That’s the philosophy behind Section 234A.

One-Day Delay = One Month Interest (Yes, Really)

This is the most painful part.

File on:

- 1 August instead of 31 July → 1 month interest

- 1 December instead of 30 November → full month

There is no concept of “grace period” here.

How to Avoid Section 234A Completely

Very simple habits:

- estimate tax early

- pay any shortfall before due date

- file return even if documents are incomplete

- revise later if required

Late filing is expensive. Revision is not.

Final Thoughts

To summarize in plain words:

- Section 234A of Income Tax Act applies to late filing of ITR

- It imposes a simple interest penalty of 1% per month

- Interest is charged on unpaid tax

- It applies automatically

- Even one day counts as one full month

Late filing doesn’t just delay compliance.

It quietly drains money.

🔗 Filed Late or Seeing Unexpected Interest in Your Tax Computation?

Many taxpayers realize the Section 234A impact only after filing, when the final tax payable suddenly increases. If your return shows unexpected interest, demand, or adjustment due to late filing, replying incorrectly or ignoring it can make things worse. Before taking the next step, it’s safer to review the computation properly. You can explore professional support for income tax filings, interest disputes, and notice handling at Callmyca.com.