Section 234B of Income Tax Act: Interest for Default in Payment of Advance Tax Explained Simply

Most taxpayers first hear about Section 234B of the Income Tax Act only when an unexpected interest amount appears while filing their return. There’s no warning email, no prior notice—just a number quietly added to your tax calculation.

And that’s when the confusion starts:

- Why am I being charged interest?

- I paid tax before filing—shouldn’t that be enough?

- Is this a penalty or a fine?

The truth is, Section 234B is not a punishment. It is a mechanism to ensure discipline in paying advance tax.

In this article, I’ll explain Section 234B in a simple, conversational, and practical way—without legal jargon—so you clearly understand when it applies, how it is calculated, and how you can avoid it in the future.

What Is Section 234B of the Income Tax Act?

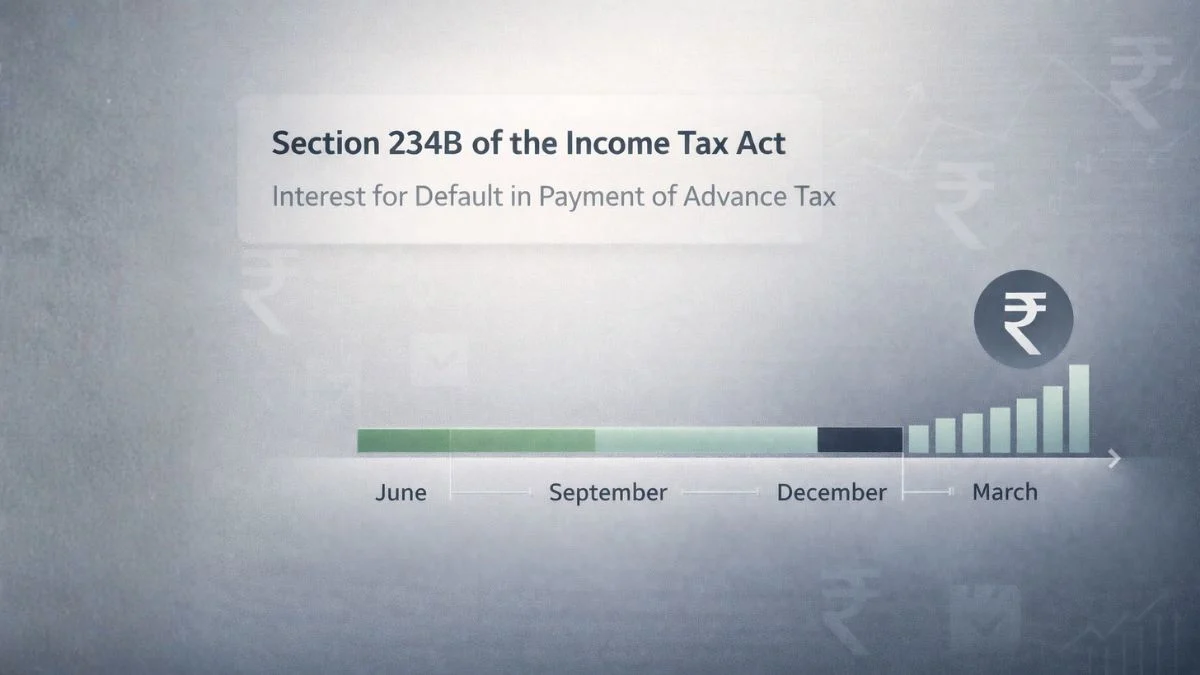

At its core, Section 234B of the Income Tax Act deals with:

👉 Interest for defaults in the payment of advance tax

This section becomes applicable when:

- A taxpayer is liable to pay advance tax, and

- Either fails to pay it entirely, or

- Pays less than 90% of the total assessed tax liability

In such cases, the Income Tax Department charges interest for delayed payment of tax.

Why Section 234B Exists

India follows a pay-as-you-earn tax system.

Instead of allowing taxpayers to pay all tax at the end of the year, the law requires:

- Tax to be paid during the year itself through advance tax

Section 234B exists to ensure:

- The government gets tax revenue on time

- Taxpayers don’t postpone payments until return filing

- There is fairness between compliant and non-compliant taxpayers

So, Section 234B is about timing, not wrongdoing.

Who Is Liable Under Section 234B?

Section 234B applies to:

- Individuals

- Freelancers

- Professionals

- Business owners

- Investors

Basically, any taxpayer who is liable to pay advance tax can be covered.

If your total tax liability (after TDS) exceeds ₹10,000 in a year, advance tax provisions apply—and so does Section 234B.

When Does Section 234B Get Triggered?

This is the most important part to understand.

Interest under section 234B is levied in the following two cases:

Case 1: No Advance Tax Paid at All

If you were liable to pay advance tax but:

- Did not pay any advance tax during the year

Then Section 234B automatically applies.

Case 2: Advance Tax Paid Is Less Than 90%

Even if you paid advance tax, Section 234B applies if:

- The total advance tax paid is less than 90% of assessed tax

Paying 80%, 85%, or even 89% is not enough.

The 90% threshold is strict.

What Is “Assessed Tax” for Section 234B?

"Assessed tax" means:

- Total tax payable

- Minus TDS/TCS

- Minus reliefs (if any)

Advance tax is compared against this figure to check whether the 90% condition is met.

Rate of Interest Under Section 234B

Here’s the part that hits the pocket.

👉 Interest under Section 234B is charged at 1% per month or part of a month

This interest is calculated:

- From 1st April of the assessment year

- Till the date of actual payment of tax

Even a delay of a few days counts as a full month.

Period for Which Interest Is Calculated

Interest is calculated:

- From 1st April

- Up to the date you pay the remaining tax

If tax is paid in parts, interest is calculated accordingly.

This is why delaying payment after March can significantly increase interest.

Simple Example to Understand Section 234B

Let’s take a very practical example.

- Total assessed tax: ₹100,000

- Advance tax paid: ₹70,000

Since ₹70,000 is less than 90% of ₹100,000, Section 234B applies.

Balance tax = ₹30,000

Interest:

- 1% per month

- From 1st April till date of payment

This interest continues to add up until the balance tax is paid.

Example Where Section 234B Does NOT Apply

- Assessed tax: ₹1,00,000

- Advance tax paid: ₹91,000

Since more than 90% is paid:

- Section 234B will not apply, even if ₹9,000 is paid later

This shows why planning that last 5–10% matters.

Is Section 234B a Penalty or Fine?

No.

This is a very common misunderstanding.

Although people search for:

- fines and penalties that the income tax department can impose

Section 234B is not a penalty.

It is:

- Interest

- Compensatory in nature

- Charged automatically

Penalties are covered under different sections.

Section 234B vs Section 234C (Important Difference)

Many taxpayers confuse these two sections.

|

Section |

Applies When |

|

234C |

Delay or shortfall in advance tax installments |

|

234B |

Failure to pay 90% of total advance tax |

You can be liable under:

- Only 234°C

- Only 234B

- Both 234B and 234C

They operate independently.

What Happens When One Misses or Forgets to Pay Advance Tax?

This is where Section 234B comes into play directly.

👉 When one misses or forgets to pay advance tax, and total payment falls below 90%, interest under Section 234B becomes mandatory.

There is:

- No discretion

- No waiver (except limited cases)

- No “first-time” relief

The system applies it automatically.

How Is Section 234B Calculated in Practice?

You don’t usually calculate it manually.

- The income tax portal calculates it automatically

- It appears in the tax computation while filing ITR

However, understanding the logic helps you:

- Plan better next year

- Avoid repeated interest costs

Can Section 234B Be Waived?

In general:

- No automatic waiver is available

However, in rare cases:

- CBDT may grant waiver due to extraordinary circumstances

- Such cases are very limited

For most taxpayers, planning is the only solution.

Common Situations Leading to Section 234B Interest

From real-world experience, these are common triggers:

- Relying only on TDS

- Underestimating business income

- Ignoring bonus or incentive income

- Believing tax can be paid at return filing time

- Confusing advance tax with self-assessment tax

These mistakes repeat every year for many taxpayers.

Practical Tips to Avoid Section 234B

Here are some simple but effective steps:

- Estimate income conservatively

- Track income quarterly

- Ensure at least 90% advance tax is paid by March

- Pay a little extra rather than a little less

- Don’t delay balance tax after March

These small habits save recurring interest.

Does Section 234B Apply to Salaried Employees?

Usually no—but sometimes yes.

If:

- The entire tax is covered by TDS

Then Section 234B does not apply.

But if:

- You have rental income, capital gains, freelance income, or interest income

- And advance tax is not paid properly

Then salaried individuals can also fall under Section 234B.

Section 234B in Case of Refund Adjustments

If you receive a refund later:

- It does not automatically cancel 234B interest

Interest is based on timing of payment, not final outcome.

Why Section 234B Feels “Harsh”

People find it harsh because:

- It starts from 1st April

- It counts part of a month as full

- There is no discretion

But from the law’s perspective:

- Tax was due earlier

- The government lost time value of money

That’s the logic.

Key Takeaways

- Section 234B of Income Tax Act deals with advance tax defaults

- It applies when advance tax paid is less than 90% of assessed tax

- Interest for defaults in payment of advance tax is charged

- The interest rate is 1% per month or part of a month.

- It is not a penalty, but interest

- It applies automatically

- Proper advance tax planning avoids it completely

Final Thoughts

Section 234B is one of those tax provisions that quietly affects taxpayers year after year—not because it’s unfair, but because it’s misunderstood.

Once you understand one simple rule—pay at least 90% of your tax before March ends—Section 234B stops being a problem entirely.

Good tax planning isn’t about avoiding tax.

It’s about paying the right tax at the right time.

🔗 Facing Section 234B Interest or Advance Tax Confusion?

Many taxpayers realize the impact of Section 234B only when interest suddenly appears during ITR filing. If your tax computation shows unexpected interest or demand, or you’re unsure whether advance tax was calculated correctly, taking the wrong step can increase the issue. Before proceeding, it’s safer to review the calculation properly. You can explore professional support for advanced tax planning, interest disputes, and income tax filings at Callmyca.com.