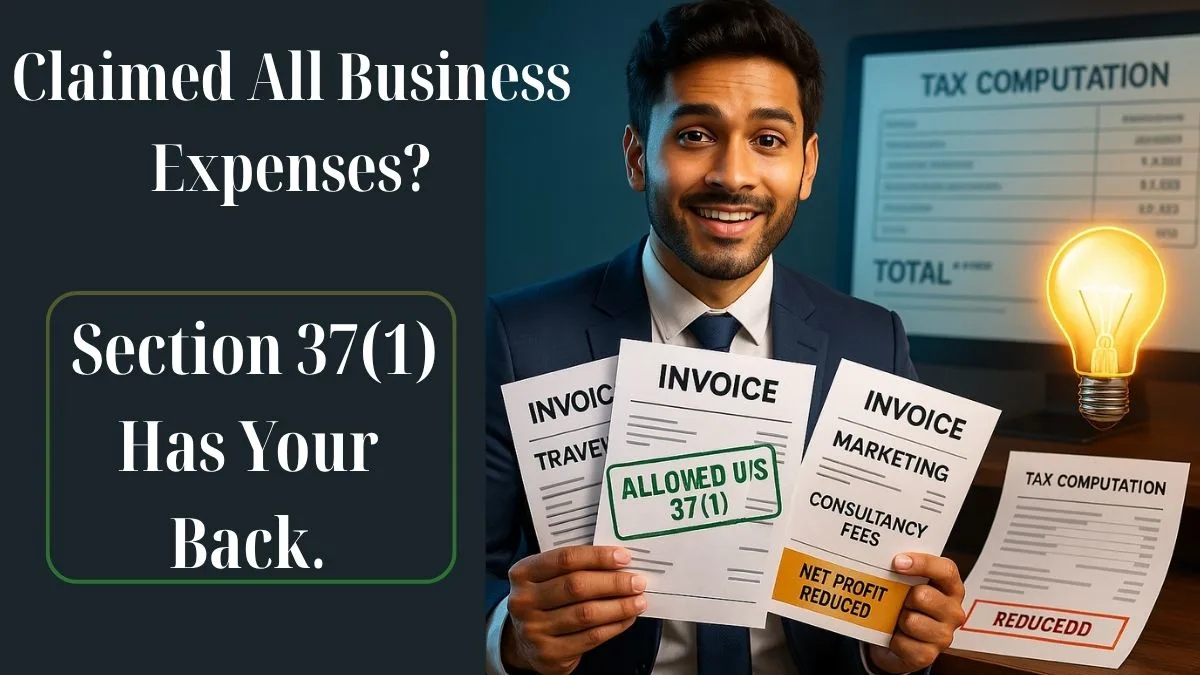

If you're a business owner or a tax professional, you've likely encountered sections like 30 to 36 of the Income Tax Act that specify various deductions—rent, depreciation, repairs, insurance, & more. But what if your expense doesn’t fall under any of those heads?

Enter Section 37(1) of the Income Tax Act—a catch-all provision that acts as a safety net for deductions that are not capital in nature but still wholly & exclusively incurred for the business or profession.

Let’s understand this important section in a way that’s practical, relatable, & crystal clear. “

📘 What Does Section 37(1) of Income Tax Act Say?

Section 37(1) allows businesses to claim deductions for any expenditure (other than those specified in Sections 30 to 36) that is:

- Not capital in nature

- Not personal

- Incurred wholly & exclusively for business or profession

This means if you’ve incurred a business-related expense that doesn’t fall into any other specific deduction category, you can still claim it under this section. “

✅ Examples of Allowable Business Expenses under Section 37(1)

Here are some classic examples where Section 37(1) allows businesses to claim deductions for specific expenses:

- Advertisement & marketing expenses

- Sales commission

- Travelling and conveyance for business

- Legal & professional fees

- Website maintenance or domain charges

- Office supplies, refreshments, etc. (used solely for business)

These are revenue expenditures that help your business grow and operate smoothly. Since they are not capital investments (like machinery) & are not personal, they fall under Section 37(1).

🚫 What Expenses are NOT Allowed?

Now here’s the twist: the section also has a specific explanation clause.

It disallows any expenditure incurred by an assessee for any purpose which is an offence or prohibited by law.

So if you’re claiming:

- Bribes to government officials

- Payments made for illegal activities

- Expenses related to smuggling, drugs, or hawala

They’ll be shot down by tax authorities. You can’t take a tax benefit on something illegal, no matter how "necessary" it may feel in certain industries.

This is where Section 37(1) draws a hard moral line: illegal expenses are not deductible.

📌 Keyword Spotlight:

Let’s smoothly incorporate your keywords with context:

- Any expenditure incurred by an assessee for any purpose which is an offence is disallowed under this section.

- However, any expenditure that is not capital in nature & is incurred purposefully for the business can be deducted.

- Section 37(1) allows businesses to claim deductions for specific expenses that support day-to-day operations.

🧾 Judicial View and Interpretation

Several courts have ruled on what qualifies as allowable expenditure. The test often revolves around:

- Whether the expense is for business

- Whether it’s legal

- Whether it’s revenue (not capital)

Courts have generally favoured taxpayers when expenses are genuinely incurred & documented, but they come down heavily if there's even a hint of illegality.

📊 Capital vs Revenue: Know the Difference

A capital expenditure creates a long-term asset (e.g., buying a building or machine).

A revenue expenditure, which Section 37(1) focuses on, keeps your business running day-to-day (e.g., salaries, marketing).

If you try to pass off a capital expense as revenue to get a deduction under Section 37(1), expect a call from the assessment officer.

🔍 What to Keep in Mind When Claiming Section 37(1) Deductions

- Document everything – Invoices, purpose, & proof of payment are crucial.

- Avoid grey areas – Don’t try to claim personal or illegal expenses as business-related.

- Be reasonable – Overstated or inflated expenses raise red flags.

- Don’t duplicate – If it’s claimed under Section 35 (like R&D), don’t double dip in Section 37.

🔁 Most Searched Queries Related to Section 37(1)

You’re not alone if you’ve searched:

- “What is Section 37(1) of the Income Tax Act?”

- “Business expense deduction not covered under other sections”

- “Can bribes be claimed under business expenditure?”

- “Revenue vs capital expense in taxation”

This shows how crucial this section is in real-world taxation for freelancers, startups, small businesses, & large corporations alike.

✅ Final Thoughts

Section 37(1) is a blessing for businesses, helping them reduce taxable income by claiming a wide range of operational expenses. But remember, tax relief doesn't extend to anything shady or personal.

Need help figuring out what’s allowed & what isn’t under Section 37(1)?

Let our experts at Callmyca.com handle it—so you don’t leave money on the table or get caught on the wrong side of tax law. Book a service now & take control of your business taxes the smart way!