Section 44AA Limit (Maintenance of Books of Accounts)

If you are a freelancer, professional, small business owner, or consultant, you’ve probably searched for section 44AA limit after hearing your CA say something like,

“You are required to maintain proper books of accounts now.”

That sentence alone can create anxiety—especially if you thought filing ITR was enough.

So let’s slow this down and understand Section 44AA of the Income Tax Act in a way that actually makes sense in real life, not in exam language.

What Is Section 44AA of the Income Tax Act?

Section 44AA of the Income Tax Act deals with the maintenance of books of accounts.

In simple words:

It specifies who is required to maintain books of accounts, what kind of books, and from when—based on income, turnover, and profession.

This section applies to:

- Businesses

- Professionals

- Freelancers

- Consultants

But not everyone has to maintain books. That’s where limits come in.

Why Section 44AA Exists

The Income Tax Department wants:

- Proper income tracking

- Verifiable expenses

- Transparency in tax reporting

Without books:

- Income can be underreported

- Expenses can be inflated

- Scrutiny becomes difficult

Section 44AA creates a clear threshold-based system—below the limit, compliance is simple; above it, discipline is required.

Section 44AA Is About “Who Must Maintain Books”

A very important clarification:

👉 Section 44AA does NOT talk about tax audits.

👉 It talks only about the maintenance of books of accounts.

Audit comes later under Section 44AB.

Who Is Liable to Maintain Accounts as per Section 44AA?

This is one of the most searched questions:

who is liable to maintain accounts as per section 44aa

The answer depends on:

- Whether you are in a specified profession

- Or a non-specified profession/business

Section 44AA(1) – Specified Professions

Section 44AA(1) of the Income Tax Act applies to specified professionals.

If you belong to a specified profession:

👉 You must maintain books of accounts, irrespective of income.

No threshold. No escape.

List of Specified Profession Under Section 44AA(1)

Here is the official list of specified professions under section 44AA(1):

- Legal (advocates, lawyers)

- Medical (doctors, surgeons)

- Engineering

- Architectural

- Accountancy (CAs)

- Technical consultancy

- Interior decoration

- Any other profession will be notified later

If you fall in this list:

👉 Books of accounts are mandatory, even if income is ₹2 lakh.

What Books Are Required for Specified Professions?

Specified professionals must maintain:

- Cash book

- Journal (if mercantile system followed)

- Ledger

- Copies of bills and receipts

- Original bills for expenses above prescribed limits

This requirement exists even if you opt for presumptive taxation later.

Section 44AA(2) – Non-Specified Professions & Businesses

Now comes the part where limits matter.

Section 44AA(2) applies to:

- Businesses

- Non-specified professions

- Freelancers not covered under 44AA(1)

Here, books are required only if income/turnover crosses limits.

Section 44AA Limit – The Core Question

Let’s answer the main query directly.

Section 44AA Limit for Non-Specified Persons

You are required to maintain books if:

- Income exceeds ₹1,20,000, OR

- Total sales/turnover/gross receipts exceed ₹10,00,000

👉 In any one of the three preceding financial years.

This is the classic section 44AA limit most people refer to.

Section 44AA Limit for AY 2025–26

Many people specifically search:

44aa limit for AY 2025-26

As of now:

- The limits remain unchanged

- Income limit: ₹120,000

- Turnover limit: ₹10,00,000

Until the law is amended, these thresholds continue to apply for AY 2025–26.

Important Point About “Likely to Exceed”

Section 44AA also applies if:

Income is likely to exceed ₹120,000.

This means:

- Even if current-year income is lower

- But expected to cross the limit

- Books should be maintained proactively

Waiting till year-end can be risky.

Does Section 44AA Apply to Companies?

Another common question:

is section 44aa applicable to companies

Technically:

- Companies are already required to maintain books under Companies Act

- So Section 44AA is practically irrelevant for companies

Section 44AA is mainly relevant for:

- Individuals

- HUFs

- Firms

- LLPs

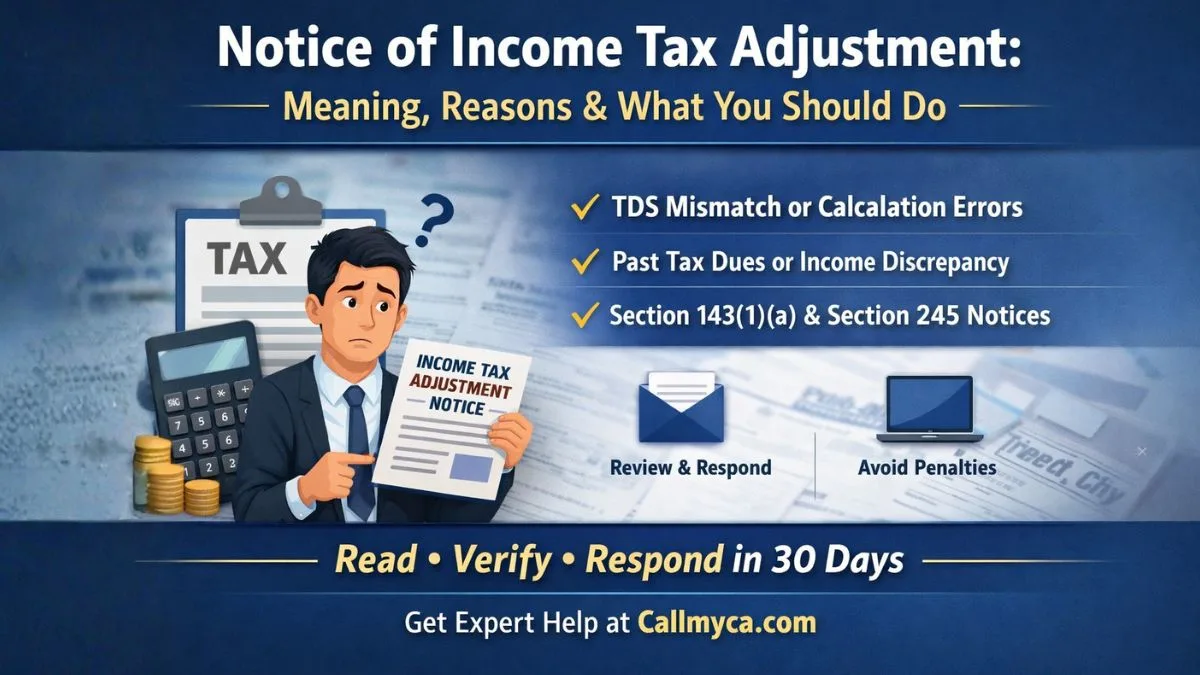

Section 44AA vs Section 44AB (Audit)—Don’t Confuse Them

|

Section |

Purpose |

|

Section 44AA |

Maintenance of books |

|

Section 44AB |

Tax audit requirement |

You may need books under 44AA even if an audit is not applicable.

What If You Are Under Presumptive Taxation?

This is a very common confusion.

Business Under Section 44AD

- If you opt for 44AD

- And declare income as per presumptive rate

- Then books under Section 44AA may not be required

Profession Under Section 44ADA

- Even under 44ADA

- Specified professionals must still maintain basic records

Presumptive does not always override 44AA.

Maintenance of Books of Accounts as per Income Tax Act – Practical Meaning

Maintaining books doesn’t mean:

- Complex accounting software

- Daily journal entries by hand

It means:

- Clear income records

- Expense proof

- Bank reconciliation

- Logical documentation

The goal is verifiability, not paperwork burden.

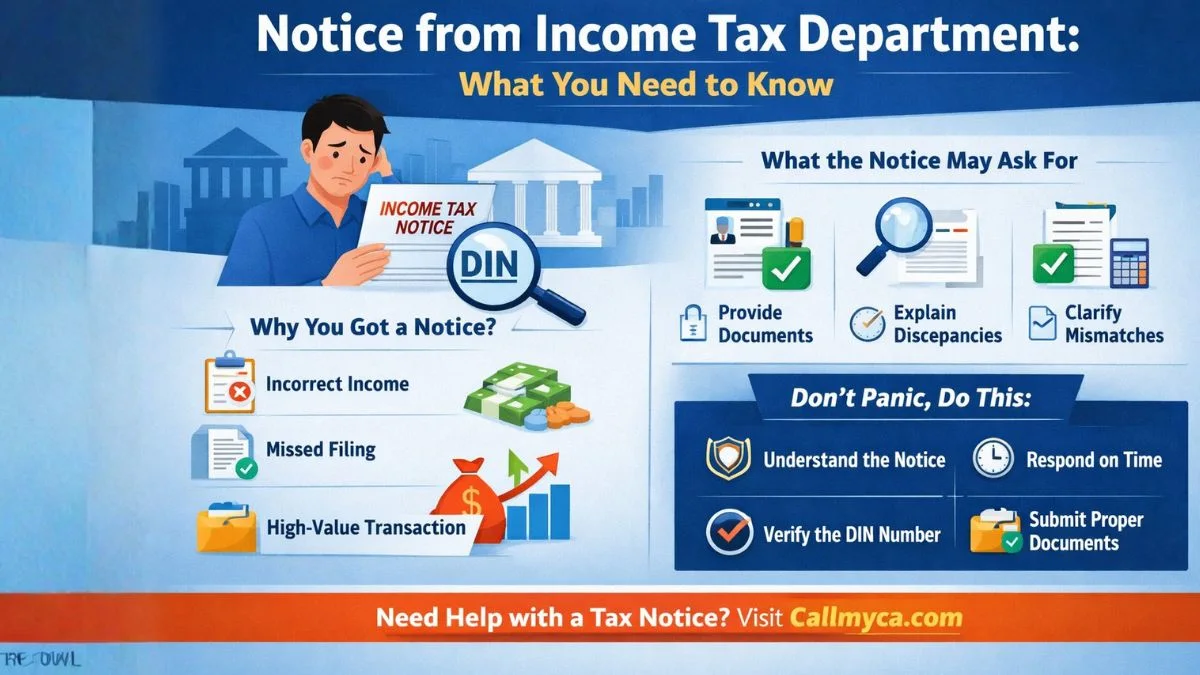

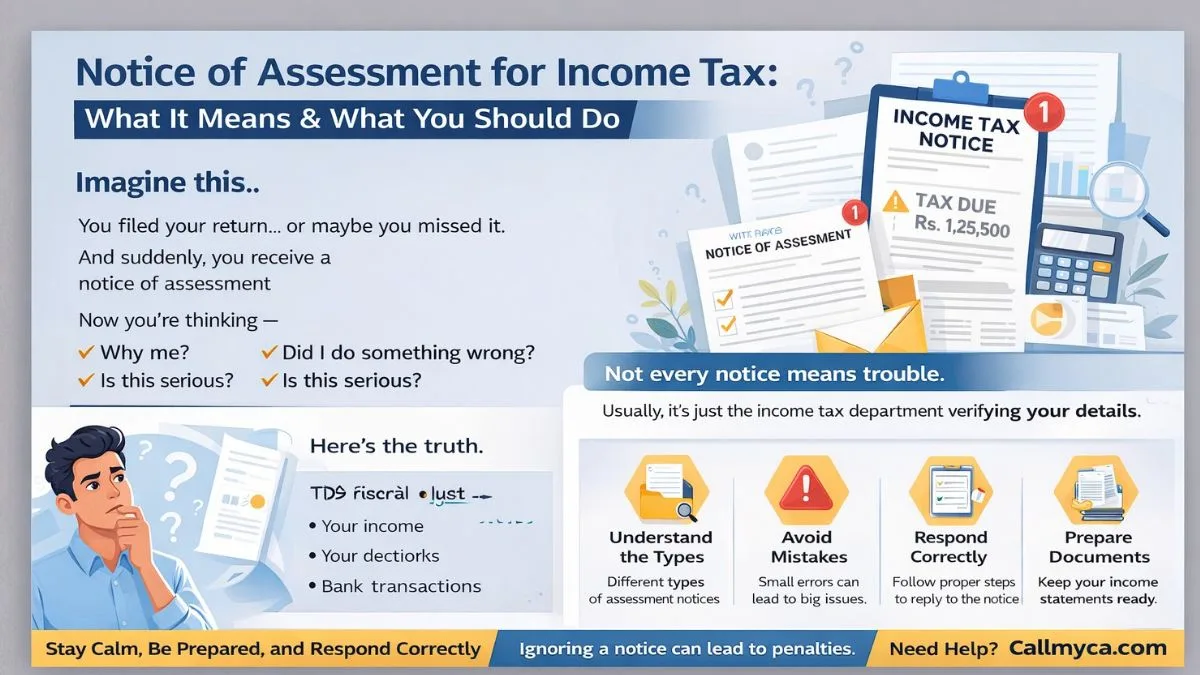

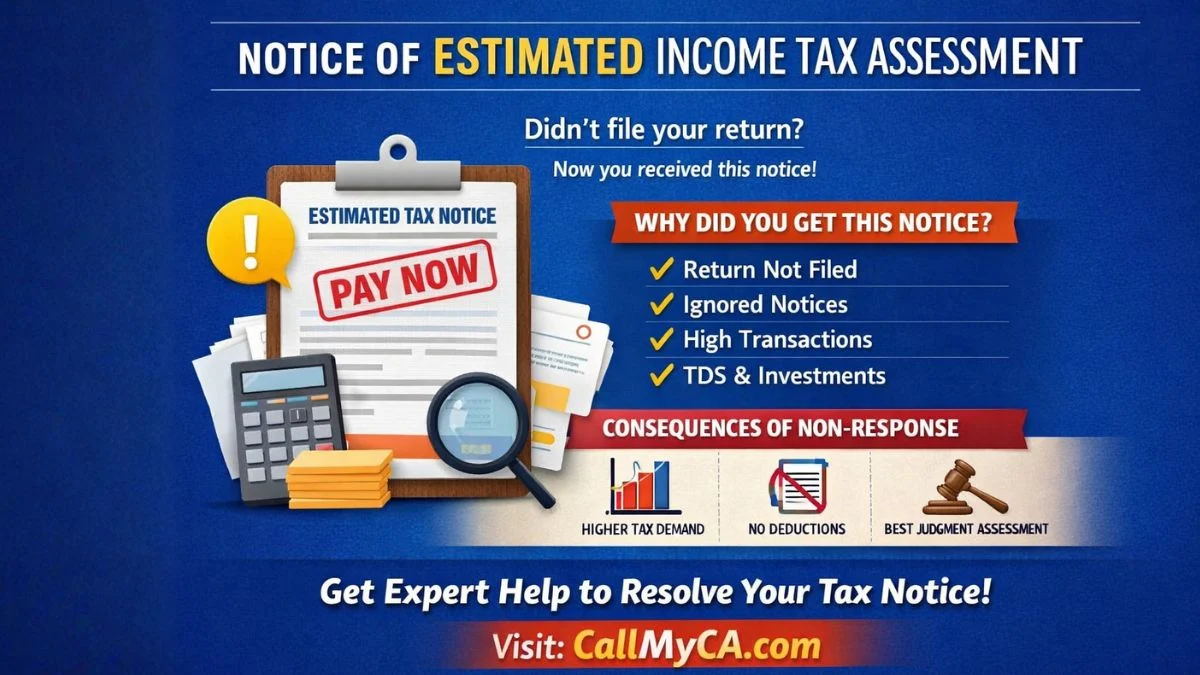

What Happens If You Don’t Maintain Books When Required?

Failure to comply can lead to:

- Penalty under Section 271A

- Difficulty during scrutiny

- Disallowance of expenses

- Higher tax liability

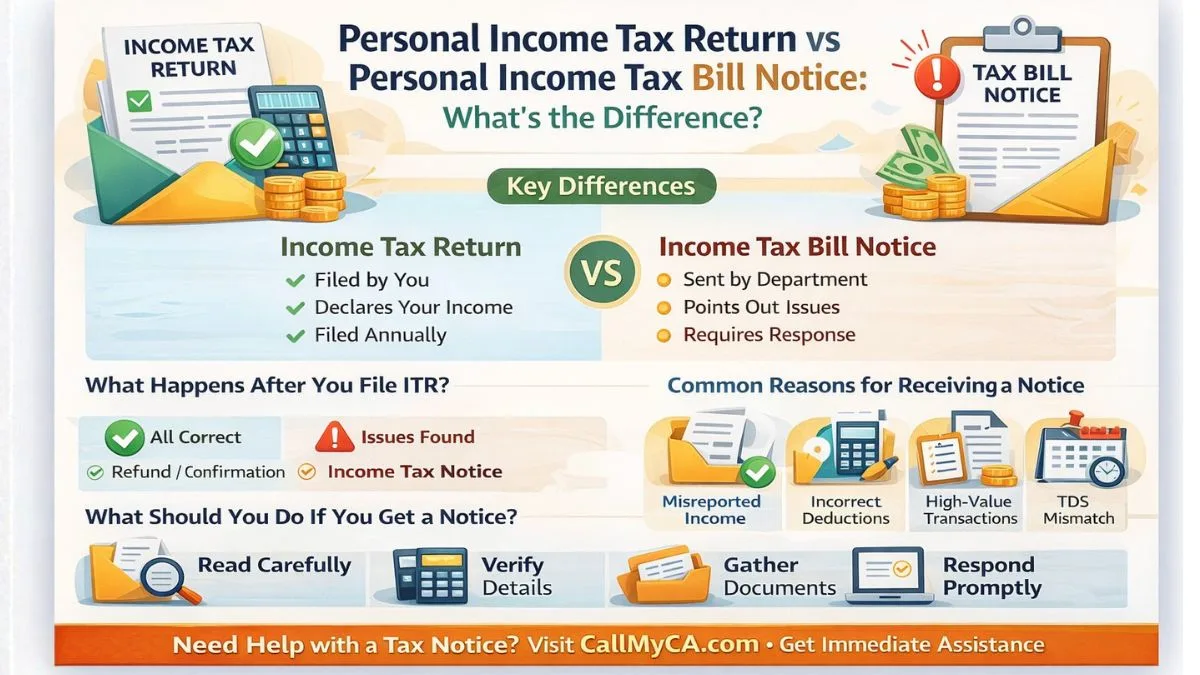

Many notices start simply because books were missing.

Common Misunderstandings About Section 44AA

Let’s clear some myths:

❌ “Only big businesses need books.”

❌ “Freelancers don’t need books.”

❌ “Bank statements are enough.”

❌ “If audit not applicable, books not required”

All of these are wrong in many cases.

Practical Examples to Understand Section 44AA

Example 1: Freelancer (Non-Specified)

- Income: ₹2.5 lakh

- Turnover: ₹8 lakh

👉 Income exceeds ₹1.2 lakh → Books required

Example 2: Small Trader

- Turnover: ₹12 lakh

👉 Turnover exceeds ₹10 lakh → Books required

Example 3: Doctor

- Income: ₹1 lakh

👉 Specified profession → Books required anyway

How Long Should Books Be Maintained?

Books should generally be preserved for:

- 6 years from end of relevant assessment year

Longer if:

- Assessment is pending

- Litigation is ongoing

Best Practices for Complying With Section 44AA

If you are close to the limit:

- Start basic bookkeeping early

- Maintain digital records

- Keep invoices and receipts

- Reconcile bank statements

- Review income projections quarterly

Compliance is easier than correction.

Section 44AA in One Simple Line

If we had to summarize the section 44AA limit in one sentence:

Section 44AA decides whether you must maintain books of accounts, based on your profession and income/turnover limits.

Why Section 44AA Is More Important Than People Think

Most tax disputes don’t start with tax rates—they start with:

- Lack of records

- Incomplete books

- Unexplained income

Section 44AA is the first line of defense in such cases.

Final Thoughts: Section 44AA Is About Discipline, Not Burden

Section 44AA of the Income Tax Act is not meant to scare taxpayers. It exists to:

- Encourage record-keeping

- Reduce disputes

- Support genuine taxpayers

Once you understand the limits and applicability, compliance becomes routine—not stressful.

Need help with bookkeeping, tax compliance, or Section 44AA applicability?

Visit callmyca.com for clear, practical guidance on income tax, audits, and compliance.