Section 56 of the Transfer of Property Act (Marshalling by Subsequent Purchaser)

If you’ve ever searched for Section 56 of the Transfer of Property Act, chances are you were either:

- Studying property law, or

- Trying to understand what happens when a property you bought is already mortgaged

And that confusion is completely justified.

Section 56 is one of those provisions that looks theoretical at first glance, but in real life, it protects buyers from unfair consequences of someone else’s loan.

Let’s break it down in plain, practical language—no heavy legal jargon, no memorization, just real understanding.

What Is Section 56 of the Transfer of Property Act?

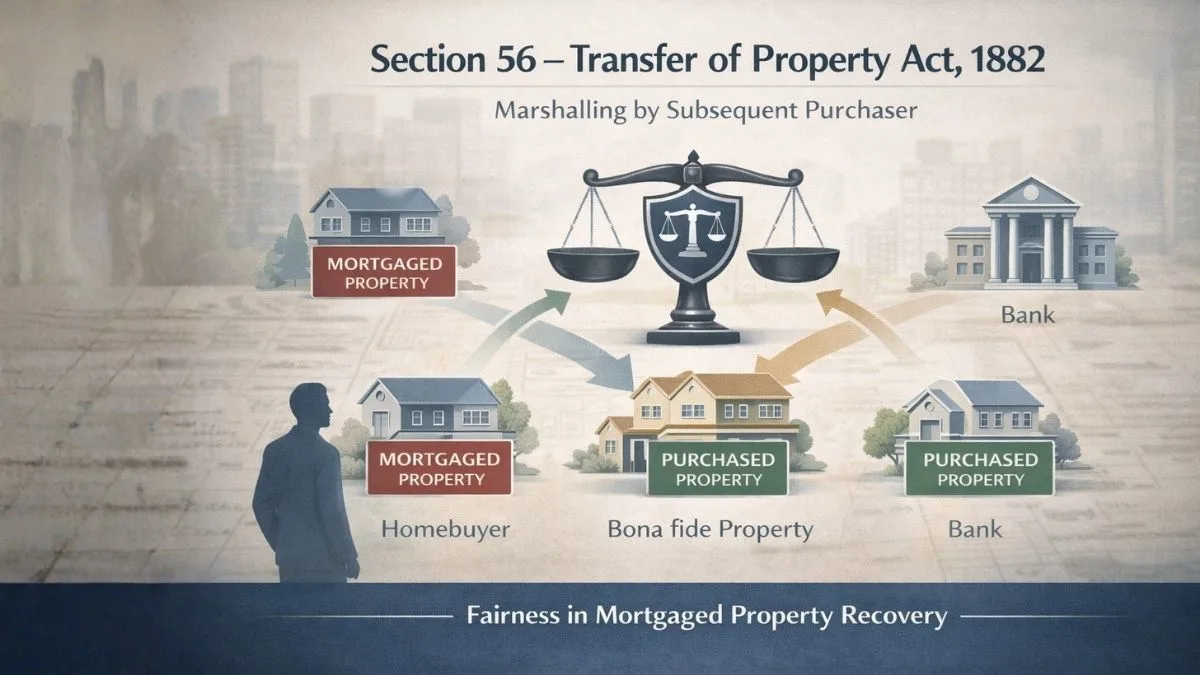

Section 56 of the Transfer of Property Act, 1882, deals with the Doctrine of Marshalling by Subsequent Purchaser.

In simple words:

If a seller has mortgaged multiple properties and later sells one of those properties to a buyer, the buyer can ask the lender to first recover the loan from the remaining properties instead of the one he purchased.

This protects the buyer from being unfairly dragged into someone else’s debt.

Why Section 56 Exists

Imagine this situation:

A person owns three properties.

- He mortgages all three to a bank.

- Later, he sells one property to you.

- The bank then tries to recover its loan by selling your property.

That feels unfair, right?

Section 56 exists to prevent exactly this injustice.

Doctrine of Marshalling—What Does It Mean?

Before understanding Section 56 fully, let’s understand marshalling.

Marshalling means:

- Arranging or prioritising claims

- In a way that protects weaker parties

- Without harming the lender

In property law, marshalling ensures fair distribution of burden.

Marshalling by Subsequent Purchaser (Core Idea of Section 56)

Section 56 applies specifically to:

- A subsequent purchaser

- Who buys one property

- Out of several properties mortgaged together

Such a buyer can say:

“Please recover your loan from the other properties first. Don’t touch the one I bought, unless absolutely necessary.”

This is called marshalling by a subsequent purchaser.

Key Conditions for Applying Section 56

Section 56 is not automatic. Certain conditions must be satisfied.

1. One Owner, Multiple Properties

The seller must own more than one property.

2. Single Mortgage Over Multiple Properties

All properties must be mortgaged together to the same lender.

3. Subsequent Sale of One Property

One of the mortgaged properties must be sold to a buyer after the mortgage.

4. No Prejudice to Mortgagee

The buyer’s request must not harm the mortgagee’s rights.

This condition is critical.

What Does “Without Prejudice to Mortgagee” Mean?

Section 56 protects buyers—but not at the cost of the lender.

If:

- Other properties are insufficient

- Or legally unavailable

- Or already exhausted

Then:

👉 The lender can still proceed against the purchased property.

Marshalling is a right of adjustment, not a right of escape.

Section 56 of the Transfer of Property Act – Simple Example

Let’s understand this with a real-life-style example.

Example

Mr. A owns:

- House X

- House Y

- House Z

He mortgages all three to Bank B.

Later:

- Mr. A sells House X to Mr. C.

If Mr. A defaults:

- Bank B should first recover money from House Y and Z

- Only if those are insufficient can Bank B touch House X

This protection for Mr. C comes from Section 56 of the Transfer of Property Act.

Does Section 56 Apply Automatically?

No.

The buyer must:

- Be aware of the mortgage

- Assert his right

- Prove that other properties exist and are available

Courts apply Section 56 based on facts, not assumptions.

Sections 56, 81, and 82 of the Transfer of Property Act—How They Connect

Many students and professionals search:

Sections 56, 81, and 82 of the Transfer of Property Act

Because all three deal with marshalling and contribution.

Let’s see how they differ.

Section 56 – Marshalling by Subsequent Purchaser

- Applies between mortgagee and buyer

- Protects a buyer of one mortgaged property

- Buyer asks lender to adjust recovery

Section 81 – Marshalling by Mortgagee

- Applies between multiple mortgagees

- Ensures fair priority among lenders

- Based on order and knowledge

Section 82 – Contribution

- Applies between owners of multiple properties

- When debt is paid, burden is shared proportionately

All three aim at fairness, but in different relationships.

Marshalling Applies to Seller and Buyer—What Does This Mean?

When people say:

marshalling applies to seller and buyer

They mean:

- The seller’s act of mortgaging multiple properties

- Should not unfairly burden a later buyer

- When other options exist

Section 56 balances interests between:

- Seller

- Buyer

- Mortgagee

Can a Buyer Waive the Right Under Section 56?

Yes.

If:

- Buyer knowingly agrees

- Or contract says buyer takes property “subject to mortgage without adjustment.”

Then:

- Section 56 protection may not apply

Contractual terms matter.

Does Section 56 Apply to All Mortgages?

It applies to:

- Valid mortgages

- Where multiple properties are involved

It does not apply where:

- Only one property is mortgaged

- Buyer purchases before mortgage

- The mortgagee’s rights would be harmed

Judicial Approach to Section 56

Courts generally:

- Support fairness

- Protect bona fide purchasers

- Ensure lender’s rights are intact

Section 56 is applied equitably, not mechanically.

Practical Importance of Section 56 in Real Life

Section 56 matters in:

- Property purchase disputes

- Bank recovery proceedings

- SARFAESI actions

- Auction challenges

- Title due diligence

A buyer who understands Section 56 is less vulnerable.

What Buyers Should Do in Mortgaged Property Transactions

If you’re buying property:

- Check if property is mortgaged

- Ask whether other properties are also mortgaged

- Understand loan structure

- Record protections in sale deed

- Seek legal advice before purchase

Section 56 is helpful—but prevention is better.

What Lenders Must Keep in Mind

Banks must:

- Act reasonably

- Respect statutory rights

- Avoid arbitrary recovery choices

Ignoring Section 56 can result in:

- Litigation

- Stay orders

- Recovery delays

Common Misunderstandings About Section 56

Let’s clear some myths:

❌ “Buyer is never liable.”

❌ “Bank must always avoid buyer’s property”

❌ “Section 56 cancels mortgage”

All are wrong.

Section 56:

- Adjusts recovery

- Does not erase liability

- Does not override lender’s rights

Section 56 vs Section 67 (Foreclosure)

Section 56:

- Deals with priority of recovery

Section 67:

- Deals with right to foreclosure

Different concepts, different purposes.

Why Section 56 Is Based on Equity

The Transfer of Property Act heavily relies on equitable principles.

Section 56 ensures:

- No party gains unfair advantage

- Innocent buyers are protected

- The credit system remains stable

That’s why courts respect it.

Section 56 in One Simple Line

If we had to explain section 56 of the Transfer of Property Act in one sentence:

It protects a buyer of one mortgaged property by allowing loan recovery from other mortgaged properties first, as long as the lender is not harmed.

Final Thoughts: Why Section 56 Matters

Section 56 of the Transfer of Property Act, 1882, may not be used every day—but when it applies, it can save a buyer from serious financial trouble.

It reflects a simple legal truth:

Law should be fair—not just powerful.

Understanding Section 56 helps:

- Buyers protect themselves

- Lawyers argue effectively

- Courts deliver balanced justice

Need help with property law, title checks, or legal interpretation?

Visit callmyca.com for clear, practical explanations on property, tax, and corporate laws.