Section 64 of the Companies Act, 2013: What Really Happens When Share Capital Changes

If there’s one compliance requirement that companies often underestimate, it’s informing the Registrar of Companies (ROC) about changes that feel “internal.” Share capital is one such area. Many promoters assume that once shareholders approve a change, the job is done.

Legally, it isn’t.

This is where Section 64 of the Companies Act, 2013, quietly steps in. It doesn’t stop you from altering share capital. It simply says:

“Fine, you can do it—but tell the government on time.”

And that one instruction carries serious consequences if ignored.

Let’s understand Section 64 in a practical, human way—how it works, why it exists, and what actually goes wrong when companies overlook it.

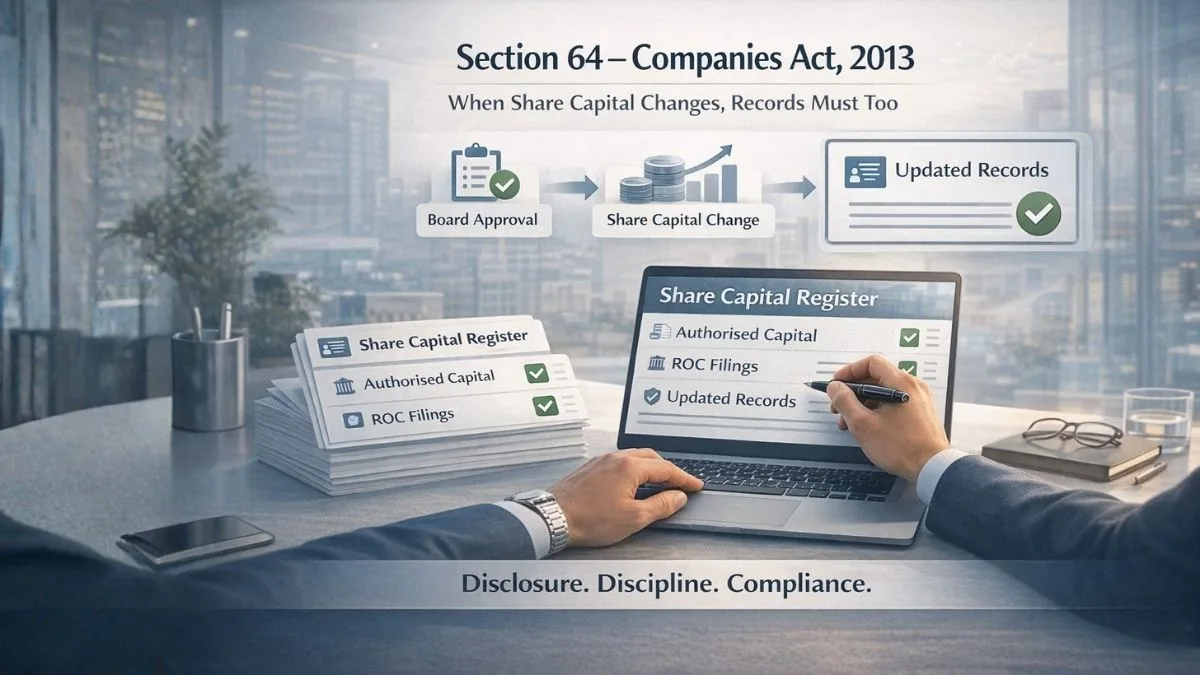

What Does Section 64 of the Companies Act, 2013, Deal With?

Section 64 is all about communication and disclosure.

In simple terms, it says:

- Whenever a company alters its share capital

- It must notify the Registrar of Companies

- Within a specific timeframe

The law calls this:

NOTICE TO BE GIVEN TO REGISTRAR FOR ALTERATION OF SHARE CAPITAL

This section ensures that the government’s records always reflect the true capital structure of a company.

What Is Meant by “Alteration of Share Capital”? ”?

Alteration of share capital can happen in several everyday business situations, such as:

- Increase in authorised share capital

- Consolidation or subdivision of shares

- Conversion of shares into stock

- Cancellation of unsubscribed shares

Any change that affects the composition or amount of share capital falls under Section 64.

The Core Requirement Under Section 64

Section 64 clearly states that a company:

- requires companies to notify the Registrar of Companies (RoC) within 30 days whenever there is an alteration to their share capital.

- must notify the Registrar of Companies within a specific timeframe.

- requires a company to file notice with the Registrar within thirty days.

This is not optional.

This is not flexible.

This is not something you “catch up on later.”

Thirty days means thirty days.

Who Must Be Notified?

The notice must be filed with:

- the Registrar of Companies

The RoC maintains the official corporate records of every company. If your share capital changes but the RoC isn’t informed, the company’s public record becomes inaccurate.

That’s exactly what Section 64 is designed to prevent.

Why the Law Takes This So Seriously

From a business point of view, a share capital change may feel routine.

From a regulatory point of view, it affects:

- Creditors’ confidence

- Investor transparency

- Statutory disclosures

- Public trust

That’s why Section 64 exists—to make sure changes don’t happen quietly behind closed doors.

Section 64(1)(a): Where Companies Usually Slip

Many compliance issues arise specifically under Section 64(1)(a).

This clause focuses on:

- The obligation to file notice

- The timeline of thirty days

- The responsibility of the company

When companies fail here, regulators don’t look at intent. They look at delay.

That’s why it’s important to explore the implications of violating Section 64(1)(a) of the Companies Act.

What Happens If You Don’t File the Notice on Time?

This is where things turn unpleasant.

If a company:

- Alters share capital

- Fails to notify the RoC within 30 days

It is considered non-compliant, even if:

- Shareholders approved the change

- The change is genuine

- There was no bad intention

Penalties can be imposed on:

- The company

- Officers in default

Late filings also create problems during:

- Due diligence

- Fundraising

- Audits

- Mergers or acquisitions

One missed filing can resurface years later.

Real-Life Example (Very Common)

A private company increases its authorized share capital to raise funds.

- Shareholders approve it

- Funds are received

- Shares are allotted

But the ROC filing is delayed.

Years later, during an investment round, the due diligence team asks:

“Why does the ROC record show old authorized capital?”

Now the company is forced into:

- Additional filings

- Penalties

- Explanations

- Delays in funding

All because Section 64 was ignored.

Why Section 64 Is About Discipline, Not Punishment

Section 64 doesn’t stop business growth.

It doesn’t restrict capital restructuring.

It simply ensures:

- Transparency

- Accurate public records

- Regulatory visibility

Think of it as updating your official address after moving houses. Living comfortably without updating records might work for a while—but it always causes trouble later.

Key Takeaways for Companies and Directors

Here’s what actually helps in practice:

- Track every share capital change immediately

- Treat ROC filing as part of the transaction, not an afterthought

- Don’t wait till the 29th day

- Maintain internal compliance checklists

Good compliance is not expensive. Bad compliance always is.

Why Directors Should Personally Care

Share capital defines:

- Ownership

- Control

- Financial structure

If records are wrong, questions will be asked. And those questions are usually directed at directors, not clerks or consultants.

Section 64 exists to protect directors too—if it’s followed properly.

How Professional Support Makes Compliance Easier

If you ever feel lost navigating old tax provisions, educational deductions, or modern compliance rules, the team at CallMyCA.com is always ready to guide you with real clarity & human support.

Sometimes, one timely filing is the difference between smooth growth and regulatory friction.