When it comes to income tax planning, carry forward & set off of losses is a powerful provision that helps businesses reduce their taxable income by adjusting past financial setbacks. Section 79 of the Income Tax Act specifically governs this mechanism for companies. However, this section doesn’t apply to all companies equally—it focuses on certain companies, especially closely held companies.

Let’s break it down in a simple & human-friendly manner. “

What is Section 79 of the Income Tax Act?

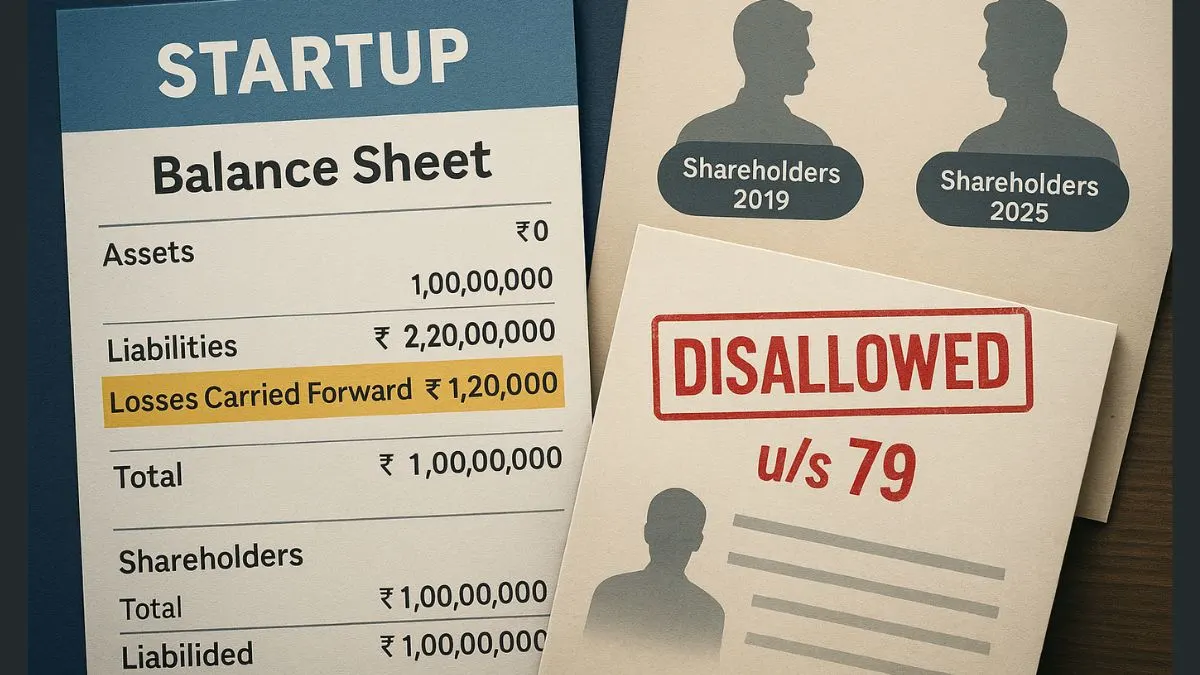

Section 79 restricts the carry forward & set off of losses in cases where the shareholding of a company undergoes significant changes. It primarily applies to closely held companies, i.e., those not substantially owned by the public.

In short, if your company changes hands, meaning more than 51% of shareholders are new compared to the previous year, you may lose the benefit of carrying forward losses. “

Who Does Section 79 Apply To?

This section applies to:

- Private limited companies

- Unlisted public companies

- Startups (with some exceptions)

- Companies where 51% of beneficial ownership changes

If a company qualifies as a closely held company, it must ensure that at least 51% of its voting power remains the same throughout the years in which it wishes to carry forward & set off its business losses.

Exception: Startups Get Some Relief

Recognising the dynamic nature of startups & fundraising rounds, the government has carved out a relaxation for eligible startups. Even if there is a change in shareholding, startups may still be able to carry forward & set off losses provided certain conditions are met, such as continuity of business and certification by DPIIT.

Why Is Section 79 Important?

Because it can limit or disallow companies from taking advantage of their previous years’ losses unless they strictly comply with the shareholding rules.

Imagine running a business during rough years, accumulating losses, & later finding out you cannot claim them simply because you brought in a new investor who took a major stake. That's why understanding Section 79 is essential for tax planning & corporate structuring.

Key Highlights

- Carry forward & set off of losses in case of certain companies is restricted unless shareholding continuity is maintained.

- Losses impacted under Section 79 typically include business losses, not unabsorbed depreciation.

- Unabsorbed depreciation can be carried forward irrespective of shareholding changes.

- Certain amendments & Supreme Court judgments have clarified this over time.

Common Mistakes to Avoid

- Assuming all losses can be carried forward regardless of ownership change.

- Not documenting beneficial ownership properly.

- Not consulting professionals before raising funds that alter the control structure.

- Confusing Section 79 with Section 78 or 80, which deal with other set-off provisions.

Practical Example

Let’s say your startup had a loss of ₹10 lakhs in FY 2021-22. In FY 2022-23, you raised funding & the new investor owns 60% of the company. Under Section 79, unless you're an eligible startup with proper recognition, you cannot carry forward that ₹10 lakh loss anymore.

What About Unabsorbed Depreciation?

Good news: Unabsorbed depreciation under Section 32(2) is not impacted by Section 79. You can carry it forward for any number of years, regardless of changes in shareholding. This is a saving grace for many companies.

Final Thoughts

Section 79 might appear as just another tax rule, but for founders, CFOs, & corporate advisors, it can have huge tax implications. One small mistake in equity dilution or M&A planning can cost crores in lost tax benefits. So, read the fine print—or better yet, get a professional to help you navigate it.

👉 Need help with tax compliance, startup structuring, or loss planning? Talk to experts at Callmyca.com & ensure you never lose out on a benefit because of a technicality!