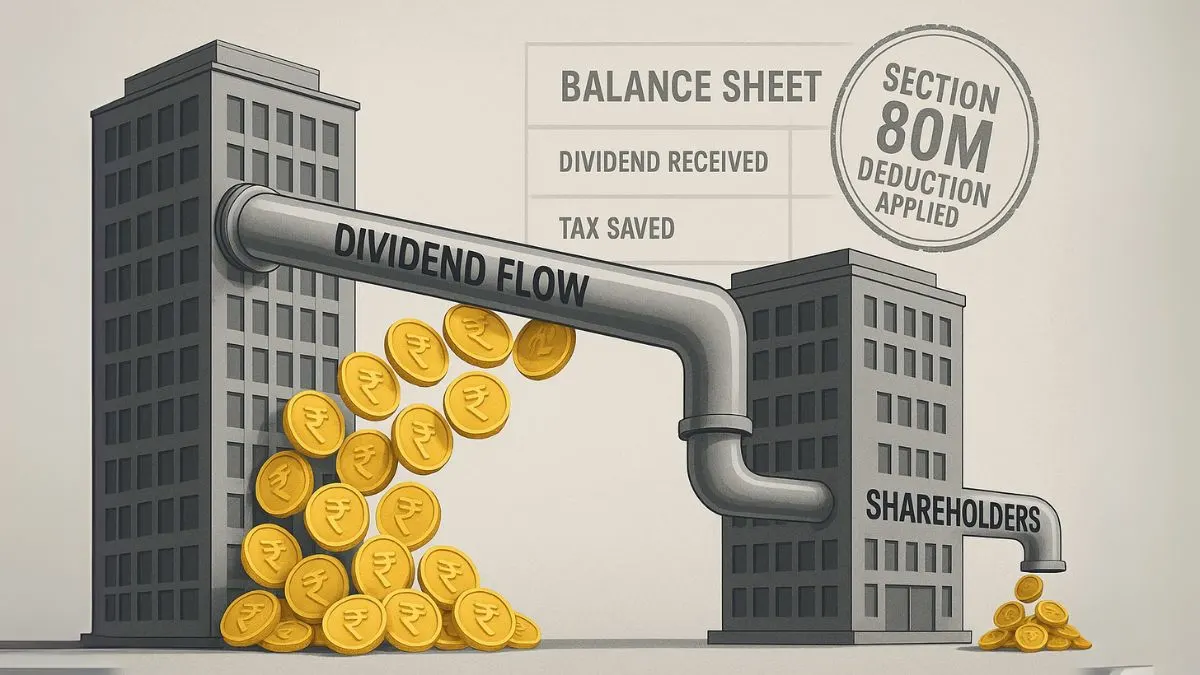

In a world where every rupee saved matters, especially in corporate taxation, Section 80M of the Income Tax Act emerges as a crucial deduction available to Indian companies. This section has seen a revival in recent years & plays a key role in preventing double taxation of dividends.

If you're running a company that earns dividend income &, in turn, distributes it further to shareholders, this provision could directly lower your tax liability. Let’s decode Section 80M of the Income Tax Act with examples, applicability, & insights into how your business can make the most of it.

What is Section 80M of the Income Tax Act?

Section 80M of the Income Tax Act 1961 was reintroduced in Budget 2020 after the abolishment of the Dividend Distribution Tax (DDT). It provides for deduction in respect of inter-corporate dividends to remove the burden of double taxation.

Here’s how it works:

- A domestic company receives dividends from another domestic company.

- If the receiving company distributes this income as a dividend before the due date of filing the return, it can claim a deduction under Section 80M.

This means that the dividend passed on won’t be taxed again in the hands of the distributing company.

Why Was Section 80M Reintroduced?

Before the Finance Act 2020, companies paid DDT on dividends declared. Once that tax was scrapped, dividend income became taxable in the hands of the shareholders, including companies. This created a problem—dividends being taxed multiple times as they moved between companies.

That’s where Section 80M of the Income Tax Act stepped in. It offered a relief mechanism that aligned with international tax principles & encouraged smooth dividend flow within corporate structures.

Applicability of Section 80M of the Income Tax Act

This section applies to domestic companies receiving dividends from other domestic companies. The key condition is that the dividend received must be further distributed as a dividend before the due date of filing the income tax return.

So, the applicability of Section 80M is strictly tied to:

- The nature of the company (must be a domestic company).

- The source of the dividend must be another domestic company.

- The timeline of redistribution (must be before the filing due date).

Section 80M of the Income Tax Act With Example

Let’s take a real-world example to understand the deduction better:

ABC Ltd. received ₹10 lakhs as dividend income from XYZ Ltd. during the financial year.

Later, ABC Ltd. declared & paid ₹7 lakhs as dividends to its shareholders before the due date of filing the ITR."

Deduction Section 80M = ₹7 lakhs (only the redistributed portion qualifies)

The remaining ₹3 lakhs will be taxed as regular income.

Section 80M vs Other Tax Provisions

It’s important not to confuse Section 80M with other deductions under Chapter VI-A,l ike Section 80C, Section 80G, or Section 54EE of the Income Tax Act (which deals with capital gains). Section 80M is a corporate-level deduction & specifically targets dividend income.

It also complements the changes brought in the Finance Act & Budget 2020, which altered how dividends are taxed across the board.

Bare Act Language of Section 80M of the Income Tax Act

While we’re focused on clarity, it’s also important to be aware of the bare act wording. Section 80M of the Income Tax Act 1961 provides for a deduction in respect of certain inter-corporate dividends to prevent cascading taxation.

In legal terms:

"Where the gross total income of a domestic company, in any previous year, includes any income by way of dividends from any other domestic company, there shall be allowed a deduction of the amount of dividend distributed to shareholders."

Practical Considerations for Companies

Here’s a short checklist for companies looking to claim a deduction under Section 80M:

- Track dividend income accurately."

- Ensure that the further dividend distribution is done before the ITR filing deadline.

- Maintain all board resolutions, bank proof of payout, & dividend registers.

Final Thoughts

In the current tax framework, where dividend income is taxable, Section 80M of the Income Tax Act acts as a shield against double taxation. It ensures that the same dividend isn’t taxed repeatedly as it moves within the corporate chain.

Whether you're a tax planner, CFO, or business owner, understanding the applicability of Section 80M, backed with real-world examples & knowledge of the bare act, can significantly improve your company's tax efficiency.

Need help understanding whether your company qualifies for this deduction? At Callmyca.com, our expert CAs help you file smart & save smarter—so you can focus on growth while we handle the tax hacks that matter.