Section 92 of the Companies Act, 2013—Annual Return and Why It Matters More Than You Think

Ask any director what compliance worries them the most.

Most will say GST.

Some will say income tax.

Very few immediately say annual return.

And yet, missing or mishandling the annual return is one of the fastest ways for a company to fall into regulatory trouble.

That’s exactly why section 92 of the Companies Act, 2013, exists.

It forces companies to pause once a year and officially declare:

“This is who we are. This is how we look. This is how we are governed.”

What Is Section 92 Actually About?

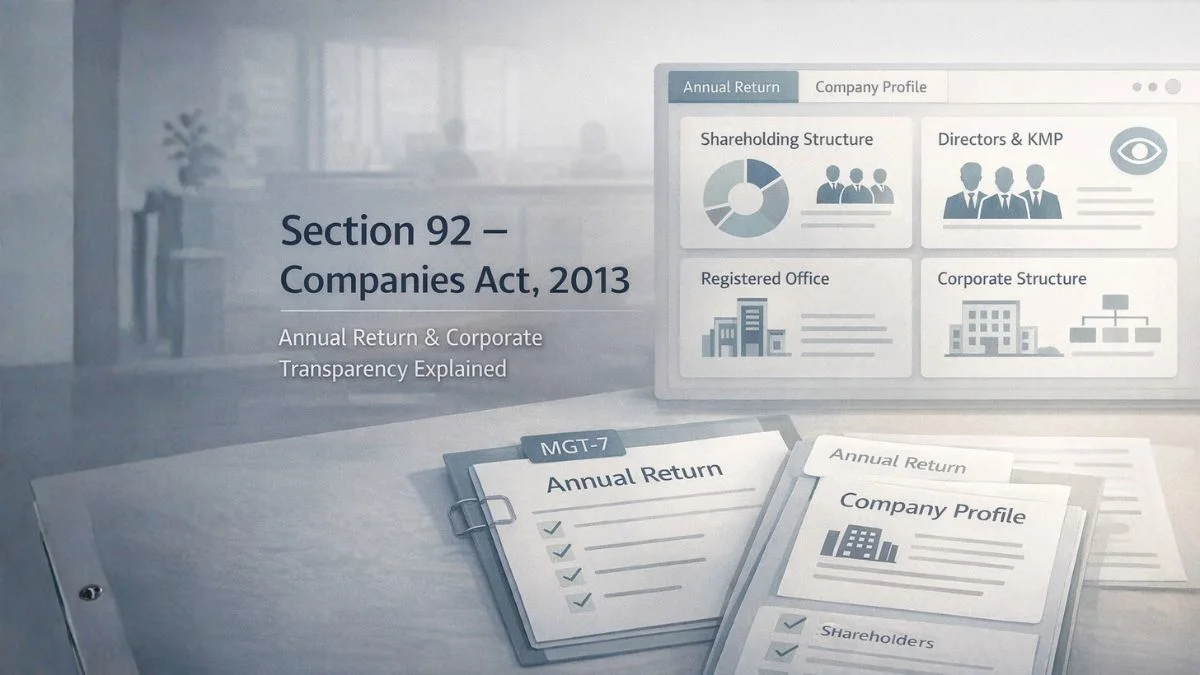

In simple words, Section 92 of the Companies Act deals with the annual return.

It mandates that every company shall prepare a return every financial year and file it with the Registrar of Companies (RoC).

This return is not about profits.

It’s about structure, ownership, and governance.

Annual Return Section 92 – The Core Requirement

Under annual return section 92, every company must file its annual return in

- Form MGT-7, or

- Form MGT-7A (for OPCs and AOCs)

This return captures a snapshot of the company as of the end of the financial year.

No assumptions.

No estimates.

Just facts.

What Information Does the Annual Return Contain?

This is where many people get surprised.

The annual return under Section 92 of the Companies Act 2013 includes details such as

- registered office address

- nature of business activities

- share capital structure

- shareholding pattern

- members and debenture holders

- directors and key managerial personnel

- indebtedness of the company

- changes in management or ownership

In short, it tells the regulator:

“Who controls the company and how?”

Why the Law Takes Section 92 So Seriously

Unlike financial statements, the annual return is publicly accessible.

Anyone can inspect it:

- investors

- lenders

- regulators

- competitors

That’s why the law uses Section 92 as a transparency tool.

It prevents:

- hidden ownership

- undisclosed control

- silent changes in management

Every Company Shall Prepare a Return—No Exceptions

This is important.

The law is very clear:

👉 Every company shall prepare a return.

It does not matter whether the company:

- made profit

- made loss

- did no business

- remained dormant

If the company exists on paper, Section 92 applies.

Applicability of Section 92—Who Must File?

The answer is simple.

- private companies

- public companies

- OPCs

- listed companies

- unlisted companies

Everyone.

That’s why people often search Section 92 of the Companies Act, 2013—because no one escapes it.

Section 92 vs Section 137—Don’t Mix Them Up

This confusion is very common.

- Section 92 → Annual Return

- Section 137 → Financial Statements

Both are mandatory.

Both have different forms.

Both have different consequences.

Missing either can attract penalties.

Time Limit for Filing Annual Return

Under section 92 of the Companies Act 2013, the annual return must be filed:

- within 60 days of the AGM

For OPCs:

- within 60 days from the date on which AGM should have been held

Late filing starts the penalty meter immediately.

Penalty for Non-Compliance Under Section 92

This is where things hurt.

If a company fails to file its annual return:

- penalty applies to the company

- penalty applies to every officer in default

And yes, penalties are per day.

That’s why searches like “section 92 of companies act 2013 penalty” are so common.

Why Annual Return Is Not Just a Form

Many companies treat MGT-7 as a clerical task.

Big mistake.

Annual return data is used to:

- verify director eligibility

- track shareholding changes

- detect benami holdings

- trigger inspections

One wrong disclosure can open a bigger inquiry.

Practical Example (Very Common Case)

A company:

- issues shares to a relative

- changes directors mid-year

- forgets to update shareholding in annual return

Years later, during funding or inspection, a mismatch is detected.

The first document checked?

👉 Annual return under Section 92 of the Companies Act.

Section 92 and Director Responsibility

Directors often think:

“CS handles this.”

But legally, responsibility rests on:

- directors

- officers in default

If something goes wrong, ignorance is not a defense.

Why Startups Ignore Section 92 (And Regret It Later)

Startups focus on:

- product

- funding

- growth

Compliance comes last.

But when:

- due diligence starts

- acquisition discussions happen

- notices arrive

Missing annual returns become red flags.

Section 92 Promotes Corporate Accountability

The purpose of section 92 of the Companies Act, 2013, is simple:

- transparency

- accountability

- traceability

It ensures the corporate veil is not misused.

Common Mistakes Under Section 92

From real experience, these mistakes repeat:

- incorrect shareholding data

- not reporting director changes

- mismatch with ROC records

- filing without AGM details

- late filing without condonation

Each one can snowball into bigger issues.

Why Investors Look at Annual Returns First

Before investing, professionals check:

- annual return

- promoter holding

- director consistency

It’s a credibility document.

A clean annual return builds trust.

Section 92 and Digital Governance

With MCA portals, filings are

- automated

- cross-checked

- data-driven

Errors don’t go unnoticed anymore.

That’s why Section 92 compliance matters more today than ever.

Final Thoughts

To summarize:

- Section 92 of Companies Act 2013 mandates filing of annual return

- Every company shall prepare a return without exception

- Annual return section 92 ensures transparency and accountability

- The return discloses ownership, management, and structure

- Non-compliance attracts penalties for company and officers

Annual return is not paperwork.

It’s corporate identity.

🔗 Missed Your Annual Return or Unsure About MGT-7 Filing?

If your company has delayed or incorrectly filed its annual return under Section 92, ignoring it further only increases exposure to penalties and regulatory action. Before responding to any RoC notice or making corrective filings, it’s safer to review the position properly. You can explore professional assistance for annual return filing, RoC compliance, and Companies Act advisory at Callmyca.com.