Section 92E of the Income Tax Act 1961 mandates the filing of Form 3CEB for persons entering into international or specified domestic transactions. Learn what section 92e in income tax, its due date, penalty under section 92e of the Income Tax Act, 1961, its applicability for AY 2020–21, AY 2019–20, and AY 2018–19, & how to comply with the report under section 92e of the Income Tax Act, 1961 in India.

Section 92E of the Income Tax Act: A Must-Know Compliance Rule for International Transactions

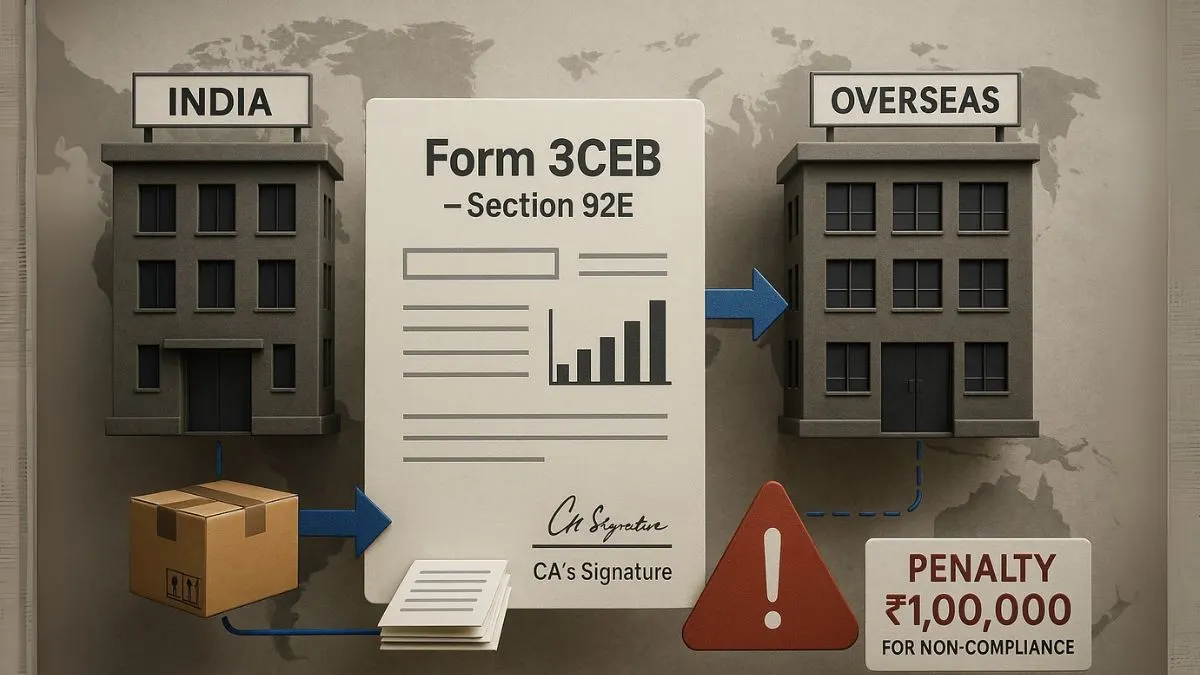

In today’s global economy, Indian businesses increasingly engage in international transactions. Whether it's buying goods from a foreign associate, providing services to a subsidiary abroad, or entering into specified domestic transactions, such dealings come under the scanner of Indian tax laws. That’s where Section 92E of the Income Tax Act steps in.

Let’s break it down in simple terms & see why section 92e is not just important but mandatory for many taxpayers.

What is Section 92E in Income Tax?

Section 92E of the Income Tax Act, 1961 requires any person who has entered into an international transaction or a specified domestic transaction during a financial year to furnish a report from an accountant in a prescribed form—Form 3CEB.

This report must confirm that the pricing of these transactions complies with the transfer pricing rules. In short, section 92e of the Income Tax Act 1961 is all about transparency & fair pricing when you deal with related parties across borders.

Who is Required to File Under Section 92E?

The applicability of section 92e of the Income Tax Act includes:

- Companies or individuals with international transactions with associated enterprises.

- Taxpayers with specified domestic transactions exceeding ₹20 crores.

- Any person who wants to avoid disputes related to arm’s length pricing.

Whether you’re a small exporter or a large multinational with inter-company dealings, section 92e income tax applicability must be reviewed.

Due Date for Filing Under Section 92E

The due date for furnishing Form 3CEB under Section 92E is one month before the due date for filing the income tax return under Section 139(1). That means if your ITR is due on October 31st, you must submit Form 3CEB by September 30th.

Always remember the section 92e of the Income Tax Act due date, as missing it can attract penalties.

Penalty Under Section 92E of the Income Tax Act

Non-compliance can be costly. The penalty under section 92e of the Income Tax Act is ₹1,00,000 if Form 3CEB is not filed on time. Also, incorrect reporting or under-reporting of international transactions can lead to further penalties & adjustments under Section 271BA.

So, if you're unsure about your reporting obligations, it's best not to take any chances."

Why Is a Report Under Section 92E Necessary?

The report under section 92e of the Income Tax Act, 1961 ensures that all cross-border transactions follow transfer pricing norms. It acts as evidence that pricing is at arm’s length, avoiding manipulation & tax evasion.

This is particularly important for:

- Subsidiaries of foreign companies

- Indian companies with overseas joint ventures

- Businesses having related party transactions

The report must be certified by a Chartered Accountant who thoroughly examines your pricing, agreements, & benchmarking studies.

Section 92E of Income Tax Act: AY 2020–21, AY 2019–20, & AY 2018–19

Section 92e of the Income Tax Act for AY 2020–21, AY 2019–20, & AY 2018–19 remained consistent in their core requirements, although deadlines were extended in certain years due to COVID-19.

If you missed filing in any of these years, it’s still advisable to rectify or revise the report if possible. Filing late is better than not filing at all, especially when international compliance is at stake.

Section 92E of the Income Tax Act Bare Act & Interpretation

For those looking into the legal jargon, you can refer to section 92e of the Income Tax Act Bare Act. However, for practical application, it's recommended to consult a professional. The bare act provides the literal interpretation, while professionals can guide you based on your specific situation.

CBDT Clarification

The CBDT (Central Board of Direct Taxes) periodically issues guidance notes on the report under section 92e to help taxpayers with proper filing. These notes explain what details to furnish, which international transactions require reporting, & how to calculate arm’s length pricing.

Always stay updated with these guidance notes, especially if you're managing a business with cross-border operations."

Final Thoughts

To sum it up, section 92E of the Income Tax is not just a compliance formality. It's a critical part of transparent international taxation. Ignoring it could result in hefty penalties & unnecessary scrutiny. So if you’re part of a business that deals internationally or with related entities in India, this section is your legal safety net.

Don’t risk errors in something as sensitive as transfer pricing, because Section 92e of the Income Tax Act in India means serious business.

👉 Confused about how to file your Form 3CEB or understand whether Section 92E applies to your business? Let the experts at Callmyca.com guide you step-by-step—before a simple oversight turns into a costly mistake!