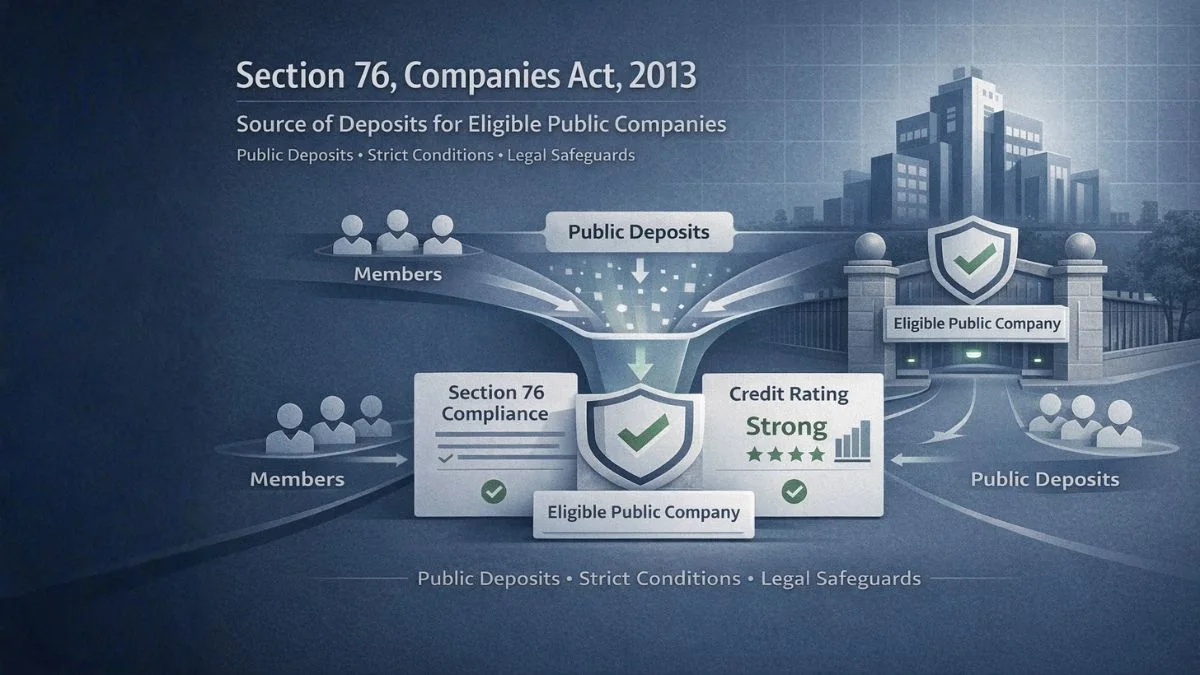

Source of Deposit for an Eligible Public Company Under Section 76 of the Act

If someone tells you that companies are not allowed to accept money from the public, they are half right.

In India, most companies cannot accept public deposits.

But some public companies can—and that exception comes from Section 76 of the Companies Act, 2013.

This section is extremely important for:

- large public companies

- finance teams

- compliance professionals

- students of company law

And yet, it’s also one of the most misunderstood provisions.

So let’s break it down calmly and practically—like a real explanation, not a bare Act reproduction.

First, what is Section 76 of the Companies Act, 2013?

Section 76 of the Companies Act 2013 deals with:

Acceptance of deposits from persons other than members

by certain eligible public companies, subject to strict conditions.

In simple terms:

- Private companies → generally cannot accept public deposits

- Public companies → can accept deposits only if they qualify as “eligible companies.”

What Does “Eligible Company” Mean Under Section 76?

This is the most important starting point.

Under Section 76, an eligible company means:

👉 A public company that has either:

- Net worth of ₹100 crore or more, OR

- Turnover of ₹500 crore or more

Only such companies are trusted by law to accept money from the public.

That’s why you’ll often see this definition repeated:

Public Company whose Net worth is more than or equal to ₹100 crore

(or turnover ≥ ₹500 crore)

If a public company does not meet this threshold, Section 76 does not apply to it.

The Big Question: What Is the Source of Deposit Under Section 76?

Now let’s come to the core question:

👉 What is the source of deposit for a public company eligible under section 76 of the act?

The answer is very clear.

An eligible public company under Section 76 can accept deposits from:

- Its members (shareholders)

- The general public (non-members)

This is what makes Section 76 special.

Normally:

- Section 73 → deposits only from members

- Section 76 → deposits from members and the public

So yes, under Section 76, a qualifying public company can source deposits from the general public.

Why Is the Law So Strict About This?

Because accepting deposits is risky.

When a company takes money as deposits:

- it is not equity

- it is not a bank loan

- it is public money

So the law allows this only when:

- the company is financially strong

- compliance safeguards are in place

That’s why Section 76 is tightly linked with rules and conditions.

Conditions to Accept Deposits Under Section 76

Just being big is not enough.

An eligible company must follow strict compliance requirements before accepting deposits from the public.

Let’s go step by step.

1. Special Resolution in General Meeting

The company must:

- pass a special resolution

- approving acceptance of deposits from public

This ensures:

- shareholders are aware

- decision is transparent

2. Credit Rating Is Mandatory

The company must:

- obtain a credit rating

- from a recognised credit rating agency

This rating:

- reflects company’s ability to repay deposits

- must be disclosed publicly

No rating = no public deposits.

3. Appointment of Deposit Trustees

For secured deposits:

- deposit trustees must be appointed

Trustees:

- protect interests of depositors

- act if company defaults

This is a major safeguard under Section 76.

4. Creation of Charge on Assets (For Secured Deposits)

If the company accepts secured deposits, it must:

- create a charge on its assets

- in favour of deposit holders

This gives depositors legal protection.

5. Filing of Circular / Advertisement

The company must issue:

- a deposit circular or advertisement

- containing full disclosures

This is governed by the Companies (Acceptance of Deposits) Rules, 2014.

Can an Eligible Company Accept Deposits From Anyone?

Not blindly.

Even under Section 76:

- deposits must be within prescribed limits

- terms must comply with rules

- repayment timelines must be followed

So while the source of deposit includes the public, conditions control the flow.

Section 76 vs Section 73—Quick Clarity

People often confuse:

- section 73 of the Companies Act, 2013

- section 76 of the Companies Act 2013

Let’s simplify.

|

Section |

Who can accept deposits from whom |

|

Section 73 |

From members only |

|

Section 76 |

From members and the general public |

But Section 76 applies only to eligible public companies.

What About Private Companies?

A very common search is

accepting of deposits from public in case of private company is…

The answer is simple:

- Private companies cannot accept deposits from the general public

- They are restricted to members, directors, or permitted categories

Section 76 does not apply to private companies.

Companies (Acceptance of Deposits) Rules, 2014 – Why They Matter

Section 76 works together with:

Companies (Acceptance of Deposits) Rules, 2014

These rules prescribe:

- limits on deposit amount

- tenure of deposits

- interest rate ceilings

- forms and filings

- maintenance of deposit repayment reserve

Ignoring these rules is a violation of Section 76.

Practical Example (Real-Life Scenario)

Let’s take a simple example.

- ABC Ltd is a public company

- Net worth: ₹150 crore

- Turnover: ₹600 crore

ABC Ltd qualifies as an eligible company under Section 76.

So ABC Ltd can:

- accept deposits from shareholders

- accept deposits from the general public

But only after:

- passing special resolution

- obtaining credit rating

- appointing deposit trustees

- issuing proper circular

Only then is the source of deposit legally valid.

Why Only Large Public Companies Are Allowed

The logic is very straightforward.

Large companies:

- have stable operations

- better governance

- higher repayment capacity

The law trusts them more with public money.

That’s why the threshold of:

- ₹100 crore net worth, or

- ₹500 crore turnover

exists under Section 76.

Common Mistakes Companies Make Under Section 76

From real compliance experience, these mistakes are common:

- assuming every public company can accept public deposits

- ignoring credit rating requirement

- missing trustee appointment

- mixing Section 73 and Section 76 rules

- violating deposit limits

These can lead to:

- penalties

- refund orders

- prosecution of officers

Section 76 in One Simple Sentence

If you remember only one thing, remember this:

Under Section 76 of the Companies Act, 2013, an eligible public company can accept deposits from its members as well as the general public, subject to strict conditions.

Quick Human-Friendly Summary

- Section 76 applies only to eligible public companies

- Eligible = Net worth ≥ ₹100 crore OR Turnover ≥ ₹500 crore

- The source of deposit includes members and general public

- Special resolution, credit rating, trustees, and asset charge are mandatory

- Governed along with Companies (Acceptance of Deposits) Rules, 2014

- Private companies cannot accept public deposits

Final Thoughts (Real Talk)

Accepting deposits is not just fundraising—it’s a responsibility.

That’s why the law allows it only to financially strong public companies, and even then, under strict supervision.

If your company qualifies as an eligible public company and you’re exploring deposits as a funding option, understanding Section 76 of the Companies Act, 2013, is non-negotiable.

And if you’re unsure about eligibility, compliance, or documentation, professional guidance can save you from serious legal trouble.

For expert support on deposit compliance, company law advisory, and MCA filings, visit callmyca.com.