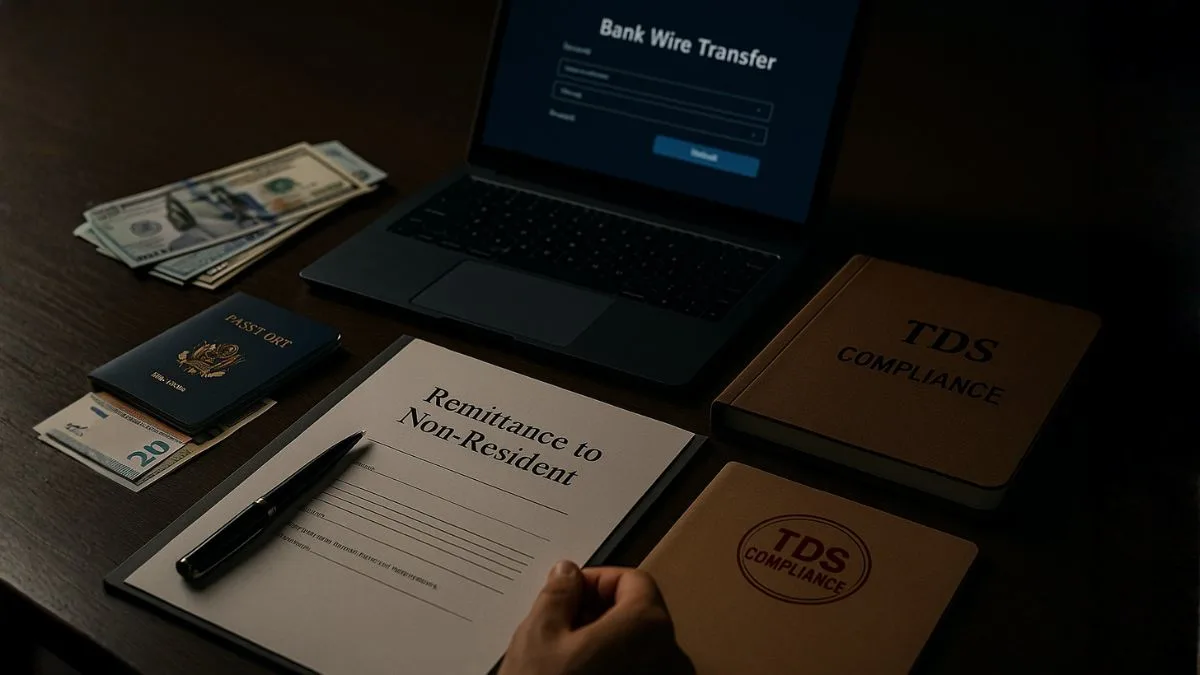

Long before India became the world’s outsourcing hub or a fintech capital, lawmakers anticipated a simple truth: money would increasingly move across borders. And tax revenue could slip away with it.

Section 195(1) was crafted to prevent a leakage — not by policing global business, but by placing responsibility on the payer sitting in India. The logic was elegant: if overseas income has a taxable link with India, the tax should not escape simply because the recipient lives outside the country.

This principle ensures that international transactions remain transparent & taxable income doesn't disappear into a foreign bank account without checks.

What the Provision Says — Beyond the Text

Section 195(1) states that any person making a payment (other than salary) to a non-resident or foreign company must deduct TDS if the payment is chargeable to tax in India.

Key elements embedded in these few lines:

- The obligation applies to any person — not just businesses

- It covers payments to non-residents & foreign companies"

- It activates only when income is chargeable to tax in India

- Salary paid abroad is handled separately (Section 192)

It places responsibility not on the non-resident, but on the Indian payer — an approach rooted in practicality. If tax authorities cannot easily enforce collection abroad, the payer becomes the withholding agent.

Legislative Intent: Plugging Cross-Border Tax Gaps Early

When Section 195(1) was introduced, international commerce wasn’t anywhere near today’s scale. Yet the framers envisioned cross-border consultancy, shipping revenue, royalties, software payments, technical service fees, interest on loans from foreign lenders — streams of income leaving India routinely.

With no TDS check, large-scale revenue loss could occur. So, lawmakers tied tax deduction to the moment of payment.

This design aligns with the philosophy behind advance-tax provisions, research incentives under the Act, & precise exemptions like those for securitisation trusts or charitable entities — laws must evolve to support development while securing compliance.

Also Read: TDS on Payments to Non-Residents

Practical Illustration

Consider an Indian technology startup paying USD 30,000 to a US-based cloud security consultant. The consultant never visits India. Yet the services benefit an Indian business, and the income is sourced from India.

Under Section 195(1):

- The Indian startup must examine taxability under domestic law DTAA

- If the sum is chargeable, TDS must be deducted at applicable rates

- Failure invites interest, penalties, & disallowances

This mechanism ensures fairness — foreign service providers earning from India contribute tax where economic value is created.

Judicial Influence — The “Chargeable in India” Test

Courts have consistently held that deduction is required only if the income is chargeable in India. This nuance is vital — it prevents blanket deduction & supports legitimate global trade.

India’s judiciary has struck a balanced view: withholding is mandatory, but only after taxability is evaluated. A procedural burden, yes — but a necessary one to maintain clean cross-border tax architecture.

Intersection With Double Tax Treaties (DTAA)

Section 195(1) does not operate in isolation. DTAA relief may:

- Reduce TDS rate

- Shift taxing rights entirely

- Offer credit mechanisms

- Provide tax residency protections

A payer who blindly deducts or fails to deduct without treaty analysis risks either excess withholding or non-compliance. Modern cross-border commerce demands tax literacy, not just tax compliance.

Also Read: TDS on Foreign Payments: Everything You Need to Know

Business Impact — Compliance Meets Strategy

Section 195(1) influences:

- Vendor selection

- Contract drafting

- Pricing of international services

- Cash-flow planning

- Exposure to foreign tax credit mechanisms

For CFOs, founders, and even independent consultants engaging foreign talent, this provision is not merely a procedural tick-box — it shapes operating decisions.

Why This Rule Matters Today

Global business now includes:

- SaaS subscriptions

- Digital advertising & cloud services

- Overseas training programs

- Commission to foreign agents"

- Cross-border royalty and IP payments

- Freelance foreign consultants

- International lending arrangements

Section 195(1) ensures that as India participates in global markets, it does not lose its tax rights in the process.

Also Read: The Backbone of Advance Tax & TDS Collection

Conclusion

Section 195(1) is a gatekeeper provision — a legal checkpoint between India’s economy & the world’s. It ensures that any person responsible for paying to a non-resident, not being a company, or to a foreign company evaluates taxability and deducts TDS where required. In doing so, it protects India's revenue interests while supporting structured cross-border commerce.

If your business pays foreign vendors or receives advisory or technical services from overseas experts, proper withholding is not optional — it is statutory duty.

For advisory on international transactions, DTAA interpretation, & lower-TDS applications, connect with our CA experts at CallMyCA.com — where global compliance meets strategic tax planning.