Notice of Estimated Income Tax Assessment: Meaning, Reasons & What To Do

Imagine this.

You didn’t file your return on time… and suddenly you receive a notice of estimated income tax assessment.

Now you’re thinking —

“How did they calculate my tax?”

“Why is the amount so high?”

Here’s the reality.

When you don’t file your return, the Income Tax Department doesn’t just wait forever. Instead, they calculate your income based on available data—and send you a notification with their estimate.

This is called an estimated assessment.

And yes, it can sometimes be higher than what you actually owe.

What is a Notice of Estimated Income Tax Assessment?

A notice of estimated income tax assessment is an official communication where the department calculates your tax liability based on the information they already have.

This usually happens when:

- You fail to file your return

- You ignore earlier notices

- You don’t respond to queries

In such cases, the department proceeds with assessing your income using available data like

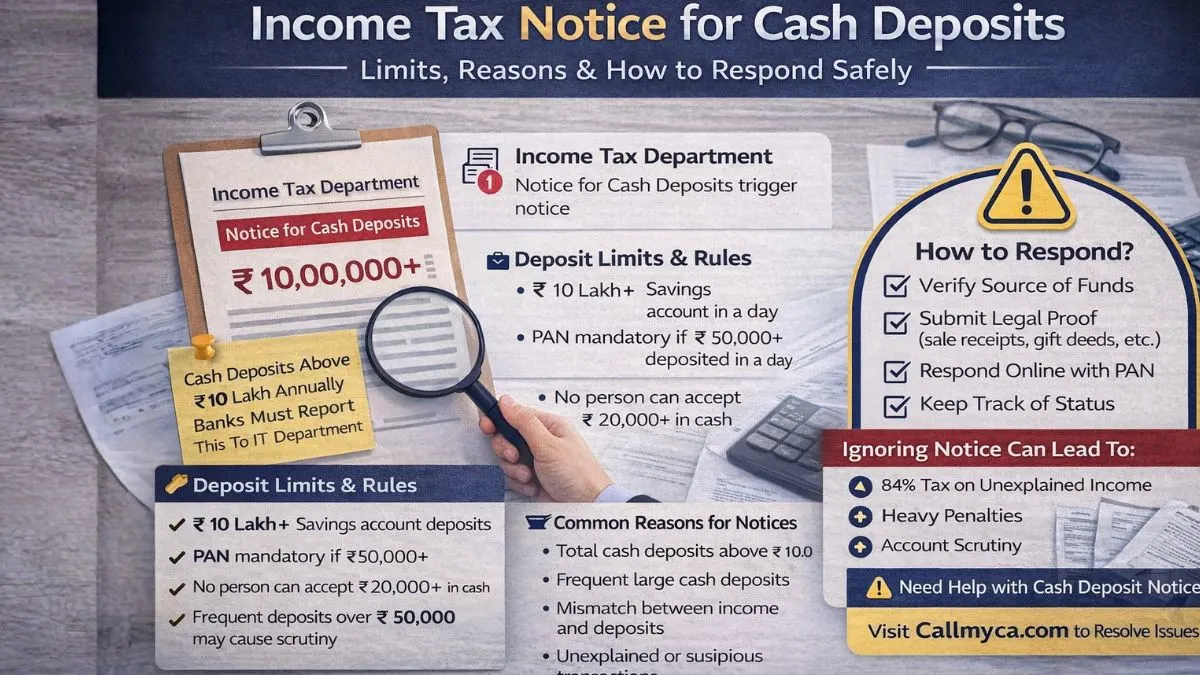

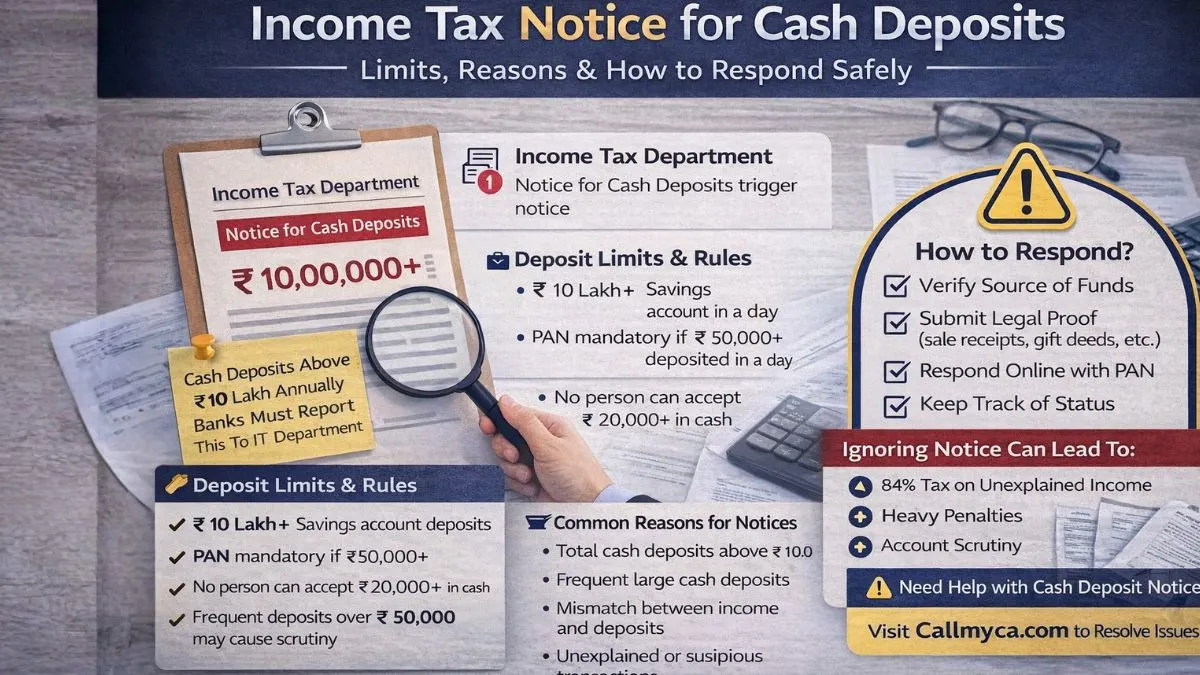

- Bank transactions

- TDS records

- Investments

- High-value purchases

This process is often linked with the 144 notice of income tax, also known as the best judgment assessment.

What is Section 144 (Best Judgment Assessment)?

When you ignore notices or fail to file your return, the department can issue a 144 notice of income tax.

In simple terms, they will calculate your income based on their judgment—not yours.

That means:

- No deductions may be allowed

- Income may be estimated higher

- Tax demand can increase significantly

This is why ignoring tax notices can become expensive.

Why Did You Receive This Notice?

Let’s keep it real.

Most people receive a notice of estimated income tax assessment for these reasons:

- Return not filed

- Response not submitted

- Mismatch in reported income

- Ignored earlier notices

The system tracks financial activity. Even if you don’t file a return, your transactions are still recorded.

So the department uses that data for assessment.

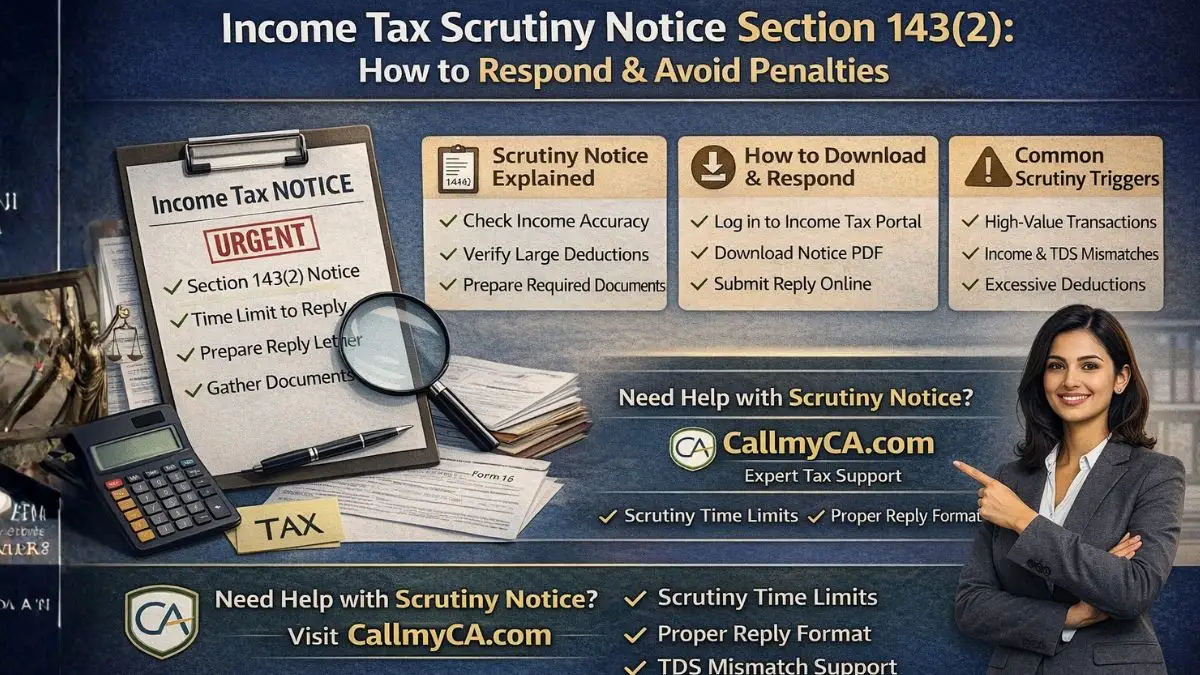

Types of Income Tax Assessments You Should Know

Before you respond, it’s important to understand the different types of assessments.

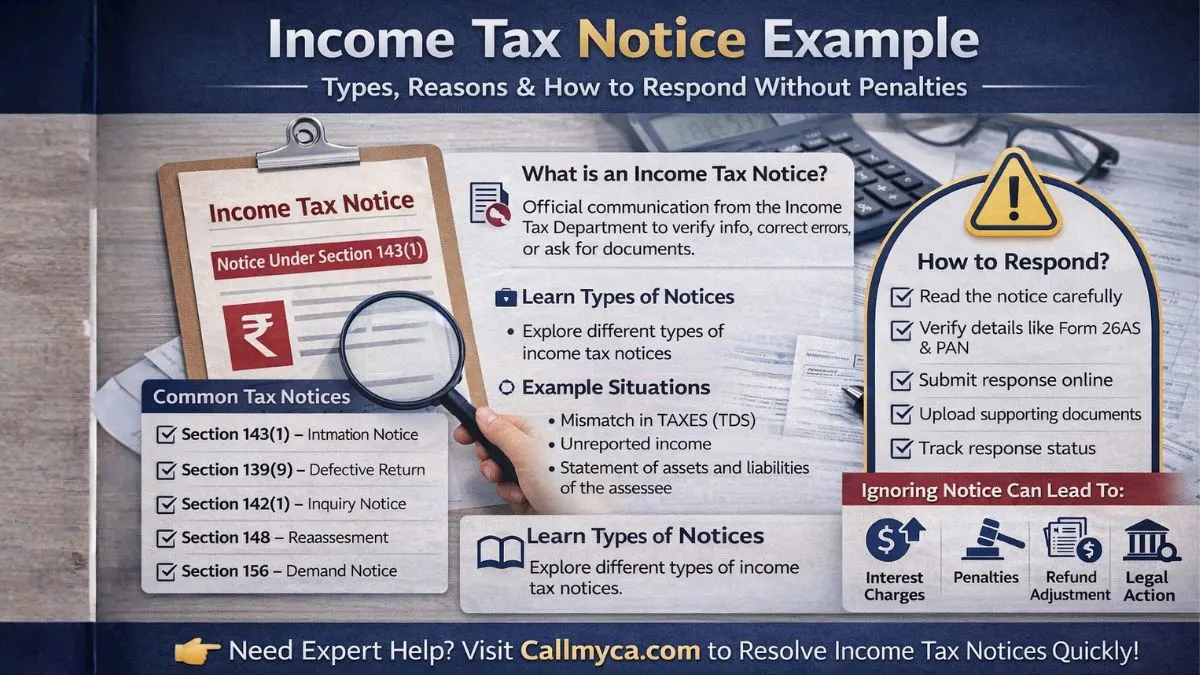

1. Summary Assessment in Income Tax (Section 143(1))

This is the simplest form.

A summary assessment of income tax is done automatically by the system.

It checks your return against available data.

You may get:

- Refund

- No change

- Small tax demand

No detailed inquiry is involved.

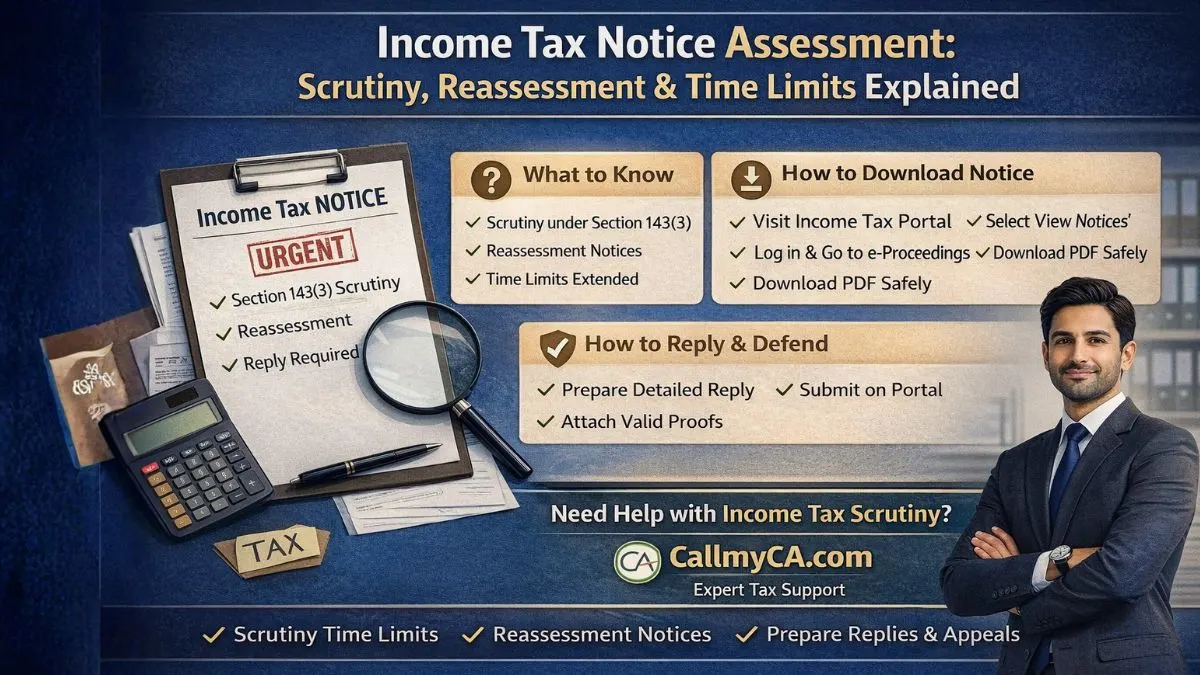

2. Scrutiny Assessment in Income Tax (Section 143(3))

This is more detailed.

In scrutiny assessment under income tax section 143(3), your return is examined carefully.

The department may ask for:

- Income proof

- Bank statements

- Investment details

This happens when the system detects discrepancies.

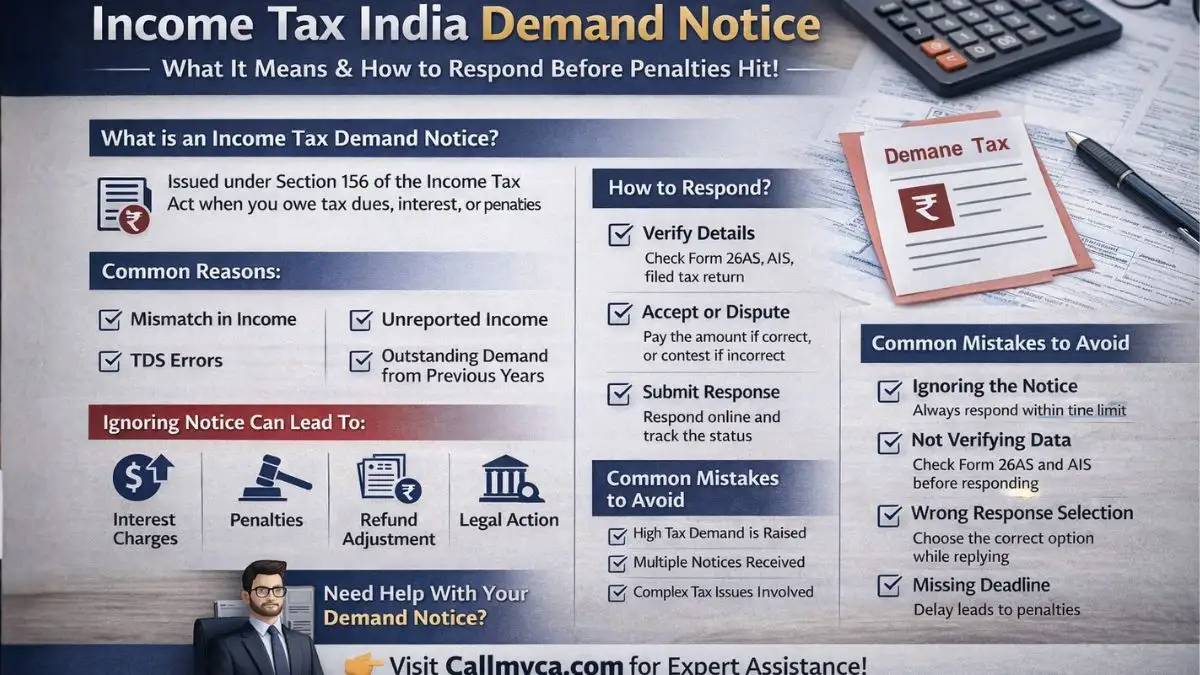

3. Reassessment in Income Tax (Section 147/148)

If the department believes income has been missed, they can reopen your case.

This is called reassessment in income tax.

Even old returns can be reviewed in such cases.

4. Best Judgment Assessment (Section 144)

This is where estimated assessment comes in.

If you fail to comply, the department calculates your income based on available data.

This leads to a notice of estimated income tax assessment.

Procedure for Assessment in Income Tax

Many people search for the procedure for assessment in income tax, but it’s actually straightforward.

Here’s how it works:

- You file (or fail to file) your return

- The department reviews your data

- A notice is issued (if needed)

- You respond with documents

- The final order is passed

If you don’t respond, the department proceeds with the estimated assessment.

This entire flow is part of the assessment procedure of income tax notes PDF people often look for online.

Income Tax Scrutiny Time Limit

Timing is important.

The income tax scrutiny time limit decides how long the department has to issue certain notices.

For example:

👉 Scrutiny notices must generally be issued within a specific period from the end of the financial year.

However, sometimes the government announces updates, and timelines may change.

So always check the latest rules.

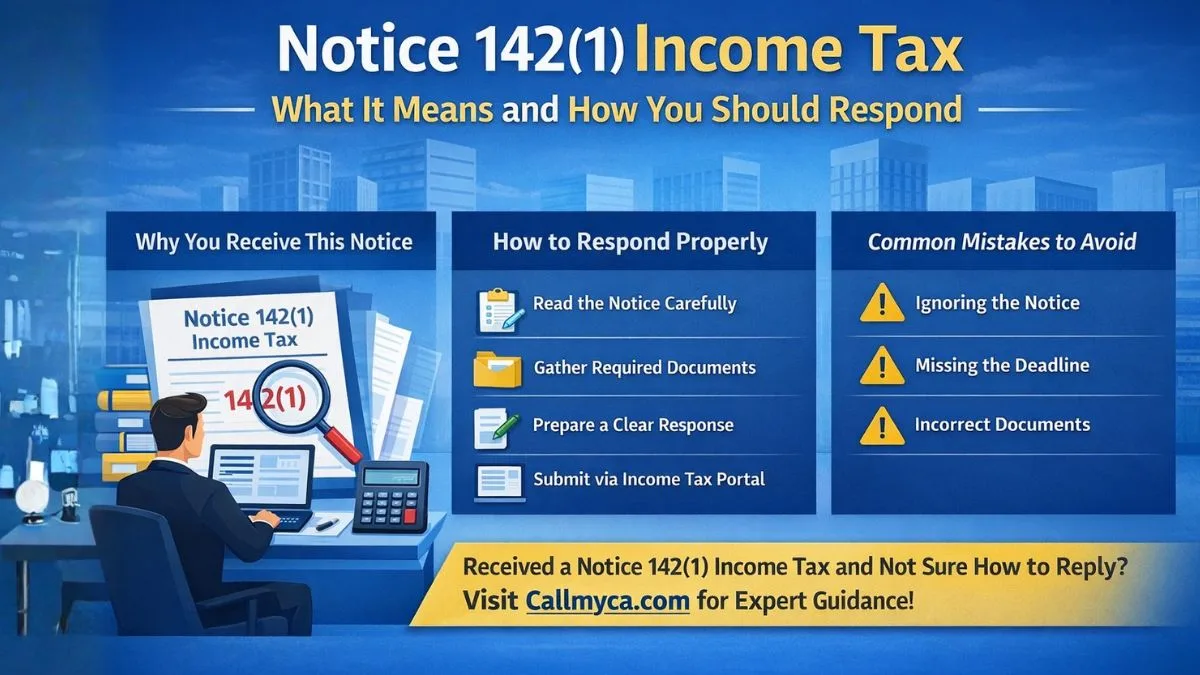

What Should You Do After Receiving the Notice?

Don’t ignore it. That’s the biggest mistake.

Here’s what you should do:

1. Read the Notice Properly

Understand why it was issued.

2. Check the Section

Is it Section 144, 143(3), or 148?

Each has different implications.

3. Gather Documents

Prepare proof of your income and expenses.

4. Respond on Time

Submit your reply before the deadline.

5. Correct Your Return (If Needed)

You may need to file or revise your return.

Can You Challenge the Estimated Assessment?

Yes, you can.

If you believe the department has calculated your income incorrectly, you can:

- File a response

- Submit supporting documents

- Request correction

In many cases, the demand can be reduced after proper explanation.

Common Mistakes to Avoid

People often make these mistakes:

Ignoring the notice

Missing the deadline

Submitting incomplete information

Not understanding the section

Delaying professional help

These can make things worse.

How to Avoid Estimated Assessment in Future

The best way to avoid a notice of estimated income tax assessment is simple:

- File your return on time

- Respond to notices promptly

- Report all income

- Match your data with AIS/TIS

- Keep proper records

Basic compliance can save you from unnecessary trouble.

When Should You Take Expert Help?

Some cases are easy.

But in certain situations, you should consult a professional:

- High tax demand

- Section 144 notice

- Reassessment cases

- Multiple notices

Expert advice can help you avoid penalties and reduce tax liability.

Final Thoughts

A notice of estimated income tax assessment is not the end of the road—but it is a warning sign.

It usually means the department has taken control of the calculation because you didn’t.

The solution is simple:

👉 Take action

👉 Provide correct information

👉 Respond on time

If handled properly, even estimated assessments can be corrected.

Don’t Let Estimated Tax Become a Big Problem

Received a notice and not sure how to respond? Don’t risk paying extra tax. Let professionals handle your case—visit Callmyca.com and get expert help to resolve your income tax notice quickly and confidently.