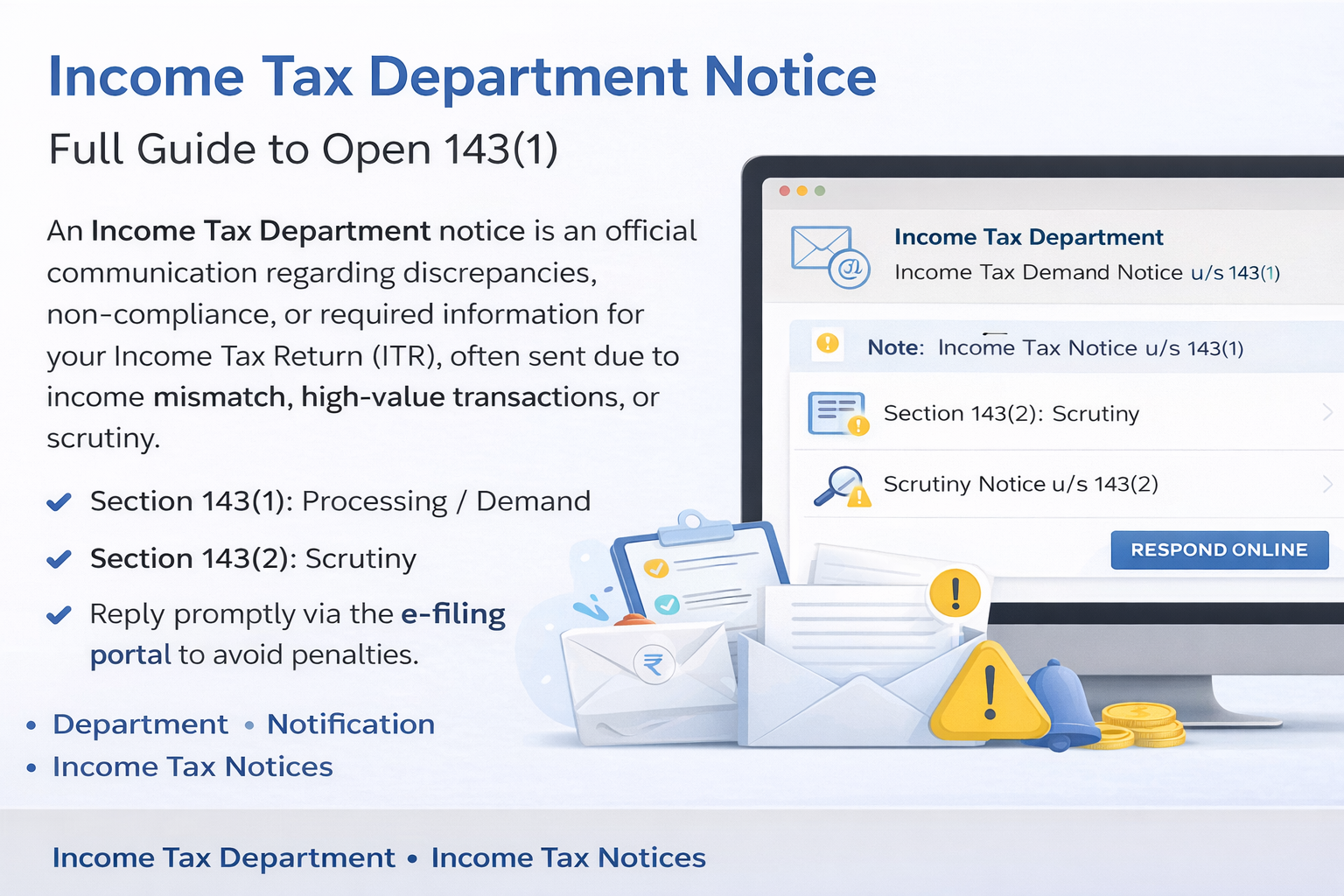

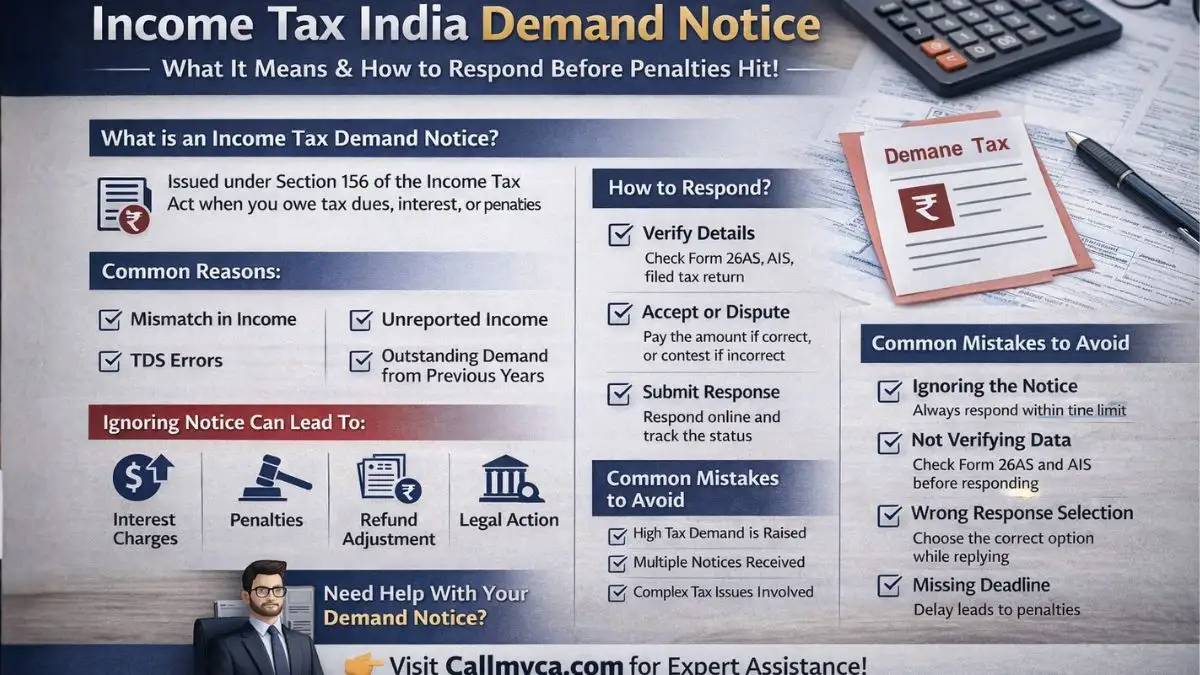

Income Tax India Demand Notice: What It Means & How to Respond Before Penalties Hit!

Have you received an income tax India demand notice and are unsure what to do next? Don’t panic. Many taxpayers receive a demand notice every year, and in most cases, it’s simply due to mismatches or calculation errors in your tax return.

However, ignoring an income tax demand notice can lead to penalties, interest, and even legal action. That’s why it’s important to understand what this notice means, why it is issued, and how you can respond within the time limit.

What is an Income Tax India Demand Notice?

An income tax demand notice is issued under Section 156 of the Income Tax Act when the Income Tax Department determines that some amount of tax demand is payable by you.

This demand can arise due to:

-

Additional tax liability

-

Interest on delayed payment

-

Penalty imposed

-

Errors in tax return

The notice clearly mentions:

-

Amount payable

-

Reason for demand

-

Deadline to respond (usually 30 days)

This is an official notice and requires your immediate attention.

Why Do You Receive a Tax Demand Notice?

Receiving an income tax demand notice does not always mean you have done something wrong. It is often triggered due to small discrepancies.

Common Reasons:

1. Mismatch in Income

Your declared income does not match records available with the income tax department.

2. TDS Mismatch

TDS claimed in your tax return is different from Form 26AS.

3. Incorrect Tax Calculation

Errors in income tax computation can lead to additional tax demand.

4. Unreported Income

Income such as interest, capital gains, or freelance income may be missed.

5. Outstanding Demand from Previous Years

Sometimes old dues remain unpaid, leading to a new demand notice.

Income Tax Demand Notice 143(1) Explained

One of the most common notices is the income tax demand notice 143(1).

This is generated after your tax return is processed. It compares:

-

Your filed return

-

Department records

If there is a mismatch, the system recalculates your income tax and raises a tax demand.

It may result in:

-

No demand

-

Refund

-

Additional tax payable

Income Tax Demand Notice Time Limit

Once you receive an income tax demand notice from India, you must act quickly.

Important Points:

-

You usually get 30 days to respond

-

Delay can lead to interest and penalties

-

Non-response may trigger recovery actions

Understanding the income tax demand notice time limit is critical to avoid complications.

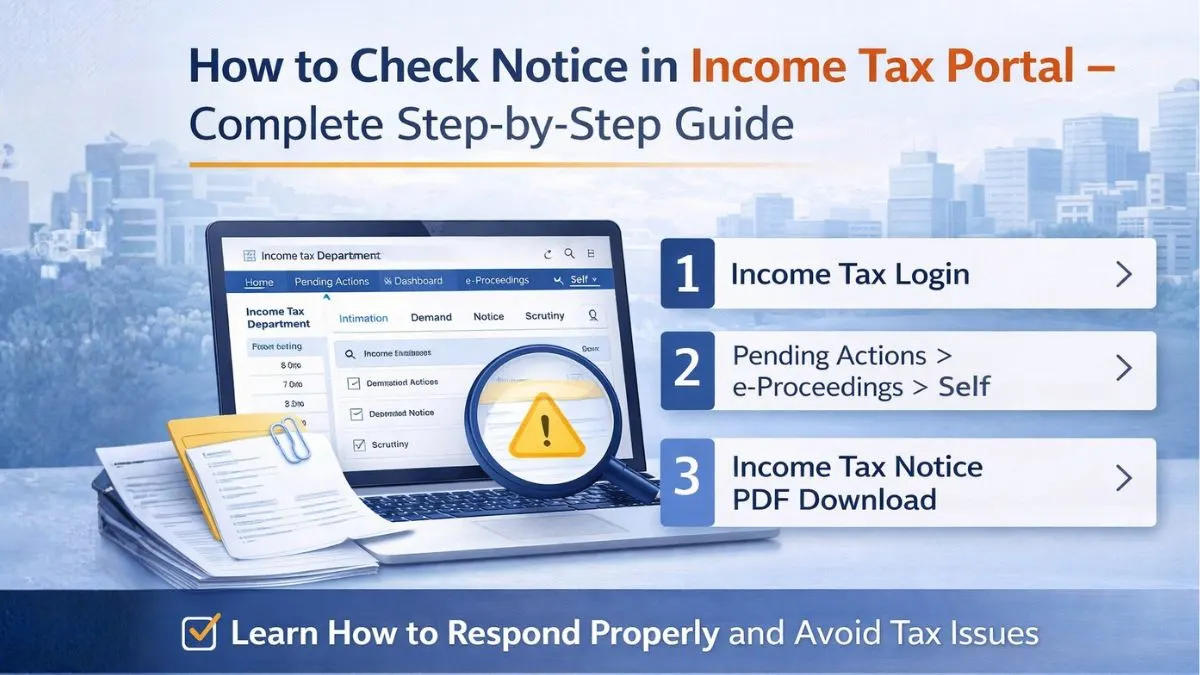

How to View Income Tax Demand Notice Online

You can easily check your income tax demand notice online through the official portal.

Steps:

-

Log in to Income Tax e-Filing Portal

-

Go to “Pending Actions.”

-

Click on “Response to Outstanding Demand.”

-

View your demand notice

This is the easiest way to understand your tax demand.

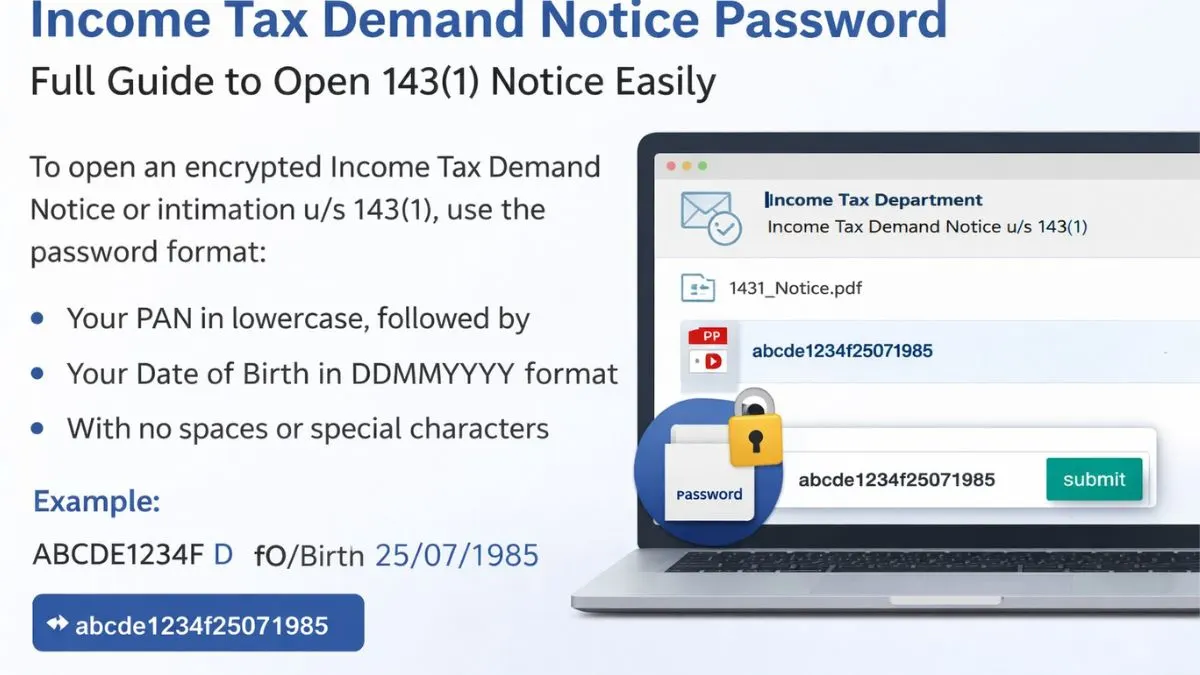

How to Download Income Tax Demand Notice PDF

If you want a copy of your notice, you can download the income tax demand notice PDF.

Steps:

-

Log in to the portal.

-

Go to “e-Proceedings.”

-

Select relevant notice

-

Click download demand notice income tax

Always keep a copy for future reference.

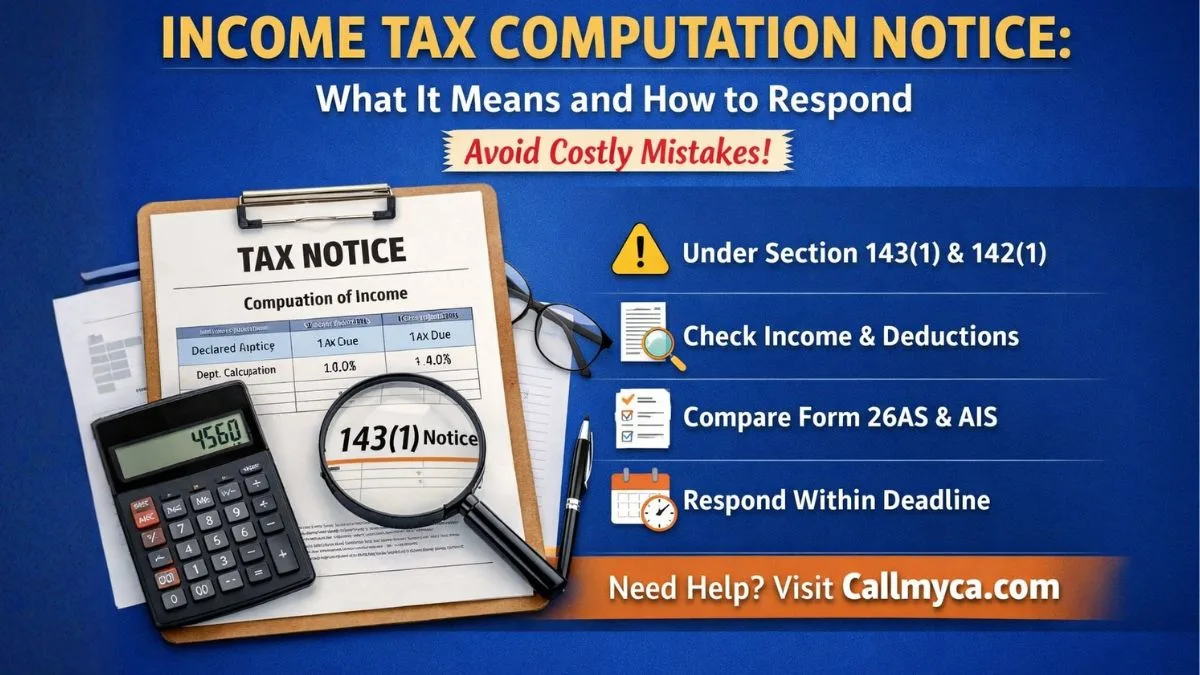

Income Tax Demand Notice Procedure: Step-by-Step

Understanding the correct income tax demand notice procedure is very important.

Step 1: Read the Notice Carefully

Check:

-

Assessment Year

-

Amount of tax demand

-

Reason mentioned

Step 2: Verify Details

Compare with:

-

Your tax return

-

Form 26AS

-

AIS

Step 3: Decide Your Response

You have two options:

Option 1: Accept the Demand

If the tax demand is correct:

-

Pay the amount online

-

Save challan

Option 2: Disagree with Demand

If you believe the demand is incorrect:

-

Submit response online

-

Upload supporting documents

Step 4: Submit Response Online

You can respond under:

-

“Response to Outstanding Demand”

Step 5: Track Status

Regularly check status until the issue is resolved.

What if the income tax outstanding demand is already paid?

Sometimes taxpayers receive a notice even after payment.

If your income tax outstanding demand already paid, then:

-

Select “Demand is Correct but Already Paid.”

-

Upload proof of payment

-

Submit response

This will help close the demand.

Consequences of Ignoring Demand Notice

Ignoring an income tax India demand notice can create serious problems.

1. Interest Charges

Interest keeps increasing on unpaid tax demand.

2. Penalty

Additional penalties may be imposed.

3. Adjustment of Refund

Future refunds may be adjusted against demand.

4. Legal Action

The department may take recovery action.

Common Mistakes to Avoid

Many taxpayers make errors while handling income tax notices.

1. Ignoring the Notice

Always respond within the time limit.

2. Not Verifying Data

Check Form 26AS and AIS before responding.

3. Wrong Response Selection

Choose the correct option while replying.

4. Missing Deadline

Delay leads to penalties.

When Should You Take Expert Help?

You should consult a professional if:

-

High tax demand is raised

-

Multiple notices received

-

Complex tax issues involved

Experts can help you:

-

Reduce liability

-

Respond correctly

-

Avoid legal issues

Final Thoughts

An income tax demand notice in India is a serious notice, but it is manageable if handled correctly.

The key is to:

-

Understand the tax demand

-

Verify your tax return

-

Respond within the time limit

Taking timely action can save you from unnecessary penalties and stress.

Need Help With Your Demand Notice?

Still confused about your income tax demand notice or tax demand?

👉 Visit Callmyca.com and get expert assistance to resolve your income tax notices quickly and avoid penalties!