Income Tax Due Notice: What It Means, Latest Notifications & How to Respond Before It’s Too Late!

Have you recently received an income tax due notice and started worrying about penalties or legal action? You’re not alone. Every year, thousands of taxpayers receive income tax notices from the Income Tax Department, and most of them don’t fully understand what these notices actually mean.

But here’s the reality—not every income tax notice is something to panic about. Sometimes, it’s simply a notification informing you about a pending tax due. However, ignoring such notices can lead to serious consequences like penalties, interest, or even legal proceedings.

What is an Income Tax Due Notice?

An income tax due notice is an official communication issued by the Income Tax Department when there is an outstanding tax due against your PAN. This is usually issued as a demand notice under Section 156 of the Income Tax Act.

This notice clearly mentions:

-

The amount of tax due

-

Interest or penalty applicable

-

Reason for the demand

-

Time limit to respond (usually 30 days)

Such income tax notices are generally issued when there is a mismatch in income, incorrect tax payment, or underreporting of income.

Ignoring an income tax due notice can lead to further action, including additional penalties or even a best-judgment assessment.

Latest Income Tax Notification 2026 You Should Know

Staying updated with the latest income tax notification for 2026 is crucial for taxpayers. The Income Tax Department frequently releases updates, circulars, and CBDT notifications that impact compliance.

Some key areas covered under recent notifications include:

-

Changes in due dates

-

Revised tax rules

-

New reporting requirements

-

Compliance updates

These income tax circulars and notifications in PDF are available on the official portal and should be checked regularly to avoid missing important updates.

What Triggers an Income Tax Due Notice?

Receiving an income tax due notice does not always mean fraud or wrongdoing. In most cases, it is triggered due to simple errors or mismatches.

Here are the most common reasons:

1. Mismatch in Income

If your declared income does not match data available with the Income Tax Department, you may receive a notice.

2. Incorrect Tax Calculation

Errors in income tax calculation can lead to an incorrect tax due amount, triggering a demand.

3. Unpaid Self-Assessment Tax

If you fail to pay self-assessment tax before filing your return, a due notice may be issued.

4. Interest or Penalty

Even if your tax is paid, unpaid interest or penalties can result in an income tax due notice.

5. Non-Filing of Return

If you have taxable income but have not filed your return, the Income Tax Department may issue a notice.

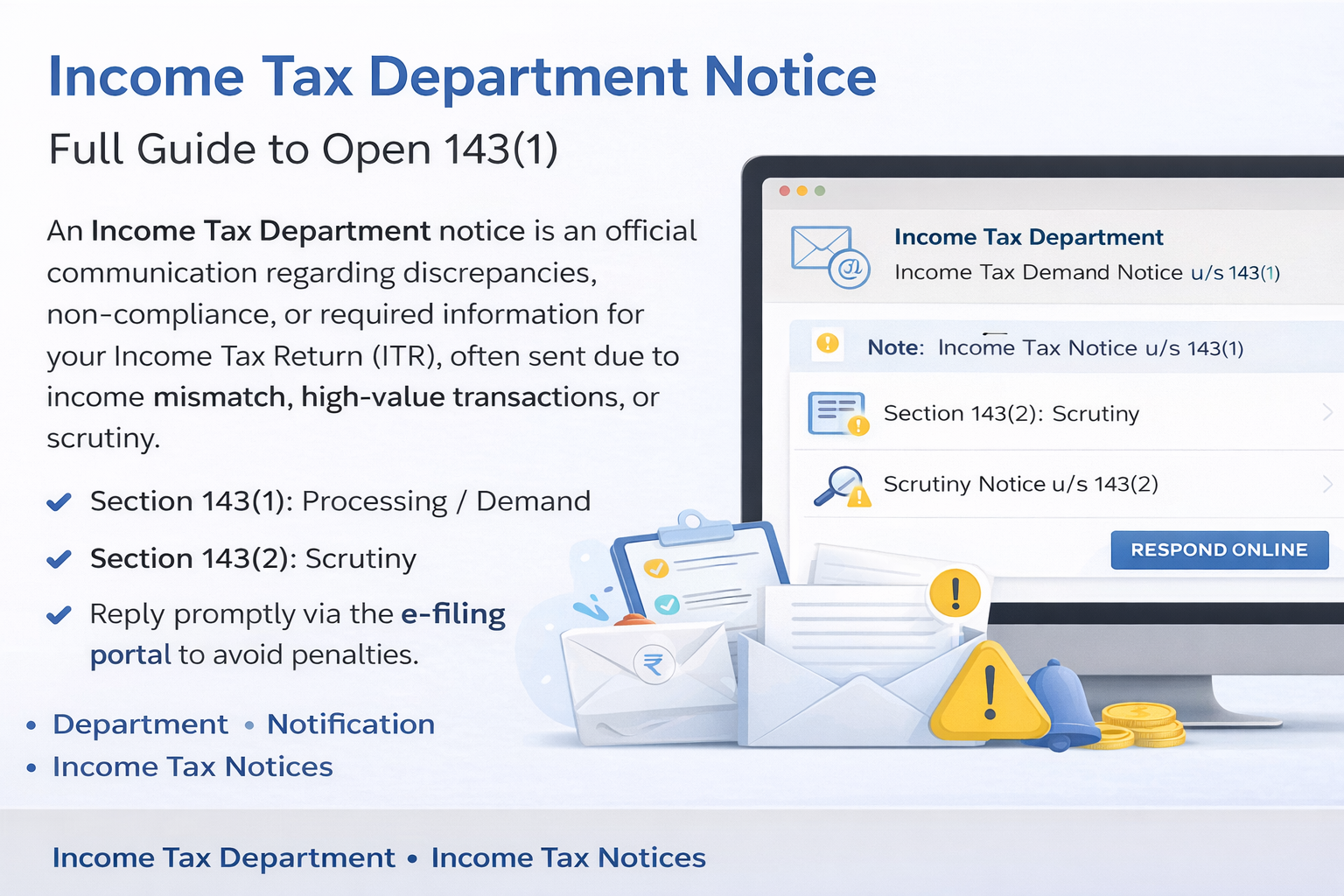

Types of Income Tax Notices Related to Tax Due

Understanding different types of income tax notices helps you respond correctly.

1. Demand Notice under Section 156

This is the most common income tax due notice. It demands payment of pending tax due.

2. Notice under Section 143(1)

After processing your return, if there is a mismatch, the department may raise a demand.

3. Notice under Section 142(1)

Issued when additional details or documents are required.

4. Notice under Section 148

This is issued for reassessment when income has escaped taxation.

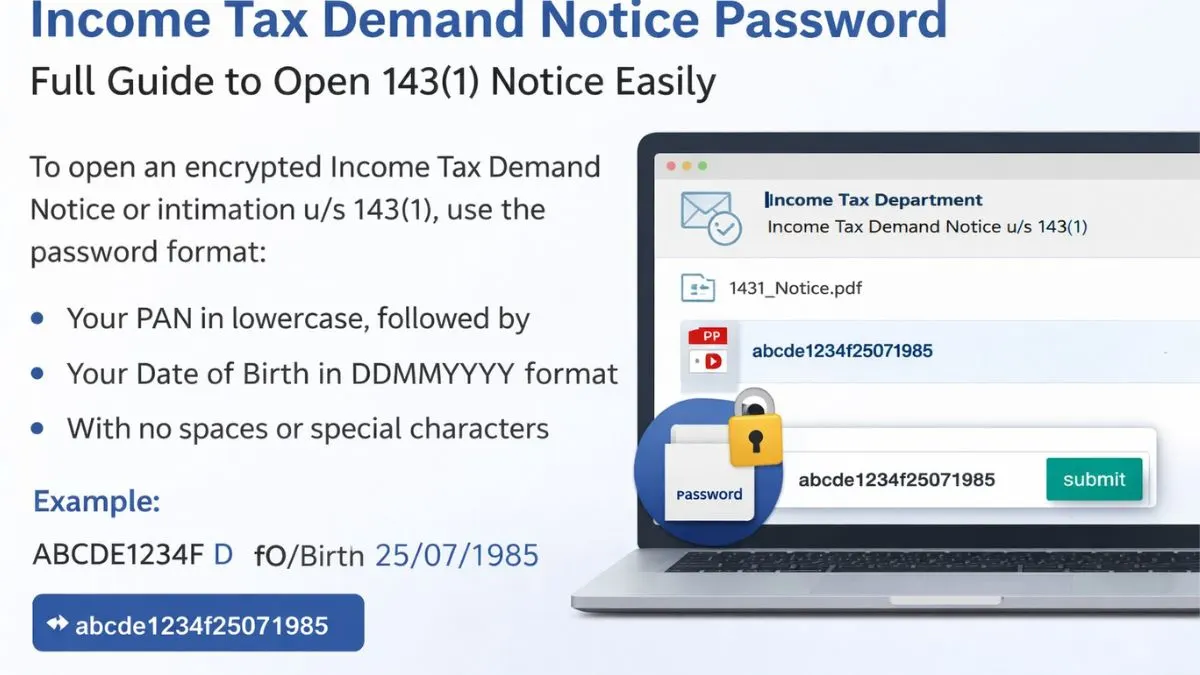

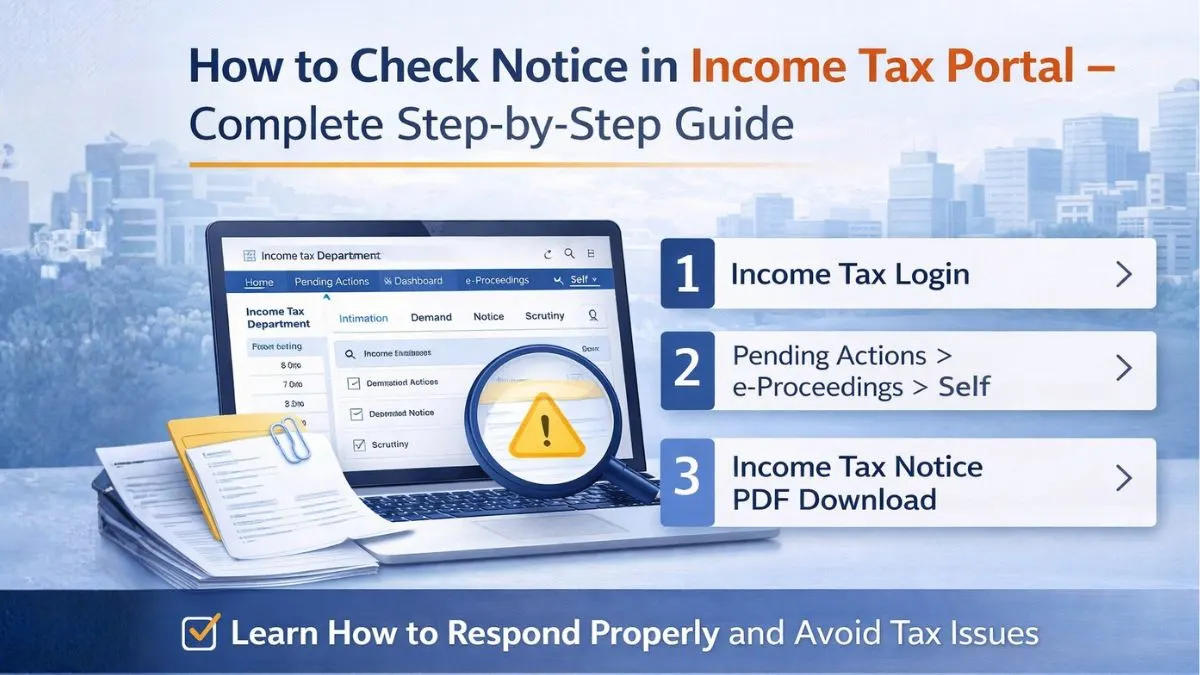

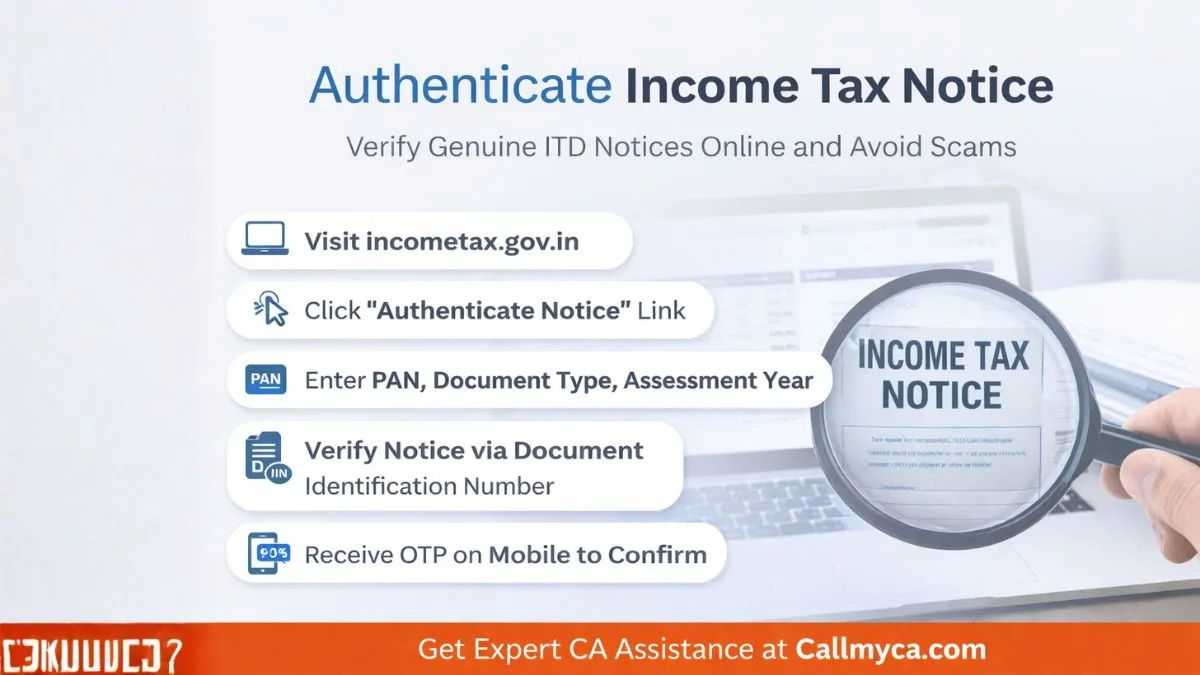

How to Check Your Income Tax Due Notice

You can easily check your income tax notice online.

Steps:

-

Visit the Income Tax Portal

-

Login using your PAN

-

Go to “Pending Actions.”

-

Click on “e-Proceedings.”

-

View your income tax due notice

You can also download the income tax notice PDF for your records.

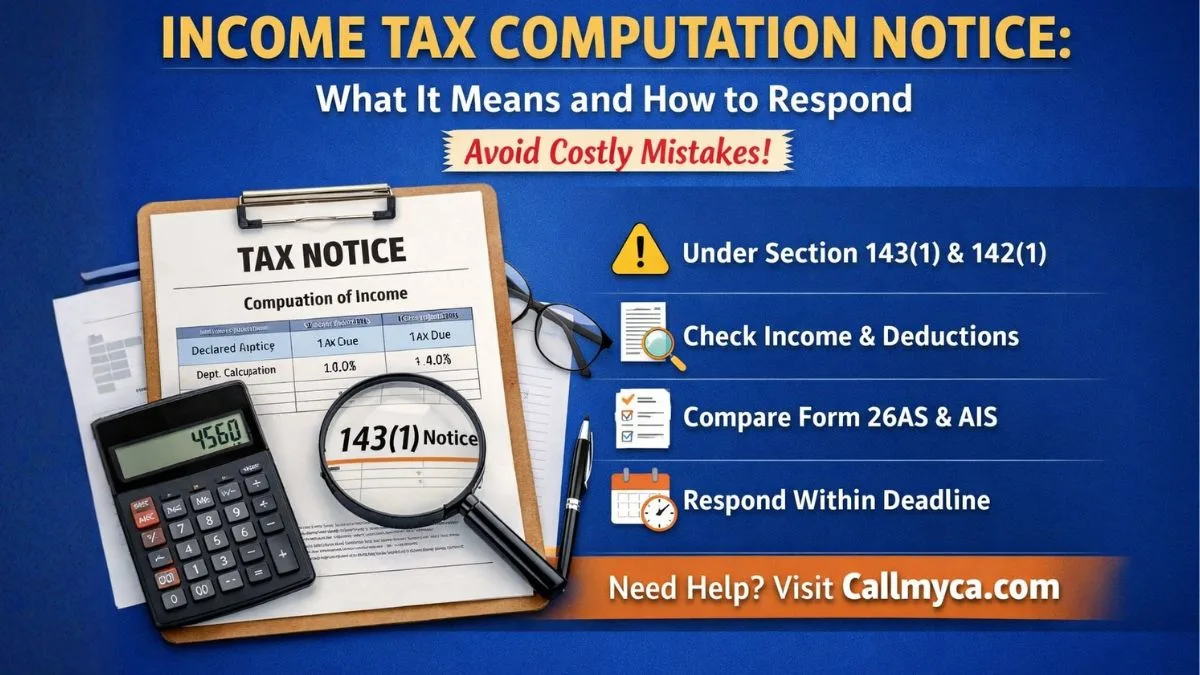

How to Respond to an Income Tax Due Notice

Responding correctly to an income tax due notice is very important.

Step 1: Read the Notice Carefully

Understand:

-

Reason for the tax due

-

Section mentioned

-

Deadline

Step 2: Verify the Details

Compare with:

-

Your filed return

-

Form 26AS

-

AIS

Step 3: Decide Your Action

You have two options:

Accept the Notice

If the demand is correct:

-

Pay the tax due online

-

Save the challan

Disagree with the Notice

If you find errors:

-

Submit a response online

-

Provide supporting documents

Step 4: Respond Within Time

Most income tax notices require a response within 30 days.

Failure to respond can result in:

-

Additional penalties

-

Recovery action

What Happens if You Ignore an Income Tax Due Notice?

Ignoring an income tax due notice can have serious consequences.

1. Penalties and Interest

Interest continues to accumulate on unpaid tax due.

2. Legal Action

The Income Tax Department may initiate recovery proceedings.

3. Bank Account Attachment

Your bank account may be frozen, or funds may be recovered.

4. Best Judgment Assessment

The department may estimate your income and raise a higher tax demand.

Income Tax Due Date Extension Latest News

Many taxpayers search for the latest news on income tax due date extensions to avoid penalties.

The government occasionally extends due dates through official notifications or CBDT notification updates.

However, relying on extensions is risky. Always try to:

-

File returns on time

-

Pay taxes before deadlines

Important Documents to Keep Ready

When dealing with an income tax due notice, keep these documents ready:

-

ITR acknowledgment

-

Form 26AS

-

AIS

-

Tax payment challans

-

Investment proofs

These will help you respond effectively.

Common Mistakes to Avoid

Handling an income tax notice incorrectly can create more problems.

1. Ignoring the Notice

Never ignore any income tax notices.

2. Delayed Response

Missing deadlines leads to penalties.

3. Wrong Information

Submitting incorrect details can worsen your case.

4. Not Checking Notifications

Always stay updated with income tax circulars and notifications in PDF.

Income Tax Circular for Salaried Employees

If you are salaried, you should follow the latest income tax circular for salaried employees issued by the Income Tax Department.

These circulars cover:

-

TDS rules

-

Standard deduction

-

Salary disclosures

Understanding these helps avoid receiving an income tax due notice.

When Should You Take Professional Help?

You should consult a professional if:

-

The demand amount is high

-

You receive repeated income tax notices

-

The issue is complex

Experts can help you:

-

Reduce liability

-

Respond correctly

-

Avoid penalties

Final Thoughts

An income tax due notice is a serious notification that should never be ignored. It clearly indicates that there is a pending tax due that needs your attention.

The best way to handle such income tax notices is to:

-

Stay calm

-

Understand the reason

-

Take timely action

Keeping yourself updated with the latest income tax notification 2026, CBDT notification, and official guidelines can help you stay compliant and avoid unnecessary trouble.

Need Help With Your Income Tax Notice?

Still confused about your income tax due notice or how to handle your tax due? Don’t take risks with compliance.

👉 Visit Callmyca.com today and get expert assistance to resolve your income tax notices quickly and stay stress-free!