summary

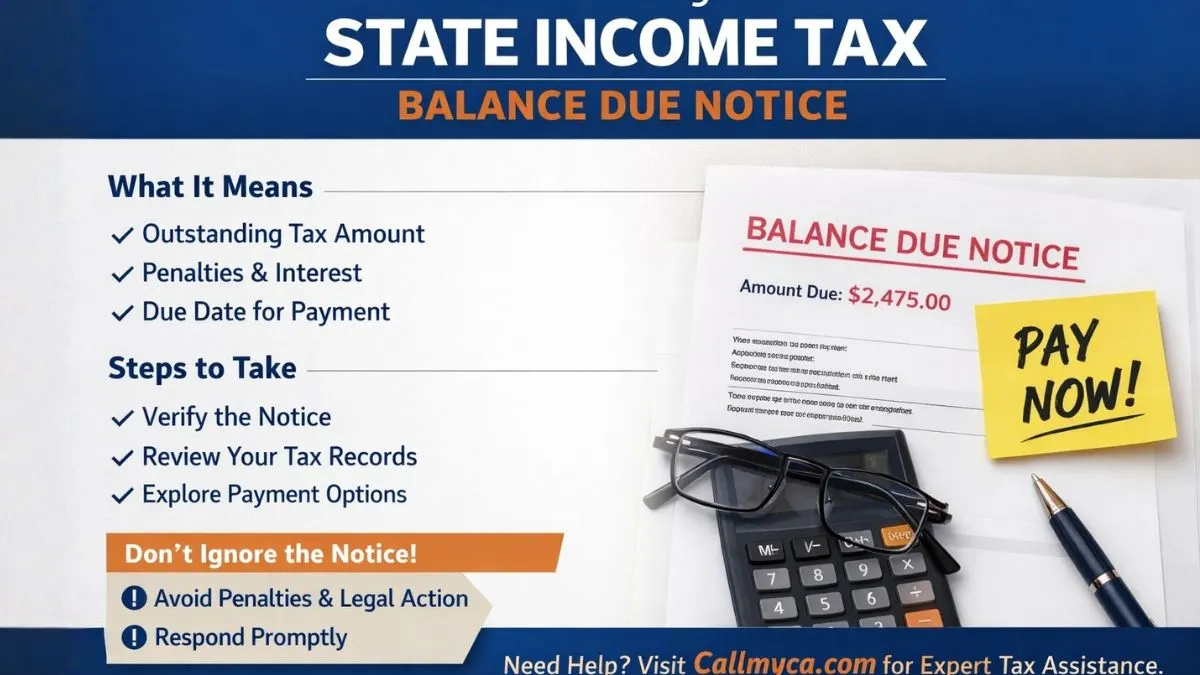

A state income tax balance due notice can create panic if you don’t know what it means. This guide explains notice of state income tax due, income tax notice portal access, how to authenticate them, California State Form 540 line 111, CP14, balance due notice, outstanding tax, payment options, and how to respond correctly to avoid penalties and legal trouble.

Receiving a state income tax balance due notice can instantly raise your stress level. One moment you’re going about your day, and the next, you’re staring at an official-looking letter or email claiming that you owe money to the tax department.

Your mind starts racing.

“Did I do something wrong?”

“Will there be penalties?”

“Is this real or a scam?”

“How much do I really owe?”

These reactions are completely normal. Many taxpayers feel confused, anxious, and even scared when they receive a notice of state income tax due. But the truth is, most balance due notices are routine communications. They don’t automatically mean you are in serious trouble.

In this detailed guide, we’ll break down everything you need to know about income tax balance notices, how to authenticate them, how to check them on the income tax notice portal, how to make payment, and how to deal with outstanding tax smartly and legally.

What Is a State Income Tax Balance Due Notice?

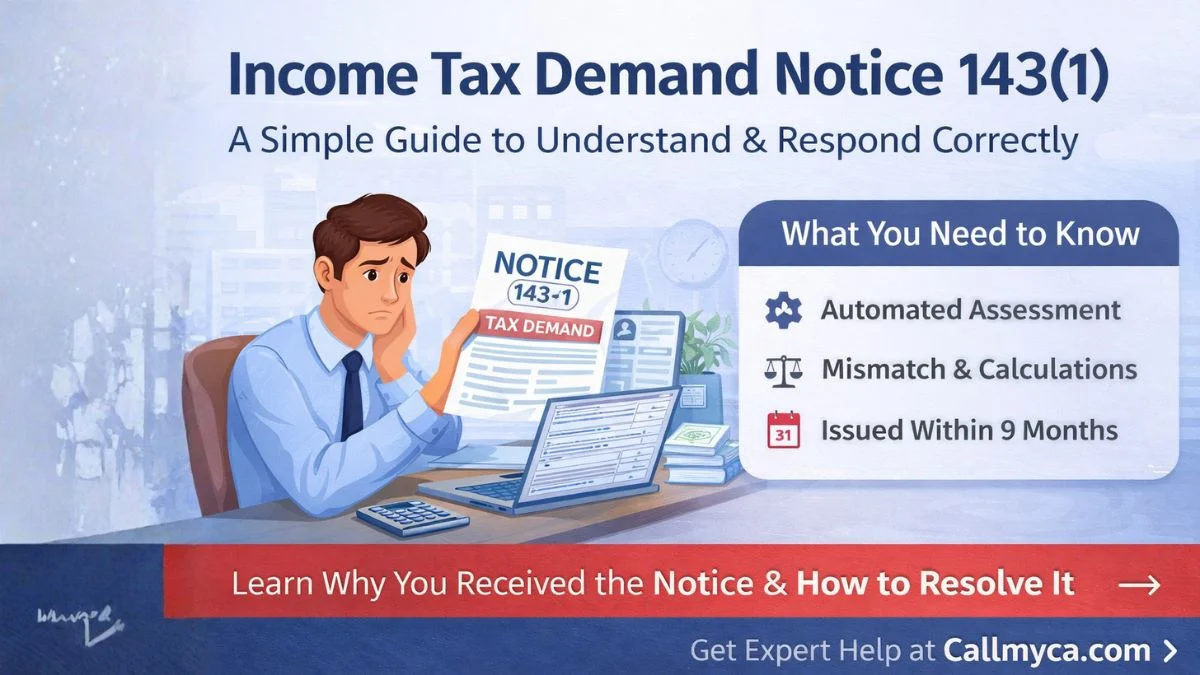

A state income tax balance due notice is an official communication sent by your state tax authority. It informs you that, according to their records, you have an unpaid tax amount, penalty, or interest pending on your income tax account.

This notice usually appears when:

- You underpaid your taxes

- Some income was unreported

- There was a calculation error in your return

- You missed a payment deadline

- Interest and penalties were added later

In simple terms, the department believes you still owe money.

This unpaid amount is often referred to as outstanding tax.

The notice typically includes:

- Your name and taxpayer ID

- Tax year involved

- Original tax amount

- Penalties and interest

- Total balance due

- Due date for payment

- Instructions for response

Ignoring this notice can make the situation worse. So understanding it is your first step toward solving the problem.

Notice of State Income Tax Due: Is It Always Correct?

No. Not always.

A notice of state income tax due is generated based on automated systems and reported data. Sometimes, mistakes happen.

Common reasons for incorrect notices include:

- Employer submitted wrong income details

- Duplicate reporting of income

- Technical errors in processing

- Missed credit or deduction

- Payment already made but not updated

- Wrong adjustment by department

That’s why you should never panic and immediately pay without checking.

Your first task is verification.

How to Authenticate Them: Avoiding Fake Notices and Scams

With the rise in digital fraud, fake income tax notices are becoming common. Scammers often send messages pretending to be tax authorities, demanding urgent payment.

So, learning how to authenticate them is extremely important.

Here’s how you can verify a genuine notice:

1. Check the Sender Details

Official notices come from verified government domains or postal addresses. Be suspicious of random Gmail or unknown email IDs.

2. Look for Reference Numbers

Genuine notices always contain a notice number, reference code, or assessment ID.

3. Verify on Income Tax Notice Portal

Log in to the official income tax notice portal of your state and check if the notice appears in your account.

4. Avoid Clicking Unknown Links

Never click payment links from SMS or WhatsApp messages. Always access the portal manually.

5. Compare With Your Records

Match the figures with your filed return, Form 16, payment receipts, and bank statements.

If anything seems suspicious, consult a tax professional immediately.

Understanding California State Form 540 Line 111

If you are a California taxpayer, one important reference point is California State Form 540, line 111.

Line 111 shows:

“Use Tax”

This is a tax on purchases where sales tax wasn’t collected, such as online or out-of-state purchases.

Many taxpayers overlook this line.

If you didn’t report or pay use tax correctly, the department may later calculate it and send you a balance due notice.

So, when reviewing your notice, always cross-check it with Form 540 and especially line 111.

Small mistakes here can lead to unexpected outstanding tax later.

What Is CP14, and How Is It Related?

While CP14 is more commonly associated with federal taxes, some taxpayers confuse it with state notices.

A CP14 is a notice informing you that you owe money on your tax account.

It includes:

- Original tax due

- Penalties

- Interest

- Total payable amount

If you receive both a CP14 and a state balance due notice, it means you may have unpaid tax at both federal and state levels.

Each must be handled separately.

Never assume that paying one clears the other.

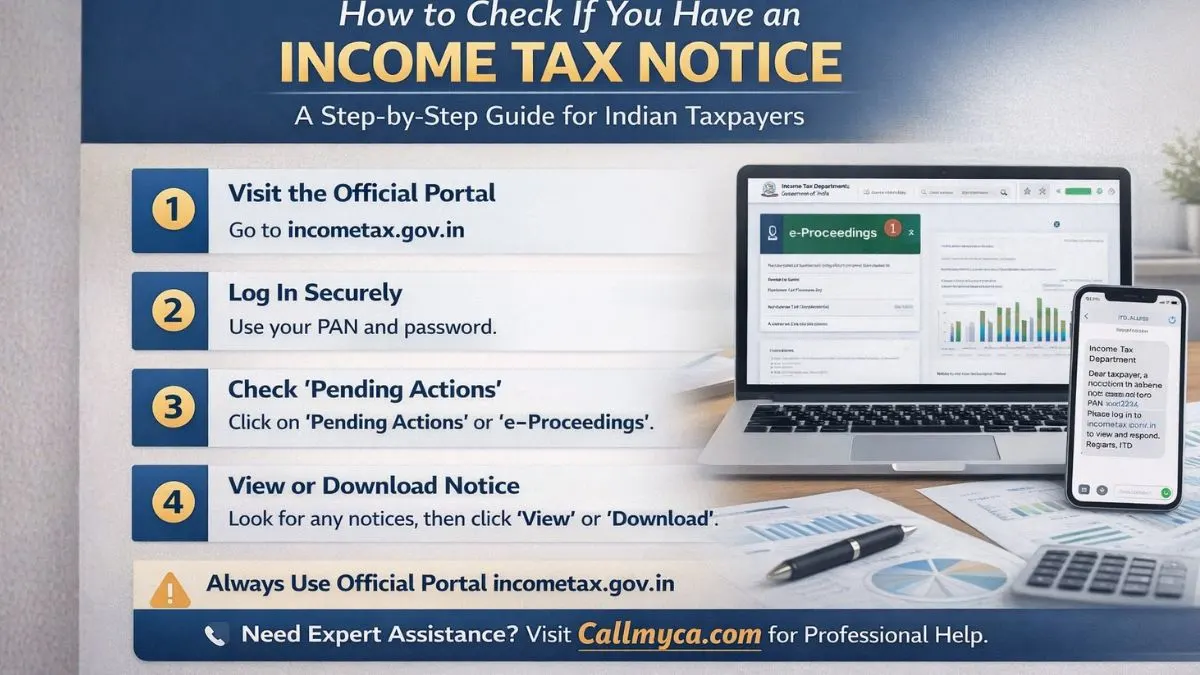

How to Check Your Income Tax Notice on Portal

Most states now provide online dashboards where you can view your notices.

Here’s how to check:

- Visit the official state tax website

- Log in using your taxpayer credentials

- Go to “Notices” or “Communications.”

- Download the notice PDF

- Review details carefully

Using the income tax notice portal ensures you’re dealing with a genuine document and the latest updated figures.

This also allows you to track deadlines and respond digitally.

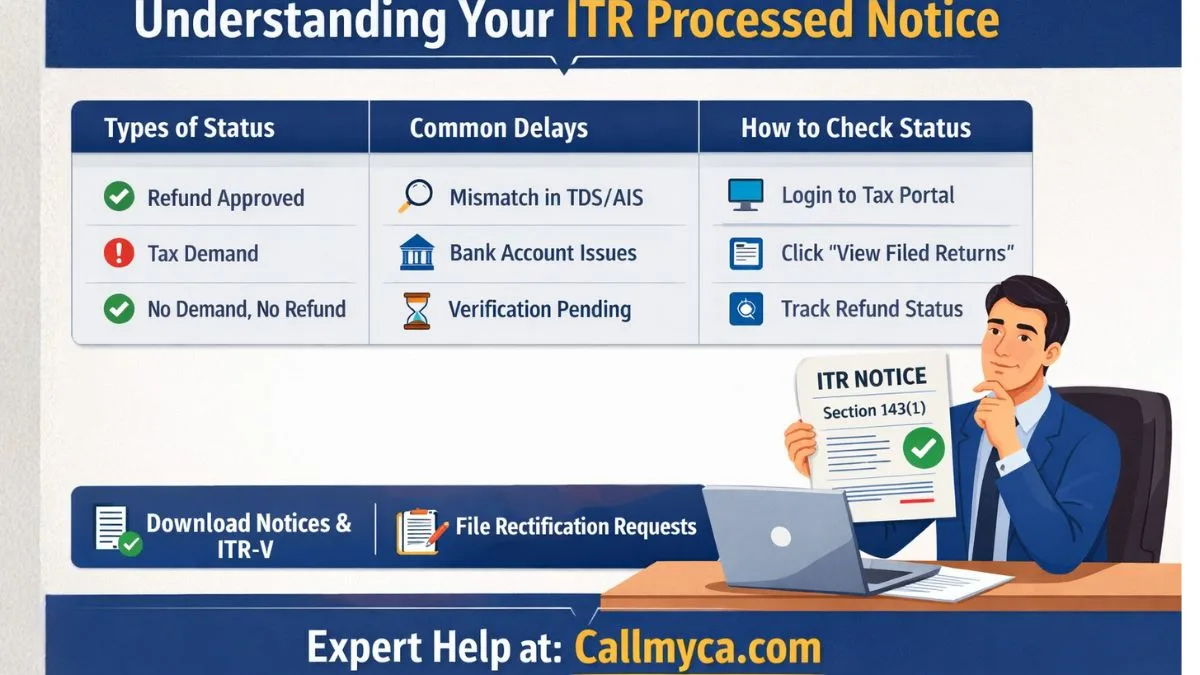

Reviewing Your Balance Due Notice Properly

Before taking any action, read the notice slowly.

Check:

- Tax year mentioned

- Assessment basis

- Calculation method

- Penalty rate

- Interest period

- Payment deadline

Compare these details with:

- Filed return

- Form 16 / 1099

- Bank payment proof

- Challenges

- Refund records

If everything matches, then payment is likely required.

If not, you may have grounds to dispute.

How to Make Payment for Outstanding Tax

If the notice is correct, you should pay immediately to avoid additional interest.

Most states allow multiple payment methods.

Online Payment

- Debit/Credit Card

- Net Banking

- State portal gateway

- IRS-style payment partners (in some regions)

Offline Payment

- Bank challan

- Demand draft

- Cheque (limited cases)

Online payment is always recommended, as it updates faster and provides instant proof.

After payment, save the receipt and screenshot.

What If You Cannot Pay the Full Amount?

Many taxpayers worry because they cannot pay the entire outstanding tax at once.

Don’t panic.

Most tax departments offer:

- Installment plans

- Payment arrangements

- Temporary hardship relief

- Penalty waiver requests

You need to apply through the portal or submit a formal request.

Ignoring the notice is the worst possible option.

Communicating early shows good faith.

How to Respond If You Disagree With the Notice

If you believe the notice is wrong, you have the right to contest it.

Steps:

- Collect all documents

- Prepare a written explanation

- Upload proof on the portal.

- File objection within the deadline.

- Track response

Your reply should be factual, polite, and supported by documents.

Never send emotional or aggressive messages.

Tax departments respond better to clear evidence.

Consequences of Ignoring a Balance Due Notice

Ignoring a balance due notice can lead to serious trouble.

Possible consequences include:

- Continuous interest accumulation

- Heavy penalties

- Account freezing

- Refund adjustment

- Legal notices

- Wage garnishment (in extreme cases)

- Property lien

What starts as a small unpaid amount can grow into a major financial burden.

Early action saves money and mental peace.

Tips to Avoid Future Income Tax Notices

Prevention is better than cure.

Follow these habits:

- File returns on time

- Report all income

- Double-check calculations

- Pay self-assessment tax properly

- Track Form 16/26AS/AIS

- Maintain digital records

- Review drafts before submission

Using professional tax assistance also reduces errors significantly.

Why Professional Help Makes a Big Difference

Many balance due notices are issued due to small technical mistakes that taxpayers don’t even realize.

A tax expert can:

- Review your notice

- Verify calculations

- Identify errors

- Draft proper responses

- Negotiate penalties

- Set up payment plans

- Ensure compliance

This saves you time, stress, and often money.

Final Thoughts

Receiving a state income tax balance due notice is not the end of the world. It is simply a formal way of informing you about a pending issue in your tax account.

If you:

- Authenticate the notice properly

- Check details on the income tax notice portal

- Understand references like California state Form 540 line 111 and CP14

- Review your outstanding tax

- Make timely payment or file objections

You can resolve the matter smoothly.

The key is: Don’t ignore. Don’t panic. Act smartly.

Need Expert Help?

If you’re confused about your balance due notice, payment process, or outstanding tax issue, let the professionals handle it for you. Visit Callmyca.com today and get personalized tax assistance that helps you resolve notices faster, legally, and stress-free.