Summary:

An income tax scrutiny notice under Section 143(2) can be stressful if you don’t know how to respond. This complete guide explains the income tax scrutiny time limit, the extended scrutiny notice time limit, the reply letter format, the income tax scrutiny notice PDF, the income tax notice PDF download, scrutiny for salaried employees, the scrutiny notice section, the income tax calculator AY 2025-26, tax deduction at source, and the TDS rate chart PDF in a simple and practical way.

Receiving an income tax scrutiny notice is one of the most worrying moments for any taxpayer.

The moment you see the word “scrutiny,” your mind automatically thinks:

“Am I in trouble?”

“Will there be a penalty?”

“Did I do something illegal?”

“Will I have to go to the tax office?”

Let me reassure you first.

Getting selected for scrutiny does not mean you are guilty. It only means that the Income Tax Department wants to verify certain details in your return.

Every year, thousands of honest taxpayers—especially salaried employees and small professionals—receive scrutiny notices due to system-based selection.

If you understand the process and respond properly, most cases get closed smoothly.

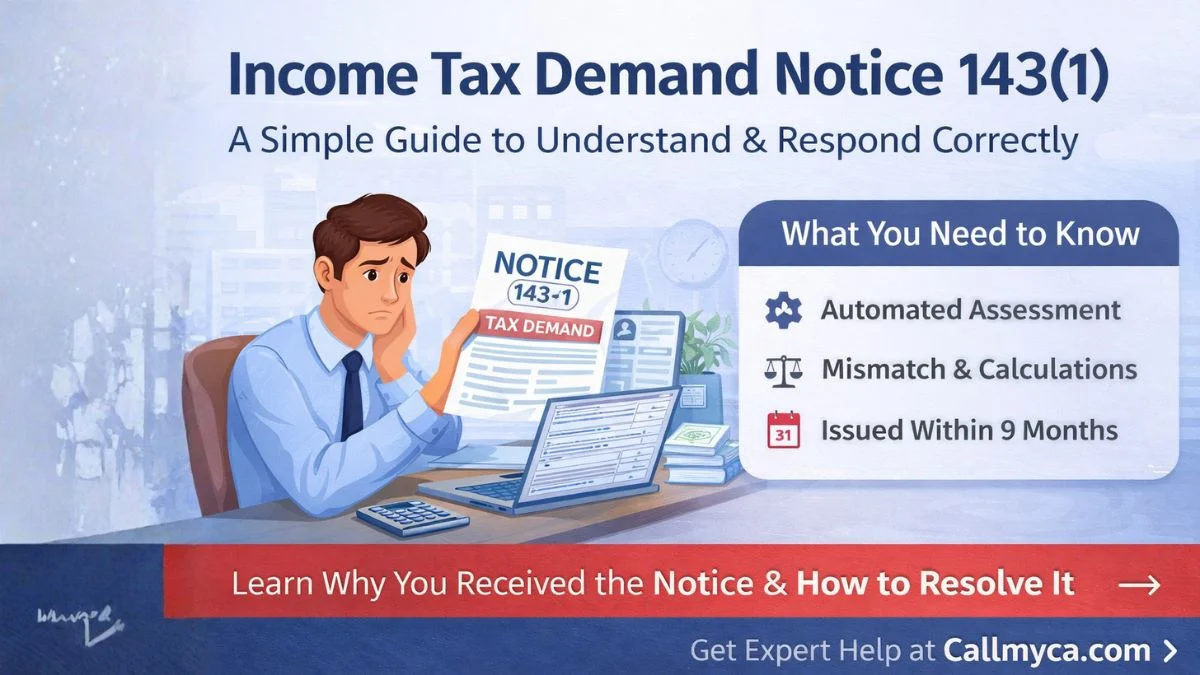

What Is an Income Tax Scrutiny Notice?

An income tax scrutiny notice is issued when the Income Tax Department decides to examine your return in detail.

This usually happens under Section 143(2) of the Income Tax Act.

It means:

- Your return has been selected for verification

- Certain transactions need clarification

- Documents may be required

- Your income and deductions will be checked

The department wants to ensure that:

- You reported all income correctly

- You claimed genuine deductions

- TDS is properly reflected

- No tax is avoided

It is a verification process, not an accusation.

Why Do You Receive a Scrutiny Notice?

Most scrutiny cases are selected through automated systems.

Common reasons include:

1. High-Value Transactions

Large bank deposits, property purchases, or heavy investments.

2. Income Mismatch

Difference between AIS, Form 26AS, and ITR.

3. Low Income With High Expenses

Spending more than reported income.

4. Excessive Deductions

Unusually high deductions under 80C, 80D, etc.

5. Capital Gains Issues

Wrong reporting of shares, mutual funds, or property sales.

6. TDS Discrepancies

Mismatch in tax deduction at source.

7. Random Selection

Some cases are selected randomly for audit.

So even if you are honest, you may still get selected.

Income Tax Scrutiny Notice Section: Which Law Applies?

Most scrutiny notices are issued under:

For detailed assessment of your return.

For seeking additional documents or information.

Sometimes, both sections are used together.

Always check the section mentioned in your notice. It determines how you should respond.

Income Tax Scrutiny Time Limit: Important Deadlines

The income tax scrutiny time limit is very strict.

For Issuing Notice

A scrutiny notice under Section 143(2) must be issued within:

3 months from the end of the financial year in which return is filed (as per current rules)

For Responding

Once you receive the notice, you usually get:

- 7 to 30 days to reply

The exact time is mentioned in the notice.

Time Limit Extended

Sometimes, the income tax scrutiny notice time limit is extended due to:

- System issues

- Natural calamities

- Government notifications

- Technical glitches

But never assume an extension automatically.

Always follow the date mentioned in your notice.

Missing deadlines can lead to best-judgment assessment.

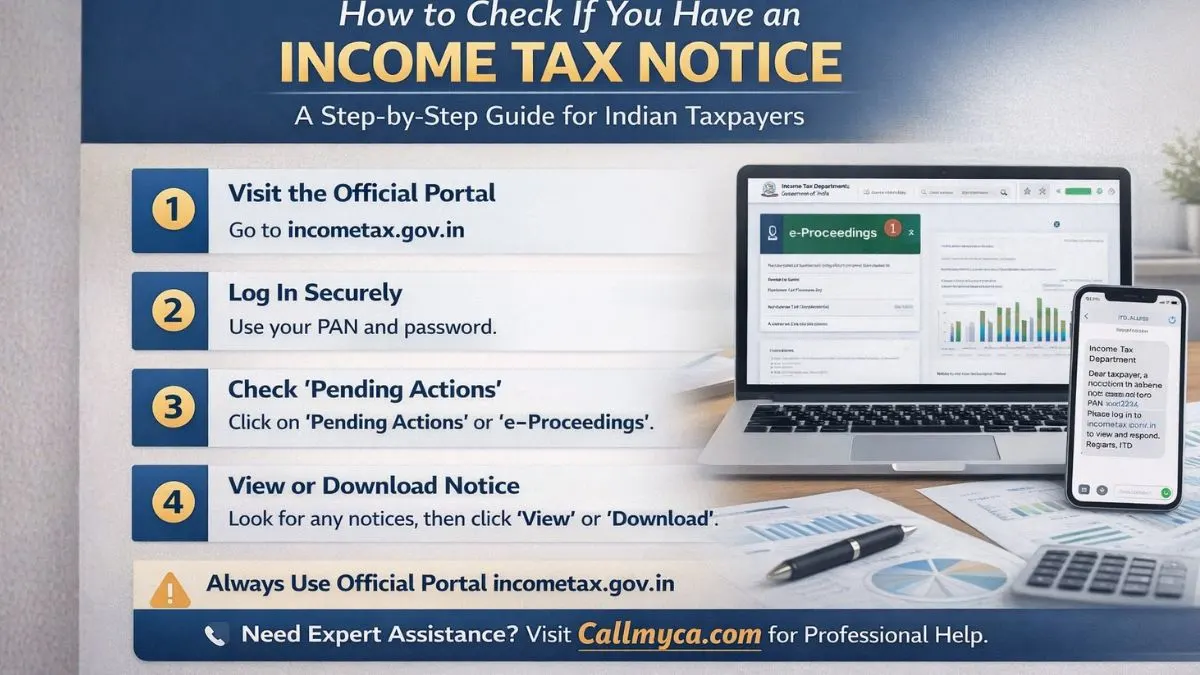

How to Do Income Tax Scrutiny Notice PDF Download

You should never rely only on SMS or email.

Always download the official notice.

Steps for income tax notice PDF download:

- Visit income tax e-filing portal

- Log in using PAN and password

- Go to “e-Proceedings” / “Pending Actions.”

- Click on “Notices.”

- Select the assessment year

- Download scrutiny notice PDF

Save it safely for future reference.

This ensures authenticity.

Income Tax Scrutiny Notice Format: What It Contains

A typical scrutiny notice format includes:

- PAN and Name

- Assessment Year

- Section applied

- Reasons for scrutiny

- Required documents

- Deadline

- DIN number

- Officer details

Read every line carefully.

Many taxpayers make mistakes because they don’t read properly.

Income Tax Scrutiny for Salaried Employees

Many people think only business owners face scrutiny.

That’s wrong.

Income tax scrutiny for salaried employees is very common now.

Reasons include:

- Wrong HRA claim

- Fake rent receipts

- Multiple employers

- High investments

- Incorrect Form 16 data

- Freelance income not declared

If you are salaried, keep these ready:

- Form 16

- Salary slips

- Rent agreement

- Investment proofs

- Bank statements

- AIS/TIS

With proper documents, most salaried scrutiny cases close easily.

Responding correctly is the most important part.

Step 1: Understand the Query

Read what exactly the officer is asking.

Step 2: Collect Documents

Arrange:

- Bank statements

- Form 16/16A

- Investment receipts

- Loan certificates

- Property papers

- Trading statements

Step 3: Match With Return

Ensure figures match your ITR.

Step 4: Prepare Explanation

Write clearly and logically.

Step 5: Upload Online

Submit reply on portal.

Step 6: Track Status

Keep checking for further queries.

Never submit incomplete replies.

Income Tax Scrutiny Notice Reply Letter Format

Your reply should be professional and simple.

Basic format:

- Reference number

- Assessment year

- Subject line

- Explanation point-wise

- Document attachments

- Declaration

- Digital signature

Example structure:

Subject: Reply to Scrutiny Notice under Section 143(2) for AY 2025–26

Then explain each point separately.

Avoid emotional language.

Stick to facts.

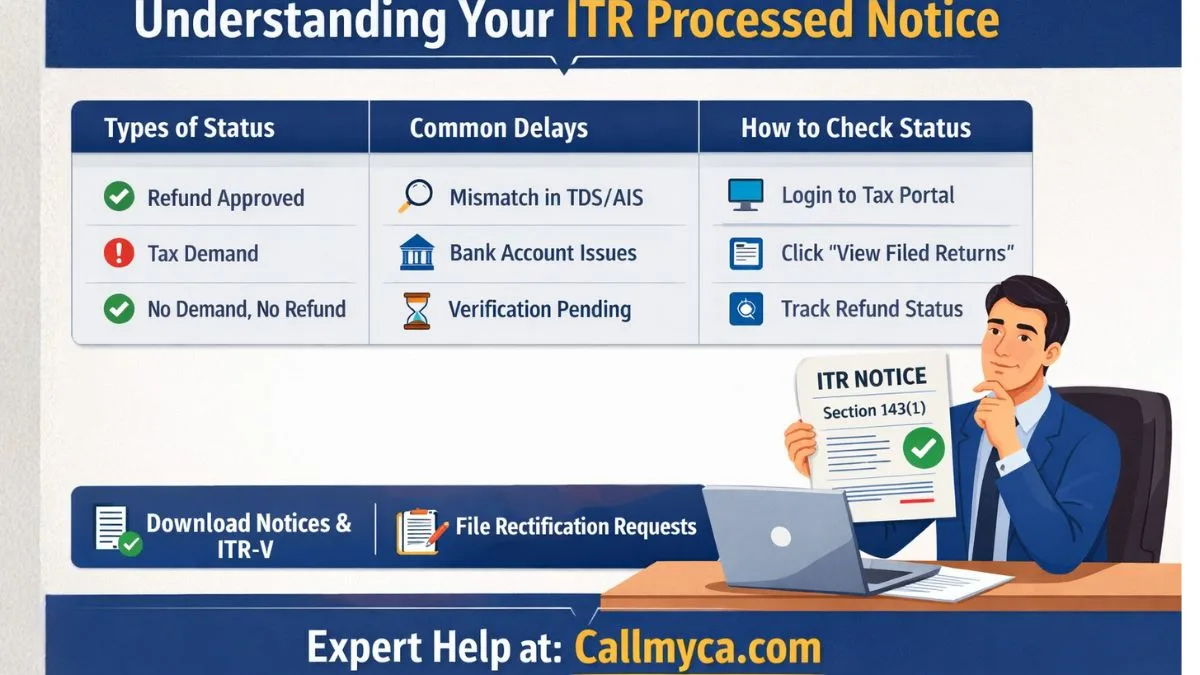

Role of Income Tax Calculator AY 2025–26 in Scrutiny

Using an income tax calculator for AY 2025-26 helps you:

- Recalculate your tax

- Verify department demand

- Check slab accuracy

- Identify errors

Before replying, always recalculate your tax.

Many disputes get resolved at this stage itself.

Importance of Tax Deduction at Source and TDS Rate Chart PDF

Many scrutiny cases happen due to TDS mismatch.

Always check:

- Form 26AS

- AIS

- TDS certificates

- Employer filings

Refer to the TDS rate chart PDF to ensure correct deduction.

Wrong TDS = scrutiny risk.

Make it a habit to verify TDS every year.

What If You Agree With the Department?

If you realize the mistake is yours:

- Pay tax immediately

- Upload challan

- Inform officer

- Close case

Quick compliance reduces penalties.

What If You Disagree With the Scrutiny Findings?

If you believe the department is wrong:

- File detailed explanation

- Attach proofs

- Request rectification

- Seek professional help

Most genuine disputes are resolved in favor of taxpayers.

But only when handled properly.

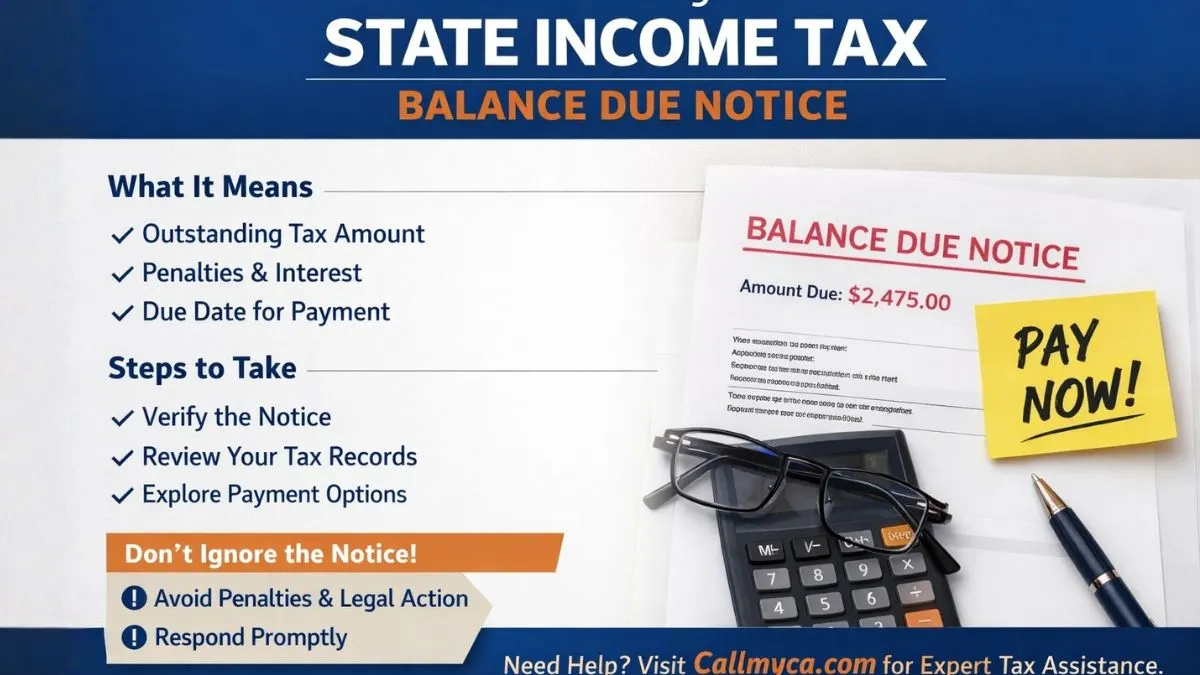

Consequences of Ignoring Scrutiny Notice

Ignoring an income tax scrutiny notice can lead to:

- Best judgment assessment

- Heavy tax demand

- Penalties

- Interest

- Refund blockage

- Prosecution (rare cases)

What could have been resolved with documents can turn into legal trouble.

Never ignore.

How to Avoid Scrutiny in Future

Follow these habits:

- Report all income

- Match AIS & 26AS

- Use correct slabs

- Avoid fake deductions

- Keep proofs

- File on time

- Review before submission

These reduce 80–90% scrutiny risk.

Why Professional Support Matters in Scrutiny Cases

Scrutiny is not just about documents.

It’s about interpretation of law.

A tax expert can:

- Draft proper replies

- Handle technical language

- Represent you online

- Negotiate issues

- Reduce tax burden

- Avoid litigation

Many taxpayers lose money simply due to wrong replies.

Expert help saves you from that.

Final Thoughts

An income tax scrutiny notice is not a punishment. It is a verification process.

If you:

- Download notice properly

- Understand the section

- Follow time limit

- Prepare correct reply

- Maintain documents

- Use income tax calculator AY 2025–26

- Verify TDS properly

You can clear scrutiny without stress.

Remember: Scrutiny is manageable. Panic is optional.

Need Help With Your Income Tax Scrutiny Case?

If you are confused about your scrutiny notice, reply format, PDF download, time limit, or TDS mismatch, don’t struggle alone. Visit Callmyca.com today and get expert support to handle your income tax scrutiny legally, confidently, and stress-free.