Personal Income Tax Bill Notice: Latest Updates, PDF Download, and How to Respond in 2025–2026

Summary

A personal income tax bill notice can be stressful if you don’t understand it. This detailed guide explains the income tax bill 2025 summary, the new income tax bill 2025 draft, the income tax notice PDF download, the new income tax bill 2026, the latest income tax notification, the income tax notification 2025, TDS mismatch, the CBDT notification, and how to verify, respond, and avoid penalties legally.

Receiving a personal income tax bill notice can suddenly make your heart skip a beat.

One day, you’re checking your emails or SMS casually. The next moment, you see a message from the tax department talking about unpaid taxes, discrepancies, or clarification.

Instantly, questions start flooding your mind.

“Did I file something wrong?”

“Will I have to pay extra?”

“Is this related to the new income tax bill?”

“Can this become a legal problem?”

If you’re feeling confused, you’re not alone.

Every year, lakhs of taxpayers receive income tax notices due to minor mismatches, technical errors, or system-generated alerts. Most of them are routine. They don’t mean you’re in trouble—if you handle them properly.

What Is a Personal Income Tax Bill Notice?

A personal income tax bill notice is an official communication sent by the Income Tax Department when they find an issue in your filed return or payment records.

It is usually generated when:

- Your tax payment is incomplete

- TDS doesn’t match your return

- Some income is unreported

- Deductions are wrongly claimed

- There is a calculation error

- Advance tax or self-assessment tax, is pending

In simple words, the department believes that something in your return needs correction, clarification, or additional payment.

This notice tells you:

- What the issue is

- Which year is affected

- How much tax is involved

- What action you must take

- The deadline for response

Ignoring this notice can lead to penalties and interest. So understanding it is very important.

Role of Income-Tax Bill and CBDT Notification

All income tax rules and procedures are governed by the Income Tax Bill and regulated through notifications issued by the Central Board of Direct Taxes (CBDT).

Whenever there is

- A new compliance rule

- A change in slabs

- A revision in procedures

- A new reporting requirement

It is communicated through CBDT notifications.

Many income tax notices are linked to recent CBDT updates. That’s why it’s important to stay aware of the latest income tax notification and the income tax notification for 2025.

Sometimes, notices are triggered because taxpayers are unaware of new reporting rules.

Common Types of Income Tax Bill Notices

Before reacting, you must understand what type of notice you have received.

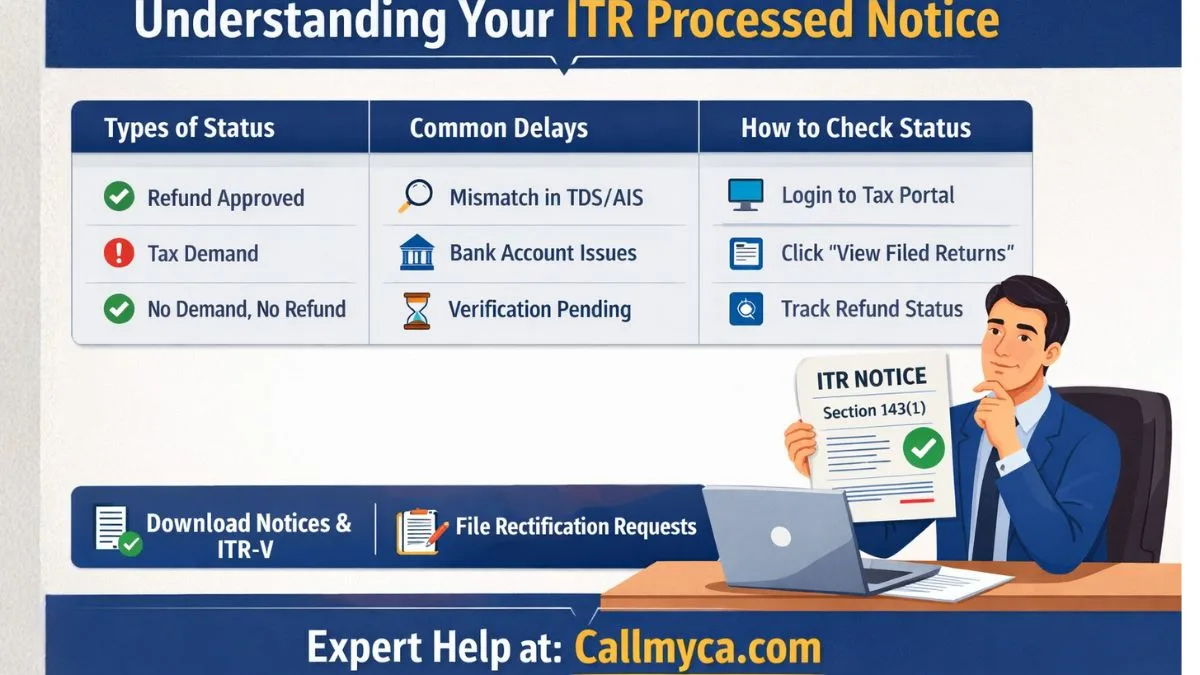

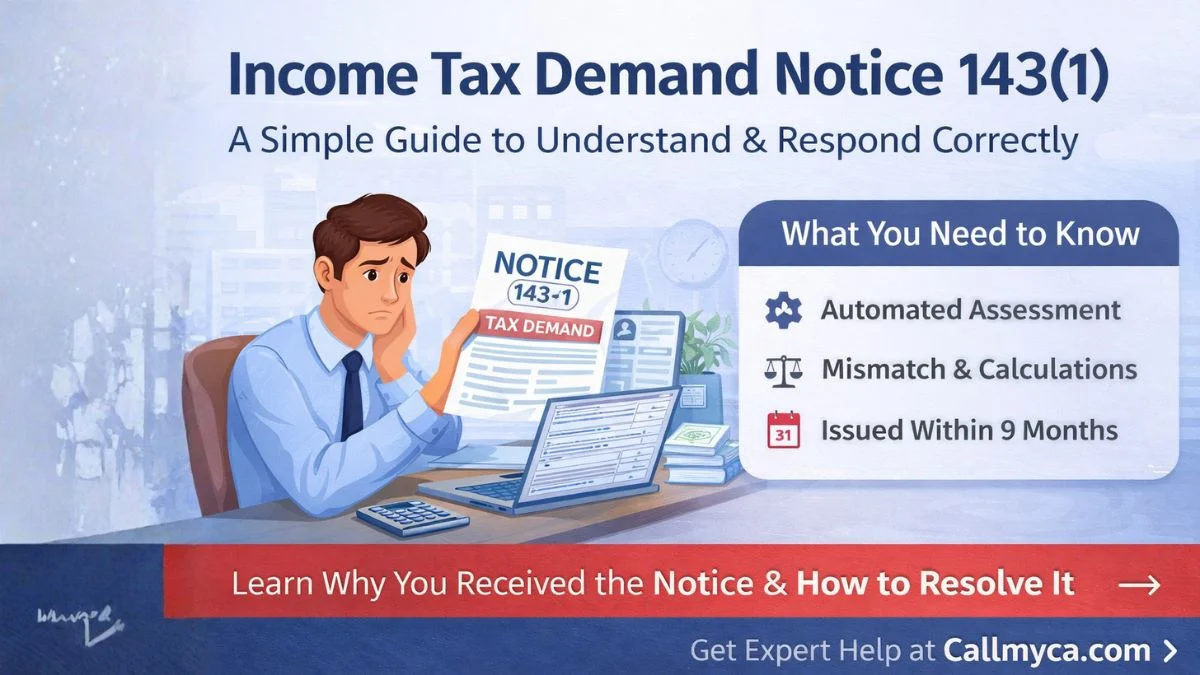

1. Section 143(1) – Intimation Notice

This is the most common notice. It shows differences between your return and department records.

2. Section 148—Escaped Income Notice

Issued when income is suspected to be hidden.

3. Section 139(9) – Defective Return

Your return has technical errors.

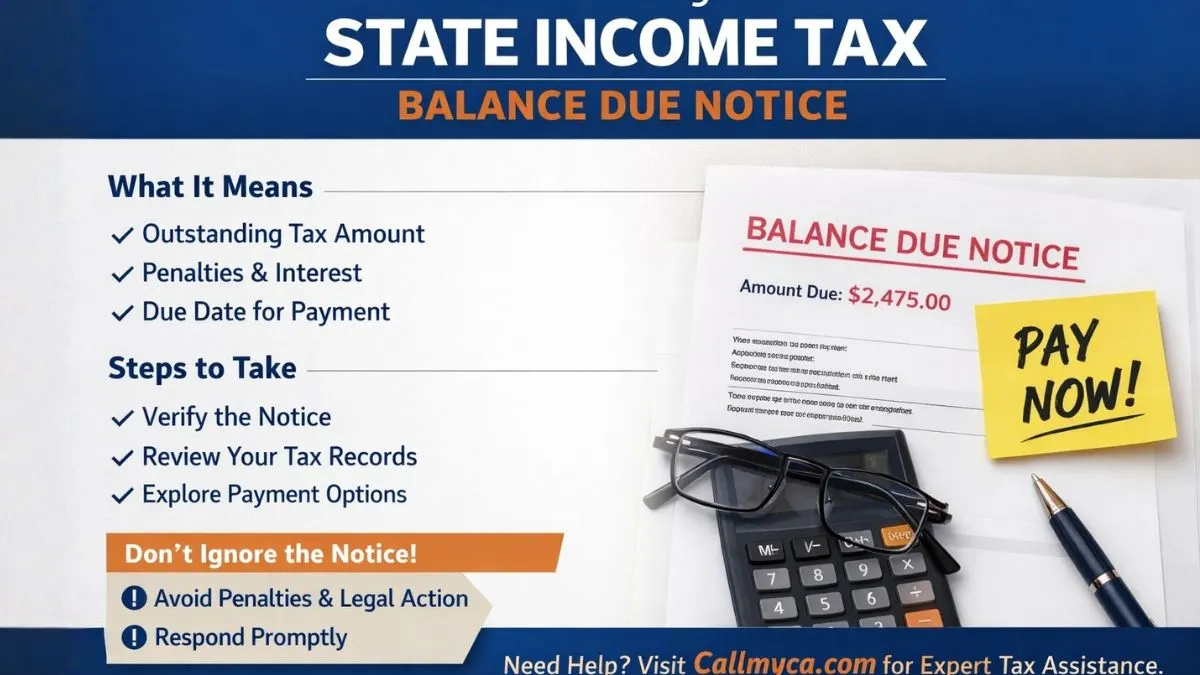

4. Demand Notice

Issued when tax is payable.

Each type has a different response process. So always check the section mentioned.

Why Do You Receive an Income Tax Bill Notice?

Most notices are not because of fraud or wrongdoing.

Common reasons include:

TDS Mismatch

Your employer or bank deducted TDS, but it doesn’t match AIS or Form 26AS.

Unreported Income

Interest, freelancing income, capital gains, or side income not declared.

Wrong Deductions

Claiming deductions without proper proof.

Calculation Errors

Manual mistakes in tax calculation.

Late Payments

Delay in advance tax or self-assessment tax.

System-Based Alerts

Automated systems flag inconsistencies.

These issues are very common, especially after the introduction of advanced data tracking.

New Income Tax Bill 2025: What’s Changing?

The new income tax bill 2025 draft aims to simplify tax laws and reduce complexity.

Key highlights include:

- Simplified language

- Clearer definitions

- Reduced litigation

- Better digital compliance

- Improved dispute resolution

Many taxpayers are searching for:

- New income tax bill 2025 PDF download

- New income tax bill 2025 slab

- Income tax bill 2025 summary

This is because the bill impacts filing structure and compliance.

Although the basic slabs may remain similar initially, procedural changes can affect notices and assessments.

That’s why staying updated is crucial.

New Income Tax Bill 2026: What to Expect?

The new income tax bill for 2026 is expected to further modernize tax administration.

Likely focus areas:

- AI-based scrutiny

- Real-time data matching

- Faster refunds

- Automated compliance

- Reduced manual intervention

This also means more system-generated notices.

So in the future, notices may become more frequent—but more accurate.

Understanding the system early helps you stay prepared.

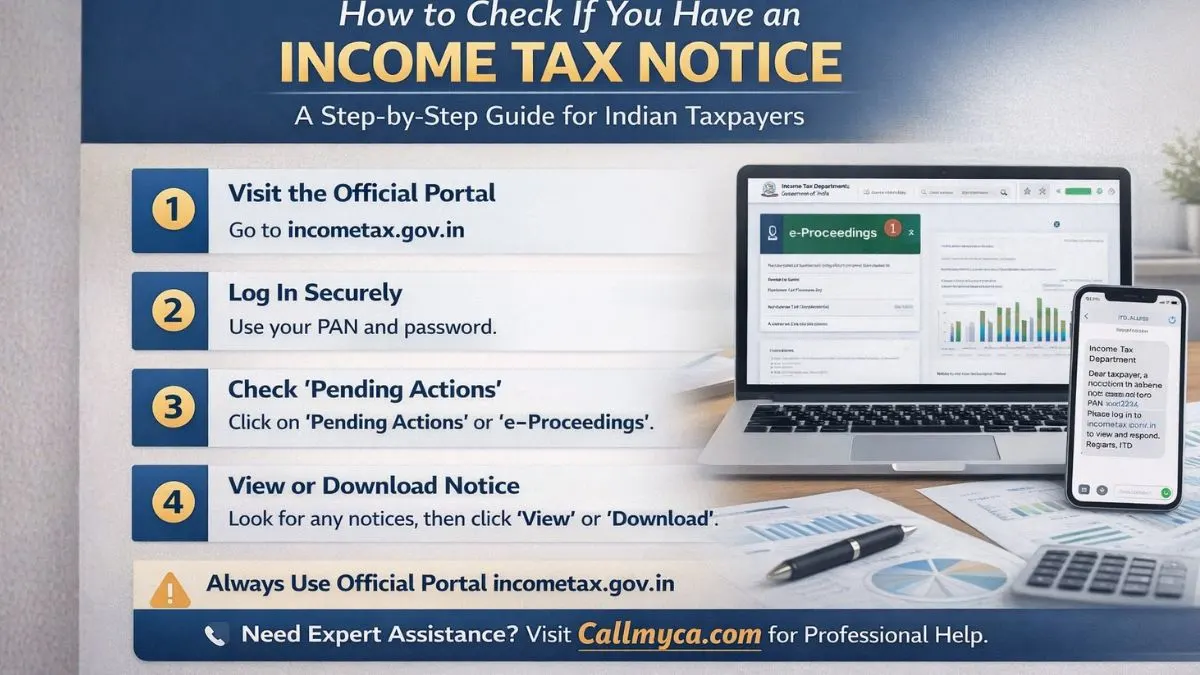

How to Do Income Tax Notice PDF Download

If you receive a message or email, never rely only on it.

Always download the official copy.

Here’s how to do an income tax notice PDF download:

- Visit the official income tax portal

- Log in using PAN and password

- Go to “e-Proceedings” or “Notices.”

- Select the relevant year

- Download the PDF

- Save it safely

This ensures you are dealing with an authentic notice.

Never respond to notices that are not visible on the portal.

How to Verify the Authenticity of a Notice

Scam notices are increasing every year.

So always verify before acting.

Check These Points:

- Is it available on the portal?

- Does it have a DIN (Document Identification Number)?

- Is the email domain official?

- Does it mention proper sections?

- Are payment links redirecting to government sites?

If any of these are missing, be careful.

When in doubt, consult a professional.

How to Respond to a Personal Income Tax Bill Notice

Once you verify the notice, take action immediately.

Step 1: Read Carefully

Understand what exactly is being questioned.

Step 2: Collect Documents

Gather:

- Form 16 / 16A

- Bank statements

- AIS/TIS

- Investment proofs

- Challenges

Step 3: Prepare Your Reply

Explain facts clearly. Attach supporting documents.

Step 4: Submit Online

Upload the response on the portal before the deadline.

Step 5: Track Status

Keep checking until closure.

Never miss deadlines. Late responses attract penalties.

What If You Agree With the Notice?

If the department is right and tax is payable:

- Pay online immediately

- Download receipt

- Update records

- Verify closure

Quick payment reduces interest burden.

What If You Disagree With the Notice?

If the notice is incorrect:

- File an online objection

- Attach evidence

- Explain discrepancies

- Seek rectification

Most genuine cases are resolved smoothly when proper proof is submitted.

Never ignore or argue emotionally.

Facts matter more than opinions.

Consequences of Ignoring Income Tax Notices

Ignoring a personal income tax bill notice can lead to:

- Heavy interest

- Penalties

- Refund blocking

- Account attachment

- Legal proceedings

- Prosecution (in extreme cases)

What starts as ₹2,000 can become ₹20,000 over time.

Silence is expensive in tax matters.

How to Avoid Notices in Future

Follow these habits:

- File returns on time

- Match AIS and Form 26AS

- Report all income

- Keep digital records

- Recheck calculations

- Follow CBDT updates

- Use professional review

These small steps reduce 90% of notice risks.

Why Professional Support Matters

Tax laws are becoming more data-driven and complex.

A professional can:

- Interpret notices correctly

- Draft legal replies

- Handle technical issues

- Negotiate penalties

- Ensure compliance

- Save money and time

Many taxpayers pay extra simply because they don’t understand procedures.

Expert help prevents that.

Final Thoughts

A personal income tax bill notice is not something to fear. It is a system-driven communication meant to correct records and ensure compliance.

If you:

- Download the notice properly

- Verify authenticity

- Understand new income tax bill 2025 and 2026 updates

- Follow CBDT notifications

- Respond within time

You can resolve the issue without stress.

Remember: Tax problems grow only when ignored.

Handle them early, and they stay small.

Need Help With Your Income Tax Notice?

If you’re confused about your income tax bill notice, PDF download, new income tax bill rules, or response process, don’t struggle alone. Visit Callmyca.com today and get expert support to resolve your tax notices legally, quickly, and stress-free.