Summary:

An income tax notice assessment is issued when the department reviews or reopens your return. Learn about the income tax scrutiny time limit, scrutiny assessment under income tax section 143(3), the extended income tax scrutiny notice time limit, the income tax notice PDF download, the income tax scrutiny notice reply letter, the assessment procedure of income tax notes PDF, reassessment in income tax, and scrutiny assessment in income tax in simple language.

Filing your income tax return is something most people do with honesty and responsibility. You submit your documents, verify your details, and move on with life.

But then one day, you receive a message or email saying:

“You have received an income tax notice.”

And suddenly, your heart skips a beat.

You start searching online for income tax notice assessment, income tax scrutiny time limit, or scrutiny assessment in income tax.

Thoughts like these come to mind:

“Why me?”

“Did I do something wrong?”

“Will I have to pay a penalty?”

If you are feeling worried, relax. Most assessment notices are part of a normal verification process.

What Is an Income Tax Notice Assessment?

An income tax notice assessment is sent when the Income Tax Department decides to examine your return more closely.

This usually happens under:

- Section 143(2) – Scrutiny

- Section 148 – Reassessment

It means the department wants to:

- Verify your income

- Check deductions

- Review investments

- Confirm tax payments

- Cross-check documents

It does NOT automatically mean tax evasion.

In many cases, it is just a routine check.

Why Do You Receive an Assessment Notice?

You may receive this notice because of:

- High-value transactions

- Sudden increase in income

- Large deductions claimed

- Mismatch with AIS/TIS

- Property or share transactions

- Foreign income

- Random selection

Sometimes, your return is picked simply for verification.

There is no personal targeting.

What Is Scrutiny Assessment in Income Tax?

A scrutiny assessment in income tax is a detailed examination of your return by an assessing officer.

It starts when you receive a notice under Section 143(2).

In this process, the officer checks:

- Income sources

- Bank statements

- Investment proofs

- Loan details

- Expense claims

- Capital gains

The goal is to confirm whether your return is correct.

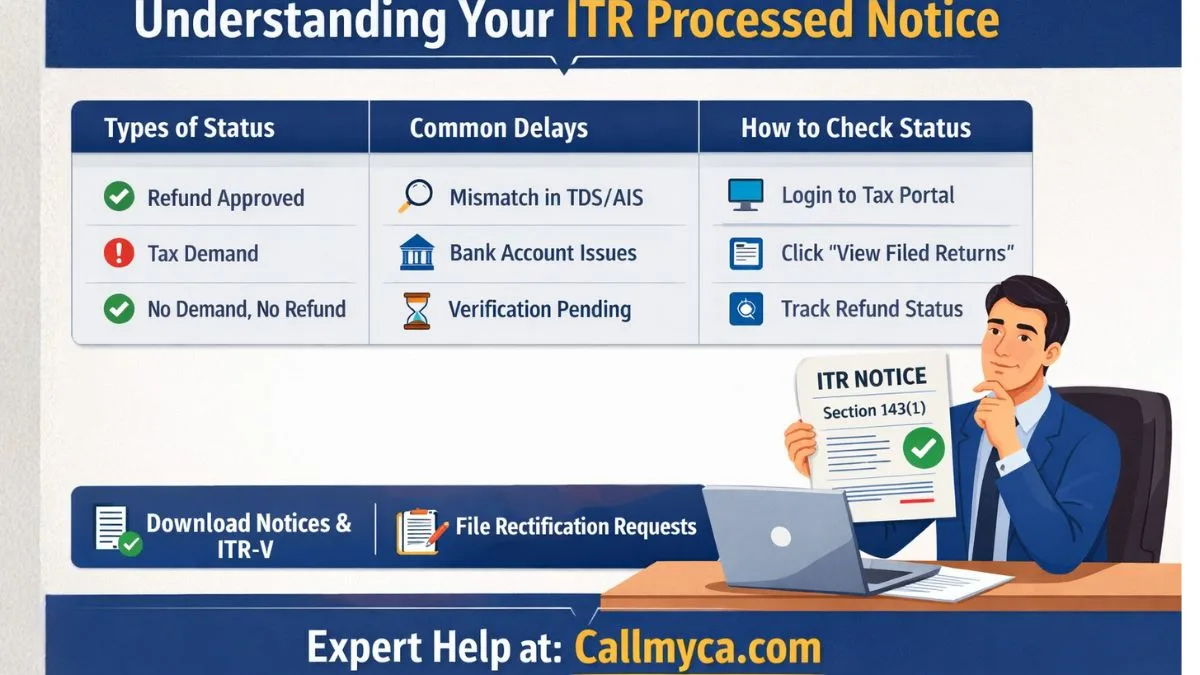

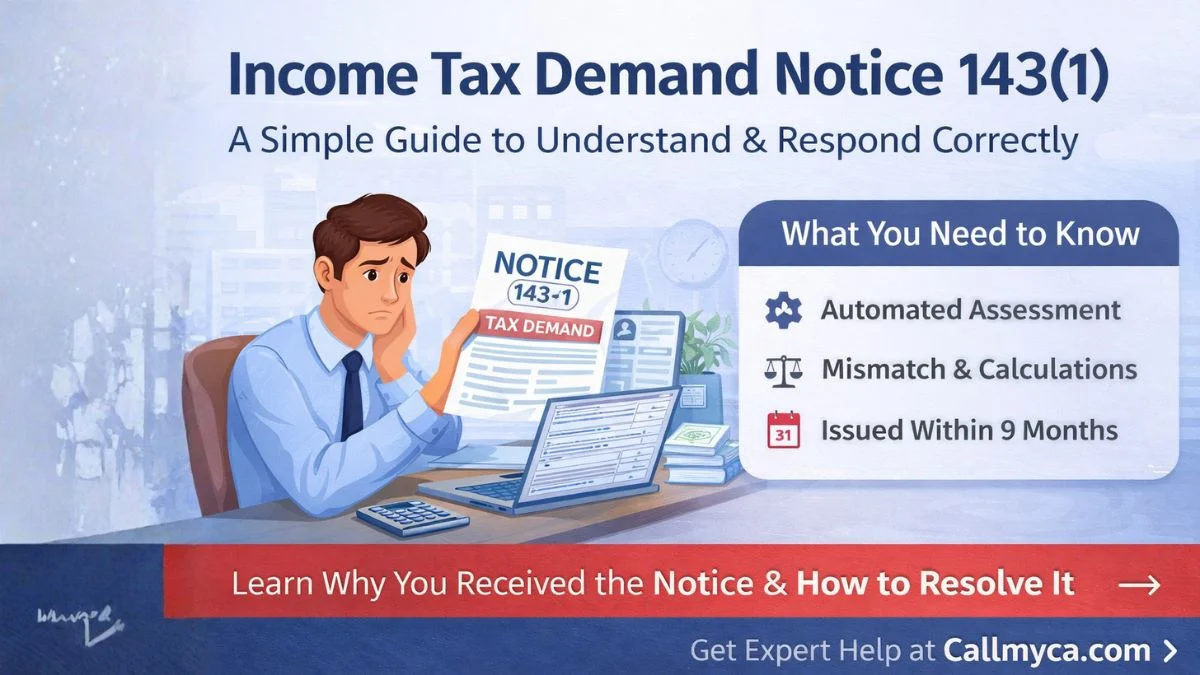

Scrutiny Assessment Under Income Tax Section 143(3)

After scrutiny, the final order is passed under Section 143(3).

This is called scrutiny assessment under income tax section 143(3).

Under this section, the officer decides:

- Final taxable income

- Tax payable/refund

- Penalty (if any)

This is the final outcome of scrutiny.

Income Tax Scrutiny Time Limit

Many taxpayers worry about how long scrutiny can continue.

The income tax scrutiny time limit is

- Generally, 12 months from the end of the assessment year.

Example:

For AY 2024–25, the time limit is till March 2026.

However, this may change in special cases.

Income Tax Scrutiny Notice Time Limit Extended

Sometimes, the government extends deadlines.

This is called the income tax scrutiny notice time limit extended.

Extensions may happen due to:

- COVID-like situations

- System delays

- Policy changes

- Administrative reasons

Such extensions are officially notified.

Always check updates.

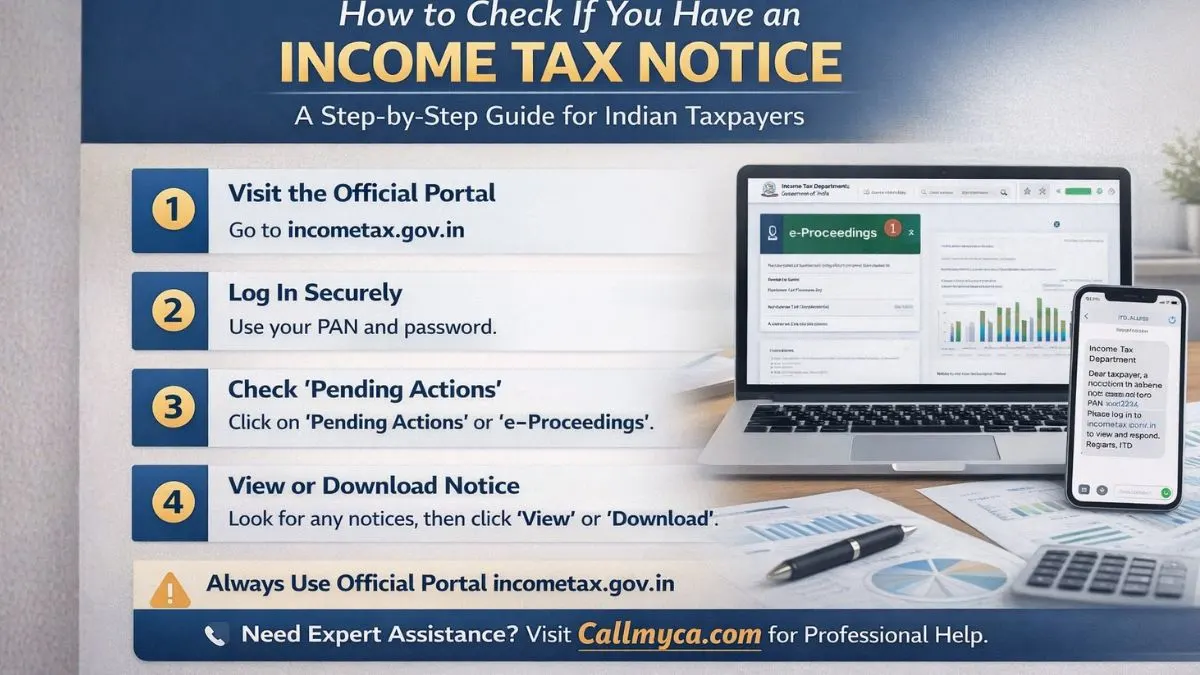

How to Do Income Tax Notice PDF Download

Once you receive a notice, your first step is to download the income tax notice PDF.

Follow these steps:

- Visit Income Tax Portal

- Log in using PAN and password

- Go to “Pending Actions.”

- Click “e-Proceedings”

- Select “View Notices.”

- Download PDF

Save this file safely.

Never rely only on email screenshots.

How to Reply to Scrutiny Notice

After downloading the notice, you must respond online.

This is done through an income tax scrutiny notice reply letter.

Your reply should include:

- Proper explanations

- Supporting documents

- Clear calculations

- Bank statements

- Investment proofs

Your reply must be honest and complete.

Incomplete replies create more trouble.

How to Prepare Income Tax Scrutiny Notice Reply Letter

A good reply letter should:

- Be polite and professional

- Answer each question clearly

- Attach valid proofs

- Avoid emotional language

- Stick to facts

If you are unsure, take professional help.

Wrong replies can backfire.

Assessment Procedure of Income Tax (Simple Explanation)

Many people search for the assessment procedure of income tax notes in PDF to understand the process.

Here is the simple version:

Step 1: Notice Issued

Under 143(2) or 148

Step 2: Document Submission

Online response

Step 3: Hearing (If Required)

Through portal or video call

Step 4: Verification

The officer checks documents

Step 5: Order Passed

Under Section 143(3)

This is the standard procedure.

What Is Reassessment in Income Tax?

Reassessment in income tax happens when the department believes some income was missed earlier.

It is done under Section 148.

Reasons include:

- Undisclosed income

- Missed capital gains

- Foreign assets

- Unreported interest

- Hidden transactions

In reassessment, old returns are reopened.

You must cooperate fully.

Difference Between Scrutiny and Reassessment

|

Scrutiny |

Reassessment |

|

Current return |

Past return |

|

Section 143(2) |

Section 148 |

|

Regular check |

Reopening case |

|

Less serious |

More serious |

Both need proper responses.

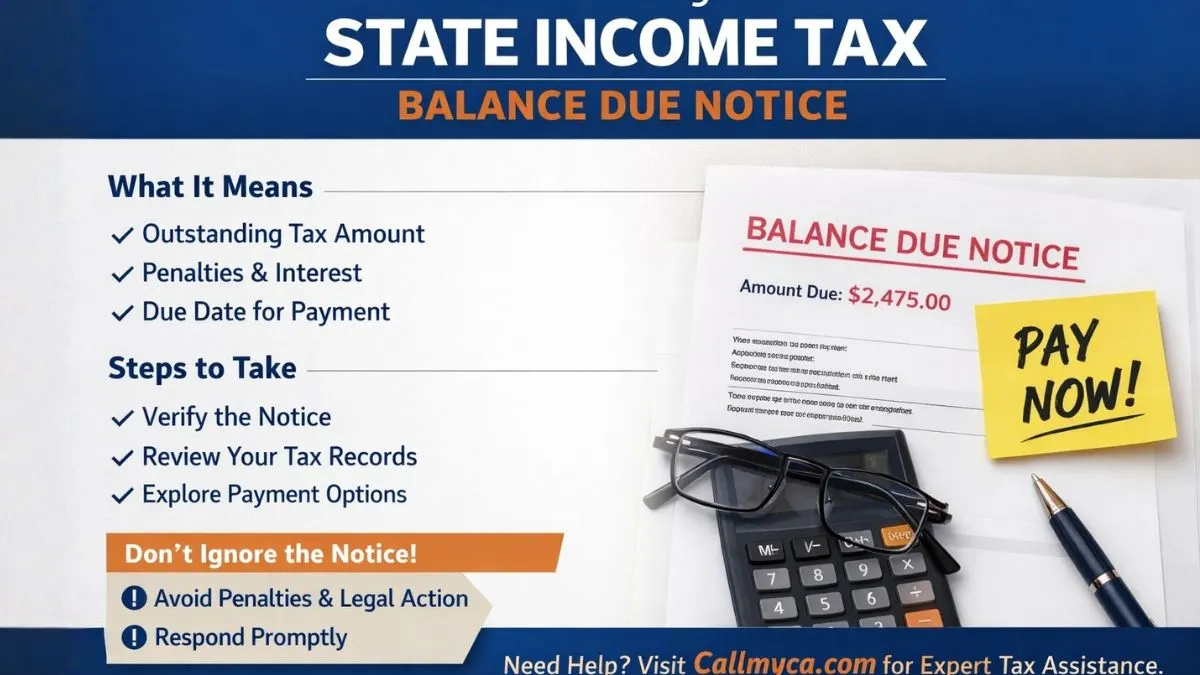

Why Assessment Notices Are Important

An income tax notice assessment plays a vital role in keeping the tax system transparent and fair. Many taxpayers panic when they receive such notices, assuming they are in serious trouble. In reality, most assessments are meant to verify information and ensure that income and deductions are reported correctly. These notices help prevent mistakes, misreporting, and revenue loss. Ignoring assessment notices can lead to penalties, interest, and long legal battles. On the other hand, timely and honest responses build trust with the department and protect your financial reputation. Assessment proceedings also improve your understanding of taxation and encourage disciplined financial behavior. When handled properly, they become an opportunity to clean your records rather than a threat. Therefore, instead of fearing assessment notices, treat them as part of responsible tax compliance.

Common Mistakes During Assessment

Avoid these errors:

- Missing deadlines

- Uploading wrong documents

- Giving incomplete replies

- Ignoring portal messages

- Hiding information

- Arguing emotionally

These mistakes increase risk.

How to Stay Safe During Scrutiny

Follow these tips:

- Keep records for 6 years

- Maintain bank statements

- Preserve investment proofs

- Download all notices

- Reply on time

- Take expert help

Preparation is your best defense.

What Happens After Assessment Is Complete?

After completion:

- You receive final order

- Tax/refund is updated

- Case is closed

- Records are updated

If you disagree, you can file an appeal.

Final Thoughts

Receiving an income tax notice assessment does not mean trouble. It means your return is being reviewed. By understanding the income tax scrutiny time limit, scrutiny assessment under income tax section 143(3), income tax notice PDF download, reassessment in income tax, and reply procedures, you can handle the process confidently and peacefully.

👉 If you want professional support for scrutiny cases, reassessment notices, replies, appeals, or documentation, visit Callmyca.com today and let our tax experts protect your interests while you focus on your work and family.