Income Tax Demand Notice 143(1): A Simple Guide to Understand and Respond Correctly

If you have received an Income Tax Demand Notice under Section 143(1), please do not panic.

I see this situation every year. People receive this notice, feel stressed, and immediately assume that something has gone wrong. Some think they will face penalties. Others believe they made a serious mistake.

In reality, most Section 143(1) notices are routine system-generated intimations. They are usually easy to understand and easy to resolve—if you know what to do.

In this guide, I will explain everything clearly: what an income tax demand notice 143(1) means, why it is issued, how to check it online, how to respond, and how to avoid problems in the future.

What Is Income Tax Intimation Under Section 143(1)?

An intimation under Section 143(1) is an automated preliminary assessment of your Income Tax Return (ITR).

After you file your return, it is processed by the Centralized Processing Centre, Bengaluru (CPC) of the Income Tax Department of India.

The system checks your return and compares it with:

-

Form 26AS

-

Annual Information Statement (AIS)

-

Taxpayer Information Summary (TIS)

-

Applicable tax rules

Based on this comparison, the system issues an intimation.

This intimation shows one of the following results:

✅ No demand, no refund

✅ Refund is due

✅ Tax demand is payable

What Is an Income Tax Demand Notice 143(1)?

When the system finds that the tax paid by you is less than what is calculated by the department, it creates a demand.

This is called an Income Tax Demand Notice under Section 143(1).

It simply means:

“According to our system, you still need to pay some tax.”

It does not mean fraud.

It does not mean prosecution.

It does not mean legal action.

It usually means there is a mismatch or calculation difference.

When Is Intimation u/s 143(1) Issued?

The time limit for issuing an intimation under Section 143(1) is

👉 Within 9 months from the end of the financial year in which the return is filed.

For example:

If you filed your return in FY 2024–25,

The intimation may be issued up to December 2026.

This is why it is important to regularly check your income tax portal.

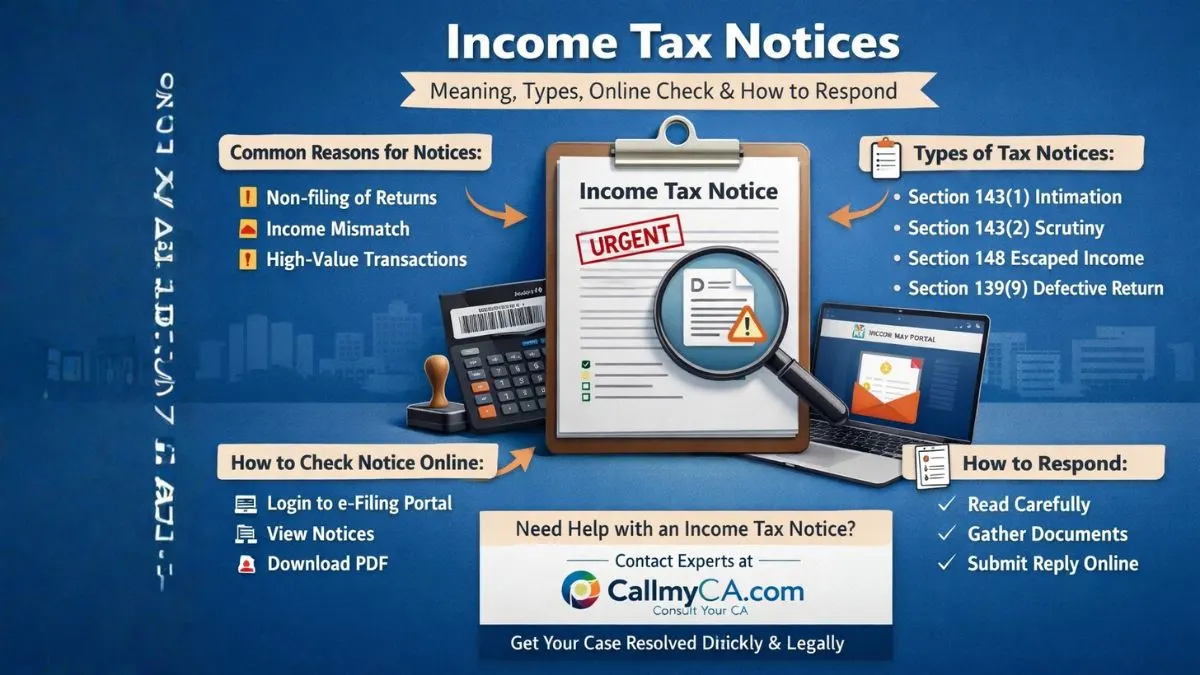

Common Reasons for Income Tax Demand Under Section 143(1)

Let us look at the most common reasons why people receive a demand notice.

1. Mismatch With Form 26AS or AIS

If the tax deducted at source (TDS) shown in your return does not match Form 26AS or AIS, the system may calculate extra tax.

Example:

You claimed ₹50,000 TDS

The system shows ₹45,000

➡ Demand for ₹5,000

2. Incorrect Tax Calculation

Many people make small calculation mistakes while filing returns manually.

Wrong slab

Wrong surcharge

Wrong cuss

These errors can create demand.

3. Wrong Deductions Claimed

If you claim deductions that are not supported by records, the system may disallow them.

Example:

-

Incorrect 80C claim

-

Invalid 80D amount

-

Wrong HRA exemption

4. Interest Under Sections 234A, 234B, 234C

If you paid advance tax late or filed your return late, interest may be added.

This interest often creates small demands.

5. Income Not Reported Properly

If interest income, capital gains, or other income is missing, the system may add it and raise demand.

Types of Intimation Under Section 143(1)

There are three possible outcomes:

1. No Demand, No Refund

Your return matches the department’s records.

No action is required.

2. Refund Intimation

You paid extra tax.

The refund will be credited to your bank account.

3. Demand Intimation

You need to pay additional tax.

You must either accept or dispute it.

How to Check Income Tax Intimation u/s 143(1) Online

You can easily check your notice online.

Follow these steps:

-

Visit the Income Tax e-Filing Portal

-

Log in using your PAN and password

-

Go to “e-Proceedings” or “Pending Actions.”

-

Click on “Intimation u/s 143(1).”

-

Download the PDF

This is also how you can do the income tax demand notice 143(1) PDF download.

How to Open Intimation u/s 143(1) Password-Protected PDF

Many users face this issue.

The PDF is password protected.

Password format is:

👉 PAN (in lowercase) Date of Birth (DDMMYYYY)

Example:

If PAN = ABCDE1234F

DOB = 15-08-1990

Password = abcde1234f15081990

What to Do If You Receive a Demand Under Section 143(1)

Now comes the most important part.

If you receive a demand, you have two options.

Option 1: Accept the Demand

If the demand is correct, you should pay it.

Steps:

-

Log in to the portal.

-

Go to “Pending Actions.”

-

Select “Response to Outstanding Demand.”

-

Choose “Agree with Demand.”

-

Pay using net banking/UPI/card

After payment, keep the receipt safely.

Option 2: Disagree With the Demand

If you believe the demand is wrong, you can dispute it.

Common reasons to disagree:

-

TDS already paid

-

Wrong calculation

-

Income wrongly added

-

Duplicate demand

Steps:

-

Log in to the portal.

-

Go to “Response to Outstanding Demand.”

-

Select “Disagree.”

-

Choose a reason.

-

Upload proof

-

Submit response

Supporting documents are very important here.

Documents Required to Respond to Demand

You may need:

-

Form 16

-

Form 26AS

-

AIS/TIS report

-

Bank statements

-

Tax payment challans

-

Salary slips

-

Investment proofs

Well-organized documents make your response strong.

Difference Between Section 143(1) and 143(1) (a)

Many taxpayers get confused here.

Section 143(1)

It is the final intimation after processing.

Section 143(1)(a)

It is a preliminary adjustment notice.

It is sent before final processing, giving you a chance to respond.

If you reply properly, adjustments may be corrected.

What If You Do Not Respond to 143(1) Demand?

Ignoring a demand is risky.

It may lead to:

-

Recovery proceedings

-

Adjustment against future refunds

-

Penalties

-

Interest

-

Legal notices

Even small demands should not be ignored.

Connection Between TDS Rate Chart 2025–26 and Demand Notices

Many demands arise because of incorrect TDS rates.

If your employer or payer deducted tax using wrong rates as per the TDS rate chart 2025–26, a mismatch occurs.

Always verify:

-

Salary TDS

-

Bank TDS

-

Professional income TDS

before filing returns.

Common Mistakes Taxpayers Make

From experience, these are very common:

❌ Not checking Form 26AS

❌ Ignoring AIS

❌ Filing in hurry

❌ Missing interest income

❌ Not verifying calculations

❌ Ignoring notices

Avoiding these saves time and money.

How to Avoid Section 143(1) Notices in Future

Follow these best practices:

✅ File returns on time

✅ Match ITR with AIS and 26AS

✅ Verify TDS

✅ Declare all income

✅ Keep documents

✅ Review before submission

These habits reduce notice risk.

Final Words

Let me leave you with this.

A Section 143(1) demand notice is usually not a serious problem.

It is a calculation-based intimation.

If you understand it and respond properly, it gets resolved smoothly.

Most issues arise only when people ignore or delay.

So stay calm.

Stay organized.

Respond on time.

And if you ever feel confused while dealing with an income tax demand notice…

👉 Visit Callmyca.com today and get expert help for handling Section 143(1) notices, refunds, demands, and compliance—before small errors turn into big problems.