Income Tax Notices for Salaried Employees: Don’t Panic, Let Me Guide You Step by Step

Let me start with a simple truth.

If you are a salaried employee and you have received an income tax notice, you are not alone.

Every year, lakhs of working professionals—engineers, teachers, managers, IT employees, doctors, and bankers—get notices from the Income Tax Department. And most of them panic for no real reason.

I get calls like this almost every week:

“Sir, I am just a salaried employee. Then why did I receive an income tax notice?”

And my answer is always the same:

Relax.

First understand.

Then respond properly.

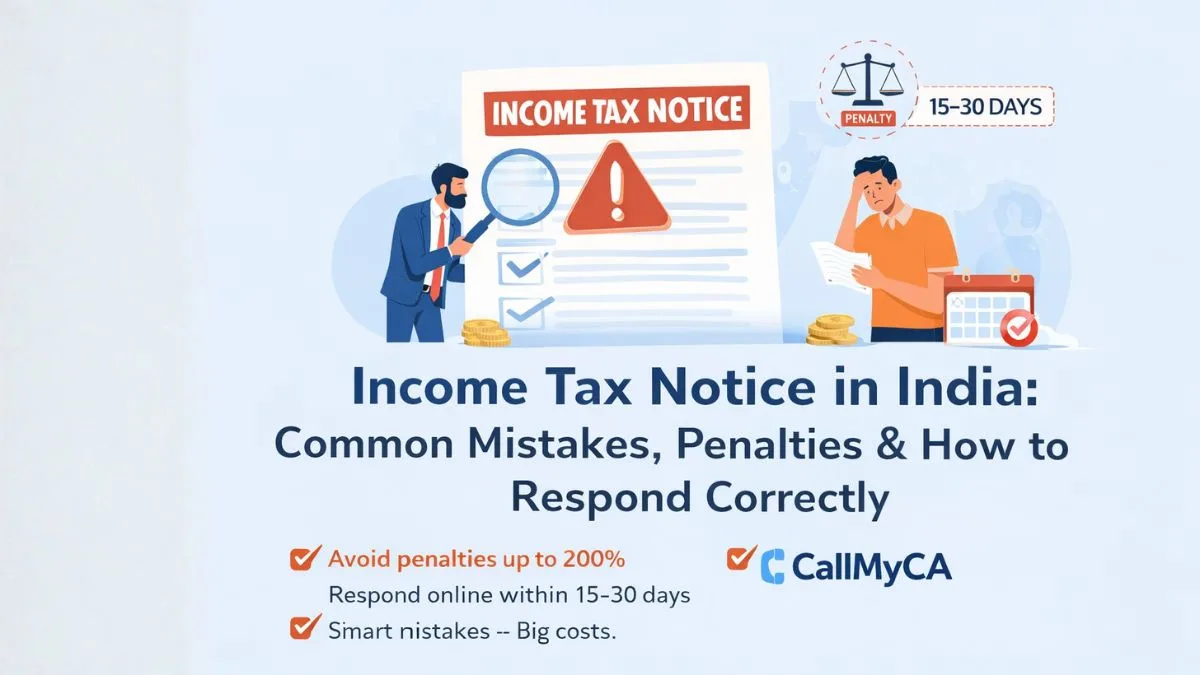

What Are Income Tax Notices for Salaried Employees?

An income tax notice is an official communication sent by the Income Tax Department when something in your Income Tax Return (ITR) does not match their records.

For salaried individuals, this usually happens because of:

-

Mismatch between Form 16 and ITR

-

Difference in Form 26AS and AIS

-

Missing interest income

-

Wrong deductions

-

Technical errors

It does NOT mean you have committed fraud.

Most of the time, it means:

“Please explain this difference.”

That’s all.

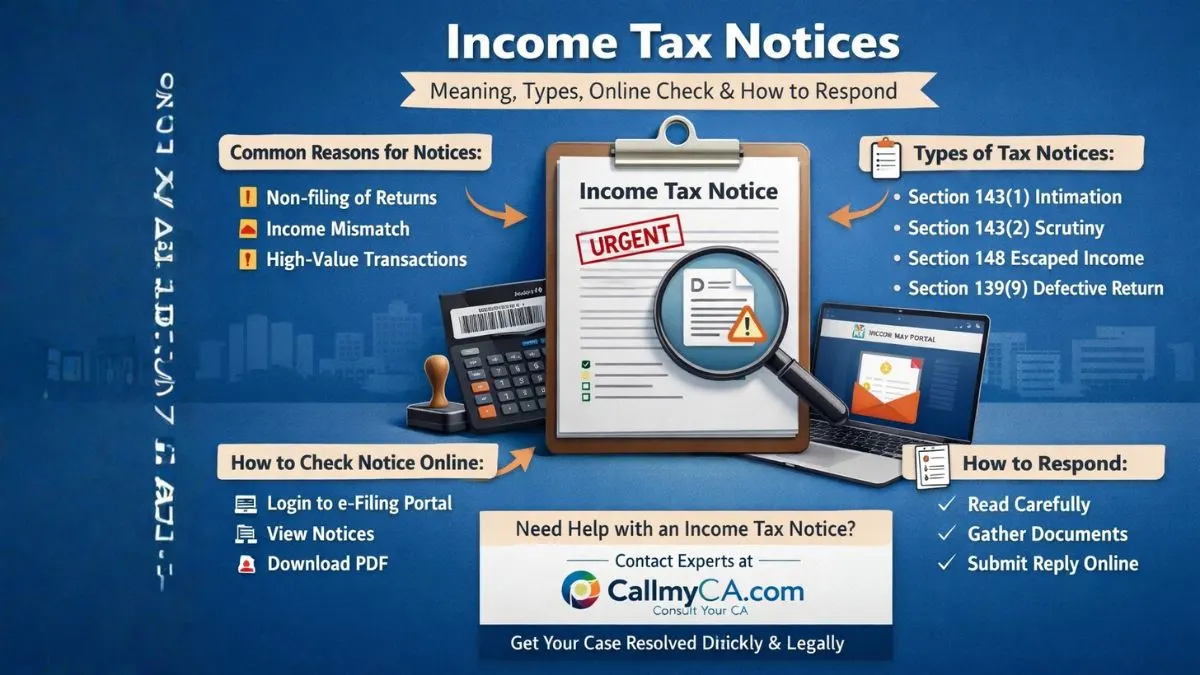

Why Do Salaried Employees Get Income Tax Notices?

Let me share the most common real-life reasons.

1. Mismatch Between Form 26AS and ITR

This is the biggest reason.

Your employer, bank, and mutual fund companies report your income to the department.

If your ITR shows ₹8 lakh

But Form 26AS shows ₹9 lakh

➡️ Notice comes.

2. Interest Income Not Declared

Many salaried employees forget to declare:

-

Savings account interest

-

Fixed deposit interest

-

Recurring deposit interest

Banks report this.

If you don’t show it → Notice.

3. Wrong Deductions and Exemptions

Claiming deductions without proper proof is risky.

Common mistakes:

-

Fake 80C investments

-

Wrong HRA claim

-

Incorrect medical insurance deduction

This attracts attention.

4. High-Value Transactions

Examples:

-

Buying property

-

Big mutual fund investment

-

Heavy credit card usage

-

Large cash deposit

If not explained properly, you may receive notices to salaried employees.

5. Defective Returns

Sometimes your return is incomplete.

Missing schedules.

Wrong ITR form.

Calculation error.

Then you get a defective return notice.

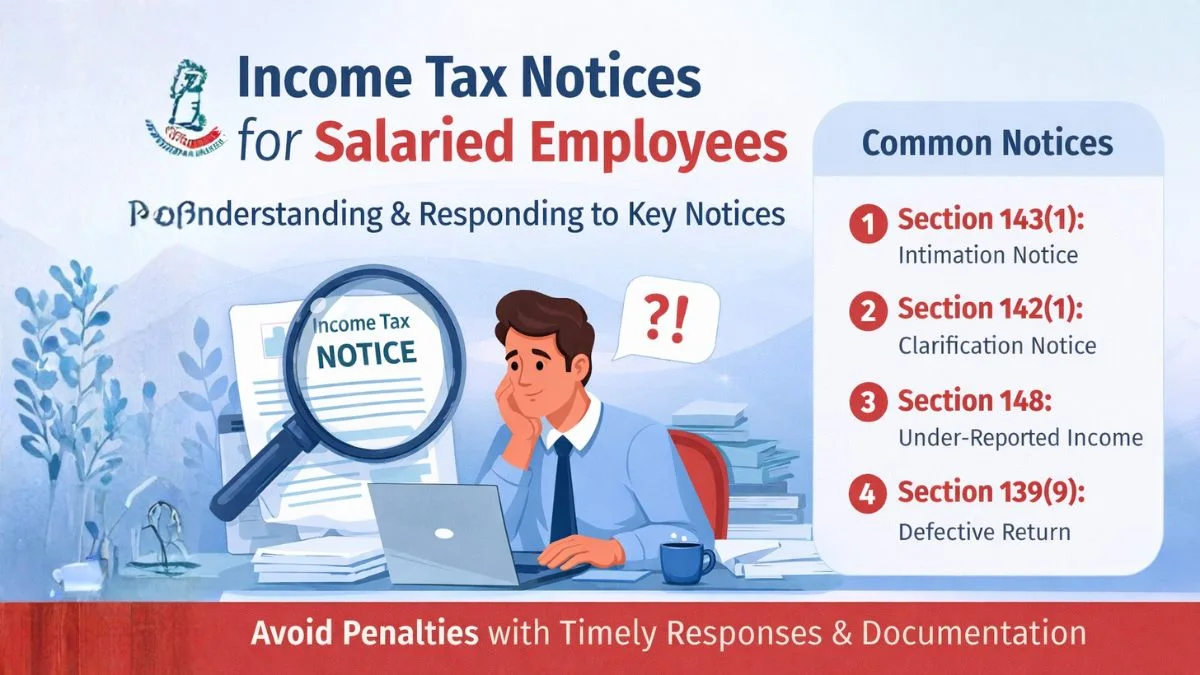

Common Income Tax Notices for Salaried Employees

Now let’s understand the main notices that salaried individuals usually receive.

Section 143(1) – Intimation Notice

This is the most common notice.

Almost every employee gets it.

It tells you:

-

Your return is processed

-

Refund amount

-

Extra tax payable

-

Minor adjustments

If everything matches, no action is needed.

If difference → Check and respond.

Section 142(1) – Clarification Notice

This means the department wants more information.

They may ask for:

-

Salary slips

-

Bank statements

-

Investment proof

-

Rent receipts

Just upload documents properly.

No need to panic.

Section 148 – Under-Reported Income

This is serious.

It means some income was not disclosed.

Usually related to:

-

Interest income

-

Rent income

-

Property sale

-

Foreign income

Here, you may have to file a revised return.

Professional help is recommended.

Section 139(9) – Defective Return

This is issued when your return is incomplete.

Examples:

-

Missing information

-

Wrong form

-

Incorrect tax calculation

You usually get time to correct it.

If you fix it, the matter is closed.

How to Check Income Tax Notice Online (Login Process)

Many people don’t know this.

You can easily check your notice online.

Steps:

-

Visit Income Tax Portal

-

Do income tax notice login

-

Go to “Pending Actions.”

-

Click “e-Proceedings.”

-

Download notice PDF

You can also do an income tax notice PDF download from here.

Always check from the official portal only.

Income Tax Notice by Post: Should You Worry?

Yes, sometimes salaried employees receive notice letters by post.

Don’t ignore them.

They are legally valid.

Always verify online and respond.

How to Respond to Income Tax Notices (Step-by-Step Guide)

Now listen carefully.

This part can save you money and stress.

Step 1: Read the Notice Calmly

Don’t panic.

Check:

-

Section number

-

Reason

-

Deadline

-

Documents needed

Understand first.

Step 2: Collect Supporting Documents

Keep ready:

-

Form 16

-

Salary slips

-

Bank statements

-

Investment proof

-

Rent receipts

Good documents = Strong reply.

Step 3: Verify AIS and TIS Data

Before replying, check:

-

Annual Information Statement (AIS)

-

Taxpayer Information Summary (TIS)

Match with your return.

Correct if needed.

Step 4: Reply Online

Upload:

-

Explanation

-

Documents

-

Correct format

Avoid sending half information.

Step 5: Consult a Professional (If Required)

For scrutiny and Section 148 cases, don’t take risks.

A small mistake can become expensive.

What Happens If You Don’t Respond?

Let me be honest.

Ignoring notices is dangerous.

It can lead to:

-

Penalties

-

Interest

-

Best judgment assessment

-

Legal trouble

Even if the notice is wrong, reply.

Silence is never safe.

Income Tax Slab and Notices: Is There Any Connection?

Many employees ask:

“Sir, slab change hone se notice aata hai kya?”

Directly no.

But if you calculate tax wrongly as per slab, then yes, a notice may come.

Always apply the correct slab and regime.

Income Tax Section for Salaried Employees You Must Know

Some important sections:

-

Section 80C – Investments

-

Section 80D – Medical insurance

-

Section 24 – Home loan interest

-

Section 10(13A) – HRA

-

Section 16 – Standard deduction

Using these properly reduces tax and avoids notices.

Salaried Employees' Income Tax Exemption: Use It Smartly

Many employees don’t use exemptions fully.

Examples:

-

HRA

-

LTA

-

Food coupons

-

Telephone allowance

If claimed wrongly → Notice.

If claimed properly → Savings Peace.

Common Mistakes Salaried Employees Make

From my experience, people make these mistakes:

❌ Forget interest income

❌ Claim fake deductions

❌ Ignore AIS data

❌ File in hurry

❌ Miss deadlines

Please avoid these.

How to Avoid Income Tax Notices in Future

Follow these habits:

✅ File on time

✅ Declare all income

✅ Match Form 26AS

✅ Check AIS/TIS

✅ Keep records

✅ Avoid cash deals

Simple habits = Stress-free life 😄

Meta Title (SEO Optimised)

Income Tax Notices for Salaried Employees: Types & Reply Guide

URL Slug (SEO Friendly)

/income-tax-notices-salaried-employees-guide

Meta Description (SEO Keywords | 50–80 Words)

Income tax notices for salaried employees are issued due to mismatched income, wrong deductions, defective returns, or under-reported income under sections like 143(1), 142(1), and 148. This guide explains how to check income tax notice online, do income tax notice login, download notice PDF, understand notice letters, income tax slab, exemptions, and sections for salaried employees, and respond correctly to avoid penalties.

Final Words

Let me tell you honestly.

If you are a salaried employee and you received an income tax notice, it does not mean trouble.

It means:

“Please clarify.”

If you reply properly, nothing bad happens.

Most problems happen only when people panic or ignore.

So relax.

Be honest.

Be timely.

And if you ever feel confused while replying to a notice…

👉 Don’t struggle alone. Visit Callmyca.com today and get expert support for handling income tax notices, replies, exemptions, and compliance—before small mistakes turn into big losses.