Income Tax Notice in India: Meaning, Types, Reasons, Verification Process & How to Respond

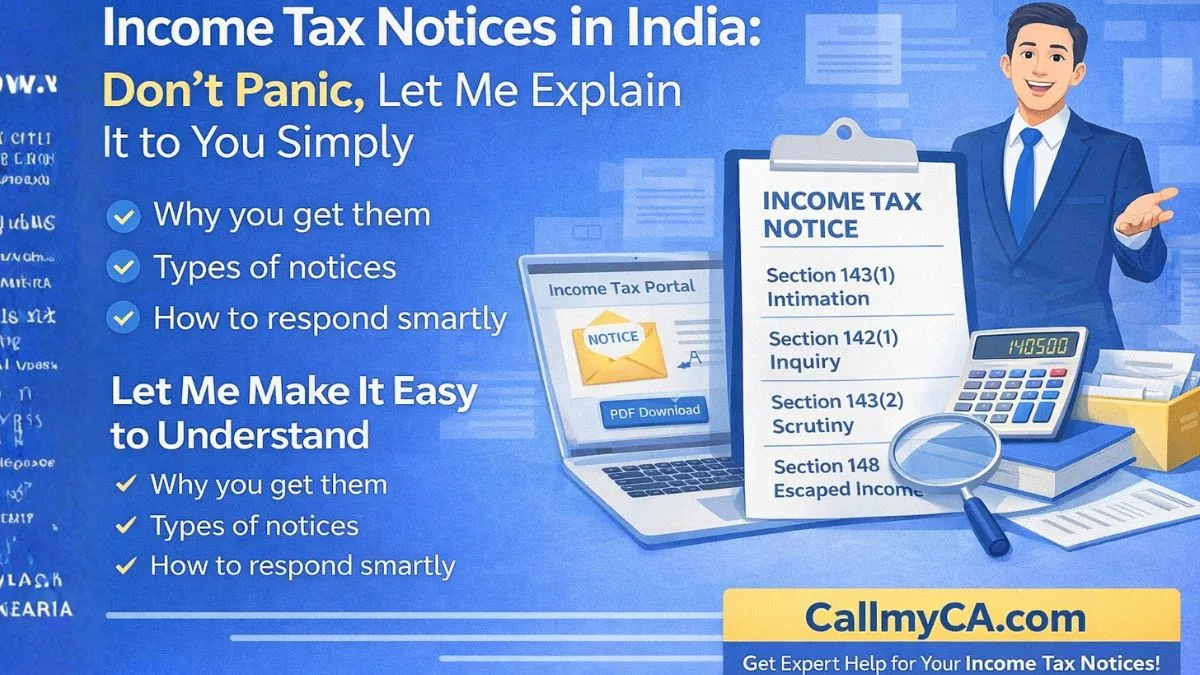

If you have ever received an income tax notice in India, you know how stressful it can feel.

One message from the Income Tax Department, and suddenly your mind is full of worries:

“Did I make a mistake?”

“Will I have to pay extra tax?”

“Will I get into legal trouble?”

“Do I need a CA immediately?”

This reaction is completely normal.

But here’s the truth most people don’t know:

👉 Most income tax notices are routine.

👉 Many are sent automatically by the system.

👉 A large number can be resolved easily.

You don’t need to panic. You need information.

What Is an Income Tax Notice?

An Income Tax Notice is an official communication from the Income Tax Department about your Income Tax Return (ITR).

It is sent when the department feels that:

-

Some information is missing

-

Some numbers don’t match

-

Some income is not clear

-

Some deductions look incorrect

-

Some documents are required

In simple terms, the department is saying:

“Please explain this part of your return.”

That’s it.

It is not an accusation. It is a question.

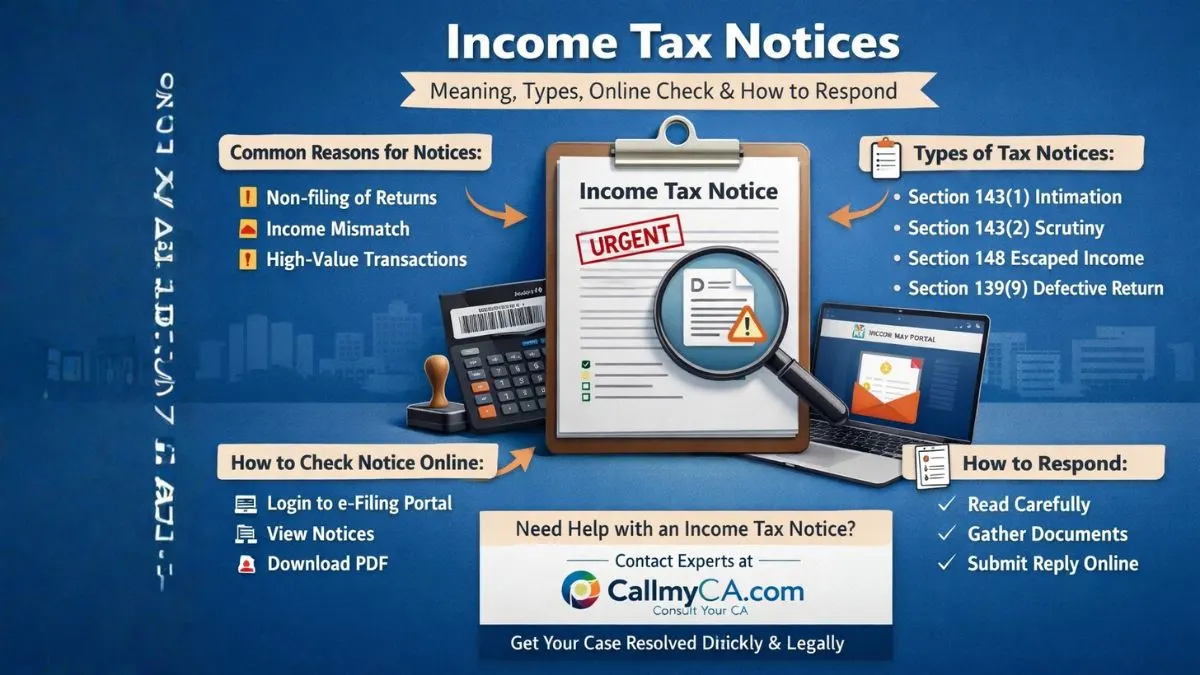

Why Do Taxpayers Receive Income Tax Notices?

Let’s look at the most common real-life reasons.

1. Income Does Not Match Records

Your salary, interest, or capital gains may not match Form 26AS, AIS, or TIS.

This is the biggest reason.

2. Late or Missing Return

If you file late or forget to file, the system automatically flags it.

3. High Deductions Without Proof

Claiming 80C, 80D, or HRA without proper documents attracts notices.

4. Large Financial Transactions

Buying property, depositing big cash, or sending money abroad can raise questions.

5. TDS Problems

Sometimes your employer or bank makes mistakes in TDS reporting.

You suffer for it.

6. Old Pending Issues

If you had problems in previous years, they may come back.

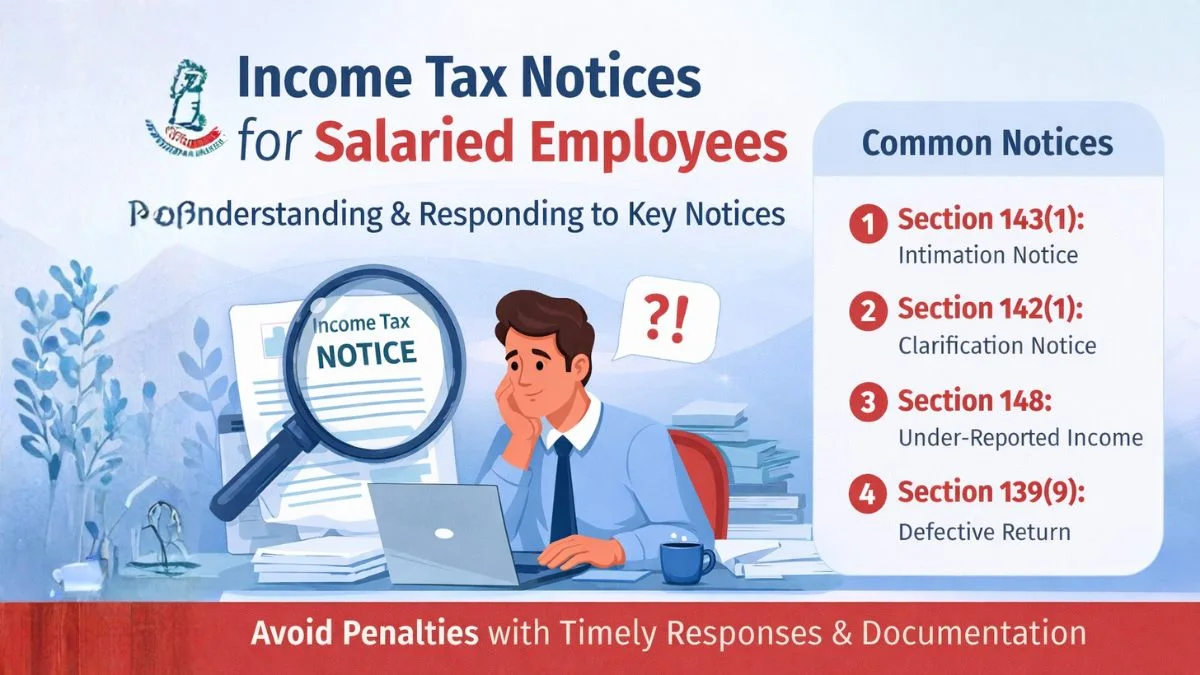

📌 Types of Income Tax Notices in India

The section number written on your notice is very important.

It tells you how serious the notice is.

✅ Section 143(1) – Intimation

This is the most common notice.

And usually the least dangerous.

What It Means

After you file your return, the department processes it.

Then they send you an “intimation” showing:

-

Refund amount

-

Tax payable

-

Minor corrections

-

Calculation changes

Do You Need to Worry?

Mostly, no.

If everything matches, just keep it for records.

Reply only if you disagree.

Section 143(2) – Scrutiny Notice

This is more serious.

What It Means

Your return is selected for detailed checking.

The department wants proof for:

-

Your income

-

Your investments

-

Your expenses

-

Your deductions

What You Should Do

Collect documents and reply properly.

Ignoring this is a big mistake.

Section 142(1) – Inquiry Before Assessment

This is an information-seeking notice.

What It Means

The officer wants more details before finalizing your case.

They may ask for:

-

Bank statements

-

Books of accounts

-

Income details

-

Pending returns

Important

If you ignore this, you may face a penalty.

Always respond.

Section 148 – Income Escaping Assessment

This is a serious notice.

What It Means

The department believes you did not report some income earlier.

So, they reopen old cases.

Example

You forgot to report capital gains or foreign income.

What to Do

Don’t handle this alone.

Consult a CA.

Section 139(9) – Defective Return

This notice means your return has mistakes.

Examples:

-

Wrong ITR form

-

Missing balance sheet

-

Incomplete data

You get time to fix it.

Do it quickly.

Other Important Income Tax Notices

🔹 Section 156 – Demand Notice

You have to pay tax.

🔹 Section 245 – Refund Adjustment

Your refund is used to clear old dues.

What Is a Document Identification Number (DIN)?

Every genuine notice has a Document Identification Number (DIN).

Think of it like a tracking number.

It proves the notice is real.

If there is no DIN, be careful.

Always verify.

How to Verify an Income Tax Notice

Never trust WhatsApp forwards or random emails.

Always check officially.

✅ Through e-Filing Portal

-

Visit incometax.gov.in

-

Login with PAN

-

Go to Pending Actions

-

Open e-Proceedings

-

Check notices

✅ Through DIN Verification

Use the “Verify DIN” option.

Only genuine notices appear there.

How to Respond to an Income Tax Notice Online

Here is the simple process.

No technical headache.

Step 1: Login

Log in on incometax.gov.in.

Step 2: Open e-Proceedings

Go to Pending Actions → e-Proceedings.

Step 3: Select Your Notice

Click on the notice.

Step 4: Collect Documents

Prepare:

-

Form 16

-

Bank statements

-

Investment proofs

-

Bills

-

Receipts

Step 5: Upload & Explain

Upload documents.

Write clearly.

No emotional language.

Only facts.

Step 6: Submit

Submit and save confirmation.

Step 7: Monitor

Check status regularly.

Practical Tips from Experience

✔ Don’t delay

✔ Don’t panic

✔ Don’t hide facts

✔ Don’t submit wrong papers

✔ Keep copies

✔ Stay calm

✔ Take help if confused

Many problems happen only because people delay.

What Happens If You Ignore a Notice?

Ignoring notices is dangerous.

You may face:

-

Penalties

-

Interest

-

Forced tax assessment

-

Legal issues

-

Bank attachment

All because of inaction.

Never do this.

When Should You Hire a Chartered Accountant?

You should consult a CA if:

-

You get Section 148 notice

-

There is heavy tax demand

-

Scrutiny case

-

Business income involved

-

Foreign income involved

Professional help saves money in the long run.

Frequently Asked Questions

Is every income tax notice bad?

No. Many are routine.

Can I reply to myself?

Yes, if it’s simple.

How much time is given?

Usually 15–30 days.

Are fake notices common?

Yes. Always verify DIN.

Missed deadline?

Contact the department or CA immediately.

Final Thoughts

Receiving an income tax notice in India does not mean you are in trouble.

Most notices are simply part of the system.

If you:

✔ Read properly

✔ Verify authenticity

✔ Respond on time

✔ Submit correct documents

You will be fine.

Tax compliance is not about fear.

It is about awareness.

And now, you have it.

If you are confused about an income tax notice or need expert help in replying correctly, visit callmyca.com and connect with experienced chartered accountants who can guide you step by step.