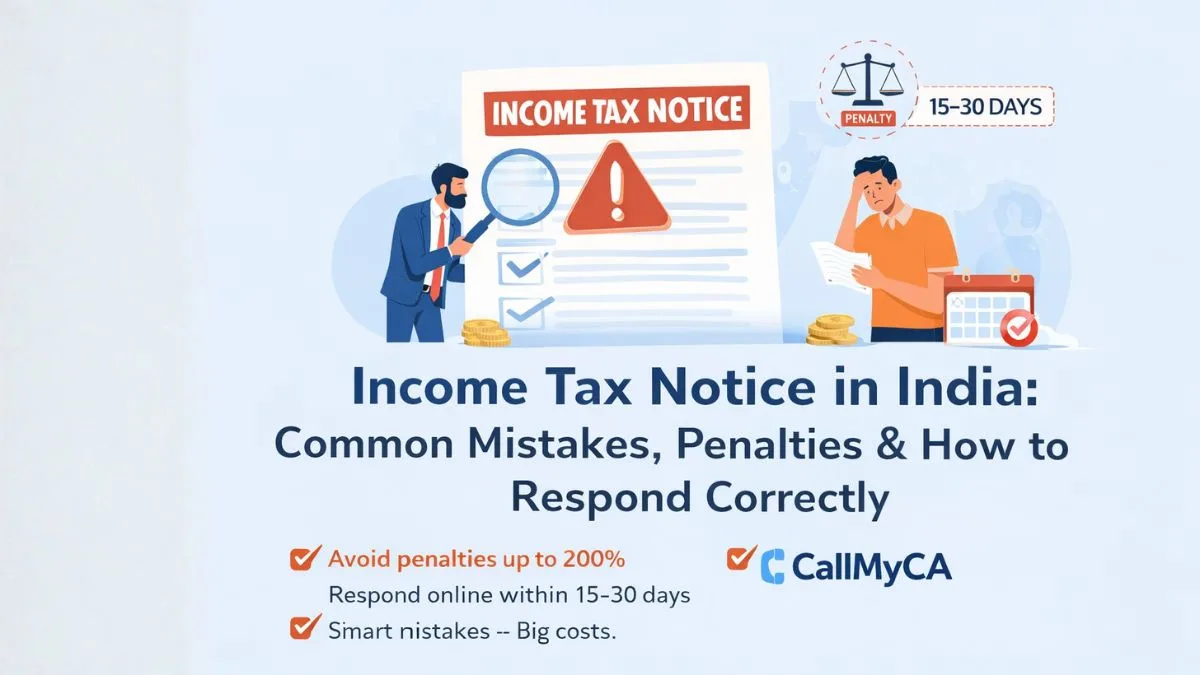

Income Tax Notice in India: Common Mistakes, Penalties & How to Respond Correctly

The moment you see the words "income tax notice" in India, your mood changes.

Your heart skips.

Your mind starts racing.

You think, “What did I do wrong now?”

Most people immediately imagine heavy fines, court cases, or long government visits.

But in reality, most tax notices are far less scary than they look.

An income tax notice in India is an official communication regarding discrepancies, missed filings, or required clarifications on your Income Tax Department records.

In simple words, the department just wants an explanation.

If you understand what it means and reply accurately with the correct response, things usually end peacefully.

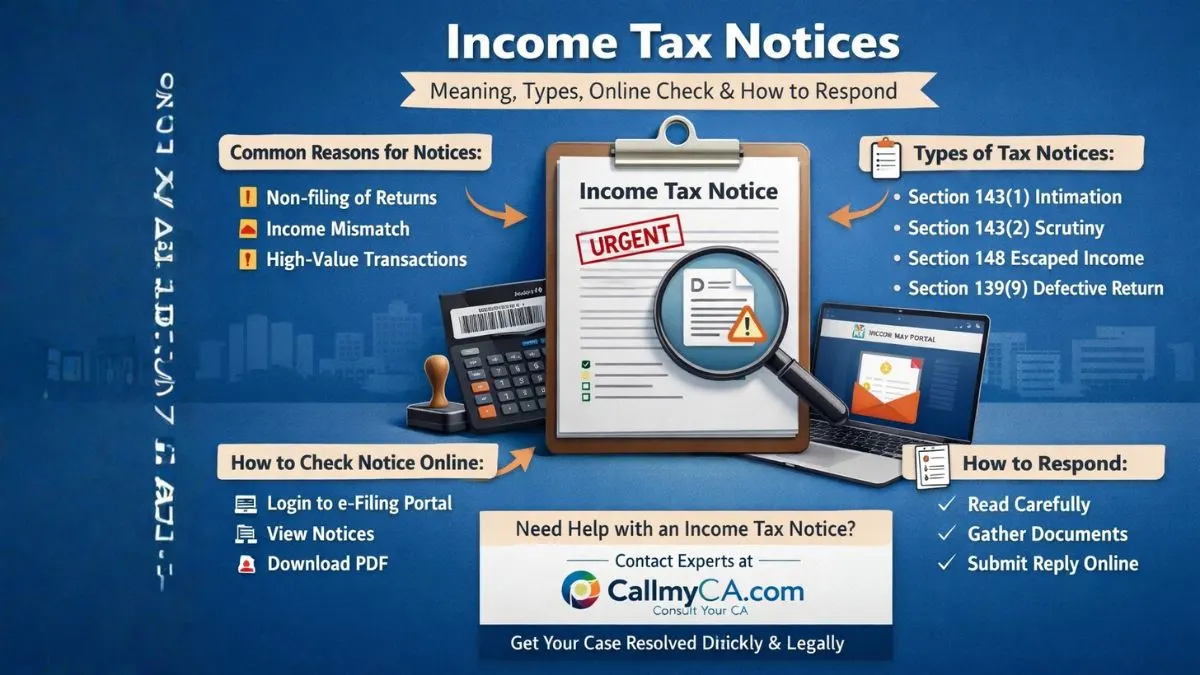

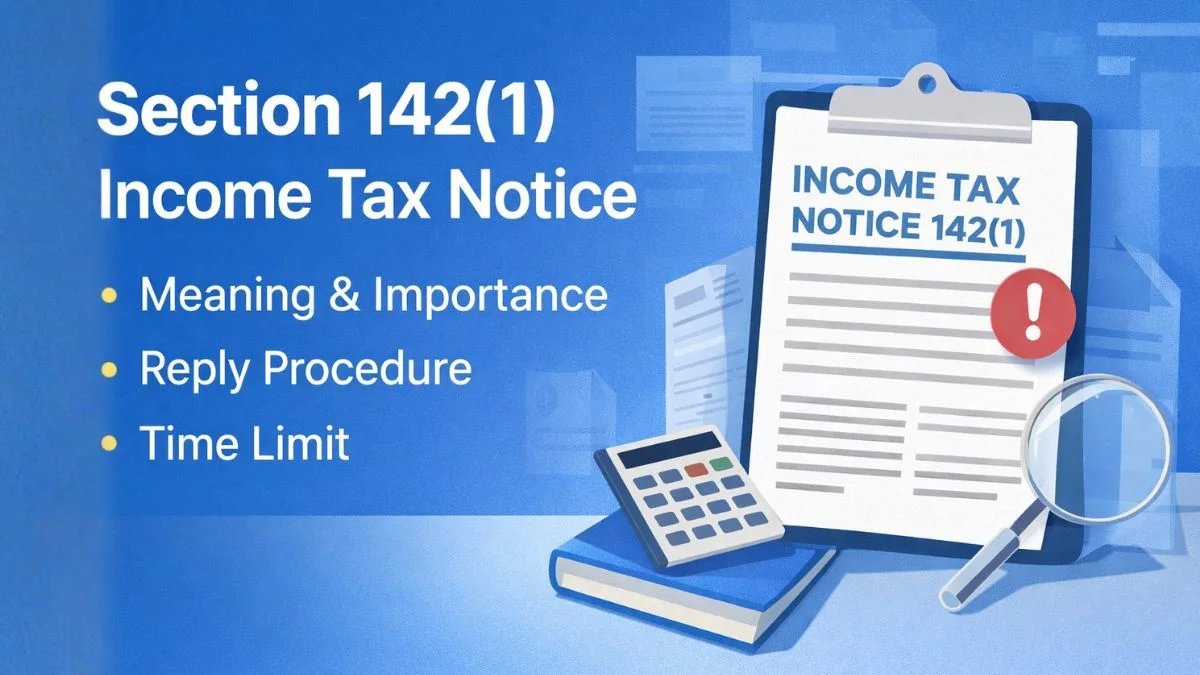

What Is an Income Tax Notice?

Here’s something nobody tells you.

The tax department today is mostly run by computers.

These systems compare your income tax return with:

-

Bank data

-

Employer records

-

Investment reports

-

AIS and Form 26AS

If anything doesn’t match, a notice is automatically generated.

It doesn’t mean you cheated.

It usually means, “Please explain.”

So if you’re asking yourself, “Why did I receive an income tax notice?”, the answer is usually data mismatch or missing information.

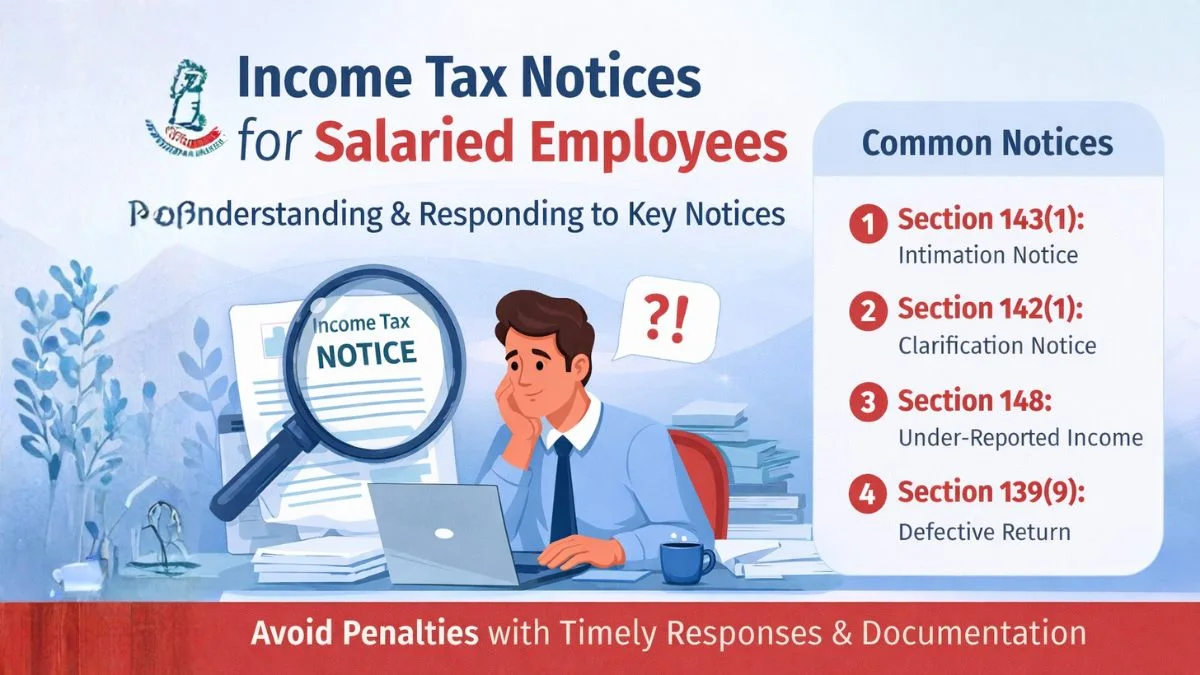

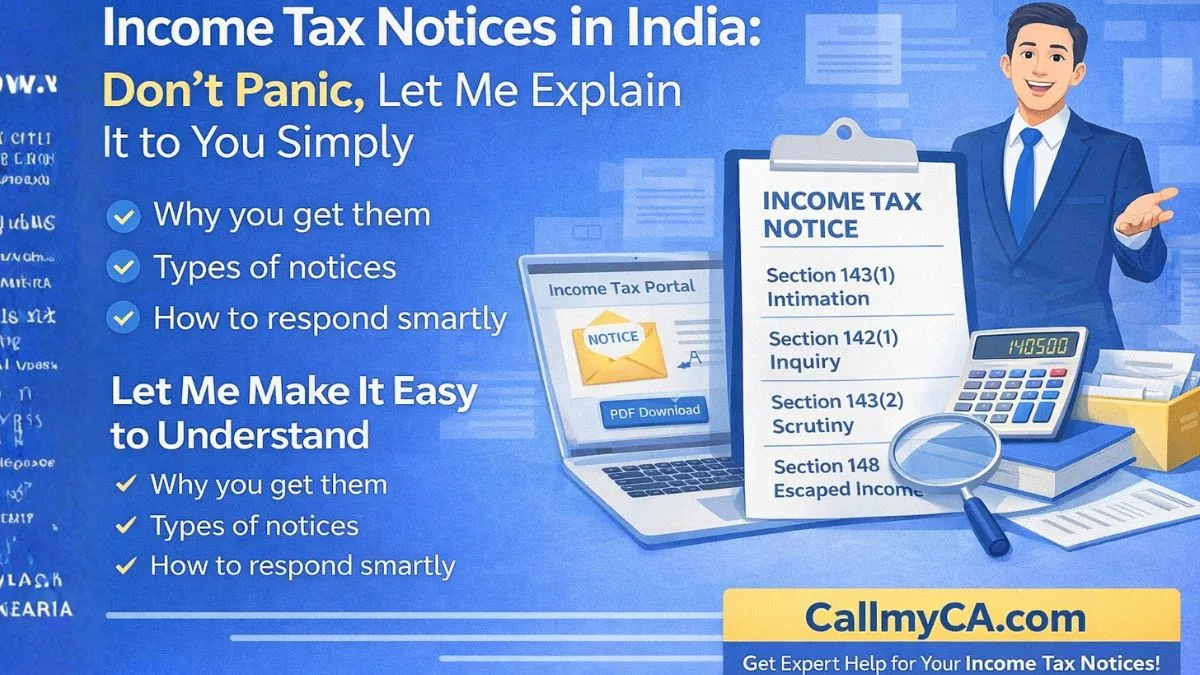

Common Types of Income Tax Notices

Knowing the common types of income tax notices helps you stay calm instead of panicking.

Section 143(1) – Intimation

Basic processing update.

Section 139(9) – Defective Return

Missing or incorrect details.

Section 143(2) – Scrutiny

Detailed checking.

Section 148 – Reassessment

Past income issues.

Section 156 – Demand

Pending tax dues.

Common Mistakes Leading to Income Tax Notices

Most notices happen because of simple mistakes.

Here are the biggest common mistakes. Leading to Income Tax Notices:

❌ Not Checking AIS/26AS

Mismatch = Notice.

❌ Missing Small Income

Even ₹500 matters.

❌ Wrong Deductions

No proof = penalties.

❌ Last-Minute Filing

Rushing causes errors.

❌ Ignoring Old Notices

Silence worsens cases.

Why Filing Accurately Matters

Filing accurately is your biggest protection.

An accurate return means:

-

Correct figures

-

Matching data

-

Proper proofs

-

Right bank details

One careful filing saves years of stress.

What Happens If You Ignore a Notice?

Ignoring notices leads to serious penalties and consequences.

1. Penalties

Up to 200% of tax due.

2. Interest

Keeps increasing.

3. Ex-Parte Orders

Decision without you.

4. Prosecution

In extreme cases.

Ignoring a notice never helps.

How to Give the Correct Response

Your response decides everything.

Follow these steps for a correct response.

✅ Step 1: Verify Authenticity

Check DIN.

✅ Step 2: Read Carefully

Understand the issue.

✅ Step 3: Collect Proof

Form 16, bank statements, etc.

✅ Step 4: Prepare Your Response

Make it factual and supported.

✅ Step 5: Submit Online

Within 15–30 days.

✅ Step 6: Track Status

Check “Pending Actions.”

Penalties and Consequences

Let’s clearly understand penalties and consequences:

| Issue | Result |

|---|---|

| Late Filing | ₹5,000 |

| Underreporting | 50% Tax |

| Misreporting | 200% Tax |

| Interest | Monthly |

| Legal Action | Possible |

Small mistakes = Big costs.

Why Professional Help Matters

Handling complex cases alone is risky.

People often:

-

Admit wrongly

-

Upload wrong forms

-

Miss legal points

A CA helps you avoid unnecessary penalties.

Best Practices to Stay Safe

Follow these habits:

✔ File early

✔ Match AIS/26AS

✔ Keep records

✔ Review carefully

✔ Respond on time

✔ Use correct forms

These reduce notices drastically.

Final Thoughts

Getting an income tax notice in India feels scary.

But most notices are just requests for clarification.

If you:

-

File your income tax return properly

-

Maintain documents

-

Reply accurately

-

Give a correct response

-

Respect deadlines

You’ll be fine.

No panic.

No drama.

No unnecessary penalties.

Just smart compliance.

If you’ve received an income tax notice and feel confused about how to respond, don’t take unnecessary risks.

Get expert guidance, proper documentation support, and a stress-free resolution with professional help.

👉 Visit CallMyCA.com today and let experienced tax professionals handle your case the right way.