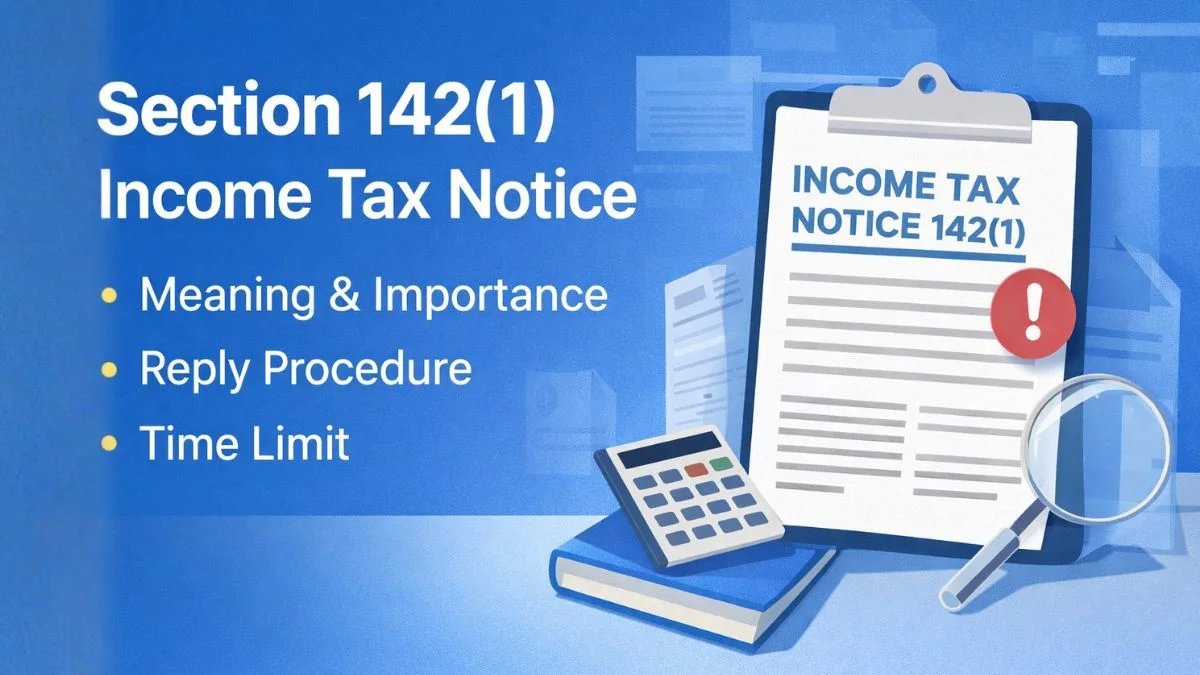

Section 142(1) Income Tax Notice: What It Really Means and How You Should Respond

Summary.

A Section 142(1) income tax notice is an official inquiry issued by the assessing officer for filing a return, producing books of accounts, and submitting income details. This blog explains income tax notice section 142(1), the notice tax process, reply to notice under section 142(1), time limit, documents required, and how to respond correctly to avoid penalties, scrutiny, and unnecessary stress.

The moment you see the words “income tax notice” in your inbox or on the portal, your heart skips a beat.

Questions start running in your mind:

“Did I do something wrong?”

“Will I have to pay extra tax?”

“Is there a penalty coming?”

“Do I need a lawyer now?”

If you have received a Section 142(1) income tax notice, relax. Take a deep breath.

In most cases, this notice is not a punishment. It is simply a way for the Income Tax Department to verify your details before finalizing your assessment.

What Is Section 142(1) Income Tax Notice?

A Section 142(1) income tax notice is an inquiry notice sent by the Assessing Officer (AO) before completing your tax assessment.

Through this notice, the department may ask you to:

-

File your return (if not filed)

-

Submit bank statements

-

Provide books of accounts

-

Share investment proofs

-

Explain income sources

-

Clarify mismatches

-

Upload specific documents

In short, this is a verification process.

The department just wants to confirm that the income you declared matches the financial data available with them.

It is more about clarity than punishment.

Why Do You Receive an Income Tax Notice Under Section 142(1)?

Many taxpayers think they receive notices only when they make mistakes. That’s not true.

Here are the most common reasons:

1. You Didn’t File Your Return

If you missed filing your ITR, the AO may send a notice asking you to comply.

2. Data Mismatch

If your return does not match AIS, TIS, Form 26AS, or bank data, clarification is required.

3. High-Value Transactions

Buying property, trading heavily, or sending money abroad can trigger scrutiny.

4. Missing Information

If your return lacks proper details, the department may ask for more.

5. Random Selection

Sometimes, cases are selected randomly for checking.

So remember: receiving a notice does not mean you are guilty.

What Information Is Asked in Section 142(1) Notice?

Every notice is different, but usually it asks for:

-

Salary slips

-

Form 16 / 16A

-

Bank statements

-

Investment proofs

-

Loan papers

-

Business records

-

GST returns

-

Capital gains details

-

Rental income proofs

The notice will clearly mention what you need to submit and by when.

Read it slowly and carefully.

Key Aspects of Section 142(1) Notice

Let’s understand the important features of this notice.

Legal Authority

It is issued under Section 142(1) of the Income Tax Act, so it must be taken seriously.

Mandatory Compliance

Replying is compulsory. Ignoring it can cause trouble.

Fixed Time Limit

You must reply within the deadline mentioned in the notice.

Mostly Online

Today, most notices are sent through the Income Tax Portal.

Before Final Assessment

This notice is issued before your case is closed.

Case-Specific Questions

The questions are based on your financial data.

Knowing these points helps you respond confidently.

Time Limit for Notice Under Section 142(1)

There is no single fixed date for issuing this notice. It depends on your assessment cycle.

However, once you receive it, you usually get 7 to 30 days to reply.

This deadline is important.

Missing it can lead to penalties and complications.

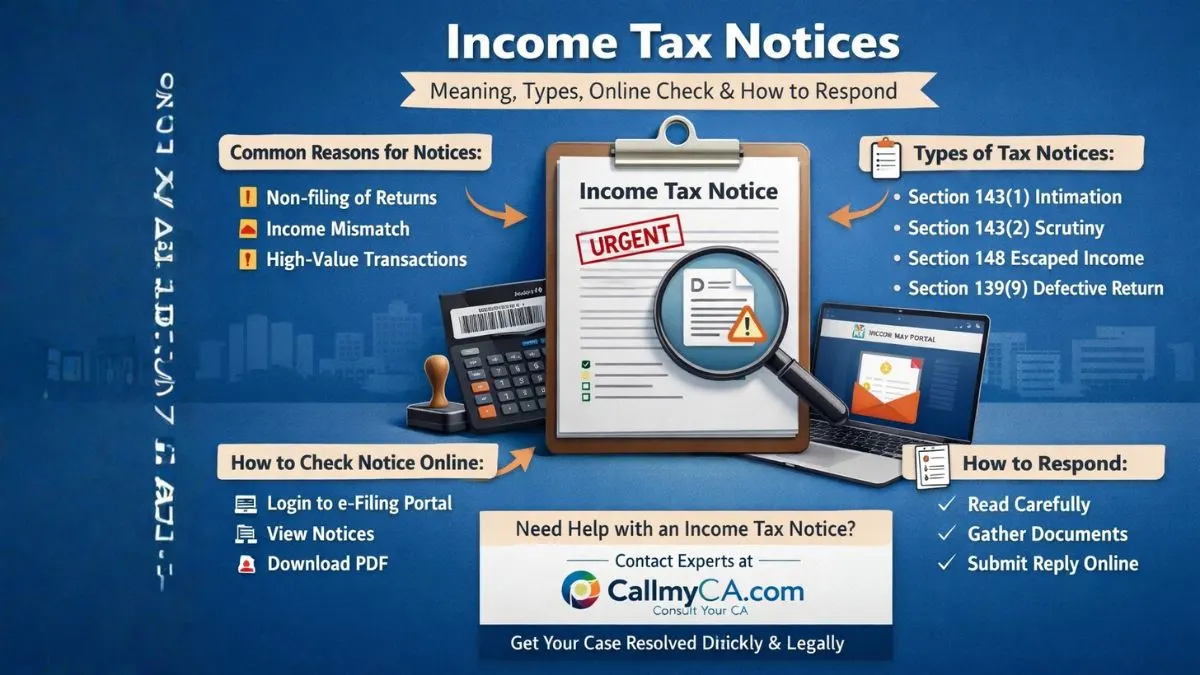

How to Check Section 142(1) Notice Online

You can easily check your notice online:

-

Visit the Income Tax e-Filing portal

-

Log in using PAN and password

-

Go to “e-Proceedings.”

-

Click on “View Notices.”

-

Download the notice

Always keep a copy saved.

How to Respond to Section 142(1) Income Tax Notice

This is the most crucial part.

A proper response can save you stress, money, and time.

Step 1: Read the Notice Properly

Don’t rush. Understand what is being asked.

Step 2: Collect Documents

Arrange all proofs neatly.

Step 3: Cross-Check Data

Match figures with your records.

Step 4: Prepare Explanation

If something doesn’t match, explain it honestly.

Step 5: Upload Response

Submit your reply online.

Step 6: Save Proof

Keep acknowledgement for future use.

Never guess or fake information. It can backfire badly.

Reply to Notice Under Section 142(1): How to Write It Properly

Your reply should always be

-

Polite

-

Clear

-

Professional

-

Supported by documents

-

Error-free

It should include:

-

Notice number

-

PAN

-

Assessment year

-

Explanation

-

Attachments

If you’re confused, take professional help.

It’s better than making mistakes.

What Happens If You Ignore a Section 142(1) Notice?

Ignoring this notice is risky.

You may face:

-

Heavy penalties

-

Best judgment assessment

-

Higher tax demand

-

Further scrutiny

-

Legal action

-

Refund blockage

Many people suffer just because they ignored emails.

Don’t make that mistake.

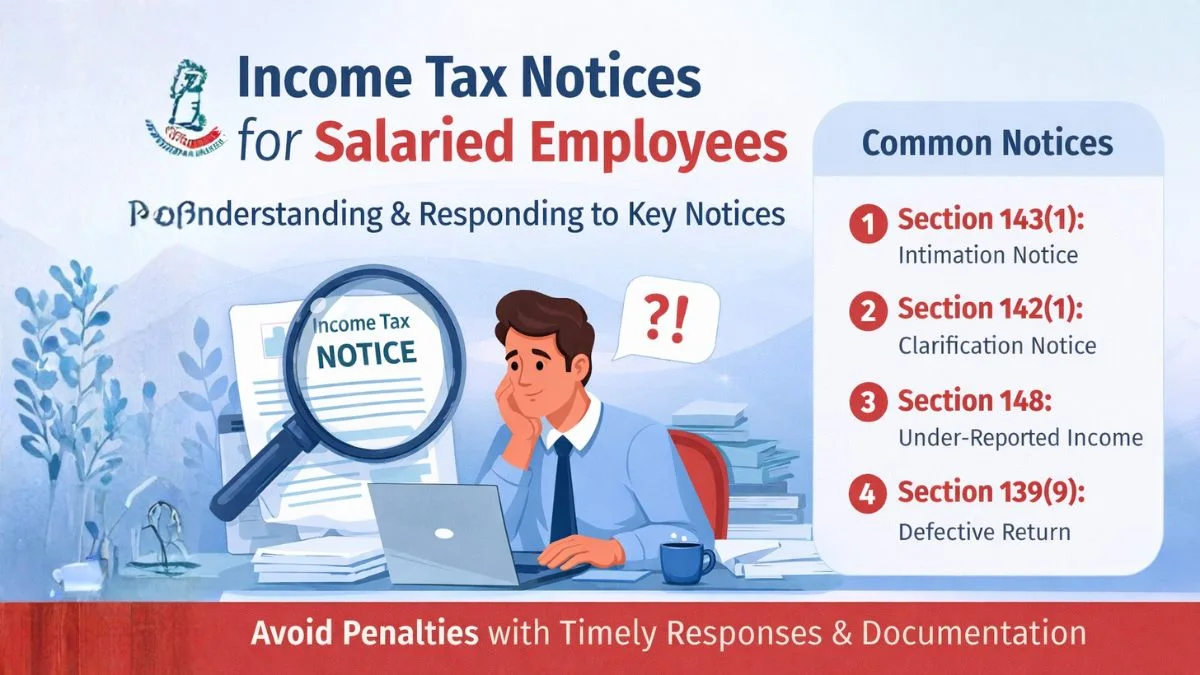

Difference Between Section 142(1) and Other Notices

Here’s a simple comparison:

| Section | Purpose |

|---|---|

| 139(9) | Defective return |

| 142(1 | Inquiry |

| 143(1 | Intimation |

| 143(2 | Scrutiny |

| 148 | Reassessment |

Section 142(1) is mainly about collecting information.

Common Mistakes While Responding

Avoid these:

-

Missing deadline

-

Uploading incomplete files

-

Writing unclear replies

-

Giving wrong figures

-

Ignoring attachments

-

Not taking advice

One small error can delay your case.

Can You Revise Your Return After This Notice?

Yes, sometimes you can revise your return if:

-

Assessment is pending

-

The mistake is genuine

But always consult before doing this.

Section 142(1) Notice for Businesses

For businesses, this notice may require:

-

Profit & Loss account

-

Balance sheet

-

GST returns

-

Invoices

-

Expense records

-

Stock details

Business cases are more detailed, so documentation matters a lot.

How Long Does Assessment Take After Reply?

After you reply, the AO may:

-

Accept it

-

Ask more questions

-

Make additions

The process may take a few months.

Patience is important.

How to Avoid Section 142(1) Notice in Future

Follow these habits:

-

File on time

-

Declare all income

-

Match AIS & 26AS

-

Keep records

-

Avoid cash dealings

-

Maintain digital files

Good compliance means fewer notices.

Why Professional Help Matters

Handling income tax notice section 142(1) alone can be stressful.

Experts can:

-

Study your case

-

Draft replies

-

Handle uploads

-

Communicate with AO

-

Reduce penalties

-

Save time

It’s an investment, not an expense.

FAQs

Is Section 142(1) Notice Serious?

Mostly no. It’s for verification.

Can I Reply Without CA?

Yes, but expert guidance helps.

Is Penalty Guaranteed?

No, only if you don’t comply.

Can the Deadline Be Extended?

Sometimes, on request.

Final Words

A Section 142(1) income tax notice is not something to fear.

It is simply the department saying:

“Please help us understand your financial details better.”

If you reply honestly, submit documents on time, and stay calm, your case will usually close smoothly.

Don’t panic. Be proactive.

That’s the secret.

Need Help With Your Income Tax Notice?

If you have received an income tax notice, section 142(1), and want expert support for replying, documentation, and compliance, the professionals at Callmyca.com can help you resolve it quickly, legally, and stress-free.