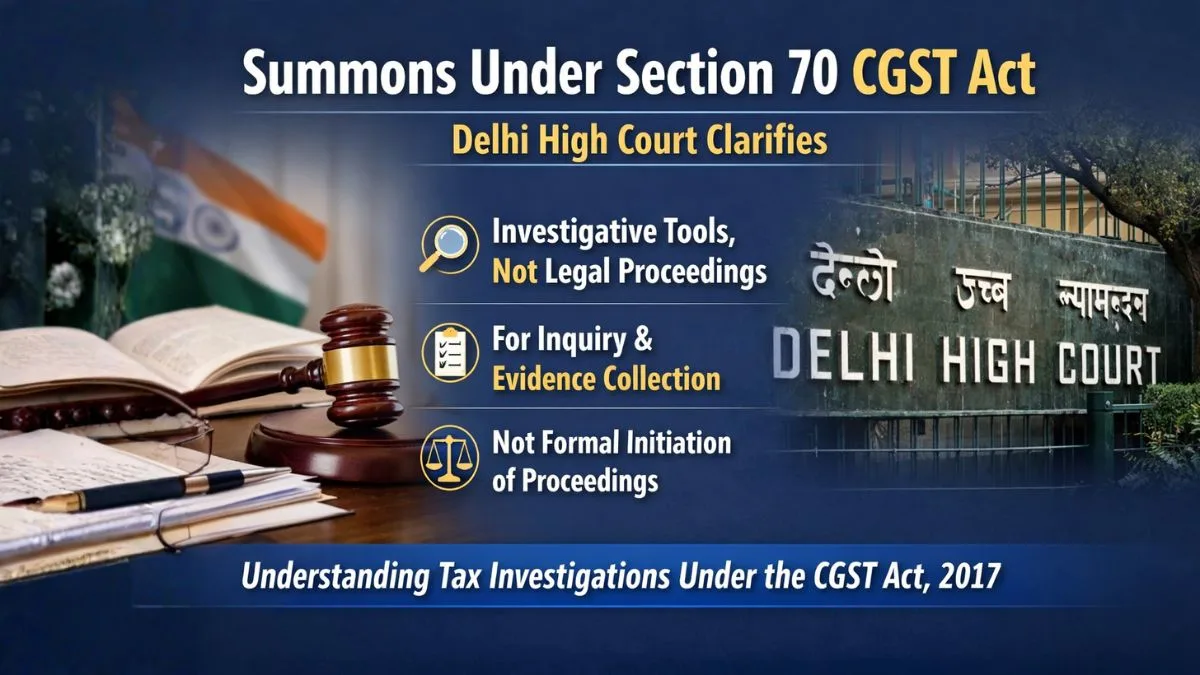

Summons Under Section 70 CGST Act Are Only Investigative Tools, Not Legal Action: Delhi High Court Explains

If you are a business owner, freelancer, or professional working under GST, receiving a summons can be a scary experience. The moment you see an official notice from the department, your mind starts racing. Questions pop up instantly. “Have I done something wrong?” “Is my business in trouble?” “Will there be a court case?”

Many taxpayers in India face this anxiety when they receive summons under Section 70 of the CGST Act, 2017. Most people assume that a summons means legal proceedings have already started. But that is not true.

In a recent judgment, the Delhi High Court clearly stated that summons issued under Section 70 are only investigative tools. They are meant for inquiry and evidence collection. They do not amount to the formal initiation of proceedings.

This judgment has brought major relief to taxpayers. In this blog, we will explain what Section 70 really means, why summons are issued, how tax investigations work, and what you should do if you receive one.

What Is Section 70 of the CGST Act, 2017?

Section 70 of the Central Goods and Services Tax Act, 2017, gives legal power to GST officers to issue summons during an inquiry. This section allows officers to call any person who can help in collecting information or evidence.

Under Section 70, officers can summon:

-

Business owners

-

Directors and partners

-

Employees

-

Accountants

-

Consultants

-

Any relevant person

The main purpose is simple. Authorities want to understand facts. They want to verify records. They want to check whether GST rules are being followed properly.

This section is mainly used during tax investigations. It helps officers gather documents, statements, and explanations.

Many people think that summons means punishment. In reality, it is just a tool for inquiry.

Why Are Summons Issued During Tax Investigations?

GST authorities issue summons when they need clarity. It is part of the evidence collection process.

Some common reasons include:

-

Mismatch in GST returns

-

Incorrect input tax credit

-

Delay in filing returns

-

High-value transactions

-

Suspicious data reports

-

Complaints or intelligence inputs

In many cases, taxpayers ignore emails or notices. When that happens, officers use Section 70 to ensure personal appearance.

It is not about harassment. It is about getting accurate information.

Think of it like this. If your bank calls you to verify a transaction, it does not mean fraud. It only means verification. The same logic applies here.

What Did the Delhi High Court Say?

In the recent case, a taxpayer challenged the summons. They claimed that repeated summons were equal to starting legal proceedings and caused mental stress.

The Delhi High Court disagreed.

The Court said clearly:

-

Summons are for inquiry

-

They are for evidence gathering

-

They are part of tax investigations

-

They are not court proceedings

-

They do not mean prosecution

-

They do not start adjudication

The court explained that inquiry is a preliminary stage. Authorities first collect facts. Only after that do they decide whether any legal action is required.

So, just receiving a summons does not mean you are in legal trouble.

Inquiry vs Proceedings: Know the Difference

Many people get confused between inquiry and proceedings. Let’s simplify it.

Inquiry

An inquiry is the first step. Officers check documents. They ask questions. They verify data. There is no accusation at this stage.

Proceedings

Proceedings start when authorities issue a show cause notice or file a case. This is when legal consequences may follow.

Section 70 summons belong only to the inquiry stage. Not proceedings.

So, there is no need to panic.

Your Rights and Responsibilities During Summons

When you receive a summons, you have both duties and rights.

Your Responsibilities

-

Appear on the given date

-

Carry required documents

-

Give honest answers

-

Cooperate with officers

-

Follow legal instructions

Ignoring summons can lead to penalties. So never take them lightly.

Your Rights

-

You can ask for reasonable time

-

You can consult a professional

-

You cannot be forced to confess

-

You must be treated respectfully

-

You can seek clarification

GST officers are bound by law. They cannot misuse power.

How This Judgment Helps Businesses

This ruling is very important for Indian businesses.

Earlier, many taxpayers rushed to courts after receiving summons. They were afraid of harassment. Now, this judgment provides clarity.

Benefits include:

-

Less fear among taxpayers

-

Better cooperation in investigations

-

Reduced unnecessary litigation

-

More transparency

-

Stronger trust in the system

Professionals like CAs and consultants can now guide clients better using this ruling.

It creates balance between authority and taxpayer rights.

Common Misunderstandings About Section 70 Summons

Let’s clear some myths.

❌ “Summons means criminal case.”

No. It means inquiry.

❌ “My business will shut down.”

No. Operations continue normally.

❌ “I must say yes to everything.”

No. You can explain facts.

❌ “Ignoring is safe.”

No. It can worsen your case.

❌ “Only fraud cases get summons.”

No. Even genuine mistakes can trigger inquiry.

Knowing these facts helps reduce unnecessary stress.

What Should You Do If You Get a Summons?

If you receive a summons under Section 70 of the CGST Act, follow these steps.

First, stay calm. Do not panic.

Second, read the notice properly. Check the date, time, officer name, and purpose.

Third, gather all documents carefully.

Fourth, consult a tax expert if needed.

Fifth, appear on time and cooperate.

Sixth, answer honestly. If you don’t know something, say so.

Seventh, keep copies of all submissions.

A professional attitude makes a big difference.

Long-Term Impact on GST System

This judgment will influence future GST matters across India.

Courts will now be careful before interfering at the inquiry stage. Authorities will also use summons more responsibly.

It will reduce unnecessary writ petitions. It will improve administrative efficiency. It will promote voluntary compliance.

In the long run, it makes the GST system stronger and fairer.

Final Thoughts: Don’t Fear, Stay Informed

The Delhi High Court has made it clear that summons under Section 70 of the CGST Act, 2017, are investigative tools. They are issued for inquiry and evidence collection. They do not amount to the formal initiation of proceedings or court action.

Instead of fearing summons, focus on compliance. Maintain proper records. File returns on time. Take professional advice when needed.

Knowledge is your biggest protection.

👉 If you need expert help in handling GST summons, tax investigations, notices, or compliance matters, connect with our professional team at Callmyca.com and get trusted guidance for your business growth.