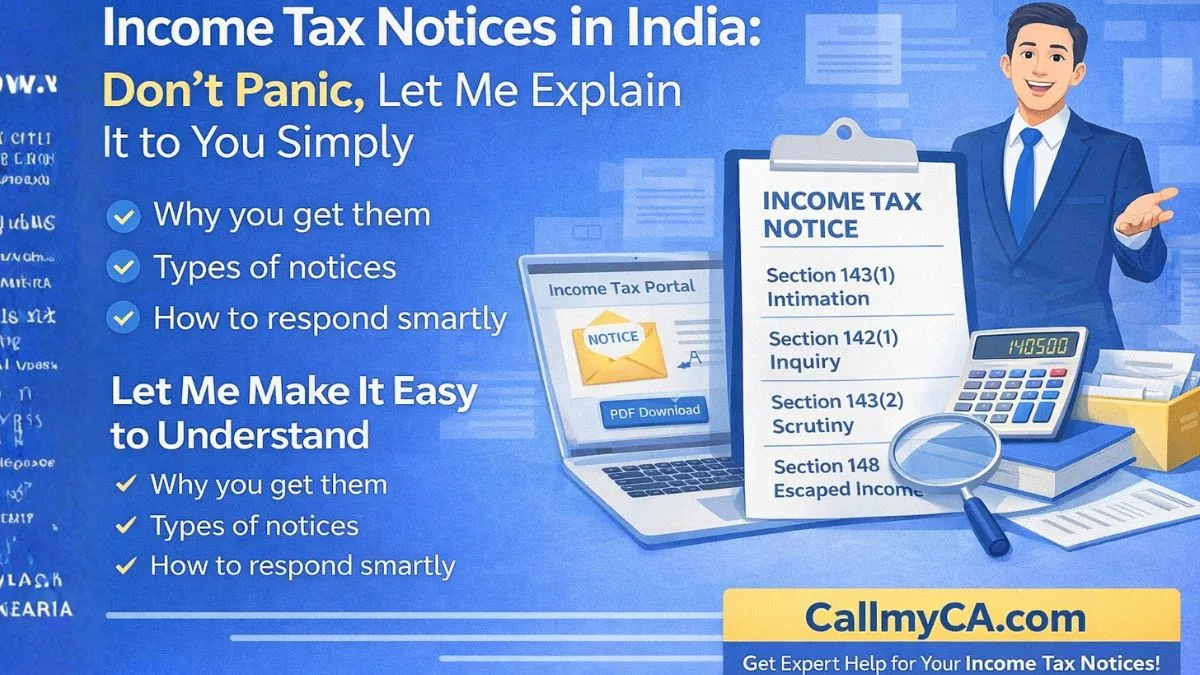

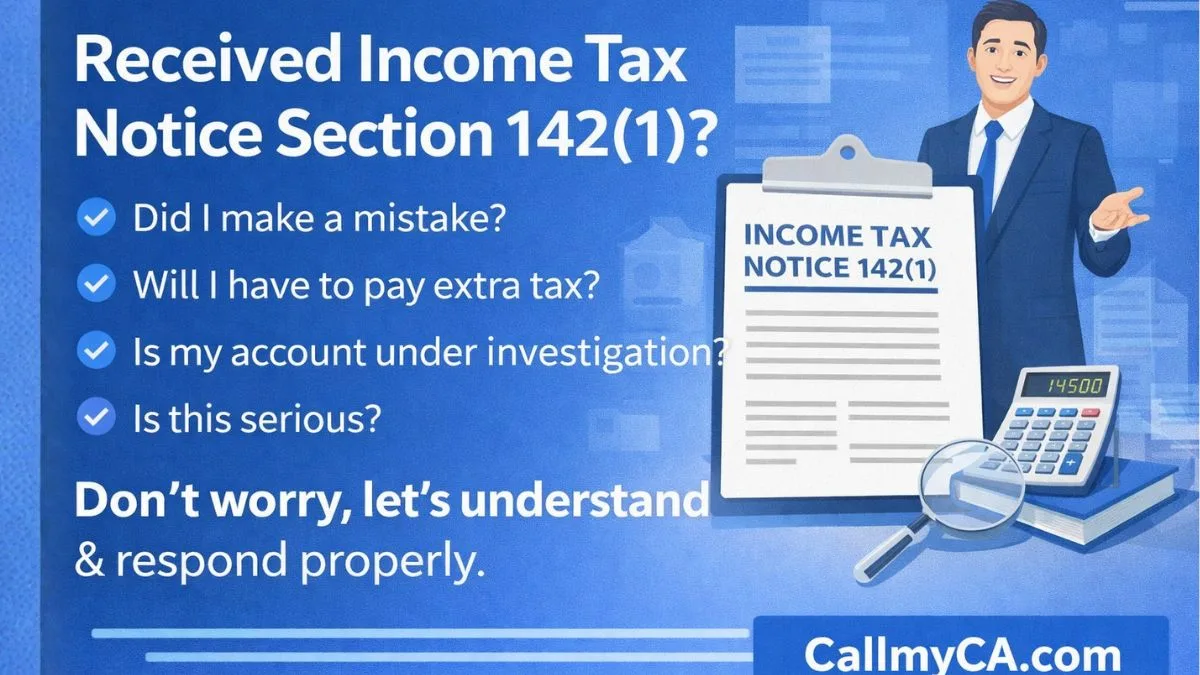

When you type “income tax notice section 142(1)” on Google, you’ll see thousands of people searching the same thing every day.

Why?

Because the moment someone receives a notice from the income tax department, fear kicks in.

Your heart races.

Your mind panics.

And suddenly, you’re wondering:

“Did I make a mistake?”

“Will I have to pay extra tax?”

“Is my account under investigation?”

“Is this serious?”

If you have received an income tax notice under Section 142(1), relax.

You are not alone.

And in most cases, it is completely manageable.

What Is Income Tax Notice Section 142(1)?

An income tax notice under Section 142(1) is an official inquiry issued by the Assessing Officer (AO) before completing your assessment.

It is sent when the department needs:

-

More information

-

Supporting documents

-

Clarification

-

Return filing (if not filed)

-

Explanation for discrepancies

This notice is part of the notice tax verification process.

It does not automatically mean wrongdoing.

It simply means:

“Please help us verify your financial details.”

Why Do You Receive a Notice Under Section 142(1)?

There are several reasons why this notice is issued.

1. Return Not Filed

If you missed filing your ITR, the department may ask you to comply.

2. Mismatch in Data

If your ITR does not match AIS, Form 26AS, or bank data, the AO will seek clarification.

3. High-Value Transactions

Large property purchases, heavy trading, or foreign transfers can trigger scrutiny.

4. Incomplete Information

Missing details in income, deductions, or investments may invite a notice.

5. Random Selection

Some cases are selected randomly for verification.

So, don’t assume the worst.

This notice is mostly procedural.

Information Asked in Section 142(1) Notice

Every notice is different, but usually it asks for:

-

Salary slips

-

Form 16 / 16A

-

Bank statements

-

Investment proofs

-

Loan documents

-

Capital gains reports

-

Business books

-

GST returns

-

Rental income proof

The AO clearly mentions what is required.

Never ignore these instructions.

Key Features of Section 142(1) Notice

Let’s understand the important aspects.

Legal Authority

This notice is issued under the Income Tax Act and is legally binding.

Mandatory Compliance

Replying is compulsory.

Time-Bound

There is always a deadline.

Mostly Online

Most replies are submitted through the portal.

Pre-Assessment Stage

It is issued before your case is finalized.

Case-Specific

Questions depend on your financial profile.

Understanding this helps reduce fear.

Time Limit for Notice Under Section 142(1) of Income Tax Act

There is no fixed national timeline for issuing the notice.

However, once you receive it, you generally get:

👉 7 to 30 days to reply.

This is the time limit for notice under section 142(1).

Missing this deadline can lead to:

-

Penalties

-

Higher tax demand

-

Best judgment assessment

-

Further scrutiny

Always respect timelines.

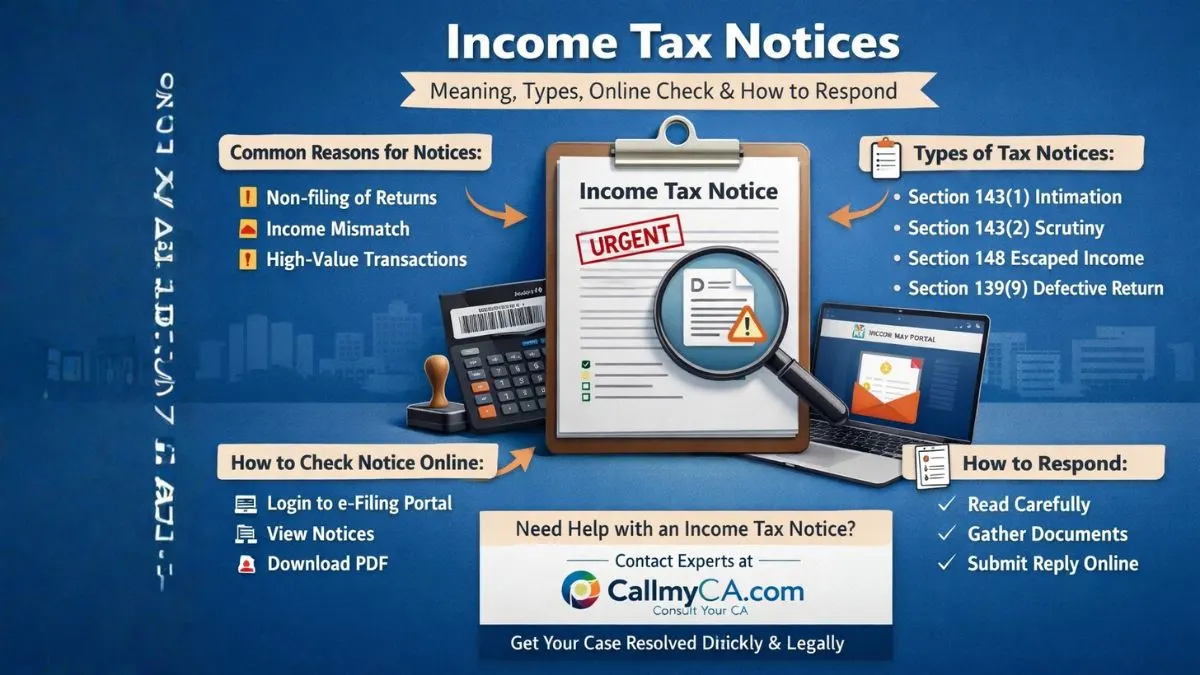

How to Check Income Tax Notice Section 142(1) Online

Follow these steps:

-

Visit Income Tax Portal

-

Login using PAN

-

Go to e-Proceedings

-

Click “View Notices.”

-

Download PDF

Many people search for:

👉 income tax notice section 142(1) pdf download

Always keep a saved copy.

How to Respond to Income Tax Notice Section 142(1)

This is the most important part.

A correct response can close your case smoothly.

Step 1: Read Carefully

Understand every question.

Step 2: Collect Documents

Arrange all proofs.

Step 3: Cross-Verify

Match numbers with records.

Step 4: Prepare Explanation

Explain mismatches clearly.

Step 5: Upload Reply

Submit on the portal.

Step 6: Save Acknowledgement

Keep the confirmation.

Never submit fake data.

It can cause serious trouble.

Reply to Notice Under Section 142(1): Proper Format

Your reply should be:

-

Professional

-

Clear

-

Honest

-

Document-backed

-

Error-free

It must include:

-

Notice number

-

PAN

-

Assessment year

-

Income explanation

-

Attachments

Many people look for:

👉 sample reply to notice under section 142(1) of the Income Tax Act

But every case is different.

Never copy blindly.

What Happens If You Ignore the Notice?

Ignoring a Section 142(1) income tax notice is dangerous.

It may result in:

-

Heavy penalties

-

Refund blockage

-

Legal proceedings

-

Higher tax demand

-

Further notices

Silence makes things worse.

Always respond.

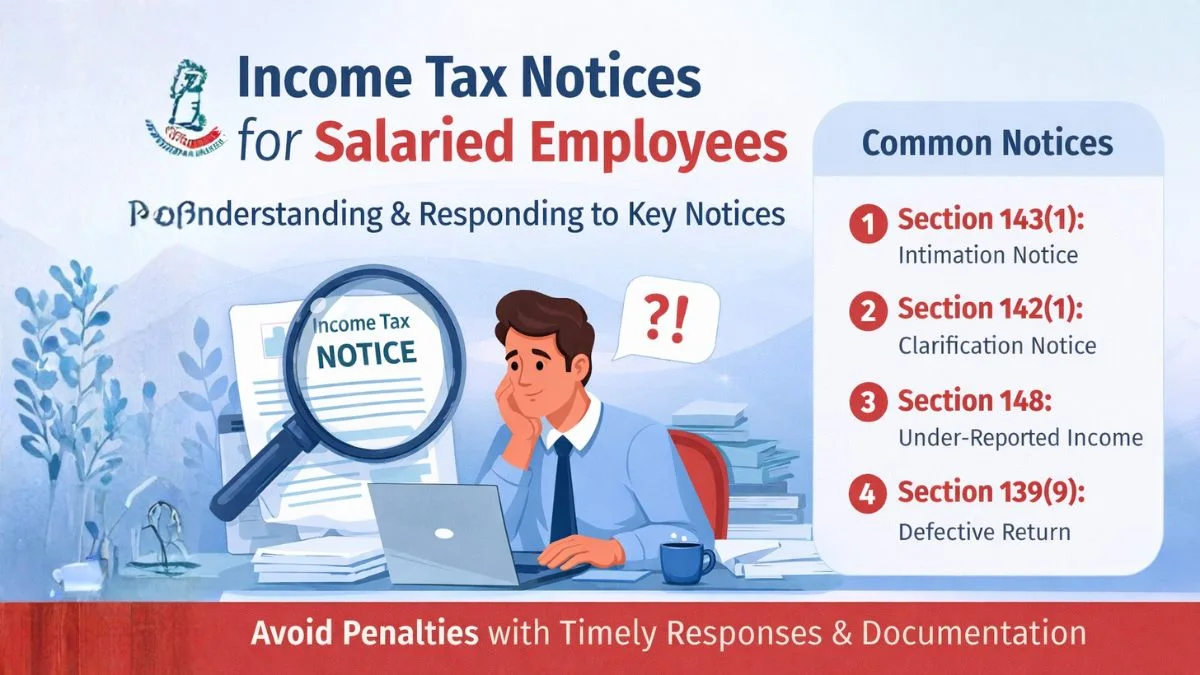

Difference Between Section 142(1) and Section 143(1)

People often confuse these two.

| Section | Purpose |

|---|---|

| 142(1 | Inquiry & verification |

| 143(1 | Intimation |

Section 143(1) is automated.

Section 142(1) is manual review.

Both are different.

Section 142(1) Notice for Businesses

For businesses, this notice is more detailed.

It may ask for:

-

P&L account

-

Balance sheet

-

GST returns

-

Purchase bills

-

Expense records

-

Stock details

Proper bookkeeping is essential.

One missing invoice can cause problems.

Can You Revise the Return After the Section 142(1) Notice?

Yes, sometimes you can revise if:

-

Assessment is pending

-

The error is genuine

But do it only after consulting experts.

Wrong revision can complicate things.

Common Mistakes While Replying

Avoid these:

-

Missing deadline

-

Uploading incomplete files

-

Wrong calculations

-

Vague explanations

-

No attachments

-

No expert help

These mistakes delay closure.

How to Avoid Section 142(1) Notice in Future

Follow these habits:

-

File returns on time

-

Match AIS & 26AS

-

Declare all income

-

Keep records

-

Avoid cash dealings

-

Maintain digital copies

Good compliance = fewer notices.

Why Professional Help Is Important

Handling income tax notices alone is stressful.

Experts can:

-

Analyze notice

-

Draft replies

-

Organize documents

-

Communicate with AO

-

Prevent penalties

-

Save time

It’s better to invest in guidance than pay fines later.

FAQs

Is Section 142(1) Notice Serious?

Mostly no. It’s for verification.

Can I Reply Without CA?

Yes, but professional help is recommended.

Is Penalty Guaranteed?

No. Only if you don’t comply.

Can the Deadline Be Extended?

Sometimes, on request.

Will It Affect My Credit?

Indirectly, unresolved tax issues can impact finances.

Final Thoughts

Receiving an income tax notice under section 142(1) does not mean trouble.

It means the department wants clarity.

If you:

✔ Respond on time

✔ Submit correct documents

✔ Stay honest

✔ Take guidance

Your case will close smoothly.

No stress.

No fear.

No panic.

Just proper compliance.

Need Help With Your Income Tax Notice?

If you have received an income tax notice under Section 142(1) and want expert support for reply, documentation, and compliance, connect with professionals at Callmyca.com and get your case resolved quickly, legally, and stress-free.