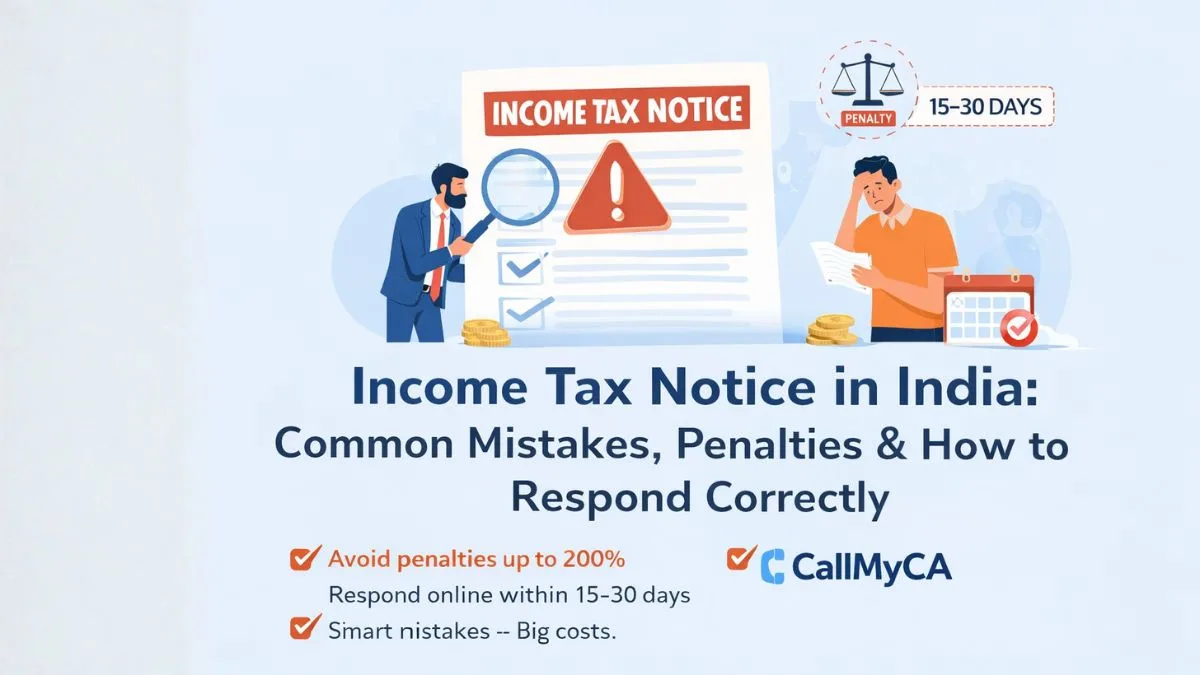

Income Tax Notices in India: Don’t Panic, Let Me Explain It to You Simply

Let me be very honest with you.

The moment someone sees the words “Income Tax Notice” on their phone, email, or letterbox, their heartbeat increases.

I have seen this for years.

People call me and say,

“Sir, I’ve received a notice… what will happen now?”

Some think they have done something illegal.

Some think they will have to pay huge penalties.

Some even stop sleeping properly.

But listen carefully.

In most cases, an income tax notice is not bad news.

It is just the Income Tax Department asking you:

“Please explain this.”

“Please confirm that.”

“Please correct this small mistake.”

That’s it.

So today, I’ll explain everything to you in simple language—what income tax notices are, why they come, what types exist, and how you should respond smartly.

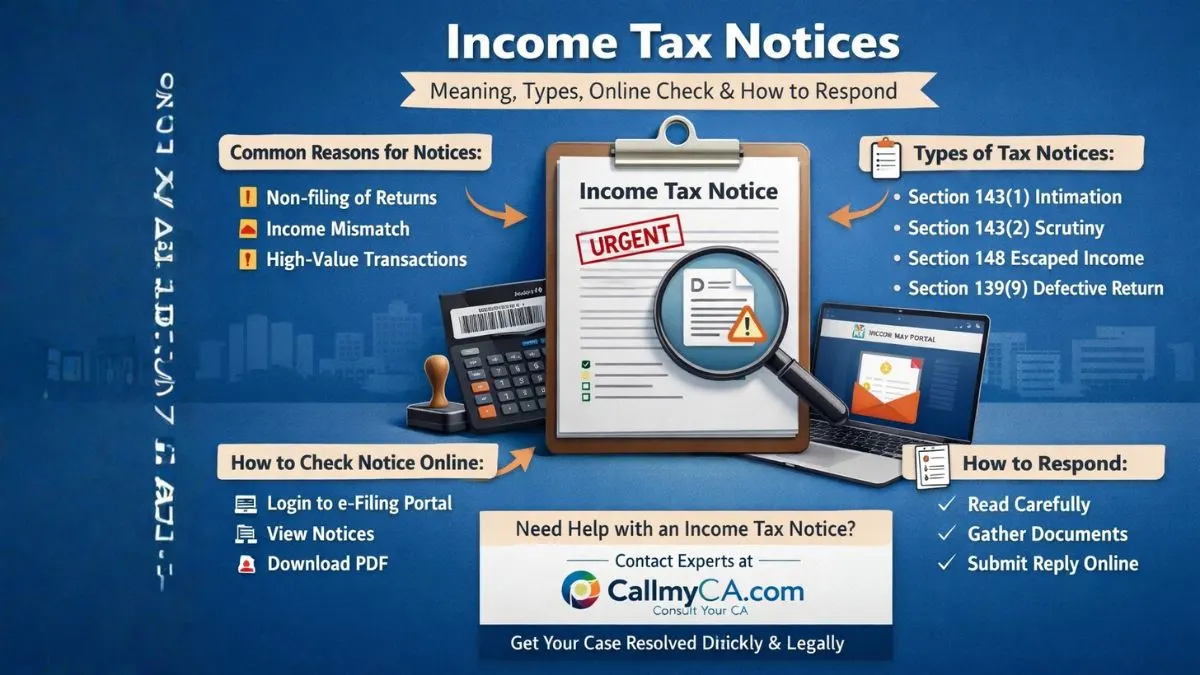

What Are Income Tax Notices?

Income tax notices are official messages sent by the Income Tax Department when something in your return does not match their records.

It can be:

-

Income mismatch

-

Return not filed

-

High-value transaction

-

Missing information

-

Technical error

Think of it like this.

You submitted a form.

The department checked it.

Something didn’t match.

So they sent you a message.

That message is called an income tax notice.

It can come:

-

Online

-

By email

-

By post

-

On the income tax portal

Yes, nowadays you can also do an income tax notice check online easily.

Why Do People Get Income Tax Notices?

Let me share what I see in real life.

Most notices come because of very small mistakes.

1. You Forgot to File ITR

Many people think:

“Income kam hai, koi dikkat nahi.”

Wrong.

If you are required to file and you don’t, a notice can come.

2. Income Does Not Match Records

Your bank, employer, mutual fund, and companies share data with the department.

If your ITR says ₹5 lakh

But their data says ₹7 lakh

➡️ Notice comes.

3. High-Value Transactions

Examples:

-

Big cash deposit

-

Property purchase

-

Large investment

-

Heavy credit card spending

If you don’t explain these properly, a notice may be issued.

4. Wrong Deductions

Claiming 80C, 80D, and HRA without proof?

The department notices that.

5. Technical Mistakes

Wrong ITR form.

Missing schedule.

Wrong tax calculation.

Yes, even these small things can trigger notices.

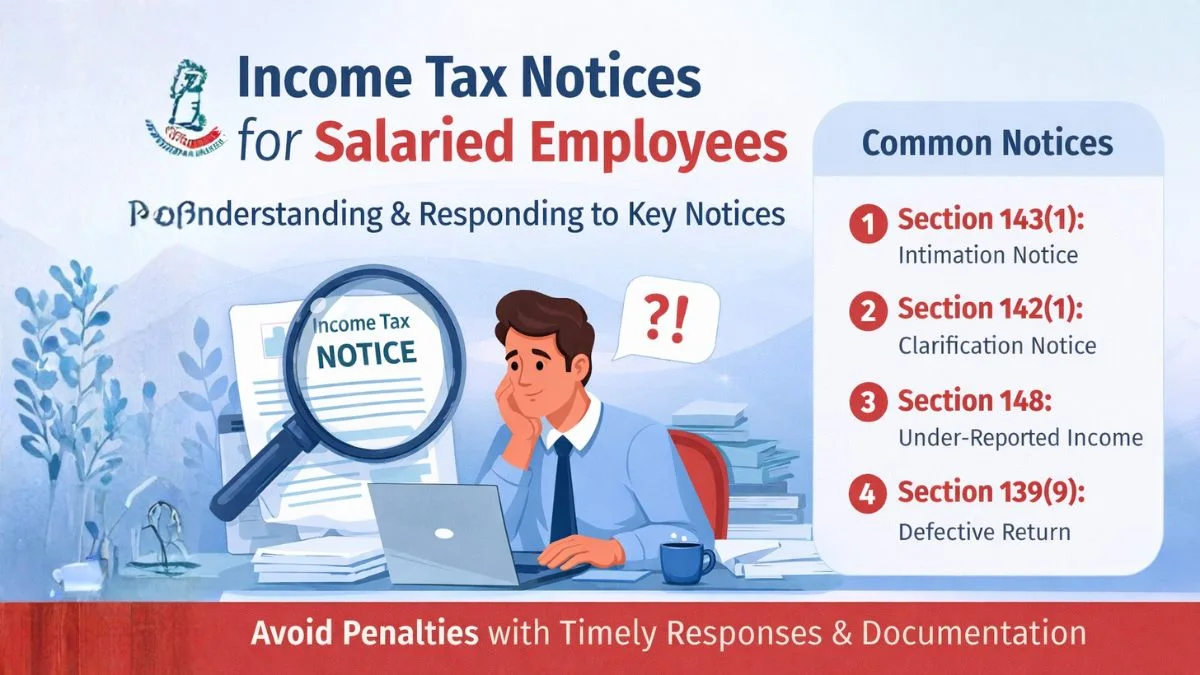

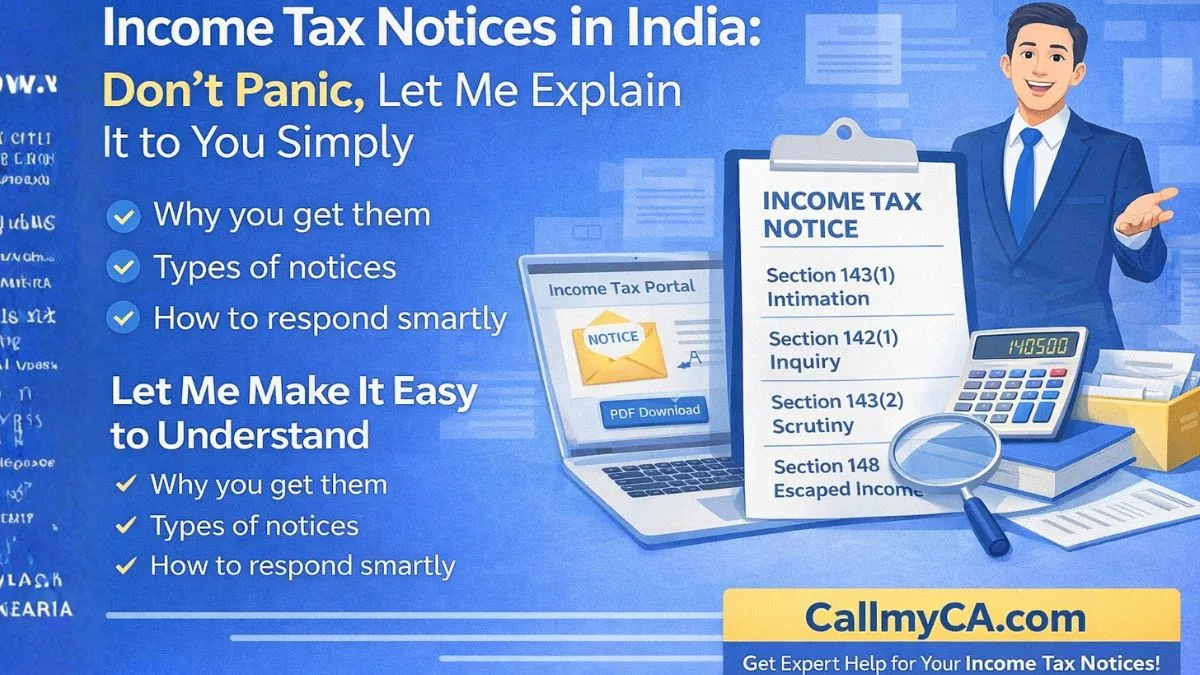

Different Types of Income Tax Notices (Very Important)

Now let’s talk about the main notices you should know.

This is where most people get confused.

Don’t worry. I’ll make it easy.

Section 143(1) – Intimation Notice

This is the most common one.

Almost everyone gets this.

It simply tells you:

-

Your return is processed

-

Refund amount

-

Tax payable

-

Small adjustment

Think of it like a receipt.

If everything matches → No tension.

If there is a difference, check and reply.

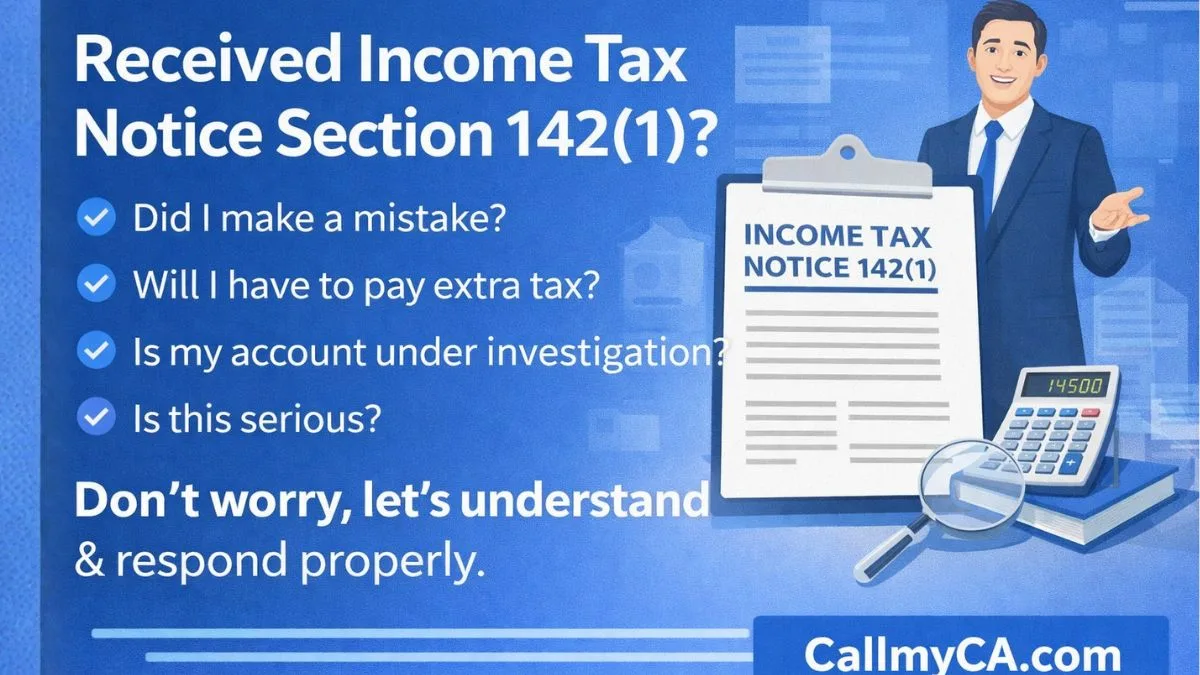

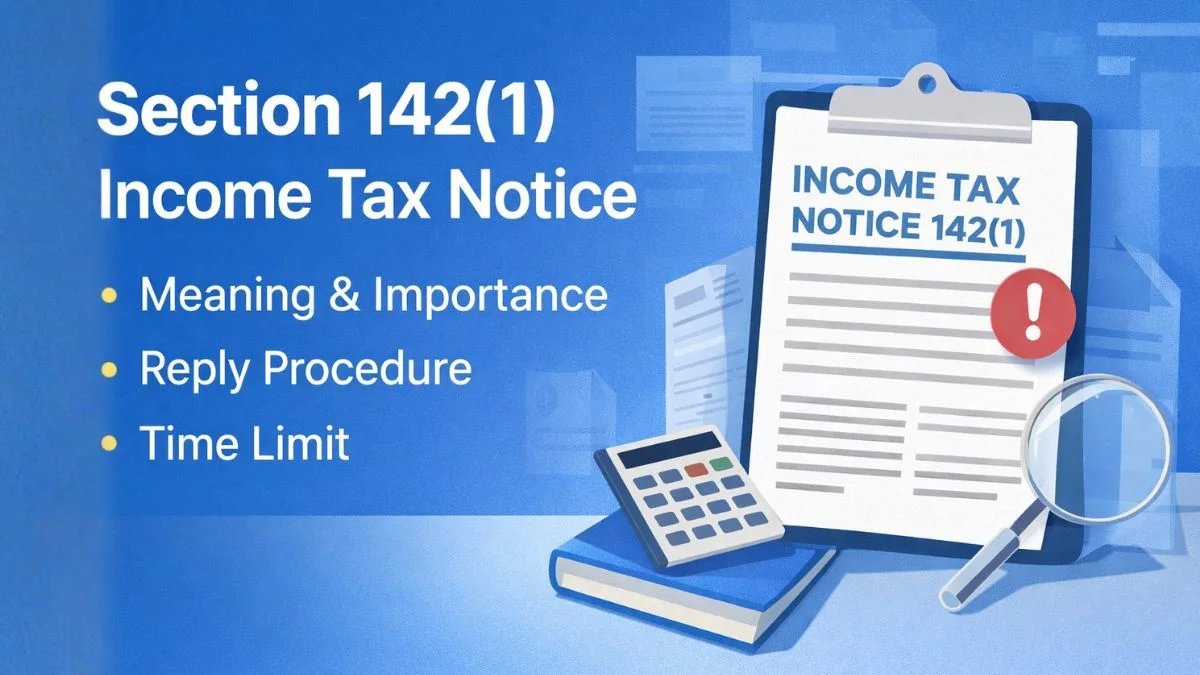

Section 142(1) – Inquiry Notice

This means:

“Please give more information.”

They may ask for:

-

Bank statements

-

Investment proof

-

Expense details

-

Income breakup

No need to panic.

Just upload documents properly.

Section 143(2) – Scrutiny Notice

This sounds scary, I know.

But listen.

Scrutiny means detailed checking.

They want to verify:

-

Income

-

Deductions

-

Capital gains

-

Business profit

Many cases are selected randomly.

It does NOT mean you are guilty.

But yes, here you should take professional help.

Section 148 – Escaped Income Notice

This is serious.

It means:

“Some income was not reported.”

Example:

-

Interest income hidden

-

Property sale not shown

-

Foreign income missed

Here, you may have to file a revised return and explain properly.

Section 139(9) – Defective Return Notice

This is very common.

It means your return is incomplete.

Examples:

-

Missing balance sheet

-

Wrong calculation

-

Incomplete details

You usually get 15 days to fix it.

If you correct on time → No problem.

How to Check Income Tax Notice Online

Many people ask me:

“Sir, notice kaise check karein?”

Very easy.

Steps:

-

Login to Income Tax Portal

-

Go to “Pending Actions.”

-

Click “e-Proceedings.”

-

Download notice

You can also do an income tax notice PDF download from here.

Always check from the official website only.

Never trust random emails or links.

Income Tax Notice by Post—Is It Still Valid?

Yes.

Sometimes, you may get a physical income tax notice letter by post.

Don’t ignore it.

It is legally valid.

Always verify it on the portal.

How to Respond to an Income Tax Notice

Now listen to me carefully.

This part is very important.

Step 1: Read Slowly

Don’t panic.

Read:

-

Section number

-

Reason

-

Deadline

-

Required documents

Understand first. React later.

Step 2: Collect Documents

Keep ready:

-

Bank statements

-

Salary slips

-

Investment proofs

-

Rent receipts

-

Sale deeds

Good documentation = Strong case.

Step 3: Reply Online

Most replies are submitted online.

Upload:

-

Explanation

-

Supporting files

-

Correct format

Avoid physical letters unless asked.

Step 4: Take Help If Needed

For scrutiny and reassessment, don’t be overconfident.

A small mistake can cost you big money.

Professional help saves stress.

What Happens If You Ignore Income Tax Notices?

Let me be blunt.

Ignoring notices is dangerous.

It can lead to:

-

Heavy penalty

-

Interest

-

Assessment without your input

-

Legal action

Even if the notice is wrong, reply.

Silence = Problem.

Common Mistakes I See People Making

From experience, people make these mistakes:

❌ Late replies

❌ Half of the documents

❌ Wrong explanations

❌ Copy-paste answers

❌ Fake data

Please don’t do this.

Always reply honestly and clearly.

How to Avoid Income Tax Notices in Future

Follow these habits:

✅ File on time

✅ Declare all income

✅ Match AIS & 26AS

✅ Keep records

✅ Avoid heavy cash use

Simple habits = Peaceful life 😄

Role of Technology Today

Today, the income tax department knows almost everything.

Banks, companies, and brokers—all share data.

AI checks mismatches.

That’s why accuracy matters more than ever.

Final Words

Let me tell you one thing honestly.

An income tax notice is not your enemy.

It is just a question.

If you answer it properly, nothing bad happens.

Most problems happen only when people panic or ignore them.

So relax.

Be honest.

Be timely.

Be smart.

And if you ever feel confused, stuck, or scared while handling a notice…

👉 Don’t struggle alone. Visit Callmyca.com today and get expert help to handle your income tax notices smoothly, safely, and stress-free—before small mistakes turn into big losses.