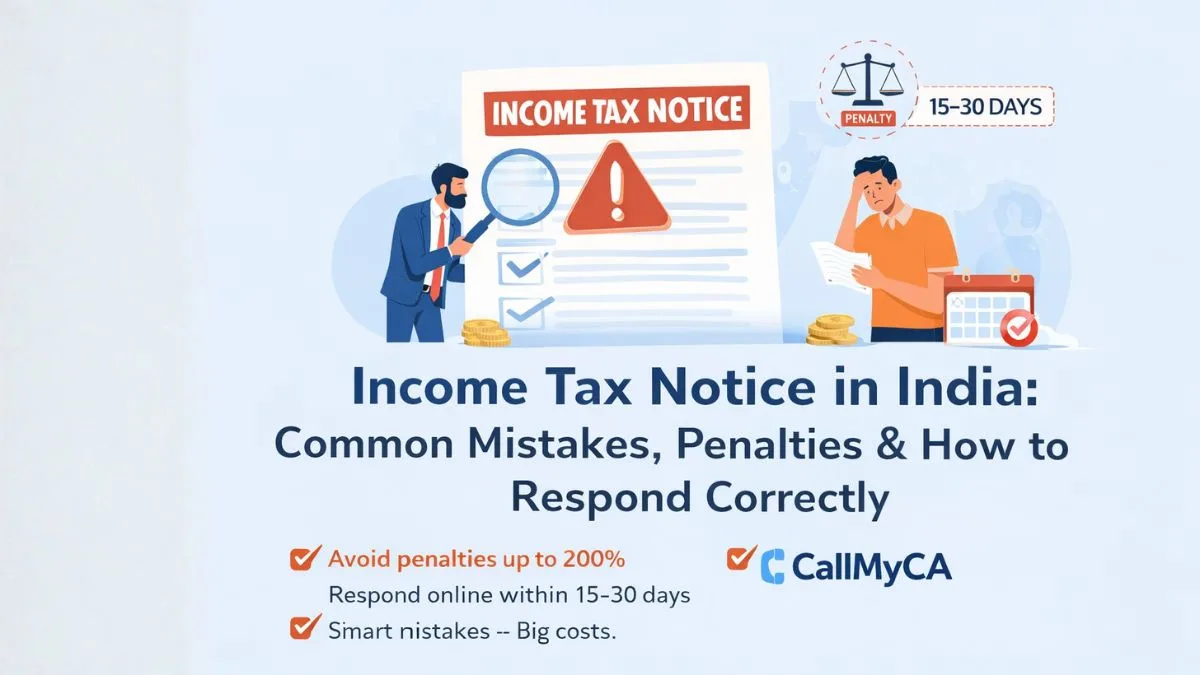

Income Tax Notices: Meaning, Types, Online Check, PDF Download & How to Respond

When people search for income tax notices on Google, it usually means one thing—they have received a message from the income tax department and don’t know what to do next.

Some panic.

Some ignore it.

Some start searching for the income tax notice PDF download or the income tax notice check online at midnight.

But here’s the truth:

Receiving an income tax notice does not automatically mean trouble.

It simply means the department wants clarification about your tax records.

What Are Income Tax Notices?

Income tax notices are official communications sent by the Income Tax Department under the Department of Revenue and the Central Board of Direct Taxes (CBDT).

These notices are issued when the department finds:

-

Non-filing of returns

-

Mismatch in income data

-

High-value transactions

-

Incorrect deductions

-

Incomplete information

-

Suspicious activities

An income tax notice letter or income tax notice message asks you to explain, clarify, or submit documents within a specific time.

Ignoring it can lead to penalties and legal issues.

How Do You Receive an Income Tax Notice?

Today, most notices are sent digitally, but some are still delivered physically.

You may receive your notice through:

✔ Income tax portal (online)

✔ Registered email

✔ SMS alert

✔ Income tax notice by post

✔ Physical letter

That’s why many people search for

👉 income tax notice online

👉 income tax notice check online

👉 income tax latest notification

Always keep your email and mobile number updated on the portal.

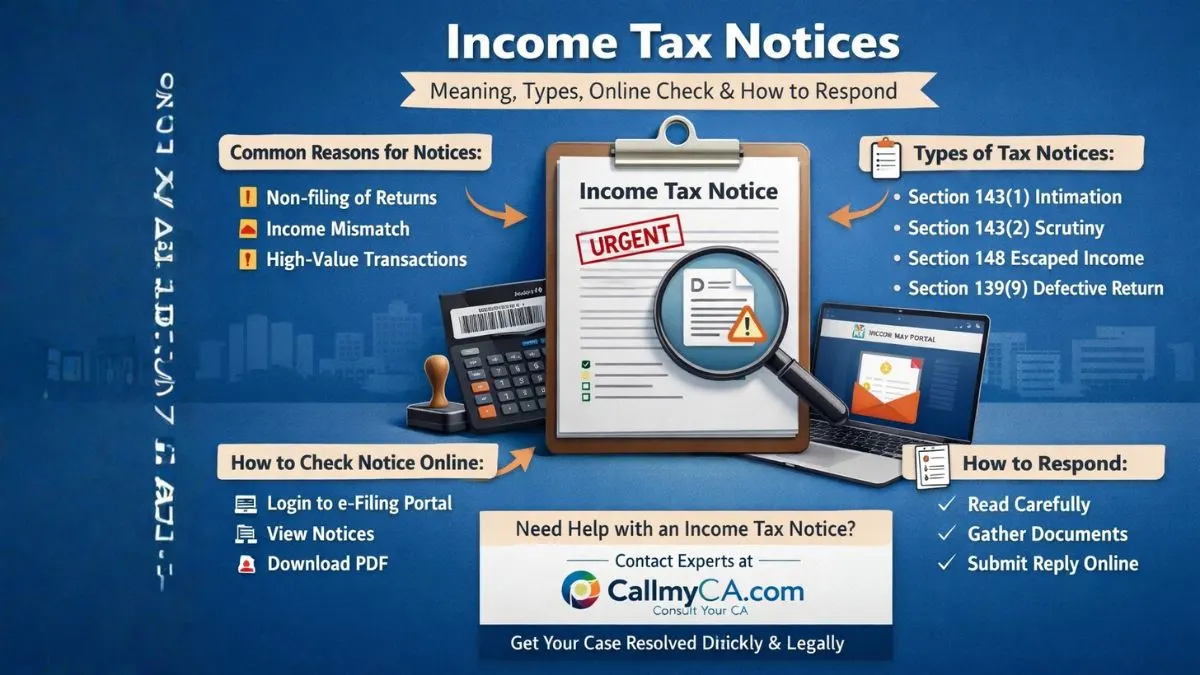

How to Check Income Tax Notice Online

If you think you’ve received a notice, follow these steps:

-

Visit Income Tax e-Filing Portal

-

Login using PAN

-

Go to “e-Proceedings.”

-

Click “View Notices.”

-

Download PDF

This is how you can access the income tax notice PDF download safely.

Never trust unknown links.

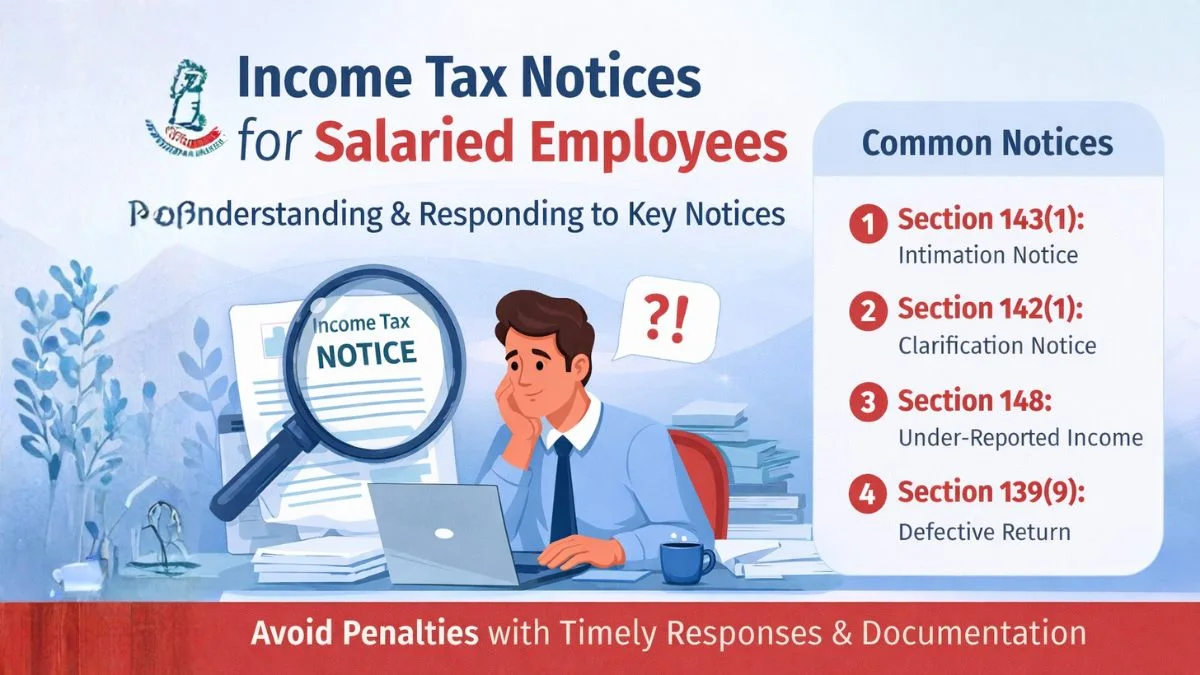

Know the Different Types of Income Tax Notices

The Income Tax Department issues different types of notices for different purposes.

Let’s understand the key ones.

1. Section 143(1) – Intimation Notice

This is an automated notice.

It informs you about:

-

Tax calculation

-

Refund status

-

Demand rose.

-

Errors in return

Most taxpayers receive this.

It is not serious in most cases.

2. Section 142(1) – Inquiry Notice

This notice asks for:

-

Documents

-

Clarifications

-

Return filing

-

Explanations

It is issued before assessment.

You must respond on time.

3. Section 143(2) – Scrutiny Notice

This means your case is selected for detailed examination.

The department wants to verify:

-

Income

-

Deductions

-

Investments

-

Expenses

This requires careful handling.

4. Section 148—Escaped Income Notice

This is issued when the department believes income was not reported.

It is more serious and needs expert help.

5. Section 139(9) – Defective Return Notice

This notice means your return has errors.

It may be due to:

-

Missing forms

-

Wrong details

-

Incomplete data

You must correct it within the given time.

Why You Should Never Ignore Income Tax Notices

Many people make the mistake of ignoring notices.

This can lead to:

❌ Heavy penalties

❌ Interest on tax

❌ Refund blockage

❌ Legal proceedings

❌ Bank account issues

❌ Continuous notices

Silence makes things worse.

A simple reply can save you thousands of rupees.

Common Reasons for Income Tax Notices

Here are the most common triggers:

-

Not filing ITR

-

Declaring wrong income

-

Mismatch in AIS/26AS

-

Claiming false deductions

-

High-value transactions

-

Cash deposits

-

Foreign income

If you stay compliant, chances of notices reduce.

How to Respond to an Income Tax Notice

If you receive a notice, follow this approach:

Step 1: Read Carefully

Understand what is being asked.

Step 2: Arrange Documents

Collect proofs.

Step 3: Verify Details

Cross-check numbers.

Step 4: Prepare Reply

Write a clear explanation.

Step 5: Submit Online

Upload on the portal.

Step 6: Save Proof

Keep acknowledgement.

Never submit wrong information.

Income Tax Notices for Businesses and Professionals

Businesses receive more detailed notices.

They may be asked for:

-

P&L statements

-

Balance sheets

-

GST returns

-

Sales invoices

-

Expense records

-

Stock registers

Proper accounting reduces risk.

How to Avoid Income Tax Notices in Future

Follow these habits:

✔ File returns on time

✔ Declare all income

✔ Match AIS & 26AS

✔ Maintain records

✔ Avoid cash dealings

✔ Keep digital backups

✔ Take professional advice

Good discipline = fewer notices.

Why Professional Help Matters

Handling income tax notices alone can be stressful.

Experts can:

-

Analyze notice

-

Draft replies

-

Upload documents

-

Talk to AO

-

Prevent penalties

-

Save time

Professional help often saves money in the long run.

Final Thoughts

Income tax notices are part of the compliance system.

They are not meant to scare you.

They are meant to ensure transparency.

If you:

✔ Read carefully

✔ Reply on time

✔ Stay honest

✔ Take guidance

Your case will close smoothly.

No panic.

No tension.

No unnecessary trouble.

Just smart compliance.

Need Help With Your Income Tax Notice?

If you have received an income tax notice and want expert support for reply, documentation, and compliance, connect with professionals at Callmyca.com and get your case resolved quickly, legally, and stress-free.