Maryland Personal Income Tax Computation Notice: What It Means and How to Respond Correctly

If you have recently received a Maryland Personal Income Tax Computation Notice, the first thing you might feel is confusion.

You filed your MD tax return, paid your taxes, and thought everything was done. Then suddenly, a notice arrives saying that your return has been adjusted and your balance has changed.

Many taxpayers panic at this point.

Some assume they made a big mistake.

Some worry about penalties.

Others ignore the notice completely.

But let me tell you something important.

In most cases, this notice is simply a clarification from the state. It does not mean you are in serious trouble. It just means the tax department found a difference and wants you to review it.

If you understand it properly and respond on time, it is usually easy to resolve.

In this guide, I will explain what this notice means, why you receive it, how to check it, how much you may have to pay in Maryland state income taxes, and how to respond correctly.

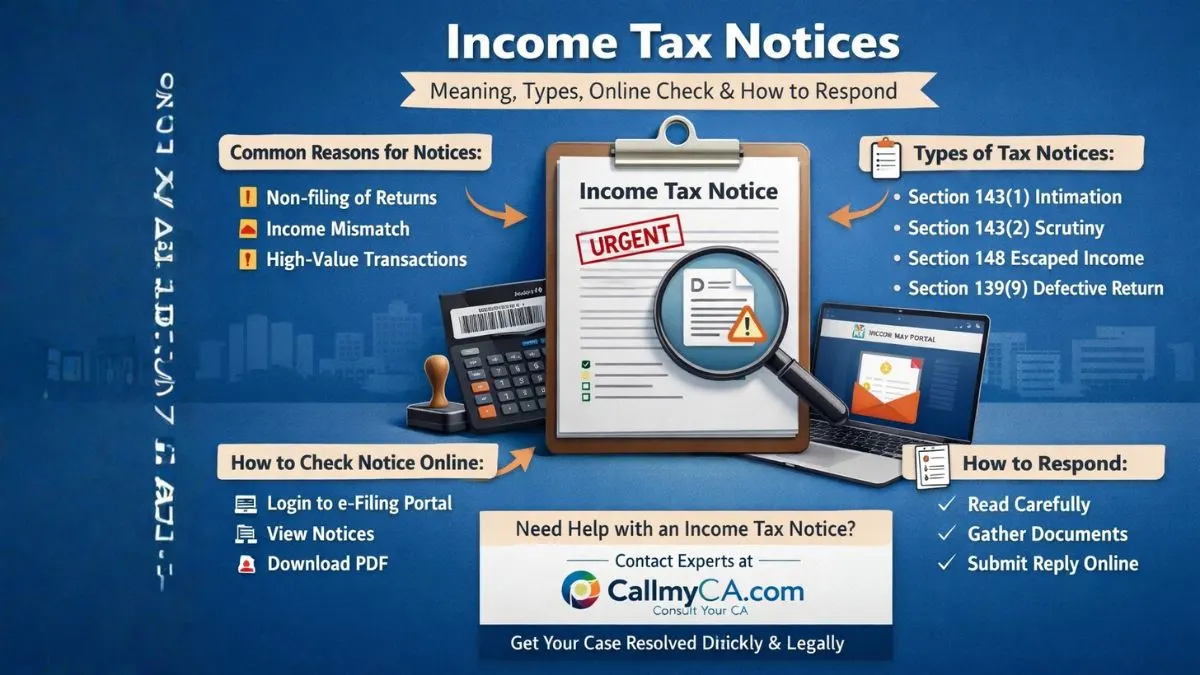

What Is a Maryland Personal Income Tax Computation Notice?

A Maryland Personal Income Tax Computation Notice is an official letter sent by the Comptroller of Maryland.

This notice is issued when the tax department makes changes or corrections to your state tax return after reviewing it.

In simple words, it means:

“We checked your return. We found some differences. Here is the updated calculation.”

The notice shows:

-

Adjustments made to your return

-

Revised tax amount

-

Additional tax owed or refund

-

Penalties or interest (if any)

-

Your 13-digit notice number

It is not an accusation.

It is a correction statement.

Why Did You Receive an MD Income Tax Computation Notice?

There are several common reasons why this notice is issued.

Let us go through the most frequent ones.

1. Errors in Your MD Tax Return

Many people make small mistakes while filing personal income taxes.

Examples:

-

Wrong income figures

-

Incorrect deductions

-

Missing schedules

-

Calculation errors

Even small mistakes can trigger a correction.

2. Mismatch With Employer or Bank Records

Your employer, banks, and financial institutions report your income to the state.

If your return does not match their records, an adjustment is made.

This is very common.

3. Incorrect Credits or Exemptions

Claiming credits or exemptions without proper eligibility may lead to changes.

For example:

-

Wrong dependent claim

-

Incorrect tax credit

-

Invalid deduction

4. Late Filing or Late Payment

If you filed or paid after the due date (such as April 15, 2024), interest and penalties may be added.

This often changes your balance.

5. System Review Adjustments

Some returns are reviewed automatically by the system.

During this process, minor adjustments are common.

Understanding the 13-Digit Notice Number

Every Maryland tax computation notice includes a unique 13-digit notice number.

This number is very important.

It helps the tax department identify your case.

You should always:

-

Keep it safe

-

Mention it in communication

-

Use it while making payments or disputes

Never ignore this number.

What Does the Notice Usually Show?

A typical MD income tax computation notice outlines:

-

Original amount you reported

-

Adjusted amount by the department

-

Difference in tax

-

Interest charged

-

Penalty (if applicable)

-

Final balance

It clearly explains how much you will pay in Maryland state income taxes after adjustment.

Read this section carefully.

Most confusion happens because people do not read this properly.

How Much Will You Pay in Maryland State Income Taxes?

Your final amount depends on:

-

Your income

-

Filing status

-

Local tax rates

-

Deductions

-

Credits

-

Penalties and interest

Maryland has both state and local income taxes.

So even small changes in income can affect your total amount.

The computation notice gives you the exact revised figure.

Always rely on the notice, not assumptions.

How to Check and Verify the Notice

Before responding, you must verify the information.

Follow these steps.

Step 1: Compare With Your Records

Check the notice against:

-

Your MD tax return

-

W-2 forms

-

1099 forms

-

Bank statements

-

Previous tax payments

Look for differences.

Step 2: Review the Adjustments Carefully

Check:

-

Which income was changed

-

Which deduction was removed

-

Which credit was reduced

Understand exactly what was modified.

Step 3: Confirm Payment History

Sometimes, payments are not properly reflected.

Verify:

-

Bank confirmations

-

Payment receipts

-

Online payment records

Missing payments can create false balances.

How to Respond to a Maryland Tax Computation Notice

Now comes the most important part.

Once you understand the notice, you must take action.

You have two main options.

Option 1: If You Agree With the Notice

If the changes are correct, you should pay the amount.

Steps:

-

Check the due date

-

Pay online, by mail, or through approved methods

-

Mention your 13-digit notice number

-

Keep proof of payment

Timely payment avoids further interest.

Option 2: If You Disagree With the Notice

If you believe the notice is incorrect, you can dispute it.

Common reasons:

-

Income already reported

-

Tax already paid

-

Wrong adjustment

-

Data mismatch

Steps:

-

Prepare supporting documents

-

Write a clear explanation

-

Attach proof

-

Submit within the deadline

Always keep copies of everything.

Documents Required for Dispute or Verification

You may need:

-

Copy of MD tax return

-

W-2 and 1099 forms

-

Bank statements

-

Payment receipts

-

Deduction proofs

-

Correspondence copies

Good documentation increases your success.

What Happens If You Ignore the Notice?

Ignoring this notice is risky.

It can lead to:

-

Additional penalties

-

Higher interest

-

Collection actions

-

Wage garnishment

-

Refund adjustment

-

Legal proceedings

Even small balances grow over time.

Always respond.

Filing Personal Income Taxes: Avoiding Future Notices

The best way to avoid computation notices is proper filing.

Follow these habits.

File Carefully

Do not rush.

Double-check:

-

Income

-

Deductions

-

Credits

-

Calculations

Use Correct Information

Always match your return with:

-

W-2

-

1099

-

Employer records

-

Bank data

File Before Deadline

Try to file before April 15 every year.

Late filing increases errors and penalties.

Keep Records

Maintain tax records for at least five years.

This helps in future verification.

Review Before Submission

Spend ten extra minutes reviewing.

It saves months of trouble later.

Common Mistakes Maryland Taxpayers Make

From experience, these are very common:

❌ Ignoring notices

❌ Missing deadlines

❌ Not checking calculations

❌ Losing documents

❌ Paying without verifying

❌ Delaying disputes

Avoiding these protects your finances.

Meta Title (SEO Optimised)

Maryland Personal Income Tax Computation Notice: Complete Guide

URL Slug (SEO Friendly)

/maryland-personal-income-tax-computation-notice-guide

Meta Description (SEO Keywords | 50–80 Words)

A Maryland Personal Income Tax Computation Notice is issued by the Comptroller of Maryland to outline changes or corrections to your MD tax return. This guide explains MD income tax computation notice, personal income taxes, how much you’ll pay in Maryland state income taxes, filing before April 15, 2024, reviewing the 13-digit notice number, disputing errors, and paying balances correctly.

Final Words

Let me leave you with this.

A Maryland tax computation notice is not a punishment.

It is a correction.

If you read it carefully, verify your records, and respond on time, most issues are resolved smoothly.

Problems only arise when people delay or ignore.

So stay calm.

Stay organised.

Act on time.

And if you ever feel confused while handling your Maryland tax notice…

👉 Visit Callmyca.com today and get expert support for MD tax returns, personal income taxes, computation notices, and compliance—before small errors turn into costly problems.