Notice of State Income Tax Due: What It Means & What You Should Do

You receive a message from the income tax department.

It says, “Notice of State Income Tax Due.”

And suddenly, one question hits you:

“Do I really owe this money?”

If you’ve received such a notice, don’t panic.

This type of notification simply means that according to the department’s records, you have an outstanding tax balance. It could be due to unpaid taxes, calculation differences, penalties, or even a mismatch in your filed return.

The key is to understand the reason before taking any action.

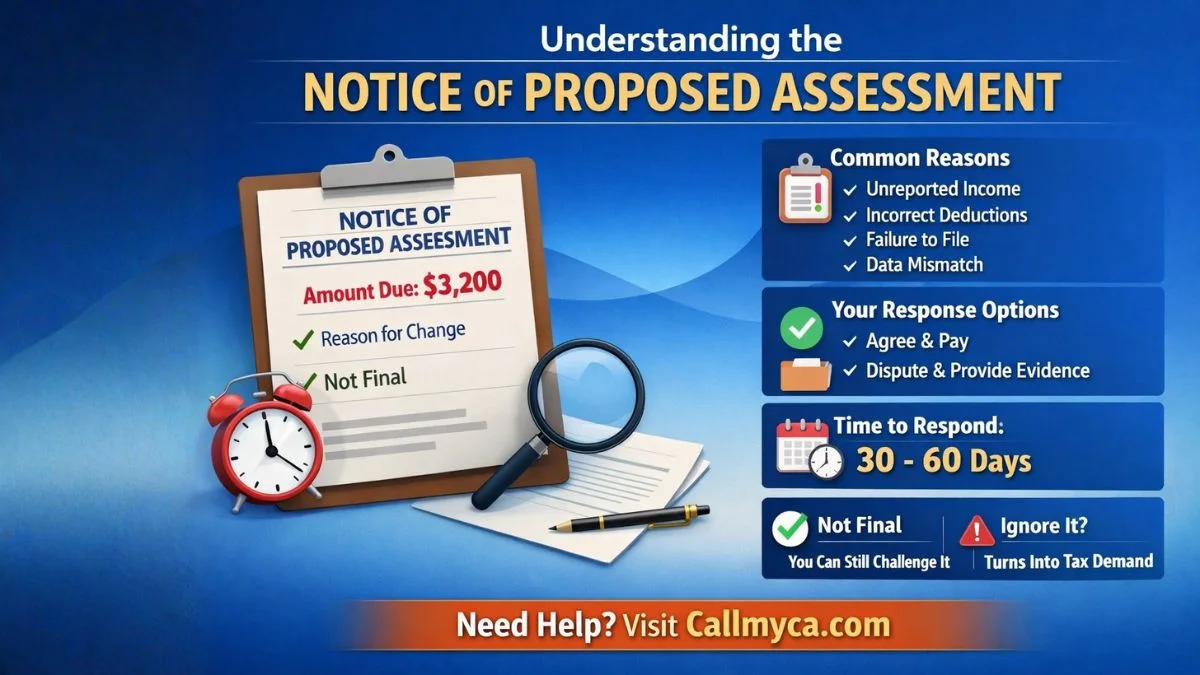

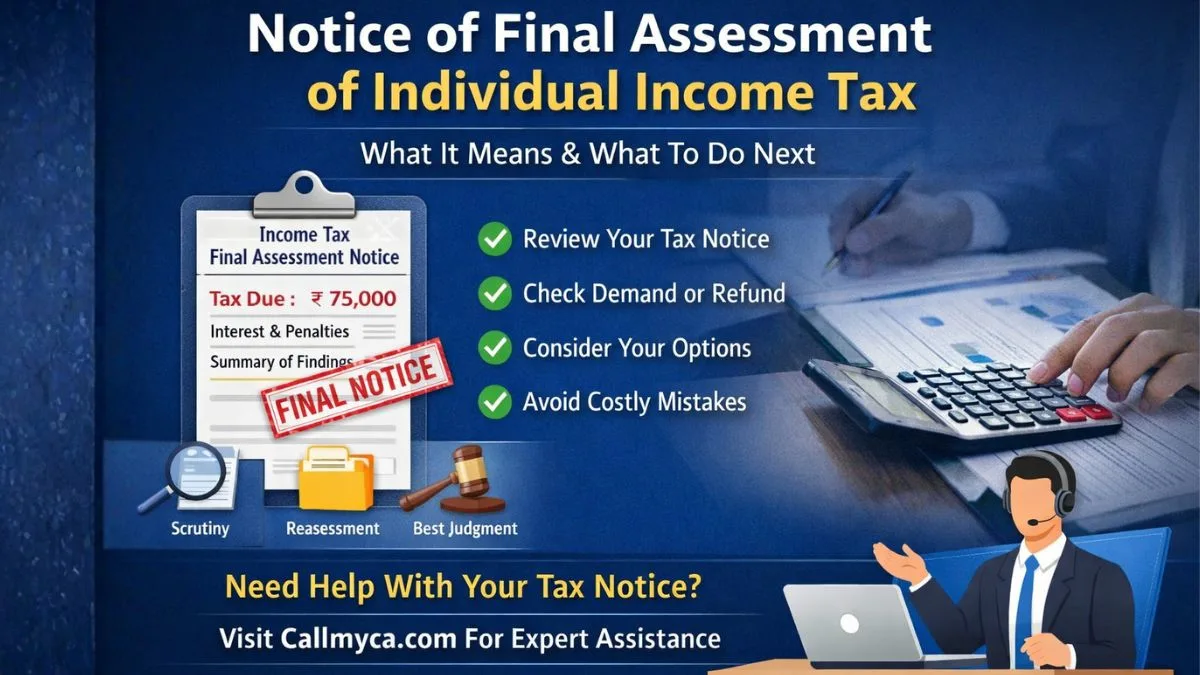

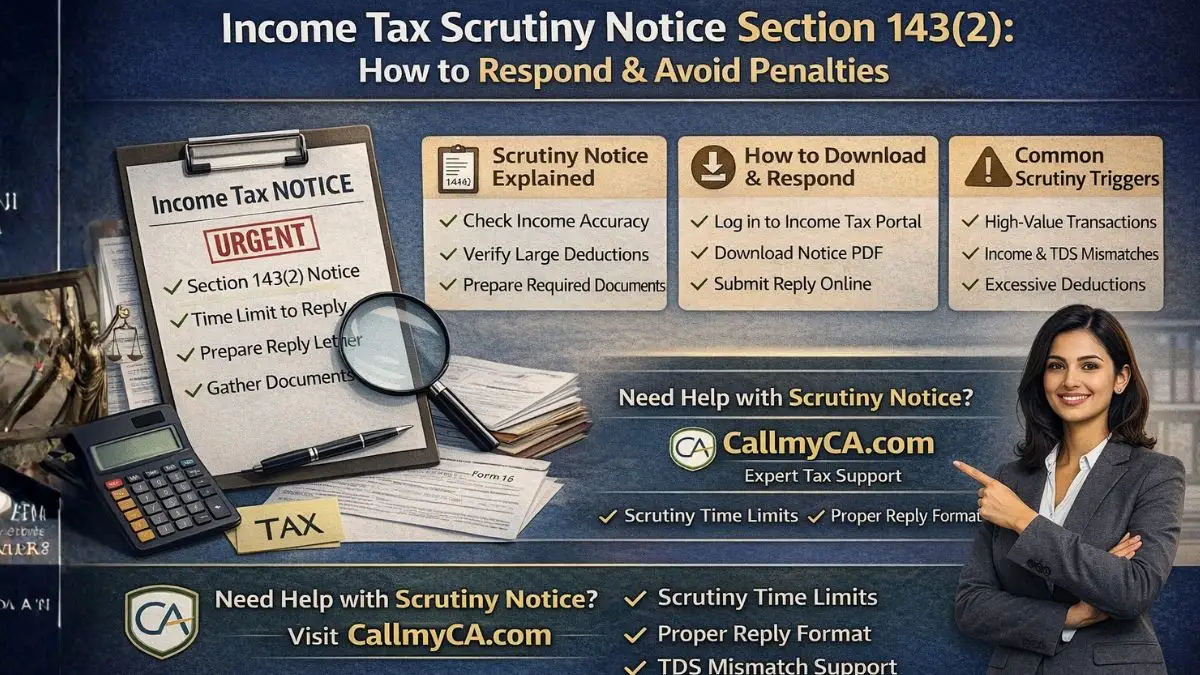

What is a Notice of State Income Tax Due?

A notice of state income tax due is an official communication sent by the tax authority informing you that:

👉 You have a balance due

👉 The payment is pending

👉 Action is required within a specified time

This notice usually includes an account balance summary, which shows:

- Tax amount

- Interest

- Penalty

- Total payable

It is basically a reminder—and sometimes a warning—to clear your dues.

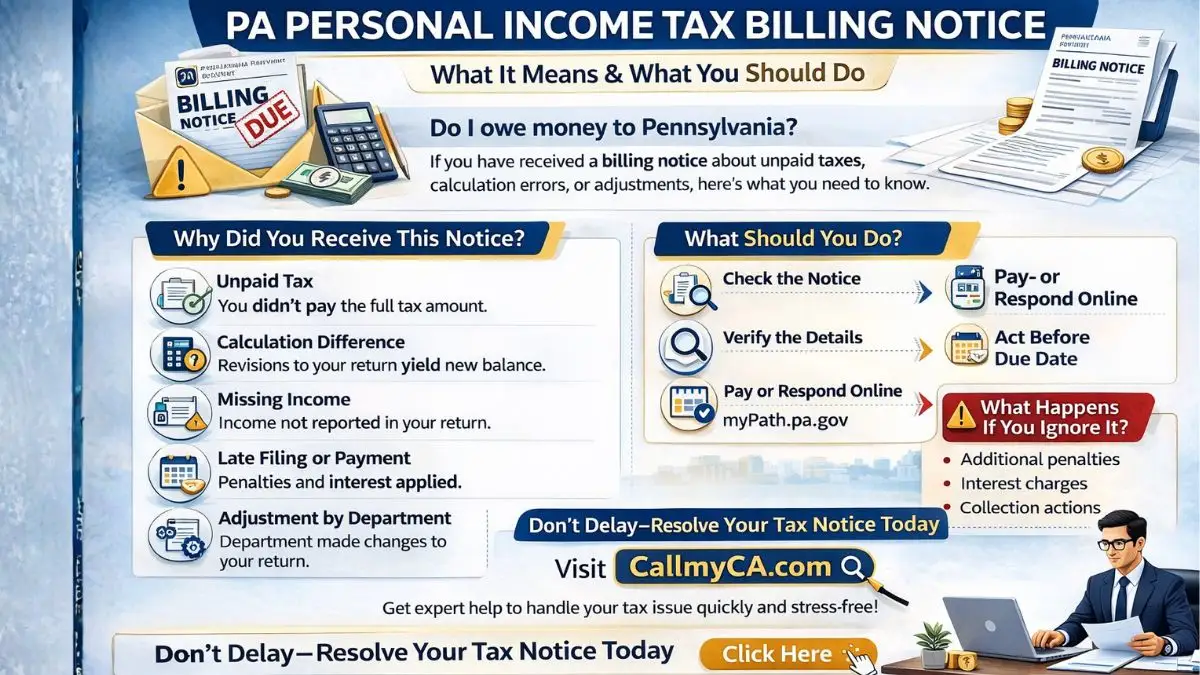

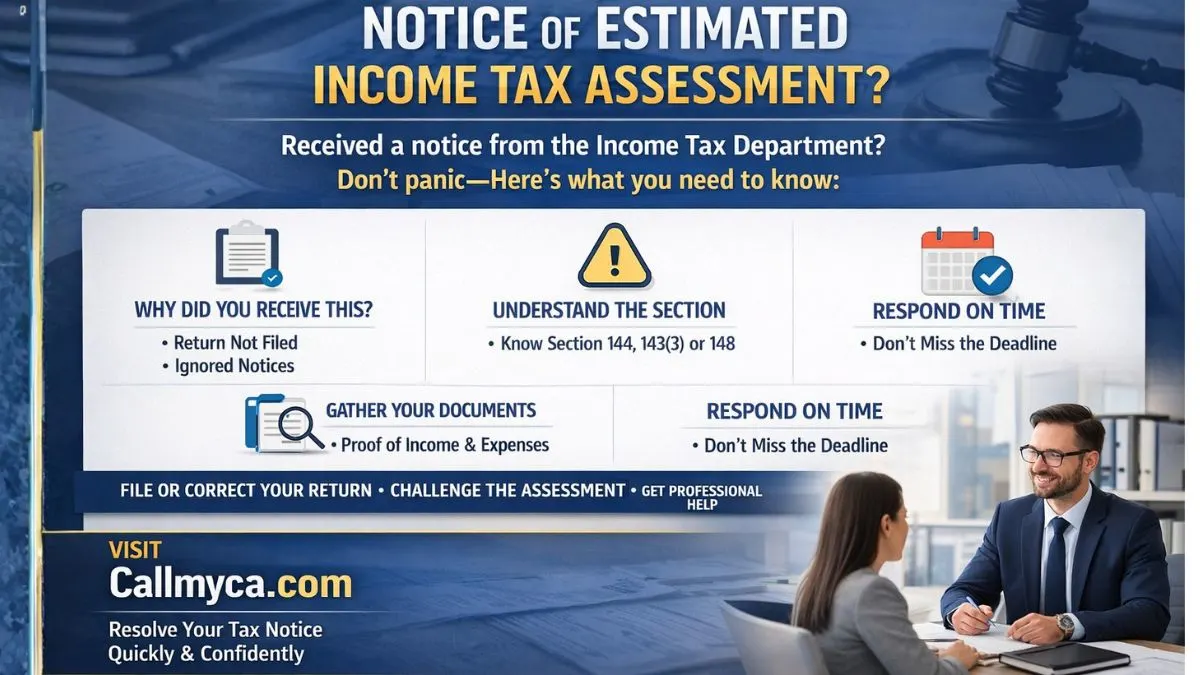

Why Did You Receive This Notice?

Let’s keep it simple.

You may receive a notice of state income tax due for several reasons:

1. Unpaid Tax

You filed your return but didn’t pay the full tax.

2. Calculation Errors

Mistakes in tax calculation.

3. Penalty or Interest

Late filing or late payment.

4. Income Mismatch

Your income doesn’t match official records.

5. Adjustment After Processing

The department revised your tax after checking.

These are common income tax notice reasons.

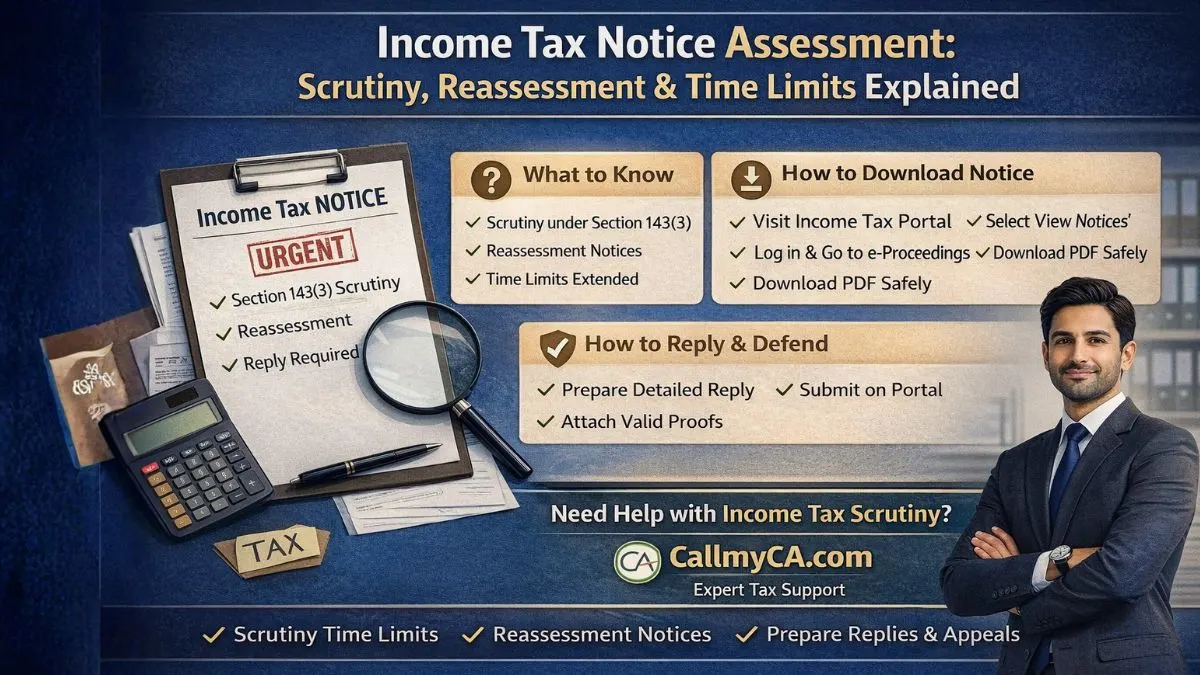

How to Check Your Income Tax Notice Online

If you’re unsure about the notice, you can verify it online.

Many people search for where to check the income tax notice on the portal—here's how:

Steps:

- Visit the income tax portal

- Log in with your credentials

- Go to “Pending Actions.”

- Click on “View Notices."

- Open your notice

You can also complete the income tax notice PDF download to see full details.

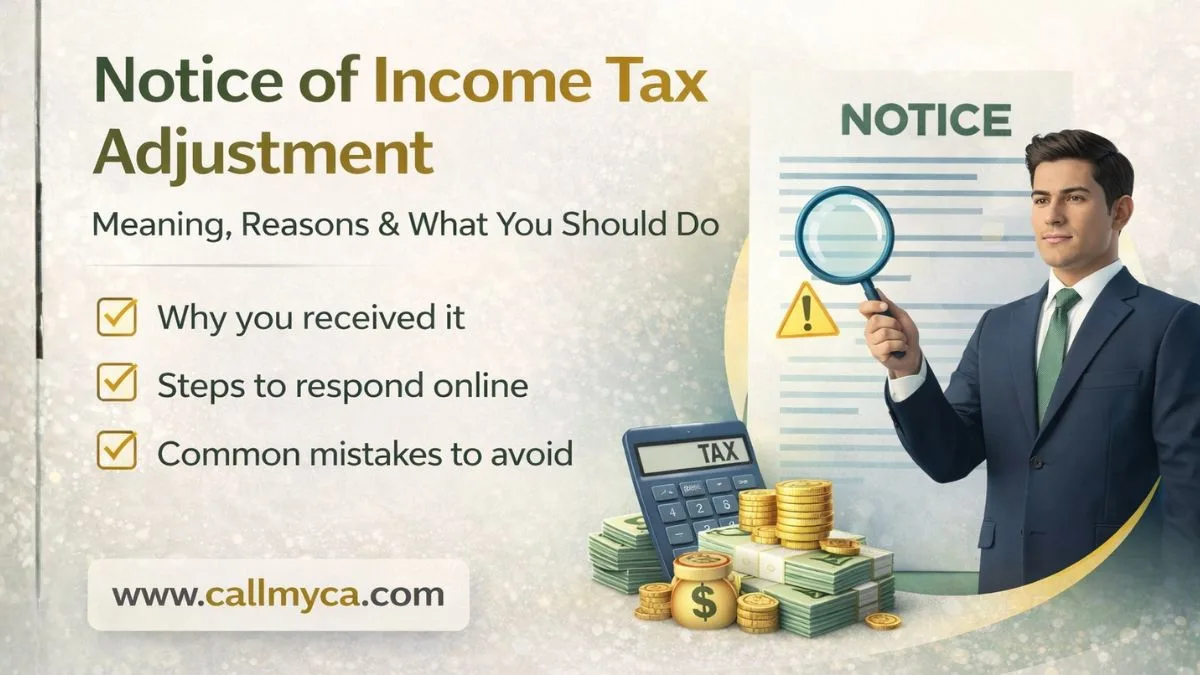

Understanding the Income Tax Notice Message

The income tax notice message contains important details.

You should always check:

- Amount due

- Reason for demand

- Due date

- Payment options

Don’t just look at the amount—understand why it is due.

Income Tax Notice Format Explained

The income tax notice format is structured and easy to read once you understand it.

It usually includes:

- Header (Income Tax Department)

- Your details

- Notice number

- Tax period

- Amount due

- Instructions

Once you know the format, it becomes easier to respond.

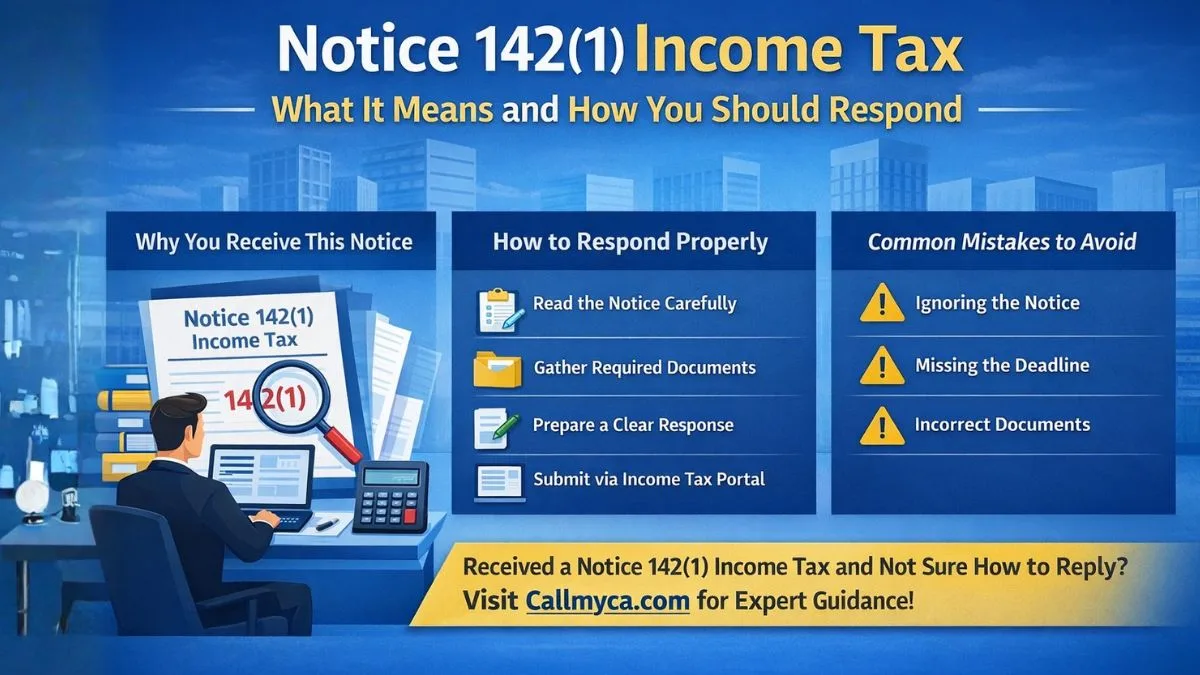

What Should You Do After Receiving the Notice?

Don’t ignore it.

Here’s what you should do:

1. Read the Notice Carefully

Understand the reason.

2. Verify the Amount

Check if the demand is correct.

3. Match With Your Records

Compare with your filed return.

4. Take Action

Pay or respond accordingly.

How to Pay State Income Tax Due

If the demand is correct, you should pay it.

Payment Options Include:

- Online payment (Web Pay)

- Credit/debit card

- Bank transfer

- Cheque

Once payment is done, keep the receipt for future reference.

What If You Disagree With the Notice?

If you believe the demand is incorrect, you have options.

You can:

- File a response online

- Submit supporting documents

- Request correction

Never pay blindly without checking.

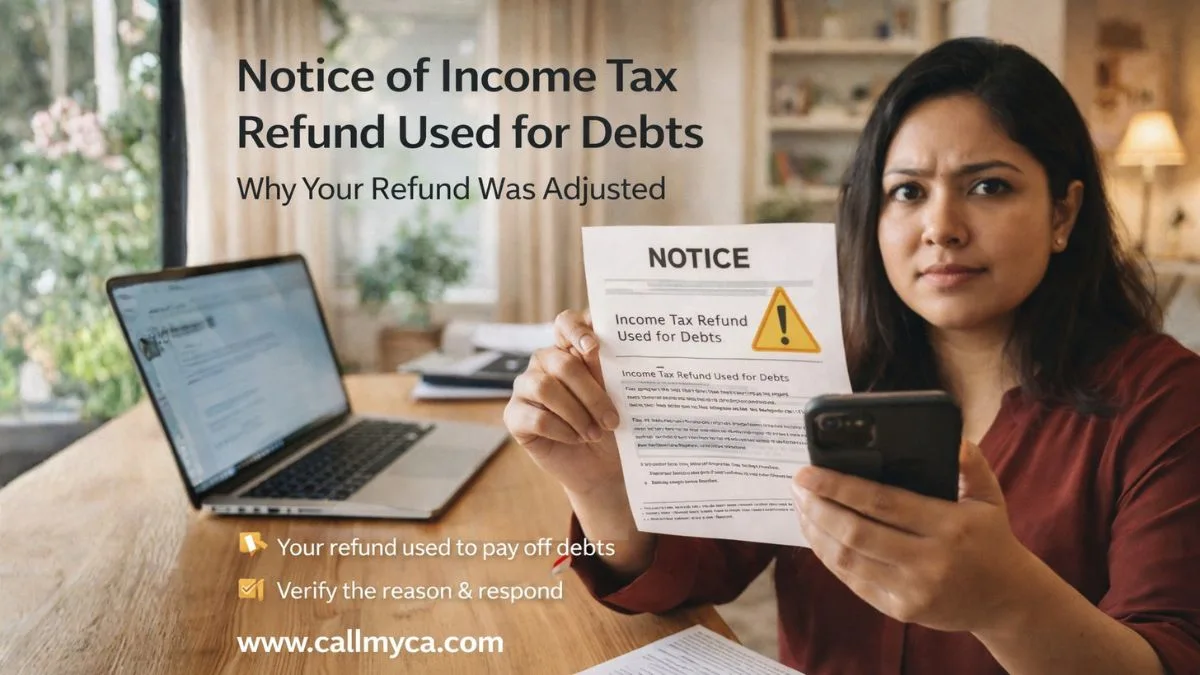

Income Tax Due Date Extension (Latest Updates)

Sometimes, the government provides relief.

You may come across income tax due date extension latest news.

These extensions allow taxpayers extra time to:

- File returns

- Pay taxes

- Respond to notices

Always check the latest income tax notification for updates.

What Happens If You Ignore the Notice?

Ignoring a notice of state income tax due can lead to:

- Additional penalties

- Interest charges

- Legal recovery action

- Adjustment of refunds

So it’s always better to act early.

Common Mistakes to Avoid

Many taxpayers make simple mistakes:

Ignoring the notice

Not checking the portal

Paying without verification

Missing deadlines

Not downloading the notice

Avoid these to stay safe.

How to Avoid Such Notices in Future

To avoid receiving such notices:

- File your return on time

- Pay full tax liability

- Match data with official records

- Keep documents properly

- Stay updated with notifications

Simple steps can save you from future stress.

When Should You Take Expert Help?

Some cases are easy.

But you should seek help if:

- Demand is high

- You don’t understand the notice

- Multiple notices are received

- There is a legal issue

Experts can help you respond correctly.

Final Thoughts

A notice of state income tax due is not something to panic about.

It is simply a notification that you have a pending tax amount.

The key is

👉 Check the notice

👉 Verify the details

👉 Take action on time

Handling it early can save you from penalties and unnecessary stress.

Don’t Ignore Tax Due Notices

Received a tax due notice and not sure what to do? Don’t risk penalties or extra charges. Let experts handle your case—visit Callmyca.com and resolve your income tax issue quickly and stress-free.