Did you get a notice under section 139(9) of the Income Tax Act and have no idea what it means?

You're not alone.

Thousands of taxpayers receive this notice every year. But don’t worry—it’s fixable. "

❓What is Section 139(9) of Income Tax Act?

Section 139(9) of the Income Tax Act deals with defective income tax returns.

It gives the Assessing Officer (AO) the authority to mark your return as defective if it’s incomplete or doesn’t comply with tax rules.

In other words, an income tax return (ITR) that is incomplete or inaccurate may get flagged under this section.

So yes, if you’ve received a notice u/s 139(9) of the Income Tax Act, it likely means your ITR has some technical or data-related issue.

🛑 What Triggers a Defective Return Notice?

A defective return notice is issued under section 139(9) for a variety of reasons. Let’s go through a few:

- You forgot to attach the Profit & Loss account or Balance Sheet (common under section 139(9) of income tax act 44aa)

- You claimed deductions but didn’t declare relevant income

- You submitted the wrong ITR form

- Your bank account or audit details are missing

- Data mismatch between Form 26AS & your return

These might result in a notice under section 139(9) of the Income Tax Act 1961, error code 86 or error code 31, among others. "

🔢 Decoding the Common Error Codes

Let’s break it down:

- Error Code 86: Audit report not attached or missing mandatory details

- Error Code 31: Claimed deductions without matching income

- Error Code 38: Discrepancy in return data or wrong ITR form

- Error Code 202: Structure or validation failure

- Error Code 999: System-generated error for miscellaneous issues

Yes, even a small mistake can cause a big interruption.

📆 Section 139(9) of the Income Tax Act Due Date

Timing matters here.

Once you receive a notice under section 139(9) of the Income Tax Act 1961, you have 15 days to respond.

That’s it—15 days to correct the return and refile. If you miss it? The original return is treated as invalid.

So if you’re searching for section 139(9) of Income Tax Act due date, remember: count 15 calendar days from the notice date. "

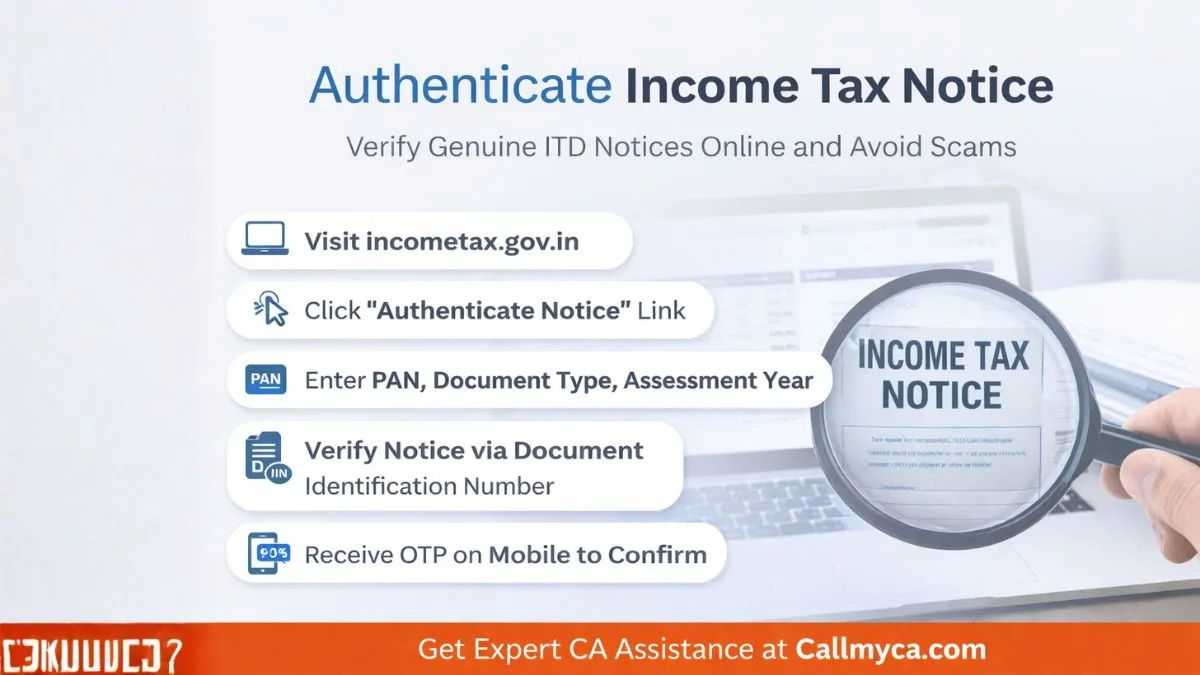

🛠️ How to Respond to the Notice

Here’s a simple guide to handle it:

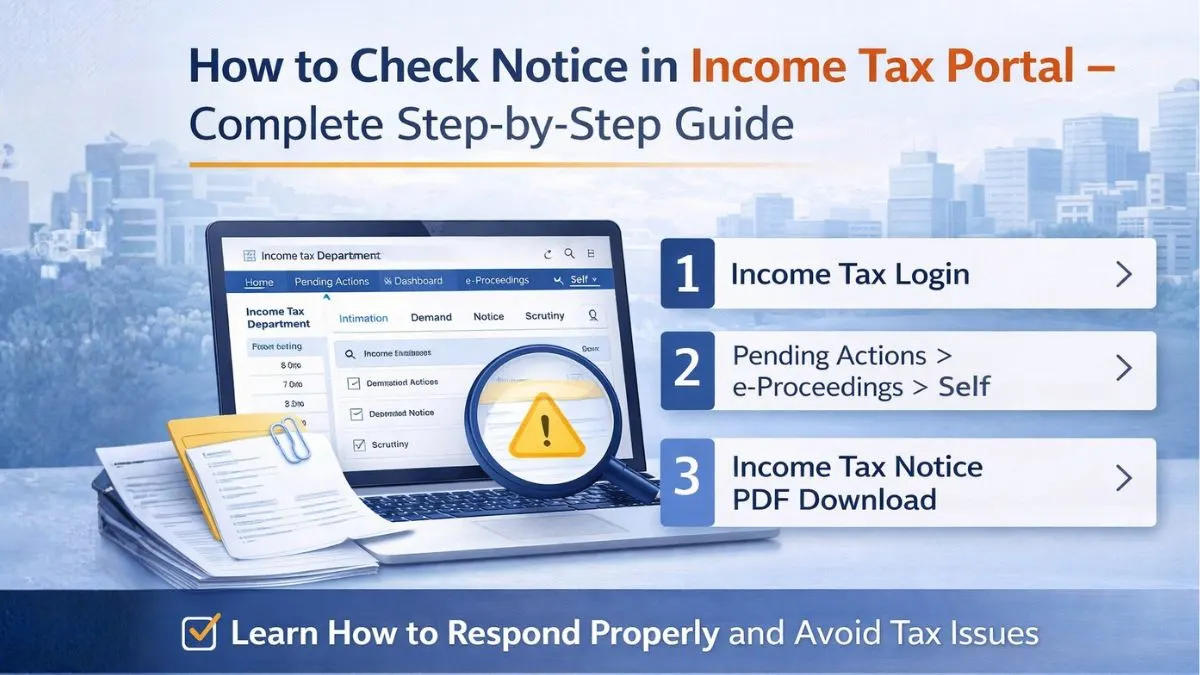

- Go to https://www.incometax.gov.in

- Log in using your PAN

- Click on ‘e-Proceedings’ > ‘Defective Returns’

- View the notice under section 139(9) of income tax act

- Check the error code and reason for the defect

- Download the JSON, make corrections using the correct ITR form

- Re-upload the corrected return

Yes, it’s that straightforward—if you don’t panic.

📘 Section 139(9) in English vs. Hindi

Taxpayers often search for:

- Section 139(9) of the income tax act in english

- Section 139(9) of the income tax act in hindi

So let’s explain both:

In English:

A return is considered defective if it’s missing essential details, documents, or is filed in the wrong form. You must rectify it within 15 days.

In Hindi (सरल भाषा में):

अगर आपने अपनी आयकर रिटर्न में ज़रूरी दस्तावेज़ नहीं लगाए हैं या गलत फॉर्म चुना है, तो विभाग आपको धारा 139(9) के तहत नोटिस भेज सकता है। इसे 15 दिनों में सुधारना ज़रूरी है।

🧾 Is This Serious?

A lot of people ask: “Is this a big deal?”

Well, yes and no.

It’s not a penalty notice. But if ignored, it can void your return. And that’s serious—because it could mean losing your refund, getting penalised later, or being non-compliant under the law.

📌 Quick Facts Summary Table

|

Detail |

Info |

|

Law |

Section 139(9) of the Income Tax Act 1961 |

|

What is it? |

It flags defective returns |

|

Why issued? |

Incomplete or incorrect ITR |

|

Notice type |

Notice under section 139(9) |

|

Response time |

15 days from notice |

|

Common issues |

Form errors, missing documents |

|

Languages supported |

English, Hindi |

|

Related sections |

44AA, bare act, 2013 provisions |

|

Common errors |

Error Code 86, 31, 38, 202, 999 |

🧠 Final Thoughts

Don’t stress if you receive a notice under section 139(9) of the Income Tax Act 1961. It’s fixable. Take a deep breath. Read the notice. Understand the error code. Fix the return.

And yes—file it again within the deadline.

Tax rules are designed to help, not just punish. Treat this as a second chance to get your return right.

🗣️ Need Help?

Still confused about your notice u/s 139(9) of the Income Tax Act?

We’re here to guide you. Drop your question in the comments or visit CallMyCA.com to consult with a CA who’ll handle it for you, stress-free.