If you're investing in mutual funds or units of a trust, you've probably heard of Section 194K of the Income Tax Act. Introduced to bring clarity & consistency in TDS treatment on income from mutual fund units, this provision ensures that taxes are collected upfront on specified types of income.

But what exactly is covered? Do capital gains attract TDS under this section? Who is responsible for deducting & depositing this tax?

Let’s break down everything you need to know about Section 194K in a simplified & practical manner.

What is Section 194K of the Income Tax Act?

Section 194K mandates that TDS (Tax Deducted at Source) must be deducted on any income in respect of units of mutual funds or specified companies, except capital gains.

This section applies to:

✅ Income from mutual fund units

✅ Income from units of specified companies

✅ Income from units of UTI (Unit Trust of India)

Why Was Section 194K Introduced?

Earlier, there was confusion about how dividend income from mutual funds should be taxed. Before FY 2020–21, dividend income was tax-free in the hands of investors, & mutual funds paid Dividend Distribution Tax (DDT).

However, with the abolition of DDT, dividends became taxable in the hands of investors, & Section 194K was introduced to ensure that tax is collected at the source before payment."

TDS Rate Under Section 194K

TDS is applicable as follows:

|

Income Type |

TDS Rate |

|

Dividend Income (from units) |

10% (if PAN is provided) |

|

|

20% (if PAN not provided under Section 206AA) |

|

Not covered under Section 194K |

So, only dividend income from mutual funds is subject to TDS under this section, not capital gains arising from sale/redemption.

When Is TDS Under Section 194K Deducted?

TDS under Section 194K is deducted at the time of credit or payment, whichever is earlier.

If the dividend amount is more than ₹5,000 in a financial year for a particular investor (across all folios), TDS becomes applicable.

Who Is Liable to Deduct TDS?

✔ Mutual Fund Houses

✔ AMCs (Asset Management Companies)

✔ RTAs (Registrar & Transfer Agents) acting on behalf of mutual funds

✔ Any person responsible for paying such income

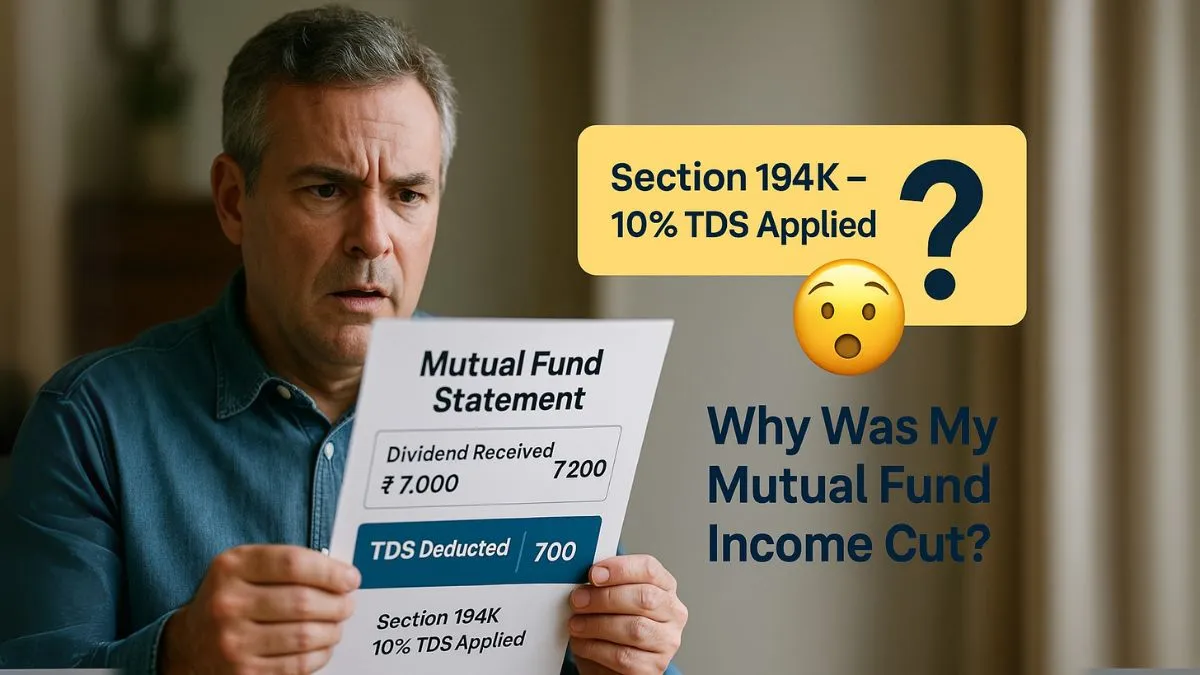

For example, if HDFC Mutual Fund pays ₹7,000 as a dividend to an investor, it must deduct 10% TDS (₹700) & credit only ₹6,300 to the investor’s bank account."

Exemptions & Thresholds

- If the total dividend paid during the year is ₹5,000 or less, no TDS is deducted under Section 194K.

- No TDS on capital gains (short-term or long-term) from the sale of mutual fund units.

- Resident individuals can submit Form 15G/15H to avoid TDS if their total income is below the taxable limit.

Illustration

Let’s say Ms. Priya has invested in mutual fund units & receives ₹12,000 in dividends in FY 2024–25. Since this exceeds the ₹5,000 threshold:

- TDS = 10% of ₹12,000 = ₹1,200

- Net payment received = ₹10,800

- The AMC will deposit the TDS with the government & report it in Form 26AS

Priya can claim credit for the TDS when filing her ITR.

Frequently Asked Questions (FAQs)

Q1. Does Section 194K apply to capital gains from mutual funds?

❌ No. It applies only to dividend income, not capital gains.

Q2. What is the TDS threshold under Section 194K?

TDS applies only if the total dividend income exceeds ₹5,000 in a financial year.

Q3. Can I submit Form 15G or 15H?

✅ Yes, if you’re eligible (e.g., senior citizens or income below the taxable limit), you can submit these forms to avoid TDS.

Q4. Is TDS applicable to SIP returns?

No. SIP returns usually comprise capital gains, which are not subject to TDS under Section 194K.

Q5. How can I claim TDS deducted under Section 194K?

Declare the dividend income in your ITR & claim credit for the TDS as reflected in Form 26AS.

Common Mistakes to Avoid

❌ Assuming TDS is applicable on all mutual fund income, including capital gains

❌ Forgetting to declare dividend income while filing ITR

❌ Overlooking multiple folios when calculating the ₹5,000 threshold"

❌ Not updating PAN with the fund house—leads to 20% TDS under Section 206AA

Conclusion

Section 194K has brought clarity to the taxation of mutual fund income by separating dividend income (subject to TDS) from capital gains (exempt from TDS). Investors need to keep track of dividend income & PAN status to ensure correct TDS treatment.

Knowing the rule ensures better tax planning & avoids unpleasant surprises during ITR filing.

👉Don’t let TDS eat into your mutual fund returns. Our experts at Callmyca.com can help you track, claim, & optimise your tax on mutual fund income under Section 194K. Book your free consultation now & invest smart, tax smarter!