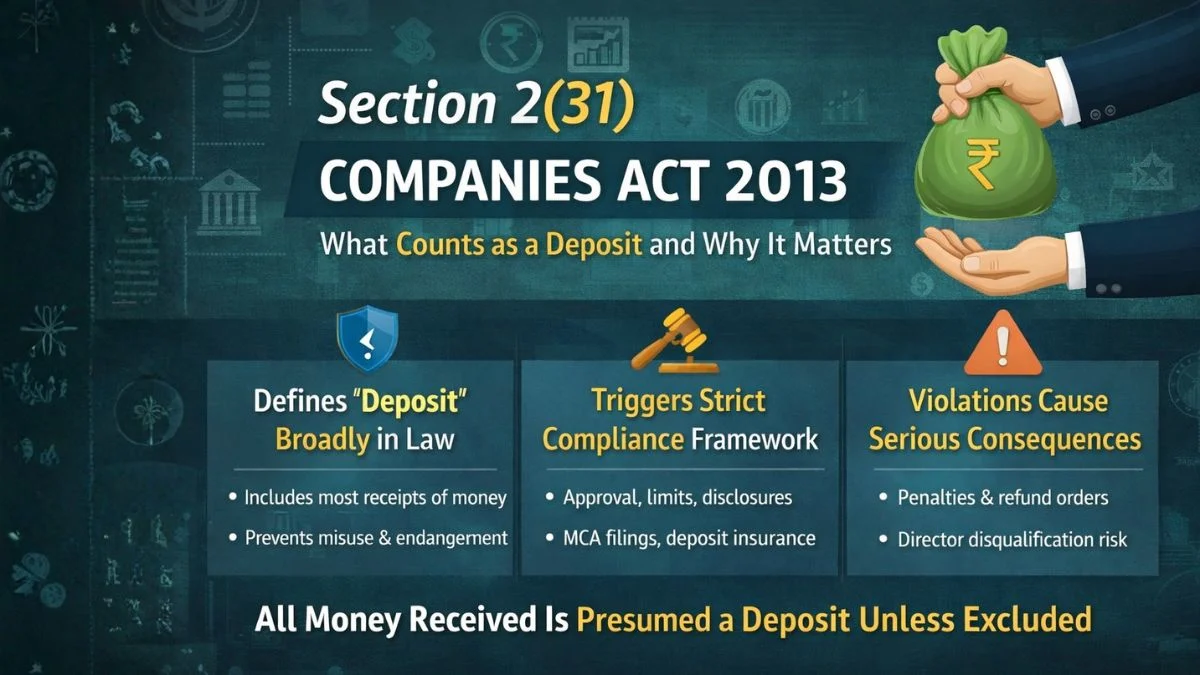

Section 2(31) of the Companies Act, 2013—What Counts as a Deposit and Why It Matters

Money coming into a company looks simple on the surface.

Someone gives money.

The company uses it.

Life moves on.

But in company law, how money comes in matters more than people realize.

Because the moment a receipt of money is classified as a deposit, an entire compliance framework gets triggered.

That’s exactly why Section 2(31) of the Companies Act, 2013, exists.

It draws the legal boundary between normal funding and regulated deposits—and crossing that line accidentally can cause serious trouble.

Why Section 2(31) Is More Important Than It Sounds

Many directors assume:

“It’s just a loan.”

“It’s from a friend.”

“It’s temporary.”

The law doesn’t care about intent alone.

Under company law, any receipt of money by way of deposit or loan can attract scrutiny unless it clearly falls under permitted exceptions.

That’s why understanding this definition is not optional.

What Does Section 2(31) Actually Say?

In simple terms, section 2(31) of the Companies Act 2013 defines what a deposit is.

It states that deposits include any receipt of money by way of deposit or loan, but subject to rules and exclusions prescribed under the Companies Act.

That one sentence carries huge consequences.

How the Companies Act Defines Deposits

The key phrase here is

👉 The Companies Act defines deposits very broadly.

The law assumes that any receipt of money by way of deposit or loan is a deposit unless it is specifically excluded under the rules.

This flips the normal thinking.

Instead of asking,

“Is this a deposit?”

The law asks,

“Why is this NOT a deposit?”

Why the Definition Is Kept Broad

There’s a reason for this strict approach.

In the past, companies:

- collected money in informal ways

- avoided deposit rules by calling it “loan” or “advance”

- endangered public interest

Section 2(31) shuts that door.

It ensures transparency and protects investors and contributors.

Deposits vs Loans—The Common Confusion

Here’s where most people get stuck.

They think:

- deposits = public money

- Loans are private arrangements

But under law, that distinction is not automatic.

If money is received and:

- repayment is promised

- interest may or may not be involved

- it doesn’t fall under exemptions

Then it can still be treated as a deposit.

Companies May Accept Deposits From Both Members and Public

Another important clarification.

Yes, companies may accept deposits from both members and the general public—but only if they follow the law strictly.

This includes:

- eligibility conditions

- limits

- disclosures

- filing requirements

- deposit insurance

- repayment timelines

Accepting deposits is not illegal.

Accepting them casually is.

Member Deposits vs Public Deposits

There’s a clear legal difference.

Deposits From Members

- allowed under certain limits

- fewer conditions than public deposits

- still regulated

Deposits From General Public

- heavily regulated

- allowed only to eligible companies

- strict compliance mandatory

Both fall under section 2(31) of the Companies Act 2013.

Why Directors Get Notices Under Deposit Laws

Most deposit violations are not intentional.

They usually happen when:

- promoters park funds temporarily

- directors give unsecured loans

- family members fund operations

- old advances are not repaid

Over time, these amounts quietly become deposits in the eyes of the law.

And then notices arrive.

Real-Life Example (Very Common)

A director gives ₹50 lakhs to the company.

No agreement.

No board resolution.

No compliance.

Years pass.

Legally, this can be treated as a deposit, unless it qualifies under exclusions.

This is how innocent funding turns into compliance risk.

Section 2(31) and Deposit Rules Go Hand in Hand

Section 2(31) defines deposits.

The detailed conditions come from:

- Companies (Acceptance of Deposits) Rules

- exemptions

- MCA notifications

But everything starts with this definition.

If something qualifies as a deposit here, the rules follow automatically.

Why This Section Is Critical for Startups and Closely Held Companies

Startups often rely on:

- founder funding

- informal loans

- bridge arrangements

But informality is dangerous under company law.

Section 2(31) doesn’t care if:

- money came from a friend

- interest was charged

- documentation was weak

Only legal classification matters.

Common Mistakes Companies Make Under Section 2(31)

From practical experience, these mistakes repeat:

- assuming director loans are always safe

- not documenting source of funds

- ignoring timelines for repayment

- missing MCA filings

- not checking deposit exemptions

These errors attract:

- penalties

- refund directions

- disqualification risk

Why Section 2(31) Protects Both Sides

This law is not anti-business.

It:

- protects contributors from misuse

- forces companies to stay disciplined

- improves financial transparency

A clear deposit framework benefits everyone.

Section 2(31) in Simple Words

If money comes into a company, ask one question:

“Does this fall under permitted exceptions?”

If not, it is likely a deposit.

That’s the mindset Section 2(31) enforces.

Final Thoughts

To summarize:

- Section 2(31) of Companies Act 2013 defines deposits

- any receipt of money by way of deposit or loan is presumed to be a deposit unless excluded

- the Companies Act defines deposits broadly to prevent misuse

- Companies may accept deposits from both, members and the general public, but only with strict compliance

Most deposit violations happen due to ignorance, not intention.

But the law does not excuse ignorance.

🔗 Received Funds and Unsure If It Counts as a Deposit?

If your company has received money from directors, shareholders, or outsiders and you’re unsure whether it qualifies as a deposit under Section 2(31), getting clarity early can prevent serious penalties later. Before responding to any MCA notice or making repayments, it’s safer to review the transaction properly. You can explore professional guidance on deposit compliance and Companies Act advisory services at Callmyca.com.