Section 233 of Companies Act, 2013: The Fast Track Merger Route Explained Simply

Corporate restructuring is rarely optional.

Sometimes it’s about growth. Sometimes survival. And sometimes, just about cutting unnecessary complexity.

Earlier, even the smallest merger had to go through the same long, exhausting NCLT process. Hearings. Delays. Costs. For small companies and startups, it often felt disproportionate.

That’s exactly why Section 233 of the Companies Act, 2013 was introduced.

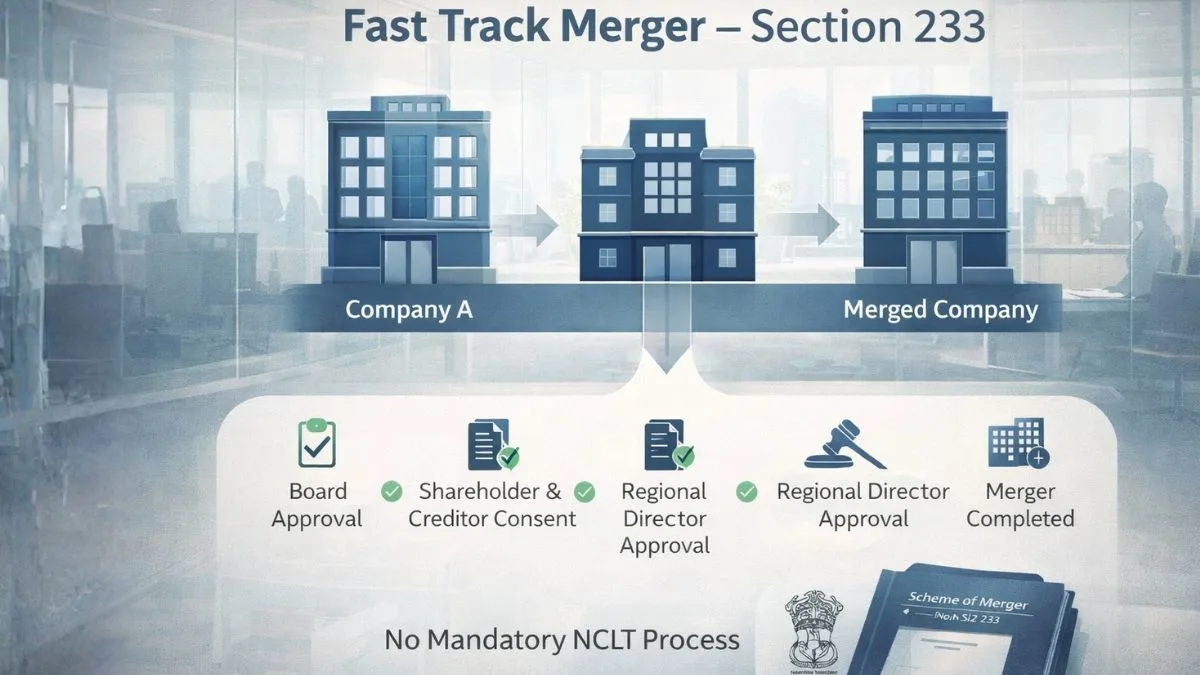

The idea was simple. If the risk to public interest is low, why force businesses into a slow judicial process? Section 233 creates a Fast Track Merger route. Faster approvals. Less paperwork. And no compulsory NCLT involvement.

What Section 233 of Companies Act, 2013 Actually Does

Section 233 allows certain companies to merge using a simplified procedure. Unlike traditional mergers under Sections 230 to 232, this route avoids the National Company Law Tribunal altogether.

Instead, approvals are handled administratively by the Central Government through the Regional Director.

This is not a shortcut. It’s a conscious policy decision. The law assumes that some mergers—especially within small or closely held structures—don’t need heavy judicial supervision.

For eligible companies, this provision saves time, money, and mental bandwidth.

Which Companies Can Use Section 233?

Not everyone qualifies. And that’s intentional.

Section 233 applies only to:

-

Two or more Small Companies

-

Two or more Start-ups

-

A Holding Company and its Wholly Owned Subsidiary

These structures usually involve fewer stakeholders and minimal public risk. That’s why the law treats them differently.

If a company does not fall into these categories, the regular merger route is mandatory. So eligibility isn’t a formality—it’s the foundation of the entire process.

Fast Track Merger vs Regular Merger: The Real Difference

The biggest difference?

No NCLT.

Instead of court hearings, the approval comes from the Regional Director. That alone cuts months off the timeline.

Costs also drop sharply. Fewer professional fees. Less documentation. Less uncertainty.

Even stakeholder approvals are simpler. Shareholders and creditors still have a say, but the mechanism is streamlined.

It’s efficient without being reckless. That’s the balance Section 233 tries to strike.

Role of the Central Government and Regional Director

Under Section 233, the Regional Director acts on behalf of the Central Government.

Once the merger scheme is submitted, the Regional Director checks:

-

Compliance with the Companies Act

-

Solvency of the companies

-

Any objection from the ROC or Official Liquidator

If everything is clean, approval is granted.

If something looks risky, the matter can still be referred to the NCLT. So the fast-track route isn’t blind. It just avoids unnecessary litigation.

Conditions That Must Be Met (No Shortcuts Here)

Section 233 is faster, but not casual.

Some key conditions include:

-

Approval by shareholders holding at least 90% of share capital

-

Consent of creditors representing a majority in value

-

Filing of declarations of solvency

These requirements ensure that speed does not come at the cost of financial stability or stakeholder protection.

Miss a condition, and the entire fast-track advantage disappears.

How a Fast Track Merger Actually Happens

It starts like any serious restructuring. With planning.

A merger scheme is drafted and approved by the boards. Notices are sent to shareholders, creditors, the Registrar of Companies, and the Official Liquidator.

Once approvals are in place, the scheme goes to the Regional Director.

If sanctioned, the merger becomes effective. Assets move. Liabilities follow. The legal identity reshapes—but the business continues.

Compared to traditional mergers, the timeline is dramatically shorter.

Why Businesses Prefer Section 233

The benefits are practical, not theoretical.

Lower costs.

Faster execution.

Less regulatory fatigue.

For startups and small companies, this matters a lot. They can restructure without putting growth plans on hold.

Holding companies also use Section 233 to clean up group structures by merging inactive or redundant subsidiaries.

It’s efficient. Predictable. And business-friendly.

Real-World Use of Fast Track Mergers

In practice, Section 233 is used for:

-

Internal group restructuring

-

Merging wholly owned subsidiaries

-

Startup consolidations

-

Simplifying compliance-heavy structures

Since there’s no prolonged litigation, businesses stay focused on operations rather than paperwork.

That’s exactly what the provision was designed for.

Conclusion: Section 233 Is About Smart Compliance

Section 233 of Companies Act, 2013 is not about bypassing the law. It’s about applying the law intelligently.

By allowing fast track mergers for low-risk entities, it removes unnecessary friction from corporate restructuring. Small Companies and Start-ups finally get a merger framework that understands their reality.

For eligible businesses, Section 233 isn’t just a convenience.

It’s a strategic advantage.