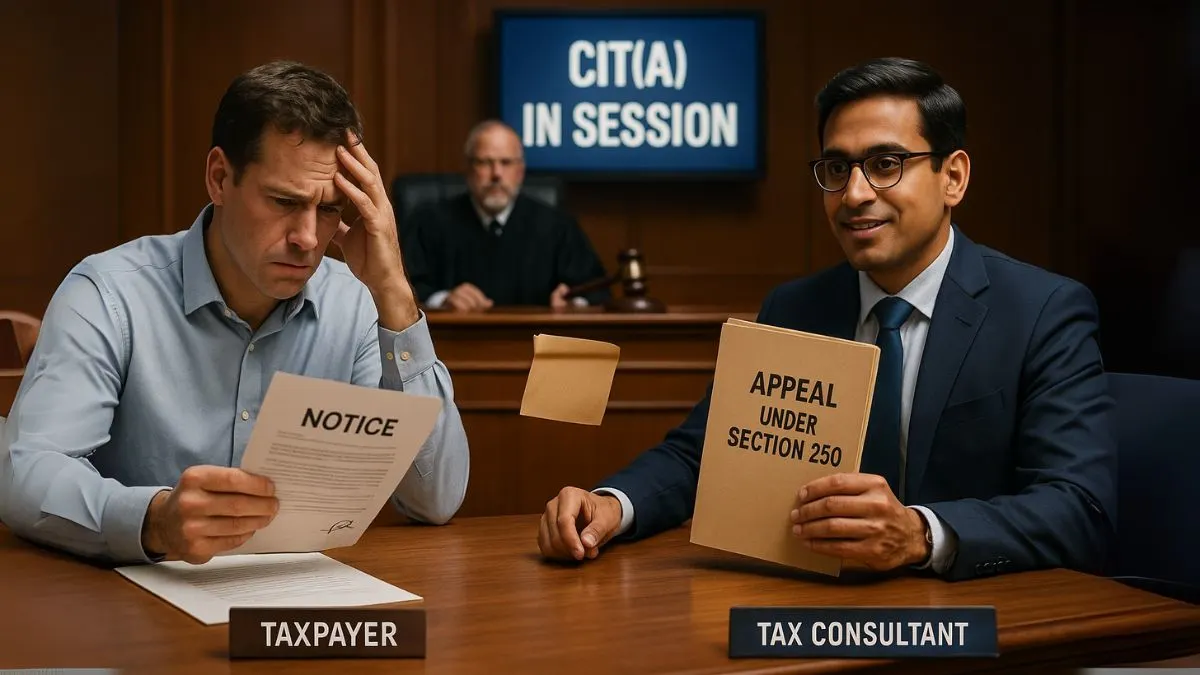

Let’s be honest—receiving a tax notice or facing a huge tax demand can feel overwhelming. But what if you strongly believe the assessment is unfair or incorrect? Thankfully, Indian tax laws give you a solid way to challenge it through the Income Tax Appeal process, & Section 250 of the Income Tax Act is at the heart of it.

Let’s break it down in simple terms—so you know exactly what happens when you file an appeal before the Commissioner of Income Tax (Appeals), also known as CIT(A).

🧾 What is Section 250 of the Income Tax Act?

Section 250 governs the procedure in an appeal before CIT(A). It provides a fair & structured opportunity to taxpayers who wish to appeal against orders passed by the Assessing Officer (AO).

It sets the ground rules: how the appeal should be heard, what rights you have, & how the CIT(A) must conduct the process. In short, Section 250 ensures the taxpayer gets a chance to be heard & the appeal is decided fairly.

📜 Filing an Appeal Under Section 250

Once the AO passes an assessment order that you disagree with—whether it's a high tax demand, wrongful addition, or disallowance of claim—you can file an appeal with the CIT(A).

Here’s what happens under Section 250:

- You file Form 35, the standard appeal form.

- You may submit supporting documents, financial statements, & written submissions.

- The Commissioner (Appeals) sends a notice, asking you to appear for a hearing.

This kicks off the income tax appeal process under section 250 of the Income Tax Act."

⏳ Time Limit for Filing Appeal

You must file the appeal within 30 days from the date of receiving the assessment order. This time limit is crucial—miss it, & you may lose your right to appeal unless condonation of delay is accepted.

If you're filing an appeal in section 250 of the Income Tax Act in Hindi, the law remains the same—the format may change, but the rights & procedures stay intact.

🧑⚖️ Opportunity of Being Heard

The principle of natural justice plays a huge role here. The law ensures that you, as an assessee, must be given a fair opportunity to be heard.

This means:

- The CIT(A) must send proper notice.

- You must be allowed to present your case—either personally or through an authorised representative.

- If you're not ready, you can even request an adjournment.

That’s the power of section 250 of the Income Tax Act opportunity of being heard—your voice cannot be ignored."

🔁 Adjournments – What If You Miss a Hearing?

Life happens. Sometimes, you may not be able to attend the hearing due to personal or professional reasons.

In such cases, you can request an adjournment under Section 250. But be mindful: the request must be genuine & reasonable. CIT(A) holds the power to accept or reject it.

This part of the law reflects the balance, giving flexibility but also ensuring the process isn’t delayed unnecessarily."

🛡️ Powers of the Commissioner of Income Tax (Appeals)

The CIT(A) is not just a formality. He or she has the power to:

- Confirm the AO’s order

- Reduce the tax demand

- Increase the tax demand (yes, that can happen!)

- Set aside the order & send it back for fresh assessment

This is why appealing under section 250 of the Income Tax Act powers of the commissioner of income tax appeals can be a double-edged sword. You need to prepare well & present your case properly.

📖 Example: How Section 250 Can Save You

Let’s say a salaried employee received an assessment order disallowing HRA exemption, creating a tax demand of ₹1.2 lakh. After filing an appeal under Section 250 & submitting rent agreements, bank transactions, & employer confirmation, the CIT(A) accepts the appeal & deletes the demand.

That’s the practical value of section 250 of the Income Tax Act, with an example—real relief in real situations.

📝 Written Submissions & Evidence

It’s not just what you say, but what you show. Filing written submissions, explanations, & documentary evidence can greatly increase your chances of winning the appeal.

That’s why expert help matters. The income tax appeal procedure under section 250 can be technical—having a tax professional makes a big difference.

💡 Final Order Under Section 250

After all hearings & documents are reviewed, the CIT(A) passes a speaking order—explaining what has been accepted, what is rejected, & why.

This final order can either:

- Give you full relief,

- Give partial relief, or

- Uphold the AO’s original order.

In rare cases, the CIT(A) may enhance the income, so be prepared & don’t treat the appeal as a formality."

🧭 Conclusion: Why You Shouldn’t Ignore Section 250

If you're someone who has received an assessment you don’t agree with, don’t panic or ignore it. Section 250 gives you a legal, fair, & systematic way to defend your case.

Understanding this section means knowing your rights, your responsibilities, & the exact income tax appeal procedure laid down under law.

💼 Need to File an Income Tax Appeal? We Can Help. At Callmyca.com, our expert CAs help you draft Form 35, represent your case before CIT(A), & build a strong written submission under Section 250. Don’t fight the tax department alone—get expert help today & improve your chances of winning.