In today’s push toward a digital economy, the Indian Income Tax Act includes several provisions to discourage the use of cash in business transactions. One of the most crucial sections in this regard is Section 40A(3) of the Income Tax Act. This section plays a pivotal role in promoting transparency, reducing tax evasion, & curbing black money by encouraging businesses to adopt digital payment methods.

What is Section 40A(3) of the Income Tax Act?

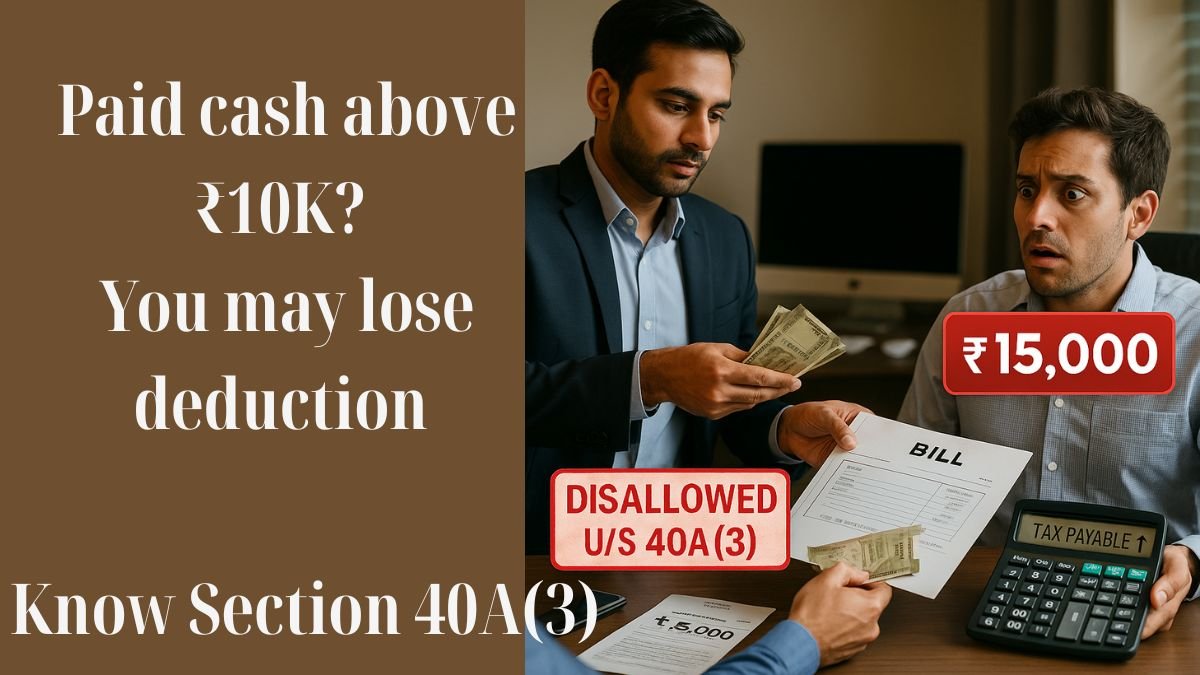

Section 40A(3) of the Income Tax Act deals with the disallowance of payments made in cash exceeding a certain limit. Specifically, all transactions exceeding Rs. 10,000 in a day to a single person are disallowed as a deduction, if paid in cash, while computing income under the head “Profits and gains of business or profession.”

This provision was inserted to discourage businesses from making large cash payments and instead encourage the use of digital payment modes or account payee cheques and drafts. "

Rule 6DD – The Relief Clause

It’s important to note that there are certain exceptions provided under Rule 6DD, which lists specific situations and recipients where payments in cash exceeding ₹10,000 are permitted. These may include:

- Payments made to government agencies

- Transactions in villages or areas with no banking facility

- Payments made on a day when banks were closed due to a strike or natural calamity

- Payments to transporters (subject to certain conditions)

Example for Better Understanding

Let’s understand Section 40A(3) of Income Tax Act with example:

Suppose a business owner makes a cash payment of ₹20,000 to a supplier on a single day for goods purchased. Since the payment exceeds ₹10,000 & is not through a banking channel, this amount will not be allowed as a deduction under Section 40A(3), unless it falls under any of the exceptions to Section 40A (3) of the Income Tax Act as listed in Rule 6DD. "

Applicability and Limit

- The limit under section 40a(3) of the Income Tax Act is ₹10,000 per person per day.

- For transporters, the daily limit is ₹35,000.

- This section applies to individuals, firms, LLPs, companies, and other taxpayers engaged in business or a profession.

- The disallowance is applied in the year of actual payment, not when the liability is recorded.

Why Was Section 40A(3) Introduced?

The main purpose of this section is to regulate high-value cash transactions, reduce tax evasion, and encourage businesses to go digital. Large cash transactions are difficult to track and easy to manipulate. With Section 40A(3), enterprises are nudged to maintain proper records & carry out transactions through verifiable modes.

Important Judicial Precedents

Over the years, various case laws have clarified the scope and exceptions to section 40a(3). Courts have emphasised that genuine hardship, business exigencies, or cash-only vendors in remote areas may justify cash payments, but the burden of proof lies on the taxpayer.

Compliance Tips for Businesses

- Never split a payment into smaller chunks to bypass the ₹10,000 limit—this still attracts disallowance if done to the same person on the same day.

- Use account payee cheques, demand drafts, or bank transfers for higher payments.

- Maintain documentation if a cash payment was unavoidable under Rule 6DD exemptions.

- Educate vendors & staff to avoid cash transactions wherever possible.

Amendment in Section 40a(3) of Income Tax Act

The section has seen several amendments over time to plug loopholes and tighten compliance. From AY 2018-19 onwards, the ₹10,000 limit was enforced more strictly, & tax authorities have been closely monitoring high-value cash dealings.

For instance, the amendment in section 40a(3) of the Income Tax Act in 2017 clarified that even if payment is split across multiple bills or invoices, the disallowance still applies if the cash amount on any day exceeds ₹10,000 to the same person.

Common Misconceptions

Many taxpayers believe that if they record a transaction properly in their books, the mode of payment does not matter. However, under section 40a(3) of the Income Tax Act, the mode of payment is a key factor, and failure to comply results in loss of deductions.

Another common misconception is that the rule only applies to large businesses. In reality, Section 40A(3) applies to all businesses claiming deductions, regardless of size.

Final Thoughts

Section 40A(3) of the Income Tax Act is a strong reminder that cash is no longer king in the world of taxation. The government’s objective is clear: minimise cash dealings, ensure accountability, & boost the digital ecosystem. By understanding the provisions, exceptions to section 40a(3), & the importance of digital compliance, taxpayers can avoid penalties & ensure that their deductions are not disallowed during assessment.