Section 80GGC Donation Notices: What’s Really Happening and What You Should Do Now

If you’ve donated to a political party and claimed a deduction under Section 80GGC, chances are you’ve felt that sudden jolt of panic.

An SMS.

An email.

Or worse—a proper notice under Section 143(2) or Section 148.

And immediately, the same questions hit your mind.

“Did I do something wrong?”

“Will I have to pay tax again?”

“Is that 200% or 300% penalty real?”

You’re not alone. Thousands of salaried taxpayers across India are facing the exact same situation right now.

Let’s slow this down. Breathe.

Because most people receiving these notices are not fraudsters—they’re just caught in a much larger net.

Why Are Section 80GGC Notices Being Sent in Bulk?

This wave of notices didn’t start randomly.

The Income Tax Department ran large-scale AI-based data analysis covering the last four assessment years. The system flagged salaried individuals who:

- Donated 10% to 50% of their income to political parties

- Claimed 100% deduction under Section 80GGC

- Had no further political or public profile

Once patterns emerged, investigations moved deeper.

What the department claims to have found is worrying:

- Many political parties never contested elections

- Several parties did not file their own ITRs

- Donor lists were not uploaded with the Election Commission of India

- During raids, statements were allegedly recorded that donations were returned in cash after bank withdrawals

Based on these statements, notices were issued not selectively, but almost to everyone who claimed 80GGC.

That’s why even genuine donors are getting notices.

First Things First: What Section 80GGC Actually Requires

Forget the noise. The law itself is very simple.

Section 80GGC allows deduction only if two conditions are met:

- The political party must be registered under the Representation of People Act, 1951

- The donation must be made only through non-cash modes

(online transfer, check, RTGS, UPI—anything but cash)

That’s it.

There is no condition in the law that:

- the party must contest elections

- the party must file returns on time

- the party must upload donor lists

Those are party-side compliances, not yours.

If you have:

✔ bank transaction proof

✔ a valid donation receipt

Then legally, your deduction is valid.

Why Genuine People Are Still Panicking

Because the notices don’t accuse politely.

They hint.

They suggest.

They imply wrongdoing without proof.

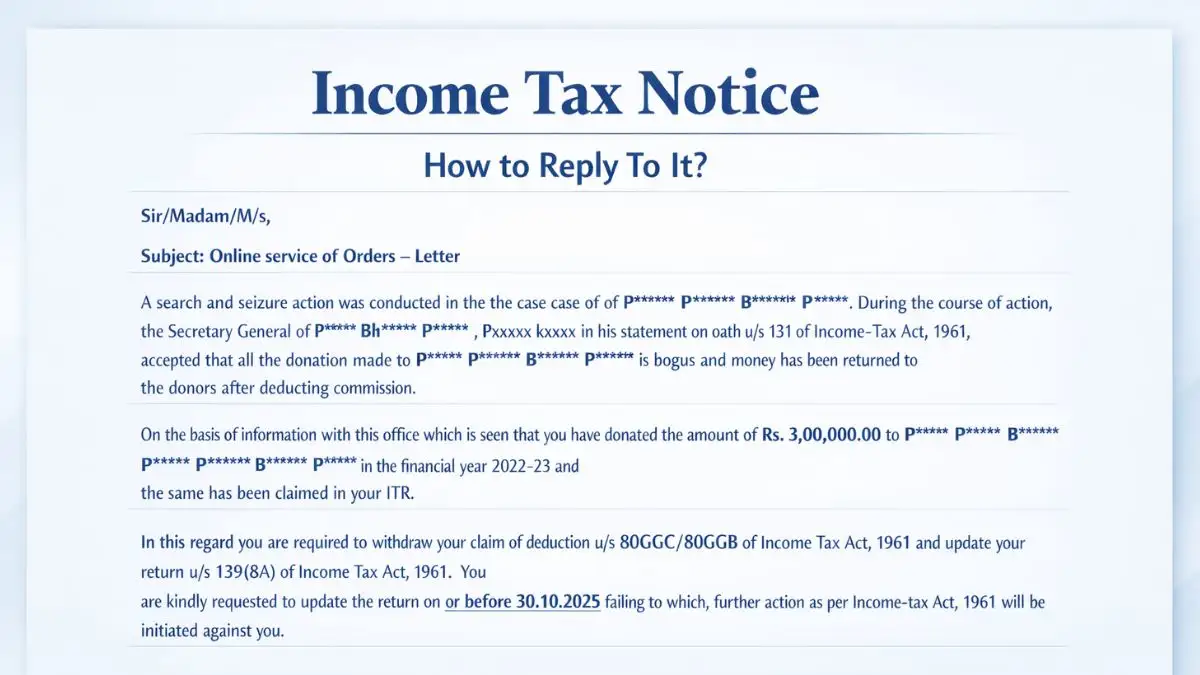

Most notices are framed like this:

“It appears that the donation claimed may be accommodation in nature…”

That single sentence is enough to trigger fear.

But remember this clearly:

👉 Allegation is not proof.

And in tax law, the burden of proof lies on the department once you show compliance.

Before You Even Think of Replying—Check This

Be honest with yourself. This step matters.

You can defend your case only if all three are true:

- You have a proper donation receipt

- The donation was made via bank

- There is nothing else in your deductions/exemptions that is questionable, and there is no trace of a cash deposit in your account.

If you:

❌ don’t have a receipt

❌ can’t show a bank entry

❌ deposited equivalent cash soon after

Then defense becomes extremely weak. In such cases, a damage-control approach is smarter.

But if your documents are clean, you absolutely can fight this.

Documents That Decide Your Fate

This is non-negotiable. You need:

1. Donation Receipt

Must clearly mention:

- Your name, PAN, address

- Party’s name & PAN

- Date, amount, payment mode

- Line stating “Eligible under Section 80GGC”

2. Bank Statement

The exact debit entry.

No narration mismatch. No cash link.

3. Donor List Verification (If Available)

Check whether your PAN appears in the list filed by the party with the Election Commission.

Helpful—but not mandatory.

How to Reply to an 80GGC Notice (The Right Way)

This is where most people make fatal mistakes.

They panic.

They write emotional replies.

They admit things they shouldn’t.

Your reply must be structured, calm, and legally aggressive.

Step 1: Discharge Your Legal Duty

State clearly:

- Donation made via banking channel

- Party registered under law

- Receipt and proof attached

Make it clear that you complied fully with Section 80GGC.

Step 2: Shift the Burden of Proof

This is critical.

Politely but firmly say:

“If it is alleged that cash was returned, kindly provide concrete evidence.”

No proof = no disallowance.

Step 3: Demand Recorded Statements

Ask for:

- Copy of any statement where your name or PAN is mentioned

- Date and authority recording such statement

Most cases fail right here.

Step 4: Assert Your Right to Cross-Examination

This is your constitutional right.

If someone has accused you indirectly, you have the right to question them.

Step 5: Establish Genuineness

Explain why you donated.

Was it:

- ideological alignment?

- event participation?

- membership?

- local influence?

Human reasons matter. Silence hurts.

Step 6: Reasonableness Matters

A donation of up to 10% of income is far easier to defend than 40–50%.

If yours is higher, justification must be stronger—but still possible.

What If You Want Peace, Not a Fight?

Litigation isn’t for everyone. And that’s okay.

If you decide to pay tax without admitting fraud, you must protect yourself.

Your submission must say:

- Payment is made in good faith

- Payment is made for peace of mind

- You are seeking immunity from penalty

This language can save you from 100%–300% penalties.

A Simple Analogy That Officers Understand

Think of it like this.

You bought a train ticket:

- Paid through the official counter (bank)

- Have the ticket (receipt)

You cannot be fined as ticketless just because the railway failed to update its passenger database.

The same logic applies here.

Why Most People Lose These Cases

Not because the law is weak.

But because:

- replies are poorly drafted

- facts are mixed with emotions

- wrong admissions are made

- no legal strategy is followed

An 80GGC notice is not routine compliance.

It is litigation-level scrutiny.

Why Professional Handling Changes Everything

A properly drafted reply:

- blocks penalty proceedings

- forces the department to prove allegations

- increases chances of full relief

- protects future years from scrutiny

This is not DIY territory.

How Our Notice Handling Service Helps You

At Callmyca.com, we don’t send template replies.

We:

- analyse your documents

- assess defendability honestly

- draft legally sound replies

- handle scrutiny & reassessment notices

- focus on penalty protection, not just tax

Most importantly—we don’t panic you into payment if defense is possible.

Final Thoughts

Notices issued under Section 80GGC are not routine compliance matters. A single poorly worded sentence, an unnecessary explanation, or a hurried reply can later become the basis for penalties or prolonged litigation. When the documents are genuine, the law is often on the taxpayer’s side—but the outcome depends entirely on how the response is drafted and presented.

If you are not confident about handling the notice on your own, or if you want to avoid unnecessary stress, risk, and future scrutiny, getting the reply drafted and handled professionally is usually the safest decision—especially when scrutiny, reassessment, or penalty exposure is involved.

👉 For professional assistance with Section 80GGC notice replies, scrutiny handling, and penalty protection, you can check the dedicated service here:

https://callmyca.com/

The right guidance at this stage does not just help in saving tax—it also protects you from future notices, penalties, and long-term compliance issues.

For more information, feel free to contact us directly on WhatsApp:

👉 https://wa.me/message/LJUJYQOPZ3BPL1