How to Claim an Income Tax Refund in India?

Step-by-Step Guide for FY 2024–25 | AY 2025–26

If you’ve paid more tax than your actual liability—either through TDS, advance tax, or self-assessment—you are eligible to receive an income tax refund from the Income Tax Department.

Now the important question is:

“How can I claim my income tax refund?”

Here’s a complete and updated guide on how to claim your refund correctly and smoothly.

✅ What Is an Income Tax Refund?

An income tax refund is the extra amount you paid in taxes that is eligible to be returned to you after proper assessment of your Income Tax Return (ITR).

It usually arises due to:

1. Excess TDS deducted on salary, FD interest, rent, etc.

2. Advance tax or self-assessment tax paid beyond the actual liability

3. Not declaring deductions (like 80C, 80D) to employer or bank

🛠️ How to Claim Income Tax Refund – Step-by-Step

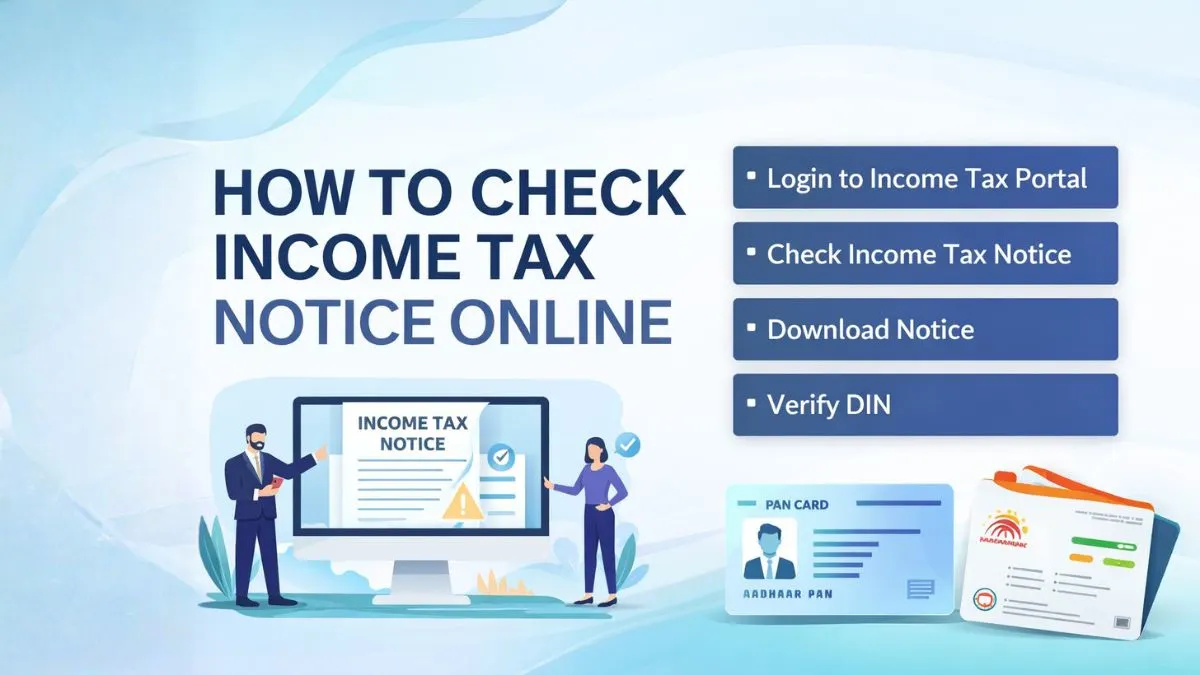

🔹 Step 1: Log in to the Income Tax Portal

- Visit: https://www.incometax.gov.in

- Log in with PAN, password, and captcha

🔹 Step 2: Choose the Right ITR Form

Based on your income source:

- ITR-1 – Salaried individuals with income < ₹50 lakh

- ITR-2/3/4 – For business, multiple properties, capital gains, etc.

🔹 Step 3: Declare All Income & Deductions

- Include income from all sources: salary, interest, rent, etc.

- Claim all applicable deductions (80C, 80D, HRA, home loan interest)

- Select the correct tax regime (Old or New)

🔹 Step 4: Enter TDS and Tax Payments

Auto-import or manually fill TDS details from:

- Form 26AS

- AIS (Annual Information Statement)

- Form 16 (from the employer)

- Ensure accuracy in PAN, TAN, and challan details

🔹 Step 5: Validate and Submit the ITR

- Preview your ITR

- Confirm the refund amount (if tax paid > tax payable)

- Click “Submit” and proceed to e-Verification

🔹 Step 6: E-Verify the Return

Choose any of the following:

- Aadhaar OTP

- Net banking

- EVC via bank account/Demat

- ITR-V (send by post if digital methods fail)

📌 The refund process starts only after e-verification.

🔹 Step 7: Track Your Refund

- Log in to the income tax portal → e-File > View Filed Returns

- OR use NSDL refund tracker: https://tin.tin.nsdl.com/oltas/refundstatuslogin.html

⏱️ When Will I Get the Refund?

1. Usually credited within 7 to 45 days after the ITR is processed

2. Paid to your pre-validated bank account

3. Processed by CPC Bengaluru

❗ What If Refund Is Delayed?

| Reason | Action to Take |

| Invalid bank account | Update and re-validate bank details |

| ITR not verified | E-verify immediately |

| Refund failed | File a refund reissue request online |

| Processing delay | Raise a grievance on the portal |

Final Words

To claim an income tax refund, you must file your ITR accurately, verify it, and ensure your bank account is pre-validated.

Always reconcile your Form 26AS, AIS, and salary slips before filing.

💡 Don’t let your excess tax payments go unclaimed! Get expert help to file your ITR, claim your income tax refund hassle-free, and stay compliant—visit Callmyca.com and let professionals handle your taxes while you focus on what you do best!