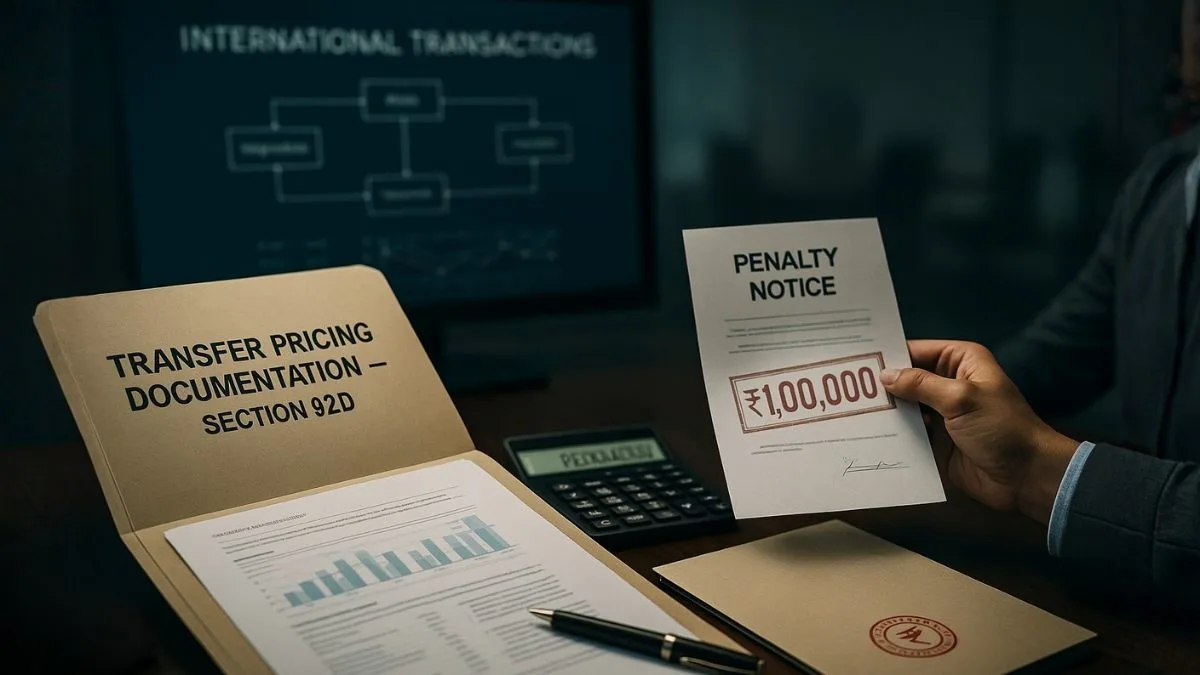

When companies operate across countries, transactions with related parties become common — selling goods, charging royalties, or offering services to a parent or subsidiary. But such relationships can blur pricing boundaries. If a company overcharges or undercharges intentionally, profits may shift from high-tax countries to low-tax ones. To control that, India’s transfer pricing regulations (Sections 92–92F) were introduced. These rules require businesses to prove that their related-party transactions are done at arm’s length — the same price they would use with an unrelated party.

Section 92D says these businesses must keep proper documentation.

And if they don’t? That’s where Section 271G comes in — to penalize non-compliance & enforce accountability.

Understanding Section 271G in Simple Terms

Section 271G of the Income Tax Act, 1961 authorizes the Assessing Officer (AO) or the Transfer Pricing Officer (TPO) to impose a penalty when a taxpayer fails to provide documents or information demanded under Section 92D(3). In essence, it penalizes failure to submit transfer pricing documentation related to international or specified domestic transactions.

It doesn’t matter whether the transaction was genuine or not; if the required papers aren’t produced on time, the penalty applies.

Quantum of Penalty

The law is clear about the amount — 2% of the value of each transaction where documentation isn’t furnished.

Let’s say an Indian company has transactions worth ₹25 crore with its foreign parent company. If it doesn’t submit the required documentation when the officer asks for it, the penalty could be ₹50 lakh (that’s 2% of ₹25 crore).

It’s not a lump-sum fine — it scales with the transaction value. For businesses with multiple transactions, this can quickly turn into a massive financial hit.

Purpose Behind Section 271G

The idea isn’t just to collect penalties. It’s about creating a culture of transparency. Transfer pricing documentation helps the tax department verify whether related entities have priced their transactions fairly. It protects the Indian tax base & builds credibility in international tax practices.

By requiring companies to disclose their pricing methods, agreements, and financial data, the government ensures cross-border dealings aren’t used to erode taxable profits.

Also Read: The Core of International Taxation and Transfer Pricing

Who Can Impose the Penalty

Three authorities can impose penalties under this section:

- The Assessing Officer (AO)

- The Transfer Pricing Officer (TPO)

- The Commissioner (Appeals)

However, before any penalty is applied, the officer must establish that:

- A formal notice was issued under Section 92D(3) requesting specific information, and"

- The assessee didn’t comply within the allowed time.

Only then can a penalty under Section 271G be justified. The provision doesn’t allow arbitrary use.

The Documentation Requirement under Section 92D

Section 92D requires every person engaged in international or specified domestic transactions to maintain a full set of transfer pricing records.

These records help demonstrate that the transaction is at arm’s length price (ALP).

According to Rule 10D of the Income Tax Rules, the following documents should be ready & updated each financial year:

- Ownership & structure of the group and its associated enterprises

- Nature, terms, and details of each transaction

- Functional analysis — what functions were performed, what assets used, what risks taken

- Economic analysis and selection of transfer pricing methods

- Comparable data for benchmarking

- Financial statements, business strategies, and assumptions used

- Inter-company agreements & invoices

Maintaining these records on time is what keeps businesses out of trouble with Section 271G.

Time Limit for Submission

Once a notice is received under Section 92D(3), the taxpayer has 30 days to provide the requested documents.

If there’s a valid reason, the officer may grant a 30-day extension, but that’s discretionary.

Failure to respond within this period makes the taxpayer liable for a Section 271G penalty — even if they later produce the documents.

Example: When the Penalty Applies

Imagine XYZ Ltd., an Indian company supplying software to its US subsidiary. During assessment, the TPO issues a notice asking for supporting documents: agreements, cost sheets, and benchmarking data.

XYZ submits only invoices but fails to provide the full transfer pricing report or functional analysis within the deadline."

Even if the pricing turns out to be correct later, the company still violates Section 92D(3) by not furnishing documents.

As a result, a penalty under Section 271G — equal to 2% of transaction value — becomes applicable.

Also Read: The TDS Default That Can Slash Your Tax Deductions

Reasonable Cause: Section 273B Protection

Fortunately, there’s a safeguard.

Under Section 273B, no penalty will be imposed if the taxpayer can prove there was a reasonable cause for not furnishing the documents on time.

For instance:

- Records were lost due to technical failure or system crash,

- Data from the foreign group company was delayed,

- Sudden change in management led to internal disruption, or

- The company genuinely believed that the transaction didn’t qualify as a specified domestic transaction.

If such reasons are credible & backed by evidence, authorities often drop the penalty.

Judicial Interpretations of Section 271G

Over time, tax tribunals have clarified that intent matters.

Here are a few important cases:

- DCIT v. Leroy Somer & Controls (India) Pvt. Ltd. (ITAT Chennai, 2013)

The Tribunal held that if the assessee provides documents later during proceedings, and there’s no intention to conceal, the penalty should not be imposed. - Mitsui & Co. India Pvt. Ltd. v. CIT (Delhi HC, 2017)

The Delhi High Court observed that Section 271G is not automatic. Authorities must establish that the failure was deliberate and not due to procedural delay. - Gharda Chemicals Ltd. v. DCIT (ITAT Mumbai, 2018)

The ruling emphasized that where partial documentation was furnished & cooperation shown, penalty shouldn’t apply. The section’s purpose is compliance, not punishment.

These cases show that while Section 271G is strict, it’s not meant to penalize honest mistakes.

Common Mistakes Leading to Penalty

Many companies fall into the penalty trap due to simple oversights:

- They prepare documentation only when a notice arrives, not beforehand.

- They assume transfer pricing applies only to foreign transactions, ignoring domestic ones.

- They delay data collection from group companies abroad.

- They fail to maintain updated functional & benchmarking analyses annually.

By the time the notice lands, 30 days isn’t enough to reconstruct everything — and that’s how penalties arise.

How to Avoid Penalty under Section 271G

A few disciplined practices can make all the difference:

- Keep a Yearly Transfer Pricing File: Don’t wait for the assessment. Prepare & review documentation every year.

- Use Comparable Data Proactively: Benchmark using public databases & keep printouts or records ready.

- Maintain Contracts & Communications: Agreements with group companies and internal emails supporting pricing logic are valuable evidence.

- Conduct an Annual TP Review: Engage a CA or TP consultant to audit documentation health.

- Request Extension in Writing: If you can’t meet the deadline, file a formal request before the expiry of 30 days.

These steps ensure full compliance — and peace of mind.

Also Read: Tax-Free Benefits from Provident Funds and Sukanya Samriddhi Account

Real-World Impact

For multinational companies, a Section 271G penalty can trigger more than just monetary loss. It signals poor compliance culture, invites deeper transfer pricing audits, and sometimes delays corporate approvals like repatriation of funds.

Even for smaller firms, it can snowball into disputes & additional scrutiny in future years."

That’s why proactive documentation isn’t just a legal formality — it’s part of sound corporate governance.

Quick Summary Table

|

Particulars |

Details |

|

Relevant Section |

Section 271G of the Income Tax Act, 1961 |

|

Related Section |

Section 92D (Transfer Pricing Documentation) |

|

Applicability |

International & Specified Domestic Transactions |

|

Penalty Amount |

2% of the value of each transaction |

|

Authority to Impose |

AO / TPO / Commissioner (Appeals) |

|

Relief Provision |

Section 273B – No penalty if reasonable cause exists |

|

Purpose |

To ensure timely documentation & transparency in transfer pricing |

Conclusion

In short, Section 271G of the Income Tax Act is a compliance-driven provision, not a revenue-generating one. It nudges businesses to stay documentation-ready for all related-party transactions. Maintaining proper transfer pricing records doesn’t just prevent penalties — it strengthens your credibility during assessments & future audits.

If your organisation handles international or domestic related-party transactions, it’s time to review your documentation practices. Our CA experts at CallMyCA.com help companies build compliant transfer pricing files, respond to notices, and prevent penalties under Section 271G.