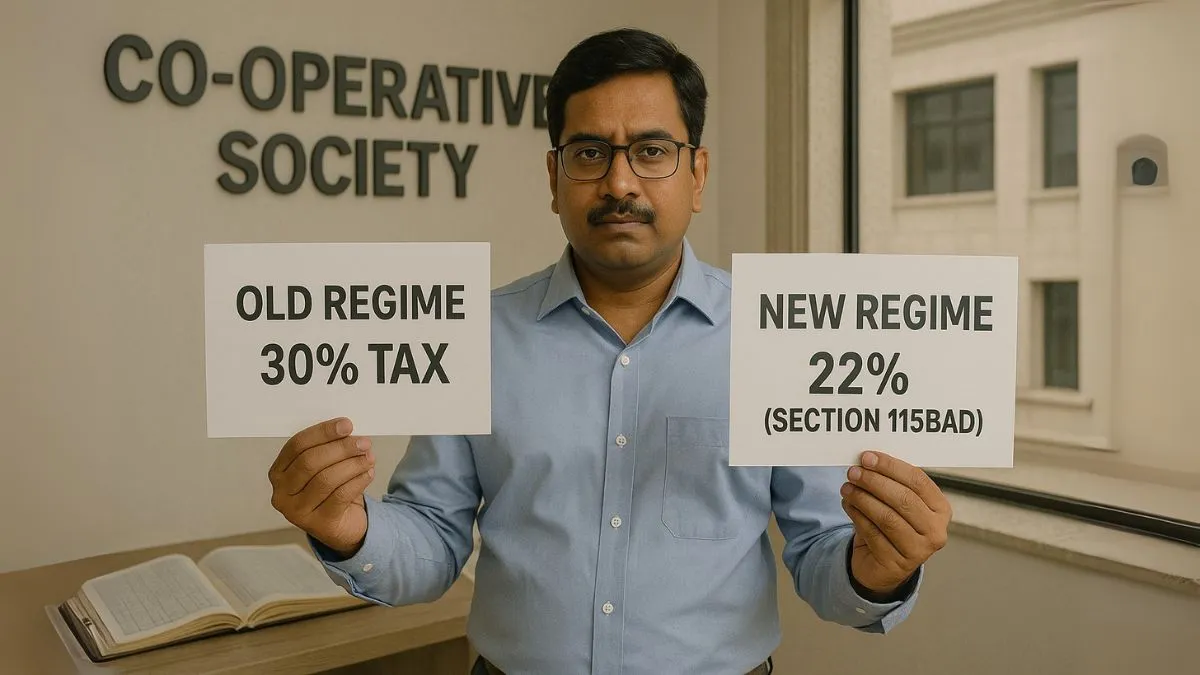

India’s taxation landscape is continuously evolving, and Section 115BAD of the Income Tax Act exemplifies this shift, extending the benefits of the “new tax regime” to co-operative societies. Introduced through the Finance Act, this provision offers eligible domestic co-operative societies the option to pay tax at a concessional rate of 22% (plus applicable surcharge and cess). However, this benefit comes with a caveat: the society must relinquish various deductions and exemptions available under the regular tax regime.

While the reduced rate appears attractive at first glance, the true benefit lies in understanding the underlying trade-offs. Section 115BAD is not a one-size-fits-all solution—it requires a careful evaluation of a society’s income structure, available deductions, and long-term tax planning strategy.

So, what are the precise provisions, conditions, & implications of opting for Section 115BAD? Let’s explore.

What is Section 115BAD?

Section 115BAD was inserted to give cooperative societies a choice. Instead of the usual slab-based taxation, societies can opt to pay tax at 22% (plus surcharge & cess), skipping several deductions & exemptions. But here’s the twist—once you choose this regime, you can’t just switch back.

This concessional regime reduces the tax liability significantly for cooperative societies, especially those not availing of too many deductions under the regular scheme. It becomes especially attractive for societies with stable income streams & lesser operational deductions.

Why Was It Introduced?

The government introduced this section to streamline compliance & reduce litigation. Cooperative societies often face audits & scrutiny, especially regarding disallowed expenditures. Sections like 40a(9), 40a(7), & 40a(2)(b) often come into play, questioning the legitimacy of certain expenses.

For instance, if your cooperative society pays a sum to an employee fund without fulfilling legal requirements, Section 40a(9) kicks in, disallowing that payment. Similarly, Section 40a(7) disallows provisions made for unapproved gratuity funds. The idea is simple: spend responsibly & legally.

Section 115BAD aims to offer peace of mind in return for fewer tax benefits. It essentially says, "Pay a bit less tax, but don’t ask for deductions."

How Does It Interact with Disallowance Provisions?

Here’s where it gets interesting. Though Section 115BAD promises a lower tax rate, you can’t escape the reach of disallowance provisions entirely. Even if you opt in, your books will still be checked for any non-compliance.

Let’s say your society makes payments in cash exceeding prescribed limits. Under Section 40a(3), these expenses can be disallowed. Similarly, if you transact with related parties without proper justification, Section 40a(2)(b) may apply, questioning the arm’s-length nature of payments.

Additionally, Section 14A disallows expenses related to exempt income. This means, if you earn tax-free dividends or agricultural income, expenses incurred to earn that income are not deductible.

Real-World Example: When It Works Wonders

Imagine a housing cooperative society that earns from membership fees & parking rentals. It has no major deductions under Chapter VI-A & doesn't claim depreciation or investment-linked deductions. For such a setup, switching to Section 115BAD can reduce their tax outgo instantly.

Even if some payments get flagged under expenses or payments not deductible in certain circumstances, the tax saved from opting for 115BAD usually outweighs the disallowed expenses.

But remember, no deduction shall be allowed in respect of any sum paid by the assessee as an employer for contributions to unapproved funds. So, even under 115BAD, your compliance has to be top-notch.

Should Every Cooperative Society Opt for 115BAD?

Not necessarily. If your society claims hefty depreciation, profit-linked deductions, or invests in specified assets, you might lose more than you gain. Each case must be evaluated individually.

One must also consider the interaction between 115BAD & provisions such as 40a(1)(b), especially if payments to non-residents or third-party entities are involved. TDS defaults can still lead to expenses being disallowed, regardless of the tax regime.

Compliance is Key

Just because you pay a flat 22% doesn’t mean you can relax on TDS compliance, payment caps, or audit trails. The regime is simple in its calculation, but strict in its enforcement. Any error in reporting or disallowance under the sections mentioned above can still result in scrutiny or penalty.

Final Thoughts

Section 115BAD is not just a new tax regime—it’s a commitment. Once a cooperative society opts in, it agrees to let go of several traditional benefits in return for a predictable & reduced tax rate. This works well for societies with clean books & minimal deductions.

But before making the switch, ensure your society isn’t exposed to risks under Section 40a(9) or Section 14A, & double-check all employer-related contributions. A wrong step can nullify the savings you hoped for.

Looking to calculate the best tax route for your cooperative society?

Let the experts at Callmyca.com guide you to smarter decisions & maximum savings without compromising compliance!