When the Income Tax Department notices irregularities—unreported sales, false invoices, or unexplained assets—it needs a legal tool to dig deeper. That’s exactly what Section 131A provides.

It grants special powers to the Assessing Officer (AO) and other tax authorities so they can summon taxpayers, inspect records, and verify facts. These powers ensure that investigations are evidence-based and not just assumptions.

In essence, this section lets officers act almost like a civil court while checking whether a person’s income declarations are genuine.

Power Regarding Discovery, Production of Evidence, etc.

The key phrase here is “power regarding discovery, production of evidence, etc.”

Through this, officers can:

- Call any person to appear for questioning.

- Ask for books of accounts, bills, or contracts.

- Inspect documents or digital records.

- Record statements under oath.

These steps help confirm what’s true and what’s not. It’s a fact-checking mechanism that gives the department real proof before taking any decision.

Why Such Powers Exist

Tax evasion doesn’t always look obvious—it can hide behind complex paperwork or dummy companies. To expose such cases, the department needs more than just forms; it needs authority.

That’s why Section 131A empowers the officers of the investigation wing. They can connect dots between cash deposits, foreign transfers, or unaccounted assets."

Without this legal support, investigations would rely on voluntary cooperation—which rarely works when large sums are at stake. This law keeps the system fair and balanced for everyone.

Also Read: Survey Power of Income Tax Authority

Difference Between Section 131 and Section 131A

|

Aspect |

Section 131 |

Section 131A |

|

Who Uses It |

Assessing Officer, CIT(A), Commissioner |

Investigation Wing (Director, Joint/Deputy Director) |

|

Purpose |

Used for routine assessment or inquiry |

Used for investigation & search cases |

|

Scope |

Limited to assessment stage |

Extends to raids and complex evasion matters |

|

Nature |

Civil court-like authority |

Field-level enforcement and evidence collection |

In short, Section 131A enhances the powers of officers in the investigation wings, especially when a case involves serious tax evasion or undisclosed income.

Who Can Use These Powers

Only specific officials are allowed to act under this law:

- Director General or Director (Investigation)

- Joint Director or Deputy Director

- Assistant Director or Income Tax Officer (Investigation Wing)

These officers can summon, question, and collect evidence—but always on the basis of reasonable belief & proper documentation.

Real-World Example

Imagine a builder who declares ₹2 crore profit but purchases property worth ₹8 crore. Such mismatch instantly alerts the department.

Under Section 131A, investigation officers can issue summons, verify property records, check loan statements, and even talk to the seller. Once they collect facts, those records go to the AO for further action.

This process protects honest taxpayers while keeping evaders accountable.

Checks and Safeguards

Though Section 131A empowers officers, they cannot use it casually. Every action must be based on “reasons to believe.” All summons, statements, and inspections are documented for later audit.

This ensures no one faces arbitrary questioning. The goal is accuracy, not harassment. Responsible use of power builds public trust in the tax system.

Also Read: Powers of Search and Seizure

What Happens During Investigation

When invoked, officers can:

- Summon taxpayers for inquiry.

- Examine bank & ledger details.

- Collect statements on oath.

- Seize or verify specific documents.

Once done, the AO evaluates everything & may reassess income or impose penalties if the evidence confirms evasion. For compliant taxpayers, this simply means more clarity & transparency.

Link With Other Provisions

Section 131A works alongside:

- Section 132 – Search and Seizure.

- Section 133A – Survey operations.

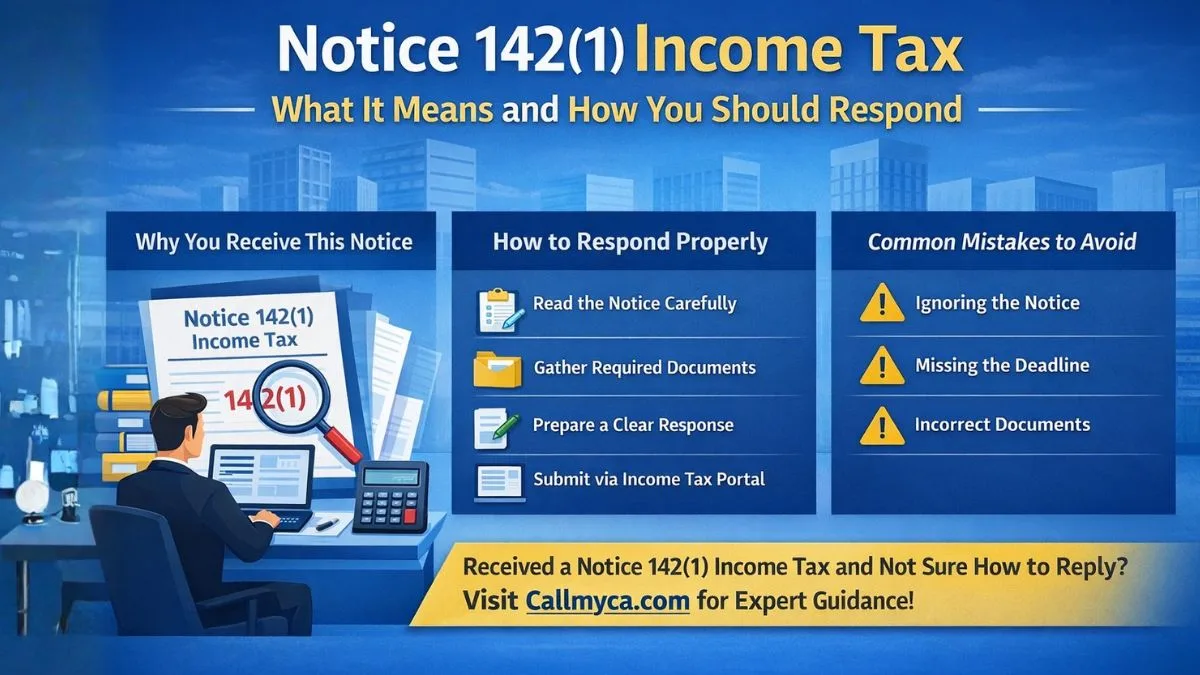

- Section 142 – Inquiry before assessment.

Together, these form a complete structure for discovery, enforcement, & compliance under the Income Tax Act of 1961.

If You Don’t Cooperate

Ignoring a summons or refusing to provide data has legal consequences:

- Penalty under Section 272A(1)(c) – up to ₹10,000 per default.

- Prosecution under Section 276D – possible imprisonment for repeated non-compliance.

The easiest path is to respond promptly and provide accurate information. Cooperation usually leads to quicker closure.

Relevance in Modern Tax System

With digital transactions and online records everywhere, Section 131A has become even more effective. Officers can cross-check PAN, GST, and bank data instantly."

It’s not about intrusion—it’s about ensuring every transaction aligns with declared income. For genuine taxpayers, this adds credibility to the entire process.

Another Simple Example

Suppose an influencer earns big from brand promotions but doesn’t report the payments. Using Section 131A, officers can request data from agencies, match it with deposits, and ask the influencer for clarification.

The result? Genuine income gets taxed properly, and unreported earnings come to light. It’s a practical way of keeping digital income streams transparent.

Why This Section Helps Honest Taxpayers

Many people see Section 131A as a threat, but it’s equally a protection. When false allegations arise, officers can use this same provision to verify facts & clear your record.

So rather than fearing it, consider it a safety net that ensures fair assessment for everyone.

Also Read: A Deep Dive into Charitable and Religious Income Exemptions

Accountability and Oversight

Each action taken under this section is reviewable. Senior officials monitor investigations to ensure that power isn’t misused. Over time, the department has shifted toward data-based scrutiny rather than physical raids, using this law to strengthen accountability.

Quick Recap

|

Focus Area |

Explanation |

|

Objective |

Enable fair and complete investigations |

|

Authority |

Investigation Wing officers |

|

Main Powers |

Summon, inspect, and collect evidence |

|

Key Clause |

Power regarding discovery & production of evidence |

|

Checks |

Reason-to-believe requirement |

|

Result |

Reduced tax evasion and better transparency |

The section strengthens enforcement while maintaining due process.

Common Misunderstandings

- “I’ll be raided if I get a notice.” → Not true; it’s for fact-finding.

- “I can ignore the summons.” → No, it’s legally binding.

- “It applies only to large companies.” → Wrong; it applies whenever undisclosed income is suspected.

Knowing your rights & responsibilities helps you handle any inquiry calmly.

Final Takeaway

Section 131A keeps India’s tax system credible. It enhances the powers of officers in the investigation wings and ensures evidence drives every decision, not speculation.

When used correctly, it protects the honest and deters evasion—making the overall tax process fairer for everyone.

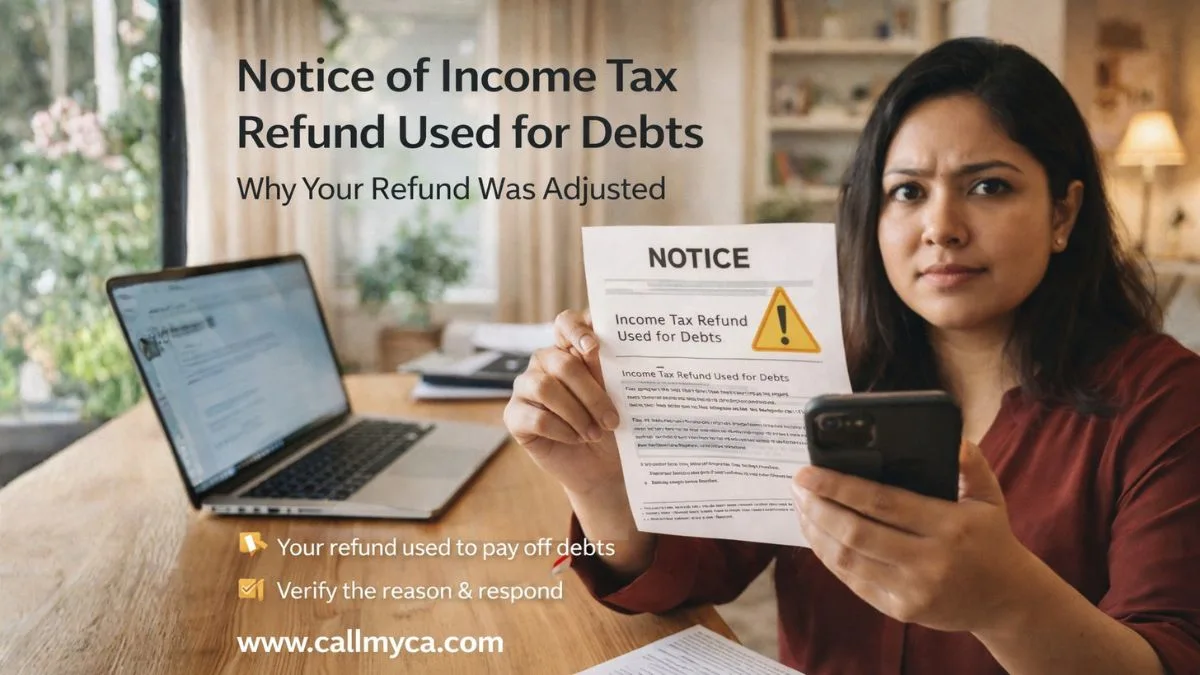

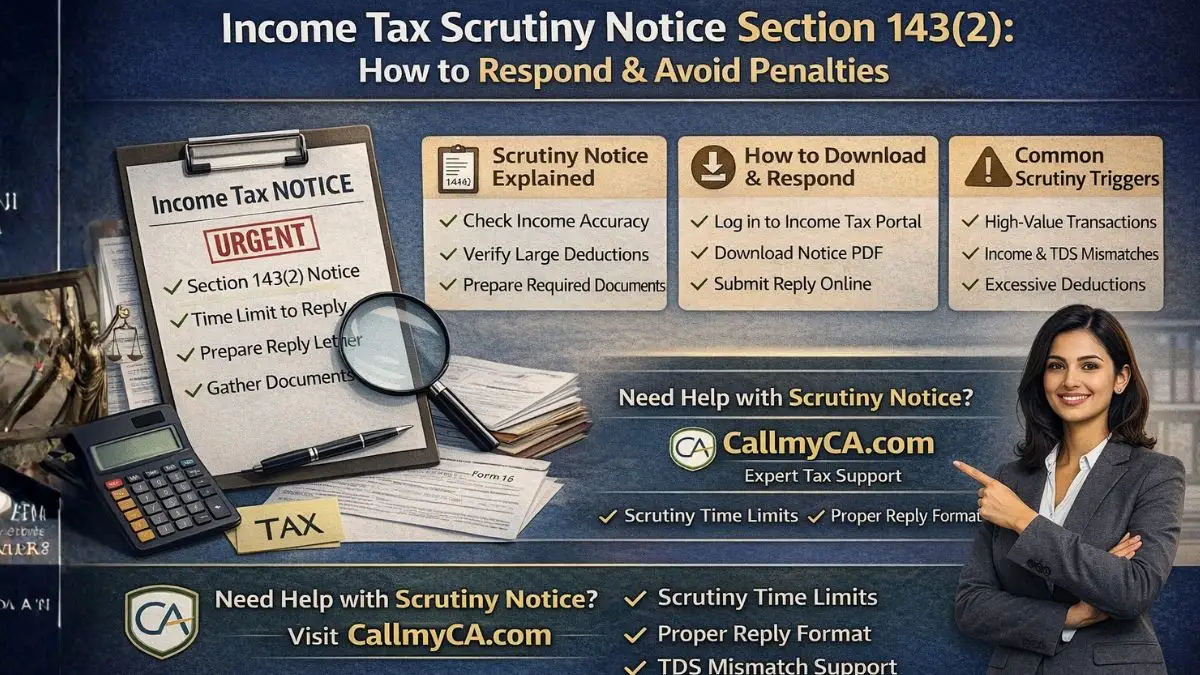

Need Assistance with Tax Notices or Investigations? At Callmyca.com, our CAs and tax experts handle documentation, draft responses, & represent you professionally before authorities.

Act early—let experts manage the technicalities while you focus on your business and peace of mind.