📘 What is Section 17 of the Income Tax Act?

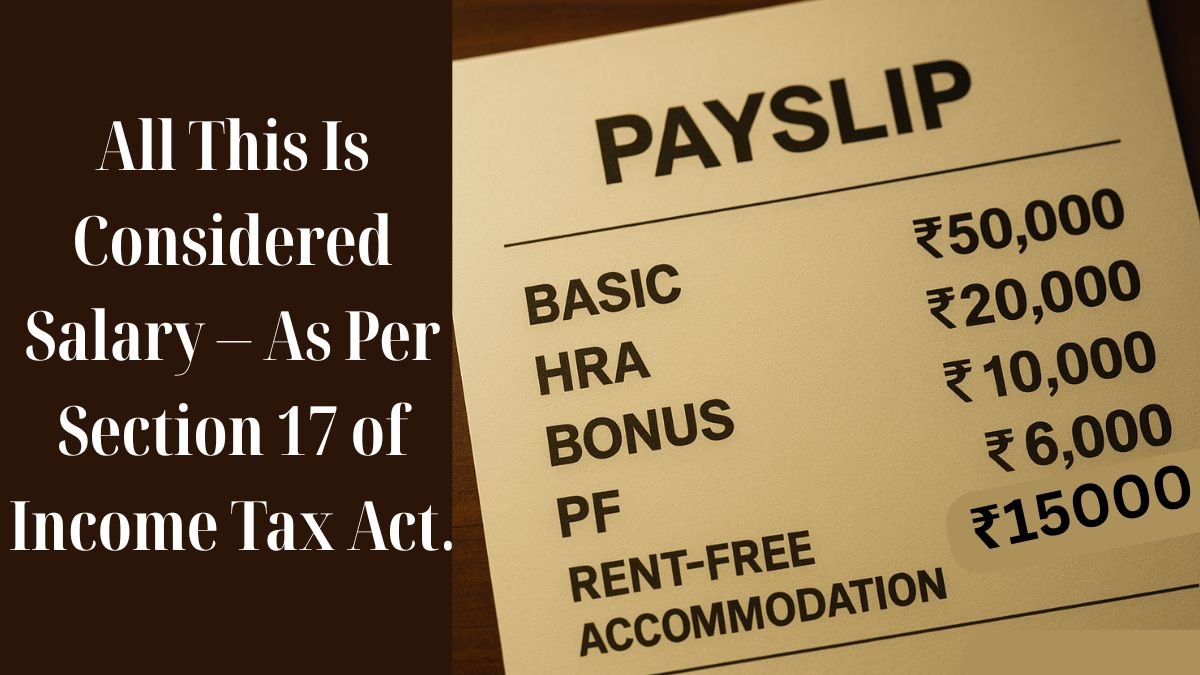

When we hear the word salary, we often think of the basic monthly amount credited to our account. But according to the Income Tax Act, that’s just the beginning.

Section 17 of the Income Tax Act goes deeper. It defines the term salary for taxes & lays down a complete framework covering not just the base pay, but also:

- Allowances

- Perquisites (like a rent-free house or car provided by the employer)

- Benefits given instead of salary (like bonuses, compensation, etc.)

In short, Section 17 of the Income Tax Act 1961 defines taxable salary in all its forms—whether cash or kind, direct or indirect.

🔍 Components Covered Under Section 17

Let’s break this down. Section 17 comprises three main sub-sections:

- Section 17(1): Salary

- Section 17(2): Perquisites

- Section 17(3): Profits instead of Salary

These sections define “salary”, “perquisite” & “profits instead of salary” with detailed inclusions, making them the backbone of salary taxation. "

🧾 Section 17(1): What Is Salary?

This clause defines taxable salary as not just your base pay, but also includes:

- Wages

- Annuity or pension

- Gratuity

- Advance salary

- Leave encashment

- Commission (if based on sales)

- Bonuses

- Employer contributions to Provident Fund (above a threshold)

So yes, even if your bonus is a “one-time reward”, it's still counted under this definition.

🏡 Section 17(2): What Are Perquisites?

Perquisites, or “perks,” are benefits provided by the employer to the employee in addition to salary. Under this, the Income Tax Act lists the various perquisites or benefits, instead of salary, that are taxable.

Here are a few examples:

- Rent-free accommodation

- Use of company car

- Club memberships are paid for by the company

- ESOPs (in some cases)

- Medical reimbursements exceeding the exempt limit

- Free meals or gifts beyond a certain amount

If your employer provides non-monetary perks, they may still be taxed in your hands as perquisites under Section 17(2).

💼 Section 17(3): Profits instead of Salary

This section deals with payments that replace or compensate for salary. For instance:

- Compensation received at termination

- Amounts received in settlement after resignation

- Payments from unrecognised provident funds

- Any other sum received from the employer in connection with employment

Section 17(3) of the Income Tax Act ensures that employees can’t bypass taxation by receiving benefits in another name. It clearly defines what counts as profits instead of salary & brings them under the tax umbrella.

💡 Why Is Section 17 So Important?

Because the definition of income under this section directly affects your taxable income.

- Want to know why HRA is taxed but LTA is not (under certain conditions)? You’ll find your answer in the framework laid out here.

- Curious why some reimbursements are tax-exempt while others aren’t? Section 17 helps clarify.

- Confused if your joining bonus is fully taxable? Again, refer to Section 17(3).

It sets the baseline for exemptions, deductions, & even calculations under Form 12BA (used for reporting perquisites). "

🧾 Example to Understand Better

Ramesh works in a private firm and earns:

- ₹10,00,000 basic salary

- ₹2,00,000 performance bonus

- ₹1,20,000 worth of rent-free accommodation

- ₹50,000 gratuity from previous employer

Under Section 17(1):

Salary bonus = ₹12,00,000

Under Section 17(2):

Rent-free accommodation = ₹1,20,000 (taxable perquisite)

Under Section 17(3):

Gratuity = ₹50,000 (taxable if it exceeds the exemption)

Total taxable salary = ₹13,70,000

🤔 FAQs

- What is the significance of Section 17 in salary taxation?

It helps calculate the actual taxable portion of your salary, including perquisites and non-salary benefits. - Are reimbursements taxed under Section 17?

Yes, unless specifically exempted (e.g., medical bills up to a certain limit under old rules). - Is the bonus taxed as per Section 17?

Yes. It is considered part of your salary income under Section 17(1).

🔚 Final Thoughts

Most people only think of CTC and take-home pay. But the Income Tax Department goes deeper.

Section 17 of the Income Tax Act gives you a full picture of what's taxed, what counts as salary, & how your employer’s benefits are valued. Whether you're salaried, in HR, or a tax consultant, understanding this section will help avoid surprises during tax filing.

💬 Need help decoding your salary breakup for tax filing?

Connect with a professional at CallMyCA.com https://callmyca.com/business-tax-filing & let us help you make the most of every deduction you’re entitled to.