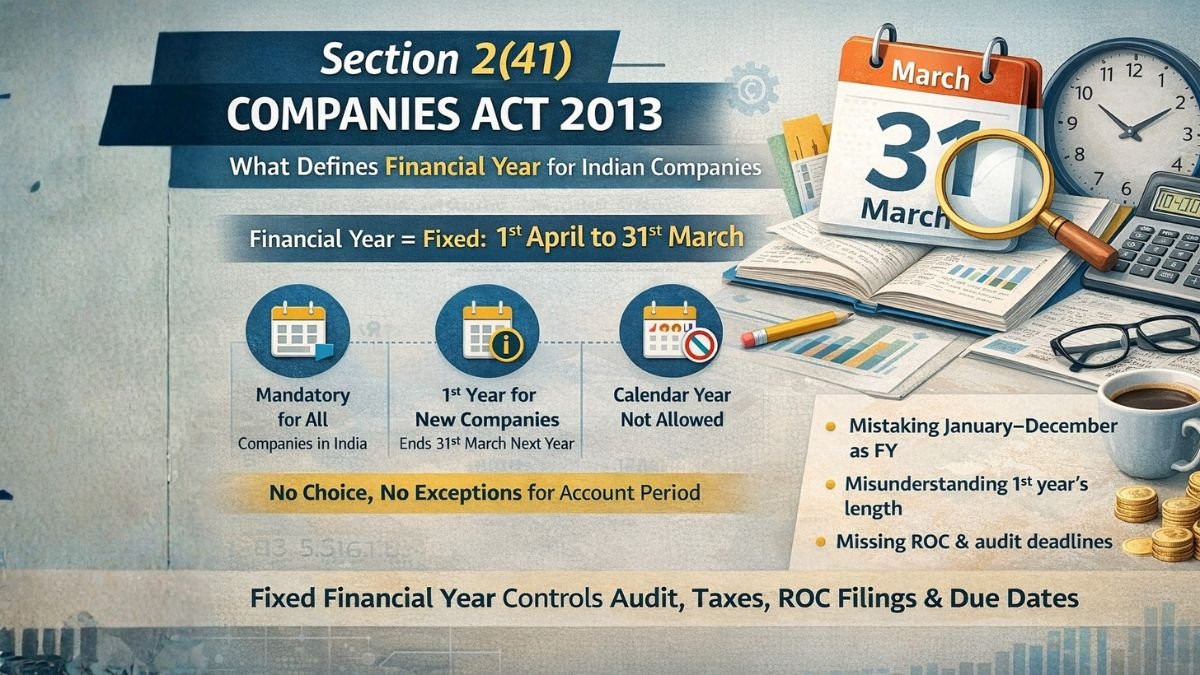

Section 2(41) of Companies Act, 2013

Ask any new founder or first-time director one basic question:

“What is your company’s financial year?”

Most people will confidently say:

“January to December.”

And that’s where the problem starts.

Under Indian company law, the financial year is not a choice.

It is clearly defined by law, and that definition comes from Section 2(41) of the Companies Act, 2013.

This section may look small, but it affects

- accounting

- audits

- tax filings

- compliance timelines

- annual returns

What Does Section 2(41) of the Companies Act, 2013, Say?

In very simple terms, Section 2(41) of the Companies Act 2013 defines what a “financial year” means for a company.

It says:

👉 A company’s financial year is

a period ending on the 31st day of March every year.

That’s it.

No flexibility.

No alternatives.

Meaning of Financial Year Under Companies Act

So, according to the law:

- Financial year = 1st April to 31st March

- This applies to all companies in India

This definition is mandatory for:

- private companies

- public companies

- OPCs

- Section 8 companies

When the Act says “financial year,” it always means ending on 31st March.

Why March 31st? (The Practical Reason)

Many people wonder:

“Why not January–December like other countries?”

The reason is simple:

- India’s tax system

- government budgeting

- audit and compliance framework

All are aligned to April–March.

To keep everything consistent:

- Companies Act

- Income Tax Act

- GST law

All follow the same financial year structure.

First Financial Year for Newly Incorporated Companies

This is where Section 2(41) becomes very practical.

If a Company Is Incorporated During the Year

The law clearly explains what happens if your company is newly formed.

👉 If a company is incorporated after 1st January,

👉 Its first financial year ends on 31st March of the following year.

Simple Example (Very Common Situation)

Let’s say:

- The company was incorporated on 10th February 2024

Now the question is:

“What is its first financial year?”

As per Section 2(41):

- First financial year =

10 Feb 2024 to 31 March 2025

Yes, the first financial year can be longer than 12 months.

Another Example

Company incorporated on:

- 15th July 2023

First financial year:

- 15 July 2023 to 31 March 2024

So the rule is very straightforward.

Can a Company Choose a Different Financial Year?

Short answer:

👉 No.

Under normal circumstances:

- companies cannot choose a different financial year

- calendar year (Jan–Dec) is not allowed

Section 2(41) makes March 31 compulsory.

Only in very limited cases (like certain foreign holding/subsidiary alignments) may approval be required—but that’s an exception, not the rule.

Why Section 2(41) Is More Important Than It Looks

Many people think:

“Financial year is just a definition.”

But this one definition controls:

- audit period

- due dates for financial statements

- annual general meeting timelines

- ROC filings

- tax audits

- compliance penalties

If you misunderstand the financial year:

- filings get delayed

- audits get mismatched

- penalties may apply

That’s why Section 2(41) is foundational.

Financial Year vs Assessment Year (Common Confusion)

Let’s clear this up clearly.

- Financial Year (FY) → defined under Section 2(41)

- Assessment Year (AY) → defined under Income Tax Act

Example:

- FY 2023–24 → ends on 31 March 2024

- AY 2024–25 → year in which tax is assessed

The Companies Act talks only about the financial year.

Does Section 2(41) Apply to All Companies?

Yes.

It applies to:

- private limited companies

- public limited companies

- OPC

- Section 8 companies

- foreign companies registered in India

No category is excluded.

Common Mistakes Companies Make

From real-life experience, these mistakes are very common:

- assuming Jan–Dec as financial year

- preparing accounts wrongly for first year

- confusing first financial year length

- missing compliance timelines

- misalignment between audit and ROC filings

All of this starts with misunderstanding Section 2(41).

Need Help With Company Compliance and Financial Year Planning?

If you are unsure about your company’s financial year, first audit period, ROC filing timelines, or annual compliance obligations, getting professional clarity early can save you from costly mistakes later.

For clear, practical guidance on company law, accounting, taxation, and end-to-end compliance, visit callmyca.com